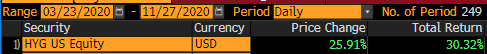

Investors that took advantage of the blowout in credit spreads back in March have seen incredible gains from the bottom. The credit markets experienced a liquidity freeze like never before, prior to the Fed’s announcement of off-balance sheet facilities. Established to purchase investment-grade and high-yield bonds helping support the markets and corporate liquidity in the depths of the Covid-19 crisis, these programs created what investors perceived to be a safety net within credit securities. This empowered investors to speculatively buy securities at significant discounts, with many of these securities seeing incredible rebounds. For example, HYG (iShares High Yield ETF) has returned over 30% from the lows.

Source: Bloomberg as of 11.27.2020

Lower for Longer… and Longer

With the Fed adamant on keeping interest rates at 0% for the foreseeable future, investors are being forced to reach for yield. Per the Fed Dot Plot below, the first inkling of a rate hike isn’t until 2022.

Source: Bloomberg (Fed Dot Plot) as of 11.30.2022

With that in mind, investors have a limited set of options to provide historically acceptable yields without adjusting risk or liquidity constraints. How we’ve seen investors adapt to the yield environment is a bit concerning.

So Where Does That Leave Us?

High Yield spreads as measured below by the Barclays US-Corporate High Yield Bond Index have contracted back near pre-COVID-19 levels. With yields compressing significantly from the March selloff, we caution investors to also consider the companies that utilize the high yield market for funding.

Source: Bloomberg, Aptus Research as of 11.30.2020

While this statement doesn’t comprise all companies that issue HY debt, we’d argue that a significant amount of HY borrowers have seen significant headwinds to their businesses. This could prove to be painful in the future, especially if the recovery takes longer to play out.

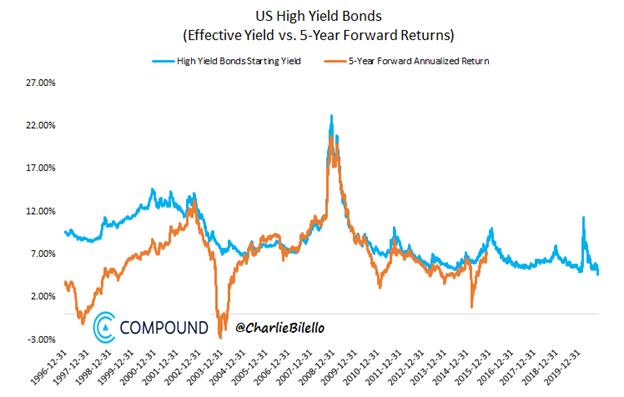

Current Yield as a Barometer For Future Returns

We know that current yields give us a decent indicator of what future returns will be. With current yields in the HY space tightening to near pre-virus lows, we believe that future returns could be less attractive than what investors have experienced historically.

Source: Compound/ Charlie Bilello as of 11.30.2020

This all while having increased risk, with less cushion from high current yield while lending to arguably weaker companies.

Sometimes It Just Doesn’t Make Sense

Now, let’s put the rubber to the road with an example. Just two weeks ago, Carnival Cruise Lines (CCL), one of the hardest hit companies from Covid-19, issued a 7.625% six-year bond deal that was over 5.5x oversubscribed! The kicker here, the bonds are not pledged to any of the assets, i.e., cruise ships. This deal follows over $9bn raised from debt/loans earlier this year and multiple equity raises to help keep the company afloat.

The Windshield View

While we obviously can’t see the future, we do know that current yields offer a look at forward returns. While the market fears have abated since March, the implications of Fed and government action have largely driven the recovery in the high yield space. Given what we believe to be a lack of further catalyst, we see the high-yield asset class as offering one of the worst rewards to risks we’ve ever seen.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed. This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible. Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2011-32.