“I argue that cost-effective risk mitigation, when done well, doesn’t just take you out of risk, but actually allows you to take on more risk.” Mark Spitznagel

We’d tweak “take on more risk” to “pursue more return” but yeah, nailed it. We call our approach the Drawdown Patrol, defending against sharp drops in portfolio value. But the real long-term value is the ability to lean on that protection to a) own more growth assets and b) deploy fresh cash into selloffs.

For comparison, think about how we’d buy a home if we couldn’t insure it. First of all, the bank wouldn’t lend us money. But even if we had the cash, how comfortable are we tying money up in an asset that could be destroyed by fire or storms? Much less so…we’d need to set aside a large reserve, for repair or replacement.

A portfolio of equities may not burn down, but if a 2000 or 2008 market comes early in retirement we have issues. And for “protection” what do most investors do? Allocate some % of the account to bonds, right?

As Drawdown Patrol investors, we don’t consider bonds to be real protection…they’re a volume knob at best. By allocating to them, we’re giving up long-term growth of our capital in order to feel better about the short-term movement of our portfolio.

Why not keep more of our money in growth mode, and buy real protection to go with it? Like an insurance premium, it will cost money. But at least we can model the insured value in a storm, with a convex (exponential) payoff of those premiums…designed to protect our large investment. Bonds just can’t deliver that, and at 2% yields they’re not even covering cost-of-living increases.

