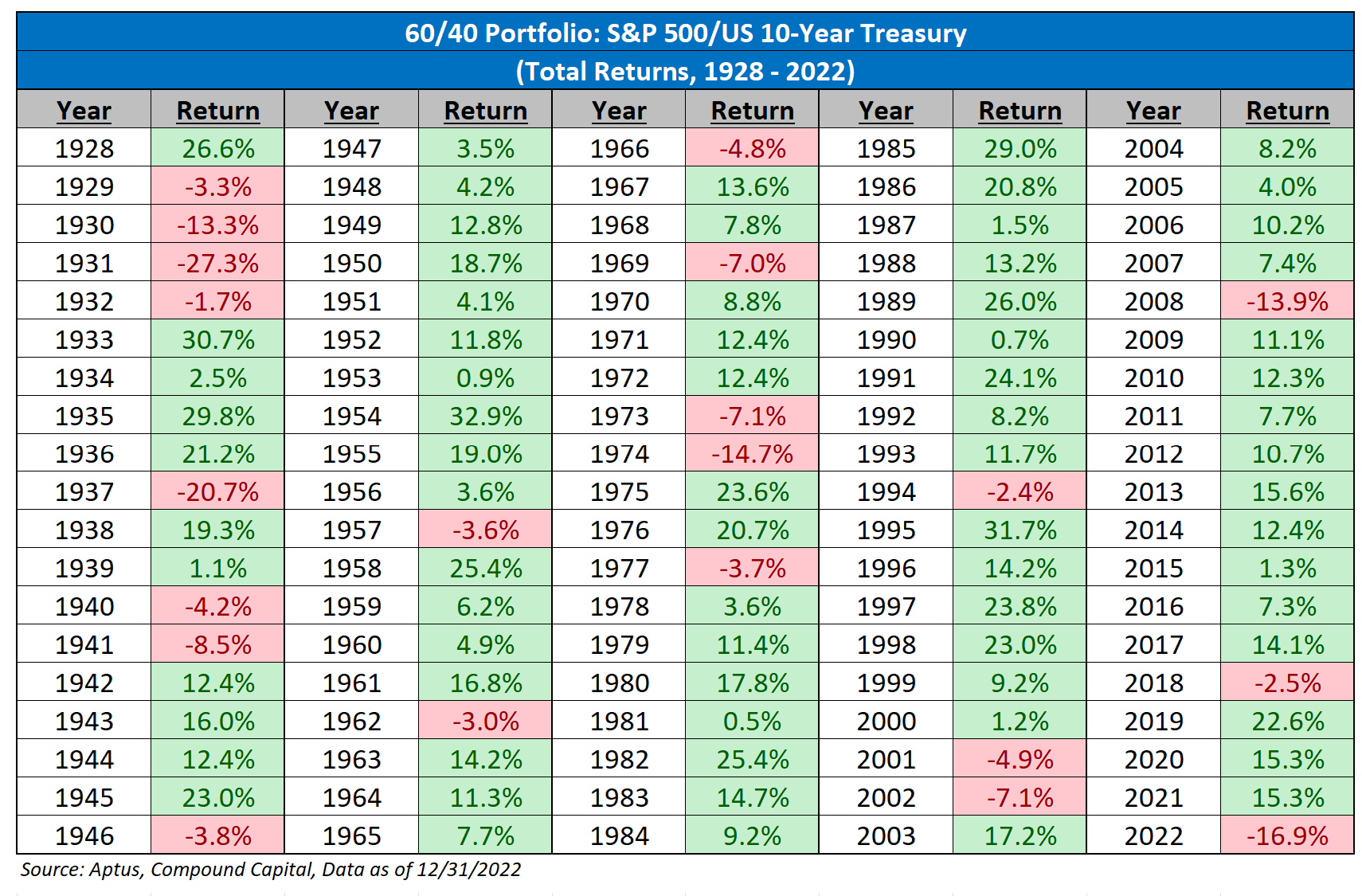

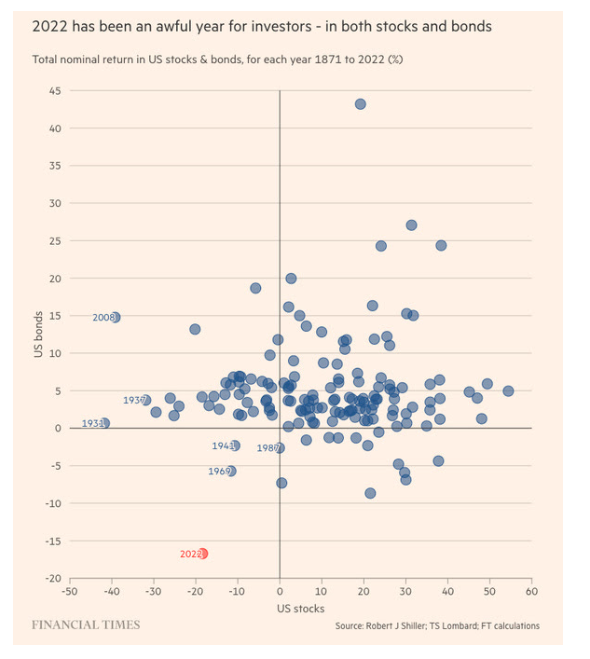

It’s now time to put a wrap on the year to do some reflecting and planning. At this point last year, your sentiment on your portfolio and maybe even the economy was likely in a totally different place. Simply said, 2022 was painful, almost regardless of your risk tolerance. 2022 was the worst year for the 60/40 portfolio since 1937. Consider the comparison of this past year to the Great Depression and it gives us all a nice reality check.

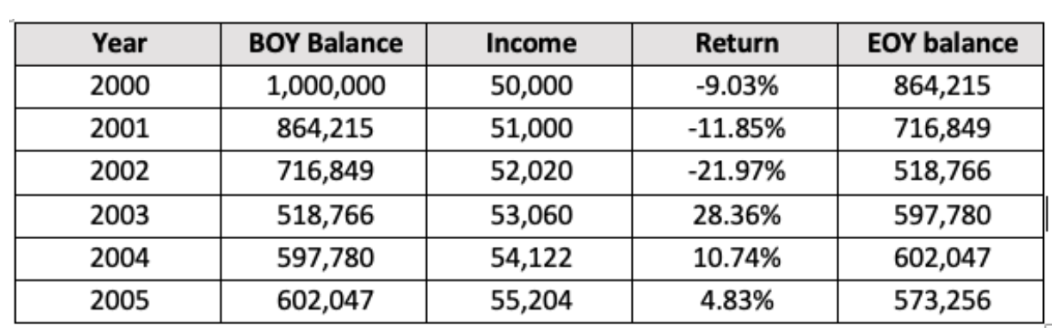

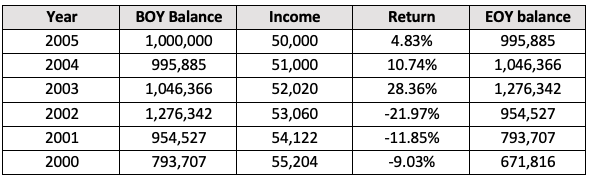

The reality of this abysmal year has most likely set in for one’s investment and withdrawal plan. Down years hurt every investor but are much more impactful for early retirees. Simply put, your timeline is the longest at this age and your resources are fixed. As we have discussed in prior pieces, early losses hurt much more than losses later in retirement, let’s look at an example:

Conceptual Illustration: Information presented above is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. These figures assume income at 50k inflated at 2% each year. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows.

Conceptual Illustration: Information presented above is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. These figures assume income at 50k inflated at 2% each year. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows.

The only factor we change from the above is the return stream is reversed. Basically, the losses are taken the last 3 years as opposed to the first 3 years:

Conceptual Illustration: Information presented above is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. These figures assume income at 50k inflated at 2% each year. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows.

Conceptual Illustration: Information presented above is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. These figures assume income at 50k inflated at 2% each year. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows.

