Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and how they help fill the puzzle of evidence:

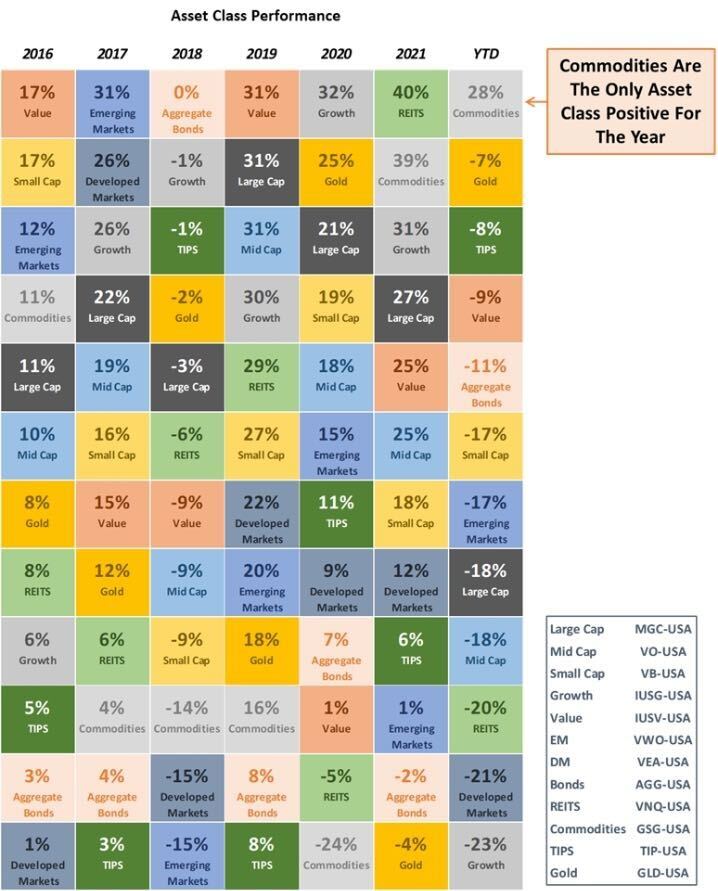

Dave: Traditional diversification has not helped most portfolios in 2022

Source: PSC as of 09.06

Source: PSC as of 09.06

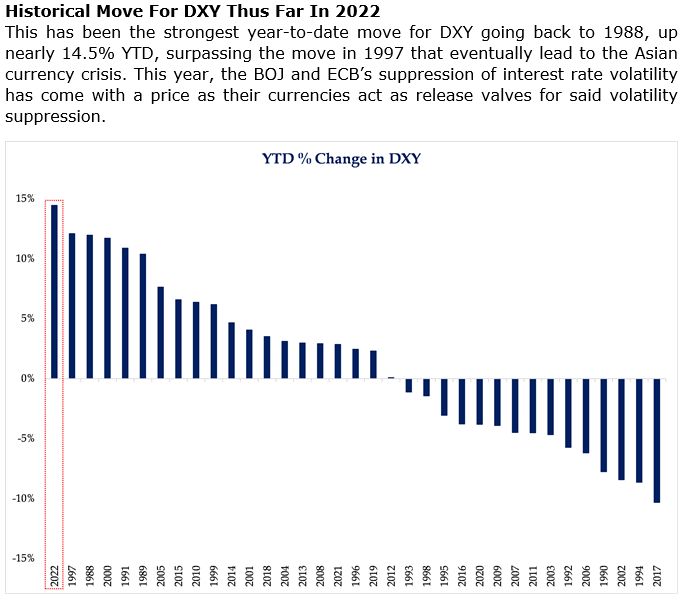

Brad: and the commodity rally is even more odd in the context of a historic US Dollar rally

