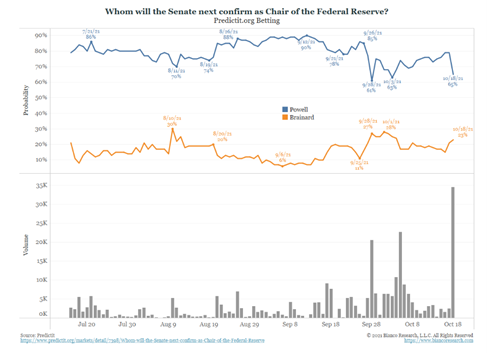

Fed Chairman Powell’s four-year term ends on February 5th, 2022. Historically, appointments (by the President) are typically made in October or early November for upcoming February openings. The reason for the timing is that the nomination needs to go through the Senate for confirmation, thus requiring a committee hearing, a committee vote, and a full Senate vote. The importance of this timing and Congressional process becomes even greater if a new Fed Chair is selected.

Source: PredictIt. As of 10/18/21.

Powell, a Republican, has proven to be accommodating to Biden and the Democrats. For example, most would agree Powell’s quick action following COVID and the patience in continuing the Fed’s monetary easing throughout the recovery has helped lift markets, while alleviating market stress. We believe Powell’s reappointment could provide assurance to market participants worried with rising inflation, an uncertain budget, and a stubbornly persistent supply chain/energy crisis. Not everyone, though, would be happy with a Powell reappointment. Influential progressive Democratic senators, particularly Elizabeth Warren and Sherrod Brown, have been vocal about the trading scandals and upset with the Fed board’s moves to deregulate the banking and securities industries.

As you’ve probably heard, Elizabeth Warren has been aggressively condemning Chairman Powell for lack of oversight following the Kaplan/Rosengren trading fiasco. We’d designate that Kaplan and Rosengren fell into the hawkish camp, removing two notable decision makers from the FOMC decision making process. In addition, the release of Powell’s trade records earlier this week which indicated sales ~$1mm worth of equity securities last October 2020 before a market drop aren’t helping his cause (although longer-term the timing doesn’t look so great as the market is up some 30% since).

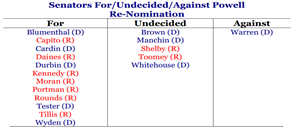

Source: Strategas. As of 10/12/21

Could the Fed See a Massive Shake Up?

With the future fate of our Monetary Policy decision makers on the table over the next month, all we can do is wait in angst. No one can be certain as to whom President Biden will select as Fed Chair, but we can’t help but think he realizes this might be a rare occasion to reconstruct the entire FOMC. Just looking at the backdrop, we know Biden already has one open FOMC seat and Vice-Chair Clarida’s seat is up in January.

Additionally, the other Vice-Chair, Randall Quarles, has his Vice-Chair title expiring in October – we believe this will allow Biden to reassign that designation to a more pro-bank regulation FOMC member. While not likely, we are watching as to whether Quarles decides to finish his term. He has indicated he would like to, but if he did leave one year early that would open another potential appointment for Biden. Together, these changes could create a completely new FOMC backdrop, let alone the consideration that a new Fed Chair could be in order.

We believe the pressure from Democratic Senate Banking Committee members will likely lead to the selection of more progressive economists, less focused on inflation, and more focused on employment (as well as social issues like inequality & climate change, etc.). Our sense is that the Fed will remain dovish next year, all else being equal, even as inflationary pressures builds up in the system. This makes the selection of the Fed Chair crucially important. The Fed Chair has an outsized role in the Fed’s decision making and although against what you’d typically expect given political ties, Powell’s policy has been quite dovish.

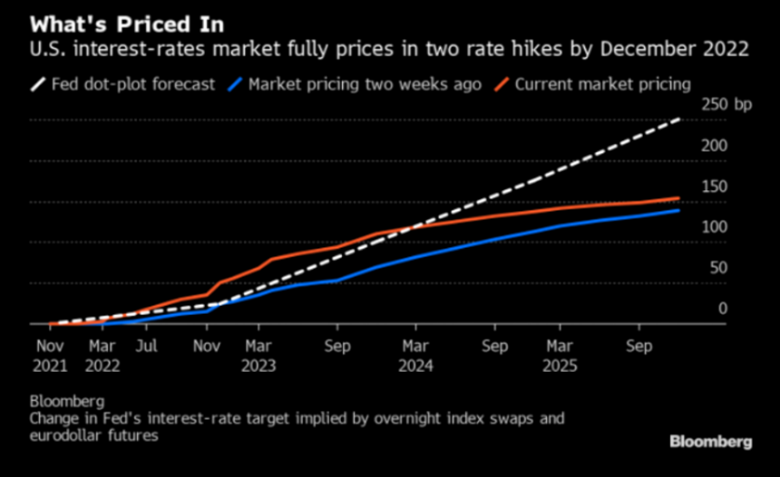

Source: Bloomberg. As of 10/20/21

So, What Does This Mean For Markets?

The market is bringing up expectations of Fed tightening in the near term, hence the increase in the short-end of the yield curve (graphic above). The view of multiple rate hikes in ’22 is getting more and more traction in the market and appears to be more and more likely. A big reason is that it’s hard for Powell to manage the hawks at the FOMC when he is in limbo. By delaying his renomination, we believe the administration could be on the cusp of a big policy error.

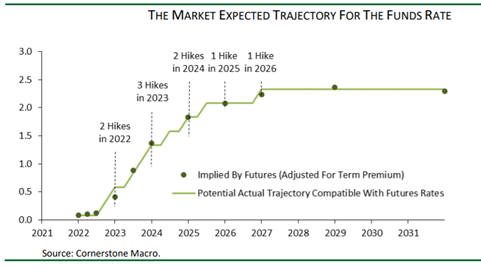

As of 10/21/21

Bottom Line

We don’t believe that, even with the market pricing in two hikes for ’22 and seven additional hikes out to ’26, we are seeing a fear of runaway inflation, but rather a potential for a Fed policy mistake due to the future uncertainty of the FOMC composition, i.e., flattening of the yield curve. The leadership role at the Fed is crucial to a well-functioning (if it can be considered that) market and if Powell get’s the boot, the newly adopted “Flexible Average Inflation Targeting Framework” could be prematurely abandoned as the economy is still recovering from the pandemic and being drug down due to a (hopefully) one-time supply chain congestion.

On that point, we believe it’s too early to claim whether inflation is persistent or transitory due to the elevated price pressures from supply chain disruptions along with the uncertainty regarding the longevity of the supply chain issues. While inflation is presently front and center, we can’t overlook the significant disinflationary forces present the last forty years which have kept inflation tamed (and are still present looking forward). Speaking out of the other side of our mouth, we believe the bottom-line concerning inflation is it really becomes a problem when it leaks into consumers day-to-day lives and spills over to politics. We could be at that juncture… buckle up!

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2110-11.