Keep in mind the return numbers are the same, just moved to different years. The ending balance is almost 100k different which equates to 10% of the initial balance between the two scenarios. Your income was the same, your assets not so much. We cannot depend on average returns to drive our retirement success. The compounded annual growth rate year-over-year and the sequence of returns’ impact on your income is what matters.

It can be overwhelming to see a negative year like 2022, with negative returns in both stocks and bonds, inflation at historic highs, and then sit down to decide where to go from here. You are either currently on a limited income today as a retiree or plan to be soon and each decision you make can be inflated in the early retirement years.

First, I will say the challenge you are facing is not uncommon. Please do not hit the panic button. Let’s look at how the moves in markets this year may impact your return drivers going forward, then focus on considerations that are within your control that can be impactful to your plan.

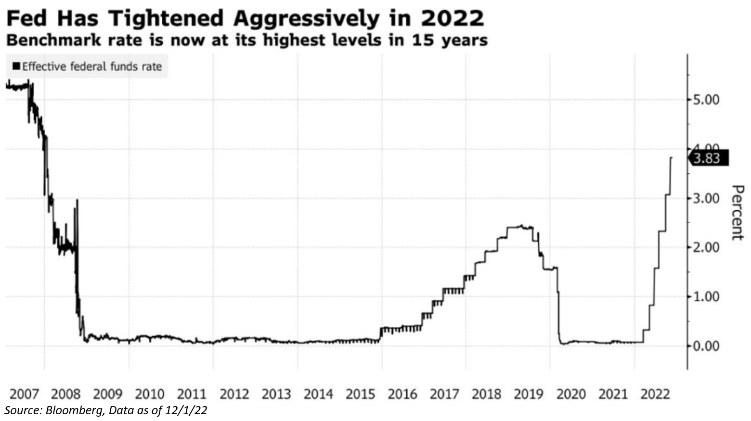

Changes In Interest Rates

If you didn’t know before this year, I would bet you know now. The Federal Reserve has a very important role with interest rates. Their mandate is to maximize sustainable employment and maintain price stability. This year they have been working to slow down demand by raising rates, with the hope to stabilize prices.

At the beginning of the year, the Fed Funds rate was targeted at 0-.25%. Fast forward to December of 2022, after 17 rate hikes, the Fed Funds rate currently sits at 4.25%-4.5%.