Source: Strategas as of 09.08

Source: Strategas as of 09.08

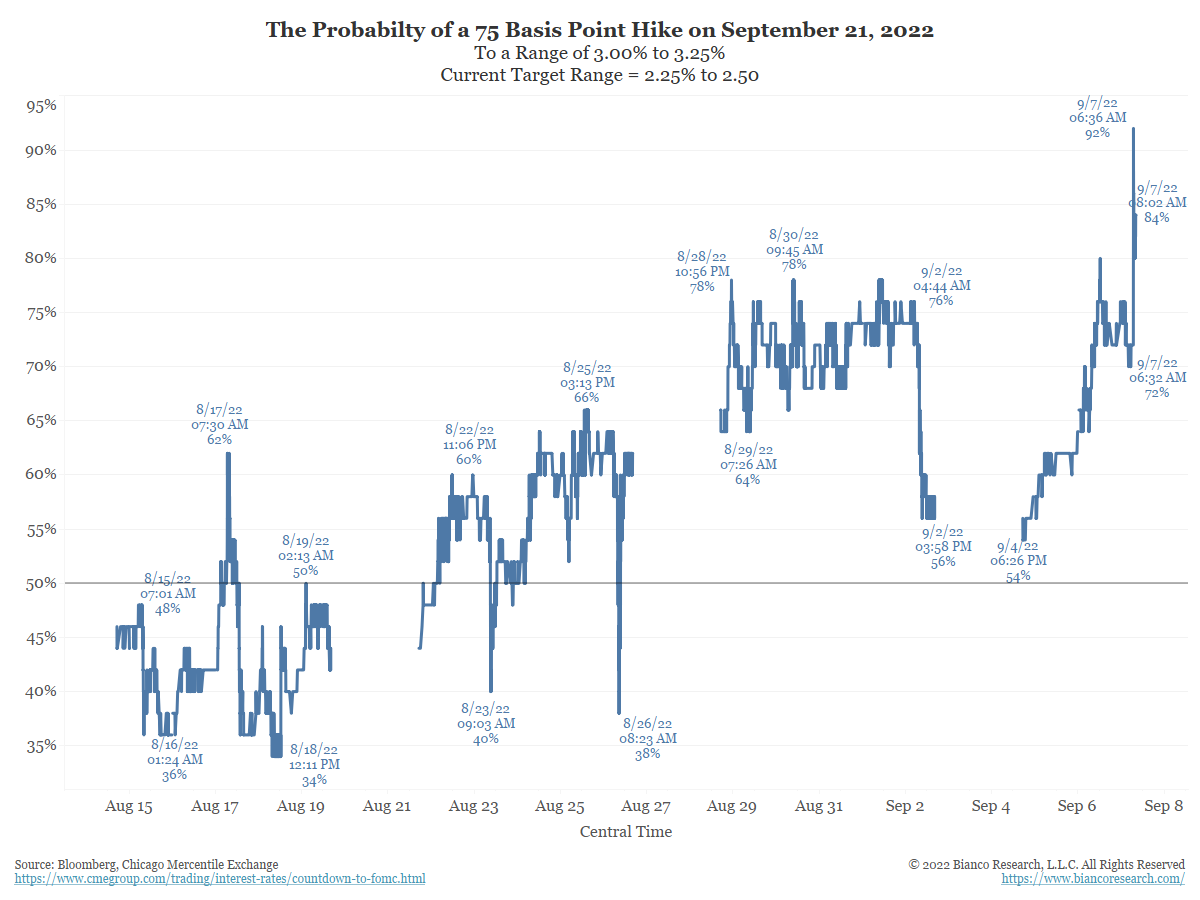

John Luke: Markets are now firmly in the “75 bps hike” camp for the Sept 21 FOMC Meeting

