Absolute valuations matter, if the history of markets is any guide. They can be a solid indicator for future returns. High valuations today lead to lower returns moving forward, and vice versa. That’s how markets work – they are mean reverting.

That can be depressing when you look at the valuation landscape today. ‘Above the mean’ is an appropriate description.

The point of this note is not bad news of lower returns. Well, for bonds it may be, but for stocks, the point is good news, and that the absolute valuation environment may matter less than in the past.

Yes, future returns may be lower, but we’d argue that looking forward through a lens of absolute valuations is not the full picture. The backdrop is different and more supportive of a relative perspective.

Complications aside, the choices are stocks or bonds. In our view, the relative opportunity still justifies the path of least resistance to be higher in the stock market. Capital that needs to earn a return is seemingly forced into stocks, with aggregate bonds yielding less than inflation.

Absolute Valuations Matter – just less than they did

Two major points to make supporting this view:

Lower Rates

We believe yields will be held lower for longer – even in the face of real economic growth and increasing inflation. The Fed seems to be clear on this…for now. Remember, stocks are valued today by taking anticipated cash flows (numerator) and discounting back to today using a discount rate (denominator). In that equation, a lower denominator equals a higher value.

“TINA”

There is no alternative (TINA), you’ve probably heard that in the media. Meaning, the only place to go for return-seeking investors is stocks. When capital is flush, and this is the case…it can be a good source of support for higher valuations.

While there is more to it than those two points, they are important underpinnings for our belief that the combination of absolute valuations AND the backdrop of the environment is what matters most moving forward. Not absolute valuations alone.

Without believing “this time is different”, we’re staying open-minded that it’s possible ‘normal’ levels for mean reversion may be resetting higher.

Relative Opportunity

As long as we have a lopsided relative opportunity set between stocks and bonds, we think stocks have a chance to grind up despite higher absolute valuations.

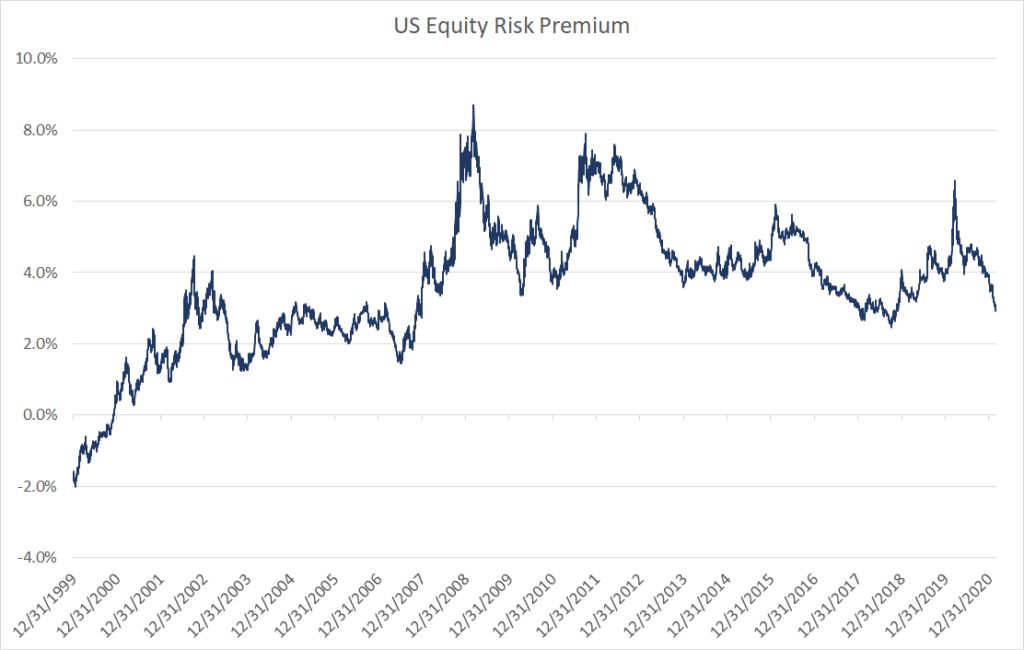

One way to think about this is by using the excess yield of stocks over bonds. This could also be referred to as the equity risk premium. Below is a chart showing the S&P 500’s earnings yield minus the real yield on 10-year government bonds.

Currently, this implies stocks to outperform bonds by roughly 3% to 3.5% per year.

Source: Bloomberg

Portfolio Positioning

Asset allocation is the most powerful lever you can pull when it comes to portfolio construction. Today, you can see our views being expressed in our holdings and the movement under the hood.

To us, bonds have poor to negative returns for the foreseeable future…we do not want to own them. They can be sneaky drivers of longevity risk – a risk to avoid.

You can further improve potential outcomes by owning the right companies. We’ve ramped up our focus on what we consider quality companies, as markets have made bets on recovery and left opportunities in steadier growers.

The Upside of the Downside

The context to read any of our thoughts starts with our exposure to long volatility and focus on drawdown avoidance.

We believe our greatest value add to portfolios today is the ability to adapt asset allocation away from bonds and to stocks without increasing risk to worrisome levels.

Valuations matter…maybe less today than in the past…but they still matter.

If our base case for rising equity markets is right, we believe our asset allocations are prepared to capture plenty of the upside.

If, on the other hand, the markets are shocked and valuations reset lower, volatility across the board should increase. Just as we saw during the COVID sell off, we’ve positioned our long volatility exposure to be ready and able. Not just to mitigate drawdown but to help produce dry powder when opportunities to pick up great businesses at discounts present themselves.

In summary – we build portfolios with upside in mind. And our approach to volatility is designed to reduce downside. In a market fed by (artificially?) low rates, we find it a compelling combination.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2104-2.