You’ve probably heard us say we like to “own” volatility. Or that we use “volatility an asset class”. What do we mean by that?

First, let’s think about what a client is trying to accomplish. Pursuing or preserving the comfort that comes with knowing expenses can be met, for life and hopefully beyond. That requires some level of saving and investing that can ultimately be turned into spending.

An endless set of personal factors go into that “level”, but let’s say a couple is fortunate enough to save $2 million by age 65. If they plan to spend $100k/yr, they’ll need to invest…or it’s completely gone in exactly 20 years.

And in real terms, it’s gone long before that. Inflation eats away at that spending power over time. There are taxes to be paid. The bank’s savings account is not going to cut it, at least not at today’s rates.

Longevity is a Real Risk

The “safe” choice is government bonds, which may get you 2%/year…if you’re willing to lock it in for those 20 years. You can offset some of the inflation and taxes that eat away at your purchasing power, but what if you live longer, have unexpected expenses, or want to leave money for family?

Owning equities is a must for this couple, as you likely know. Equities have been the savior for millions of retirees over the past 100 years. To paraphrase Warren Buffett, they can give you “ownership in great businesses that have the ability to overcome inflation by raising prices themselves”. So it’s decided, YOU MUST OWN STOCKS.

But So is Drawdown

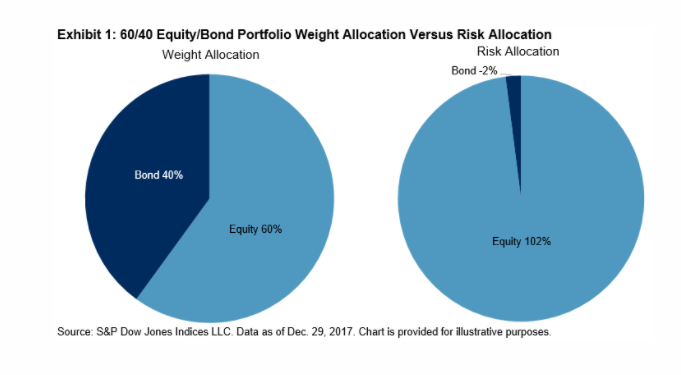

But what about the risks that come with owning stocks…losing money! How do we balance the opposing risks of longevity and drawdown? An advisor can help figure that out, but 60% stocks and 40% bonds has been the default setting for a “balanced” portfolio.

But really, it’s not balanced…the ups and downs of the stock market mean that even with 40% in bonds, virtually all of a portfolio’s movement is tied to what the stocks do:

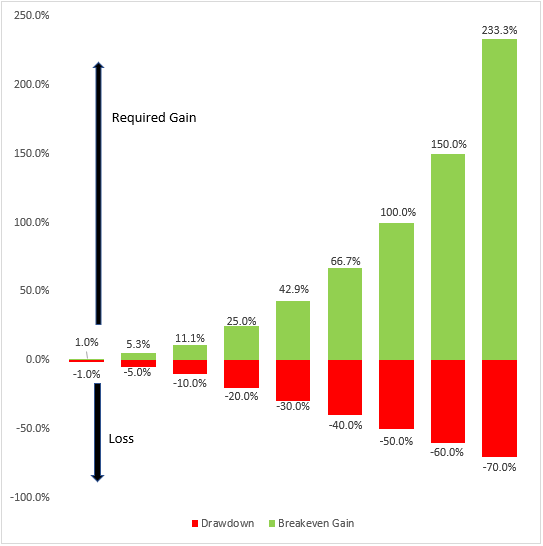

Are you comfortable banking on stocks to only go up? If my earning years are behind me, I’d say No. You have no new deposits to make, the excess movement reduces your compounded return, and 30-50% drops can trigger emotions that may not hurt but definitely don’t help. Market corrections can hit hard once you retire. Forget growing, look at the gains needed just to recover losses:

Source: Aptus

A Better Balance

So what choice do we have? More bonds, to smooth out the ride? More stocks, to make up for the drag of today’s low bond yields? A stash of cash, to buy into the next big drop? We think there is a better way to tackle this.

Own the stocks, and own some volatility! Own it as an asset class to go with (fewer) bonds and (more) stocks. But how? The only way this can result in better client outcomes is if they embrace it. So let’s think about the following:

- How do we buy volatility?

- How does it help?

- What is asymmetry?

- How much do I need?

- What are we giving up?