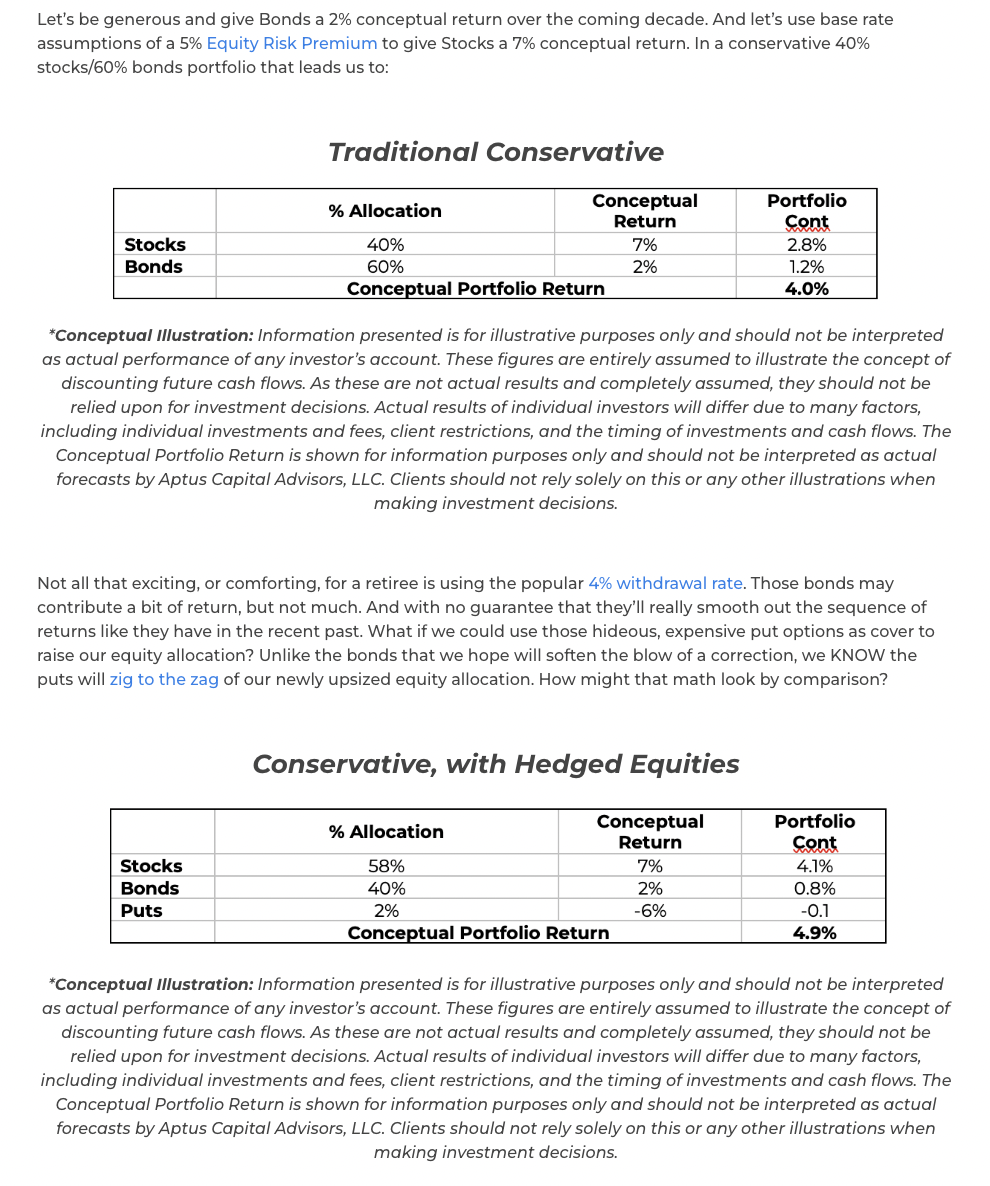

About that “cost”…like in sports, what matters is the overall output of the team NOT the performance of any one individual. Even with modest assumptions, and not factoring in our ability to opportunistically attack market selloffs, you can see how the inclusion of real hedges can lift potential returns. Yes, put options can not only reduce downside, but add upside by enabling increased ownership of equities within the same risk tolerance level. From an old post of ours The Math of Holding Too Many Bonds:

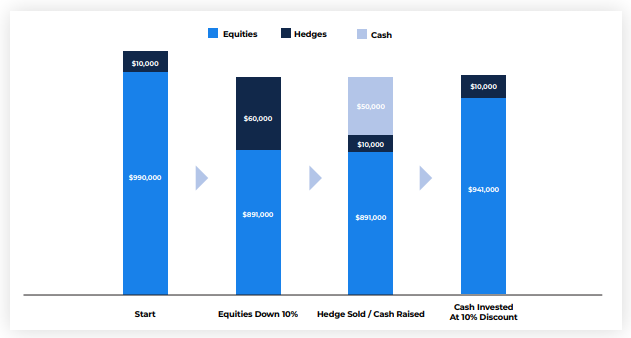

We think Spitznagel would agree. He runs an investment firm called Universa Investments, specializing in creating those convex payoffs that can protect a portfolio when market storms emerge. Known mostly for his partnership with famed author/investor Nassim Nicholas Taleb, his hedge fund gained 4000% in Q1 2020. You read that correctly, a 40x return in three months, putting holders in position to rebalance into bargains while many are fleeing, along these lines:

Source: Aptus Conceptual Illustration

Spitnagel’s fund is designed to complement an equity portfolio, by owning inversely-correlated volatility products whose value can explode in a market selloff. You wouldn’t own it as a complete solution, and couldn’t anyway because ownership is limited to large institutions and pension funds.

But there are lessons for us in its history. Among the lessons we fully embrace in our approach to owning volatility:

- A small sliver of the right put options can pack a lot of punch when markets go haywire

- Owning that sliver at all times can free you to allocate more of your portfolio to growth-oriented assets

- That sliver can be monetized to create fresh cash, giving you the freedom to buy stocks when most are in panic mode

Spitznagel is not a CNBC soundbite guy, so watching a recent 30 minute interview was a real treat. He talked about the “great dilemma of risk”, which we define as the balance between drawdown risk and longevity risk. With rates as low as they are, we think less bonds + more stocks + a sliver of volatility can provide not only a smoother journey, but ultimately a more fruitful destination.

As an advisor, this can be tough to implement across a practice. Thankfully, the ETF structure can provide not only efficient vehicles for client ownership, but in a way they can get the benefits without obsessing over the periods when protection seems unnecessary. Bear market funds can eventually prove useful, but as a separate line item you risk the same behavior CALPERS succumbed to…bailing on Universa exactly when the payoff was about to come. To us, real protection disguised inside of a growth vehicle is ultimately better for clients than an “alternative” sitting on their statement at a loss, quarter after quarter.

In the end, what matters is the compounded return earned by a portfolio, not the average return. And equally important, the investor’s ability to hold that portfolio. Effective risk mitigation can help with both, by removing dead weight from the portfolio AND creating an opportunistic mindset for the owner. Don’t take our word for it, it’s a rare discussion on “the great dilemma of risk” with the master himself:

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2112-1.