For those not familiar with the greatest TV show ever, George Costanza was the unlovable loser from the iconic ‘90’s sitcom “Seinfeld”. Ignorant, callow and a notoriously bad tipper, he seems like an unlikely source of investment advice.

However, in a rare moment of self-reflection, he tells his friends “every decision I’ve ever made in my entire life has been wrong…every instinct I have in every aspect of life…it’s all been wrong.” And, in an effort to change his fortunes, he devises a simple strategy – do the complete opposite of what his instincts say.

It begins simply enough, with an order of “chicken salad, on rye, untoasted, with a side of potato salad”; it ends with a date, an apartment, and a job with the New York Yankees.

Enter, the Summer Winter of George

For an investor to successfully navigate the current investment landscape, they would have had to do the complete opposite of what they did last year. In a way, it has been a Festivus for the rest of us, as the average stock has outperformed the New Nifty Fifty, by a wide margin, since the middle of last year. Whether it was from a sector or factor perspective, it paid to be George.

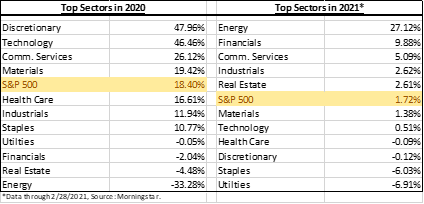

Sectors:

As the 10-Yr yield rose 44bps in February, its impact was largely seen in the “most bubbly” stocks of 2020 — aka the best performers of last year have been mean reverting the most. The 20 worst performing stocks in the S&P 500 over the past month (down 20% on average) rallied ~138% in 2020, while the top 20 performing stocks the past month (up 30% on average) fell 27% in 2020. You can easily see this at the sector level as well — XLE is up 27% this year (after falling 33% in 2020), but QQQ hit correction territory last week (after rallying 46% in 2020).

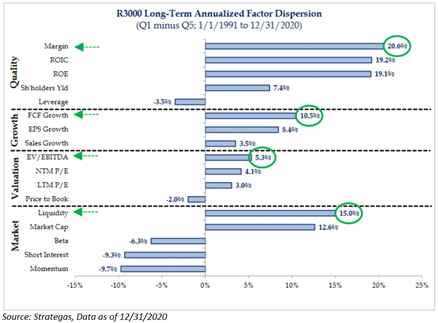

Factors:

But, where we saw even more of a discrepancy since the market bottom in March of last year, was the shift from the higher-quality stocks, which outperformed in the first half of 2020, to low-quality stocks, which have substantially won thus far since then. Given this swift shift, it has created a difficult environment for active managers, who tend to own higher-quality stocks, including ourselves, given our “Compounder” Framework.

Aptus Compounder Framework

Our style of investing – for our equities, we look for what we believe to be high-quality, lower-valued, and stronger growth companies. We tend to purchase companies that we view as having characteristics of high ROE, high ROIC, strong FCF and EPS growth. As evidenced below, over longer time intervals, these types of stocks tend to substantially outperform. Basically, alpha for the long run gives a decisive edge to exceptional operators. We aim to own exceptional operators.

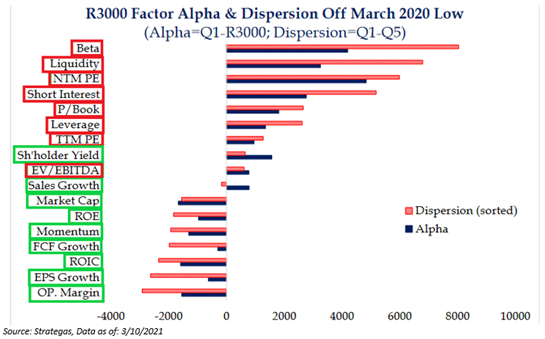

We tend to stay away from companies with higher beta, higher short interest, non-earners, and the slowest sales growth, as these factors tend to underperform over longer periods of time. But guess what factors have substantially led the equity rally year-to-date? Basically, every factor that we tend to actively have a long-term bet against (by not owning).

We have a quality overlay on our holdings as it embodies a reliable factor set that we believe portfolio managers should aim to include in longer-term portfolio allocations. From our perspective, there’s no question that thematic factors such as “risk-on” high beta and short interest have their tactical usages (i.e., strong alpha off major market lows), but lack durable, attractive returns over the long run. This year’s fitful rally, in fact, is more heavily skewed to lower-quality stocks outperforming than what we saw during the tech bubble in the early 2000s.

As you can see below, the market has rewarded those who dance like Elaine Benes – volatile and without rhythm. The factors highlighted in red, are those that we tend to avoid, while those in green are factors that we like to own.

As we have seen since the market bottom in March of last year, the first year of a recovery is very financially rewarding, but intellectually so difficult to understand. Just think, the market’s performance over the last year has been led by the most unprofitable, highly levered companies, all during a period that endured an economic recession. Simply put, it appears that fundamentals have not mattered.

Now, we believe that the second year coming out of a recession tends to be more rational. The narrative tends to be clearer, and it is easy to understand – valuation begins to matter. From a business cycle standpoint, we believe that we are out of the recovery phase and now in an expansionary territory.

One of the best lessons on perspective that we have learned from observing investors and markets over many cycles reflects on investor focus. When its intensity is trained on short-dated outcomes, bending to every price move with the premises that someone will always pay more for it tomorrow, like we are currently witnessing – it pays to step back and consider longer-dated trends and opportunities. And right now, we believe that there is a lot of opportunity to purchase higher-quality companies that are trading at a discount, given this dislocation and the market’s concentration on the riskiest of risk assets.

Conclusion

Many investors suffer from the same malady as George – their instincts are almost always wrong. Whether tulip bulbs in the 1600s or internet stocks in the late 1990s, all too often investors extrapolate current trends far into the future, bidding prices higher and higher – just look at GameStop. The reasons for this behavior reside in the recesses of our brains, which are hard-wired from an evolutionary perspective to seek rewards and avoid perceived risks, as well as fixate almost exclusively on recent events.

We understand that we are airing our grievances over this fitful rally of lower quality stocks. But we understand that over longer periods of time, the market tends to reward stocks that exhibit compounder-like factors, i.e., our “feats of strength” – high-quality, reasonable valued stocks that have strong growth.

But remember, if you consistently invest or chase companies that exhibit lower-quality factors over longer periods of time, you leave your portfolio at substantial risk of encountering some type of…shrinkage.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2103-9.