How to Buy Volatility

We think the answer is put options. A put option gives you the right to sell the index at the chosen strike price, vs. a call option that would give you the right to buy it. While a call option is designed to participate in the upside, a put option is designed to rise in price when the market falls. Consider it a form of insurance, providing a hedge against falling stock prices. Now, if stocks rise your put options will fall in value, but in the right proportion those stocks would help your portfolio rise by more than the options can fall.

How Does It Help?

If you own stocks, and the market falls, your portfolio value likely falls with it. The goal isn’t to prevent the fall; that would prevent a rise as well! But by owning volatility we could cushion it, and the great thing about a put option is its limited risk and unlimited upside. This is known as asymmetric payoff potential.

What is Asymmetry?

Hate using a $5 word if a nickel word is available, but can’t think of a way around it. Buying an option for $1000 means we can lose up to $1000, and not a penny more. If it pays off, we can make multiples of that $1000. That potential payoff comes with a low success rate, but so does hitting a baseball, where a 30% hit rate gets you in the Hall of Fame!

How Much Do I Need?

Let’s remember that we use these options to improve the portfolio, not because we want to speculate on every market move. Because the potential payoff is asymmetric, we need just a small sliver of this asset to accomplish our goal of reducing drawdown. The exact amount depends on a bunch of inputs we can cover offline, but if done efficiently we see no need to have more than 2% of a portfolio dedicated to this.

What Are We Giving Up?

There is no free lunch, anywhere. Allocating to put options means pulling it away from something; in today’s environment we think that’s bonds. With rates as low as they are, that’s not a concern. But options do cost money. That 2% of the portfolio is decaying a bit every day, quite possibly on its way to a total loss. That said, 1) we don’t just sit on the options and let them expire worthless, and 2) if your put option drifts towards zero it’s a safe bet your stocks have helped your portfolio nicely.

A Trifecta of Good Things

Hopefully that helps a bit with the mechanics of buying volatility as an asset class. Let’s try to be crystal clear on why we do it:

- Reduced Reliance on Bonds: we don’t like the return potential, and aren’t convinced of diversification benefits from these low rates. You can make the case that “safe” bonds can reduce portfolio volatility, but they also reduce potential return. We think there’s a way to get better tradeoffs.

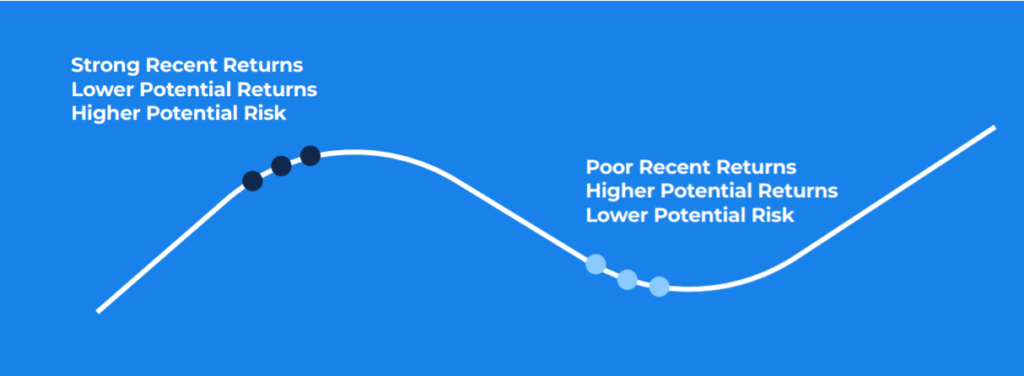

- Freedom to Own More Stocks: by owning volatility as described above, we can confidently adjust our asset allocation to own more of the asset class with actual potential…equities. Stocks might currently be expensive, and may not repeat the gains of recent years, but owning a broad set of businesses with the ability to raise prices is the best inflation hedge going, in our opinion.

- Dry Powder in Selloffs: not only can we move some of our bond allocation over to stocks to increase the potential long-term return, we can use the put options to create what everyone wants in a correction…cash. We’re not going to just watch our 2% of options become 6% and do nothing; we’re going to calmly adjust our hedges back to the target weight and make that cash available for redeployment into stocks. Something about buy low, sell high?

Source: Aptus Conceptual Illustration

Theory Into Practice

There was a time when implementation of this beyond a household or two would have been impossible. Thankfully the ETF structure has made it possible to deliver these portfolio enhancements simply and efficiently, opening the opportunity for individuals to more comfortably pursue their goals.

We think leaning on the benefits of traditional asset allocation makes sense, we just happen to believe that ultra-low interest rates dictate some flexibility of thought. By taking a sliver of the portfolio and allocating to volatility as an asset class, investors can transform a “buy and hope” approach into a more sustainable, confident approach to financial independence.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2109-16.