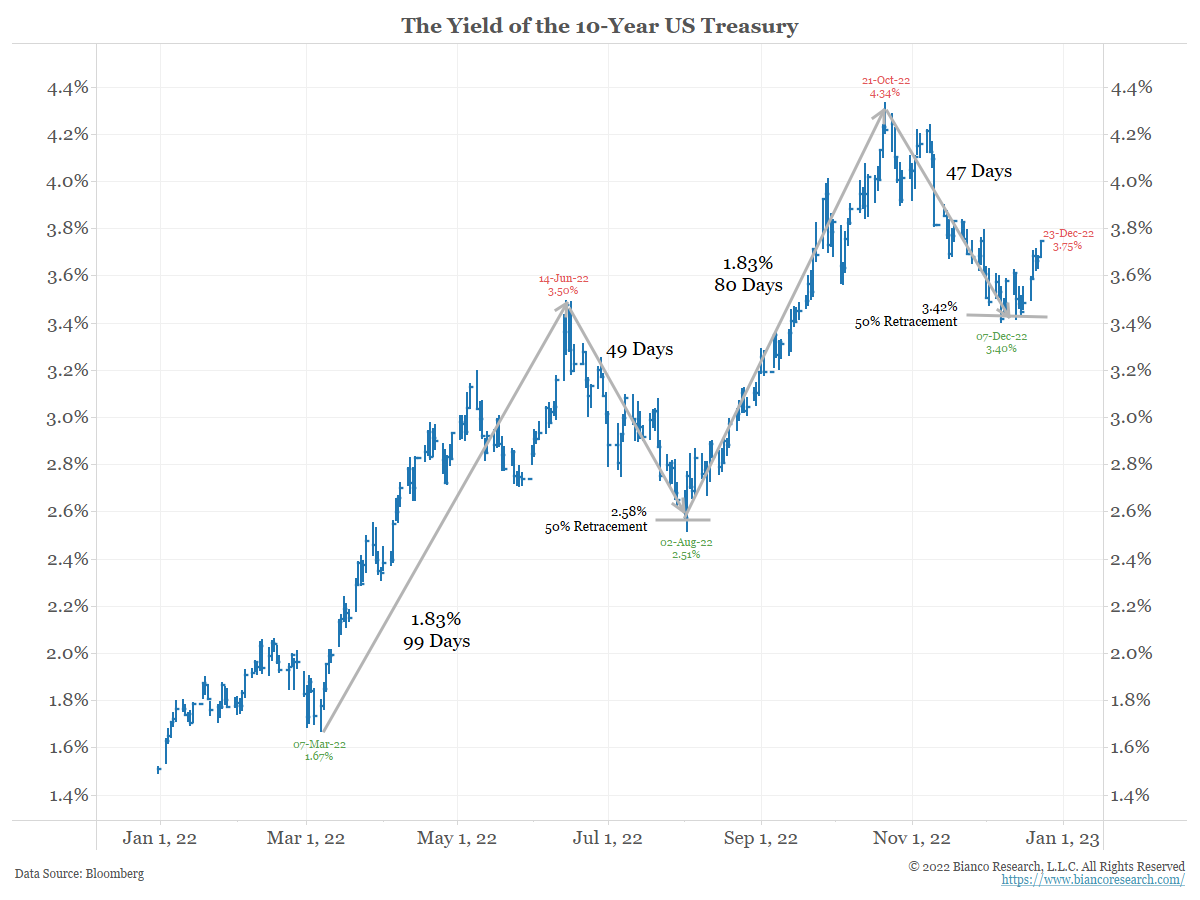

The yield on the 10-year U.S. Treasury note—which influences everything from mortgage rates to student debt—climbed to 3.826%, from 1.496% at the end of 2021.

There are two sides to the equation as rates move higher. The first being your portfolios (even risk-free savings) have opportunity to generate more return from yield. Savings accounts coming into 2021 were under 1%, and as of January 2023, you can find rates in the 3.3-3.5% range.

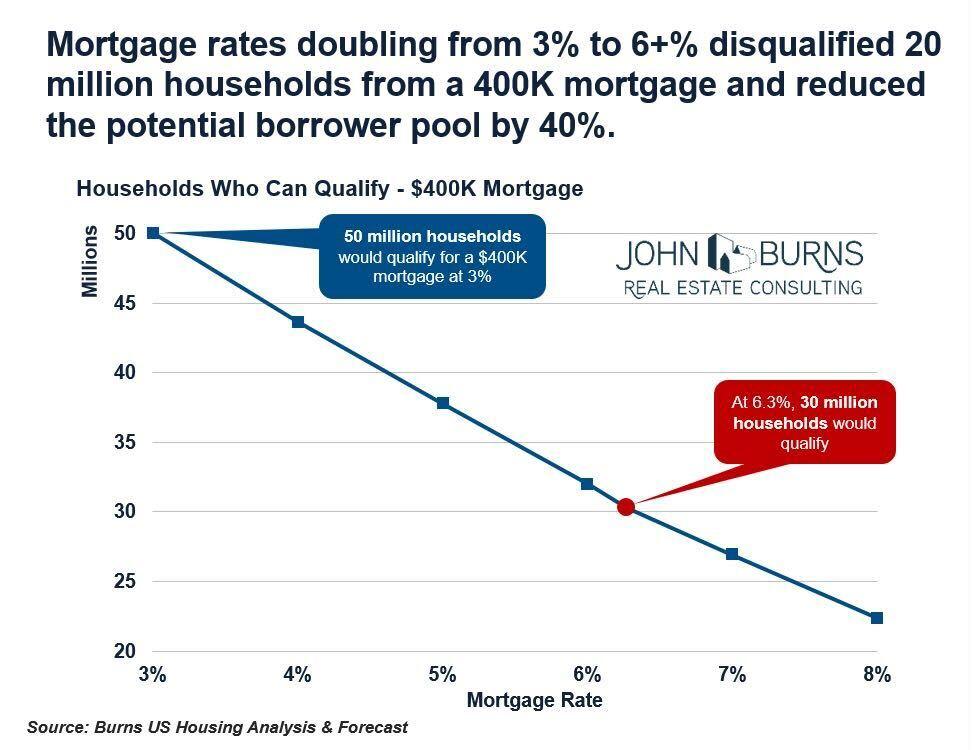

On the other side of the equation, affordability of taking on debt for business owners and future homeowners is much different. The number of Americans who can afford a 400k mortgage has almost been cut in half as rates have risen.