Data as of 09.07.2022

Data as of 09.07.2022

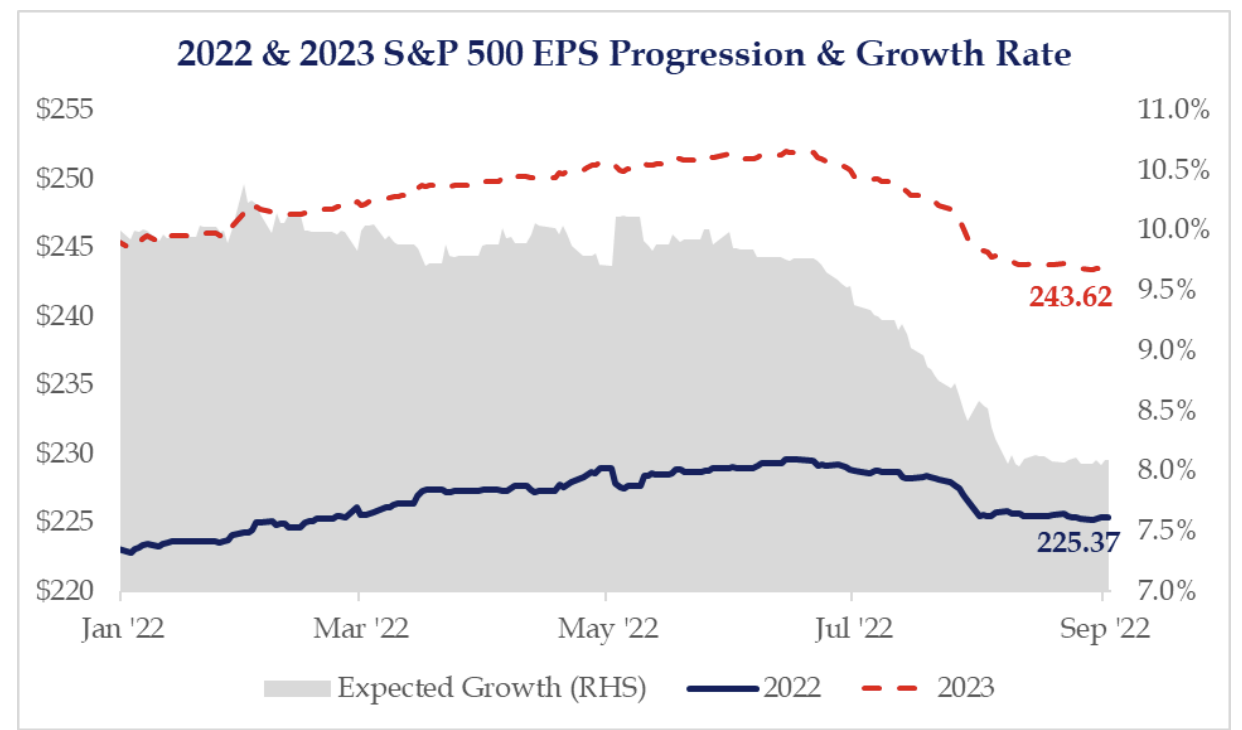

Dave: EPS estimates are trickling lower but not to the extent one would expect in a possible recession

Source: Strategas as of 09.08.2022

Source: Strategas as of 09.08.2022

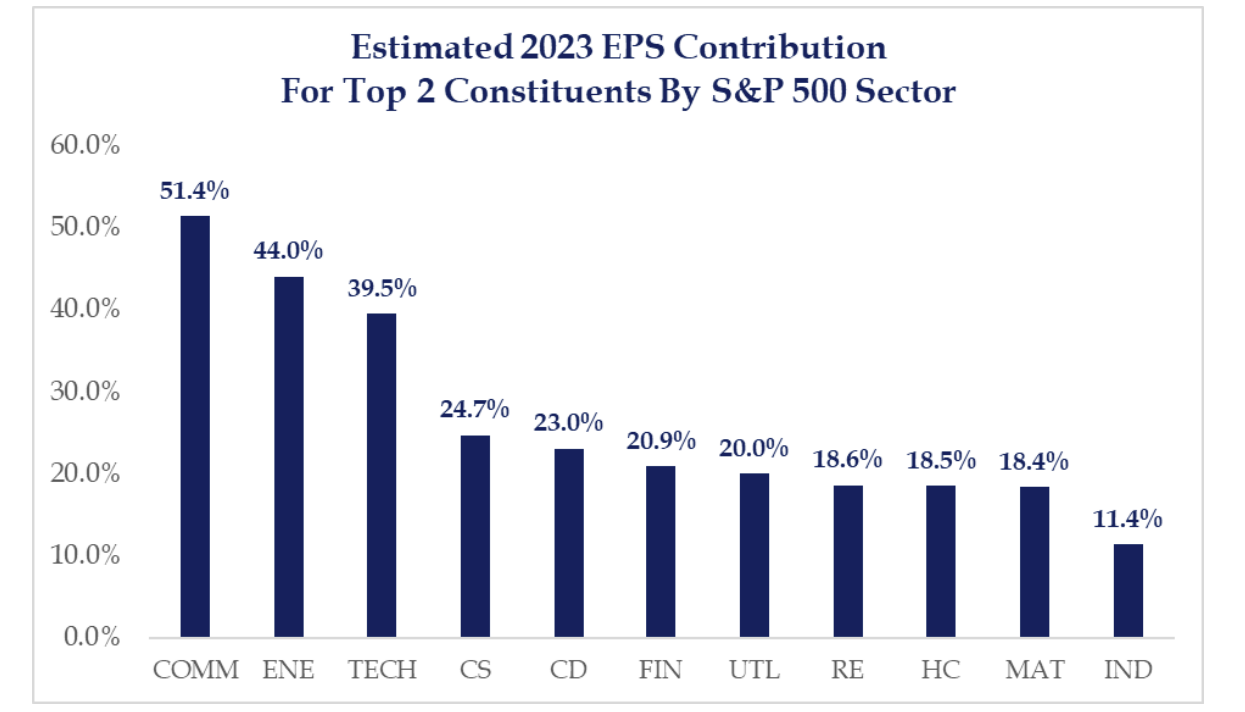

Dave: with major concentration risk in some key sectors(think, Alphabet/Meta driving ½ of Communication Svcs)

Source: Strategas as of 09.08

Source: Strategas as of 09.08

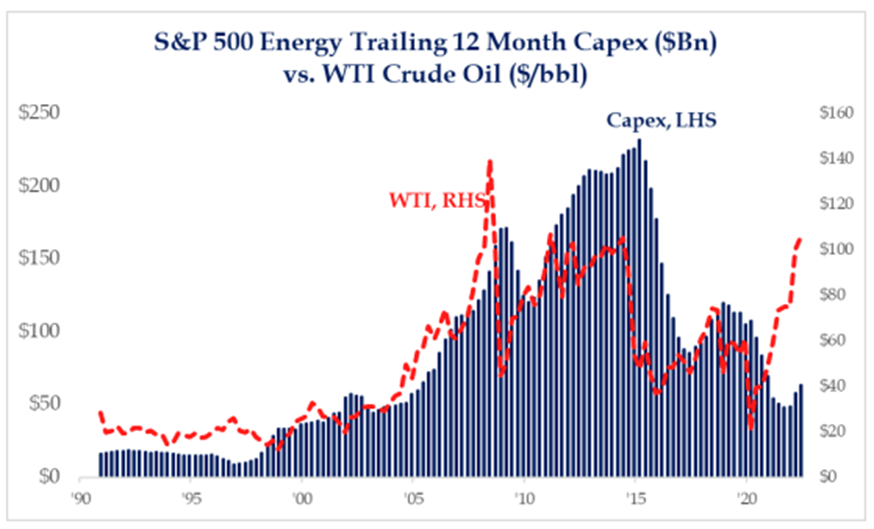

Joseph: Energy prices remain supported by low capital spending in recent years

Source: Strategas as of 09.07

Source: Strategas as of 09.07

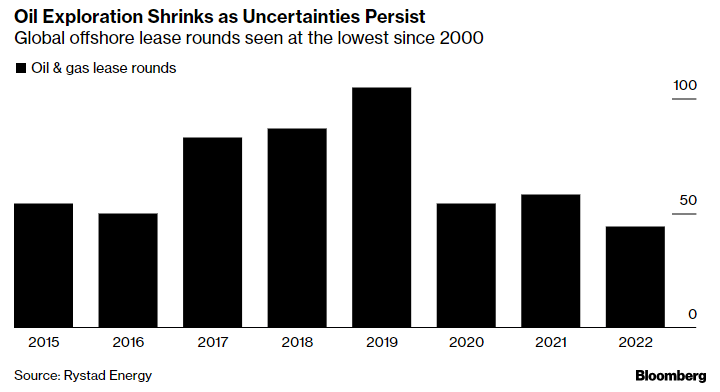

Joseph: with no relief in sight based on future lease projections

Data as of 09.08.2022

Data as of 09.08.2022

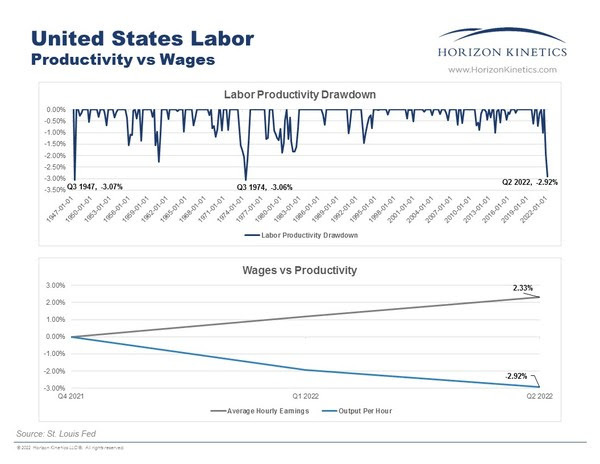

John Luke: The labor productivity decline has been historic

Data as of 06.30.2022

Data as of 06.30.2022

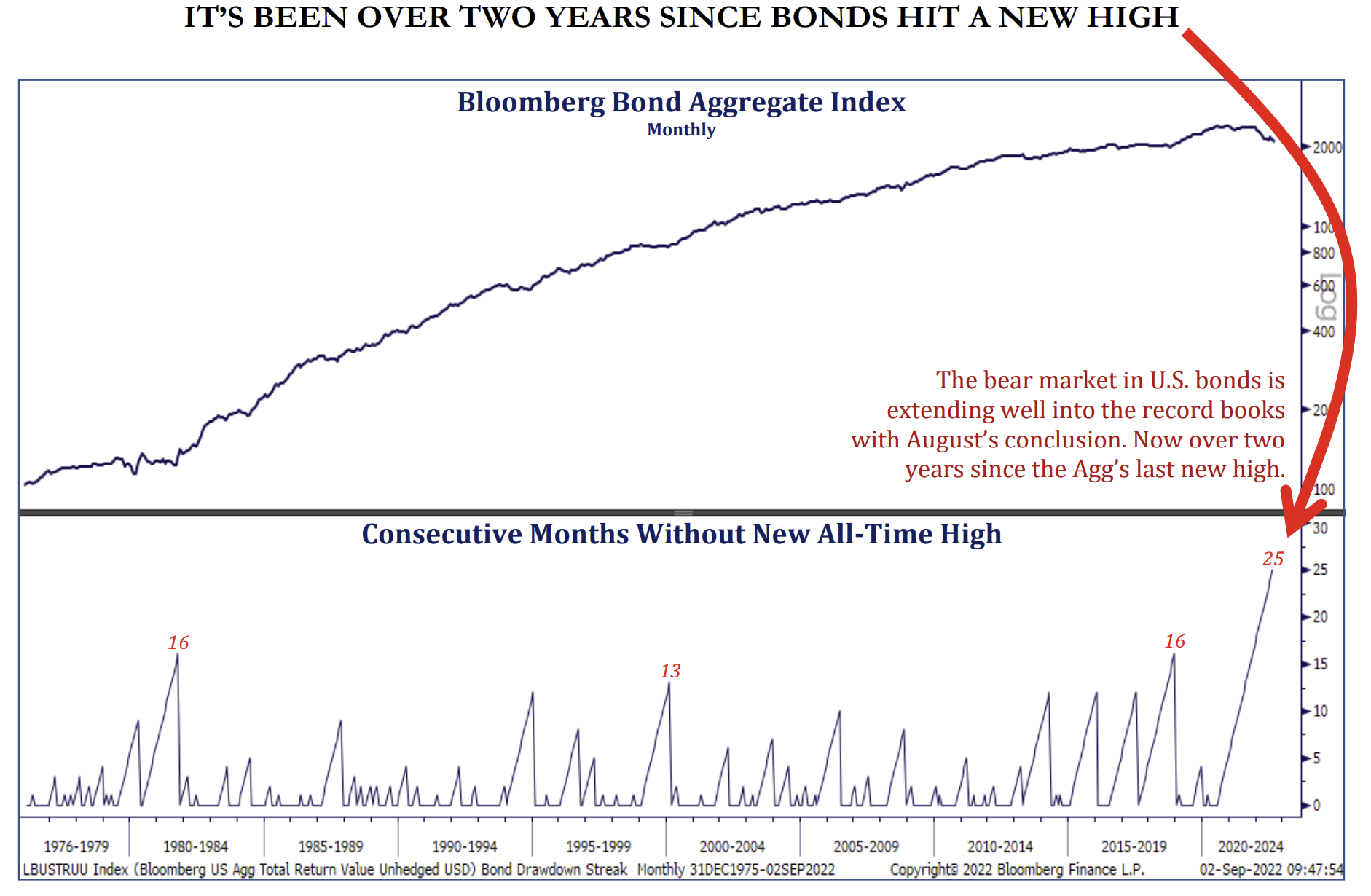

John Luke: and feeds the bear market in bonds that is pushing to unprecedented length in modern history

Source: Strategas as of 09.06

Source: Strategas as of 09.06

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2209-12.