Although being a retiree doesn’t preclude you from higher mortgage rates, we find safer growth or income as a more common need. Tighter monetary policy could slow down growth and in turn hurt the economy and your portfolios into 2023. With that said, at least we can now manage with a known quantity of yield and continue to keep a close eye on growth for your longer-term assets. The move in rates in 2022 will finally give savers the ability to earn a more favorable yield going forward than they have the past decade.

Return Expectations

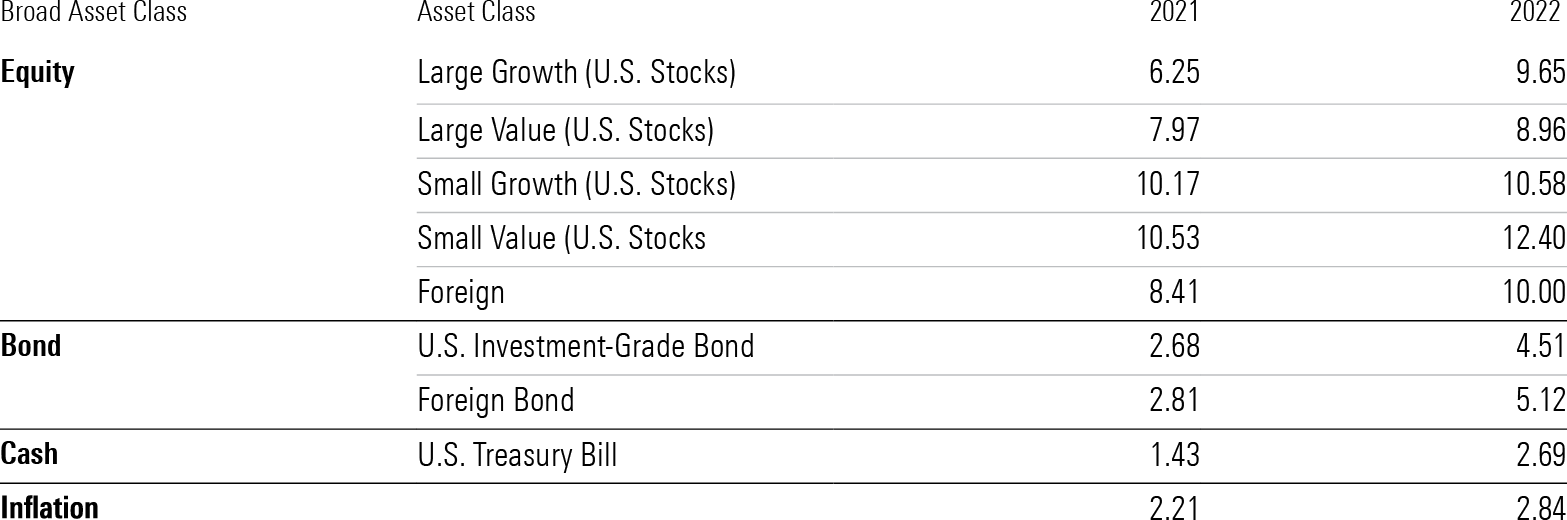

The yield to maturity on a fixed income vehicle is very useful to understand the return outlook. As mentioned early, we believe markedly improved from a year ago. Now that valuations have compressed in 2022, is it fair to assume the return outlook for all asset classes is more favorable? Shorter-term, we think the question is much harder to answer, here is the difference in Morningstar’s long-term outlook:

Source: Morningstar

Source: Morningstar

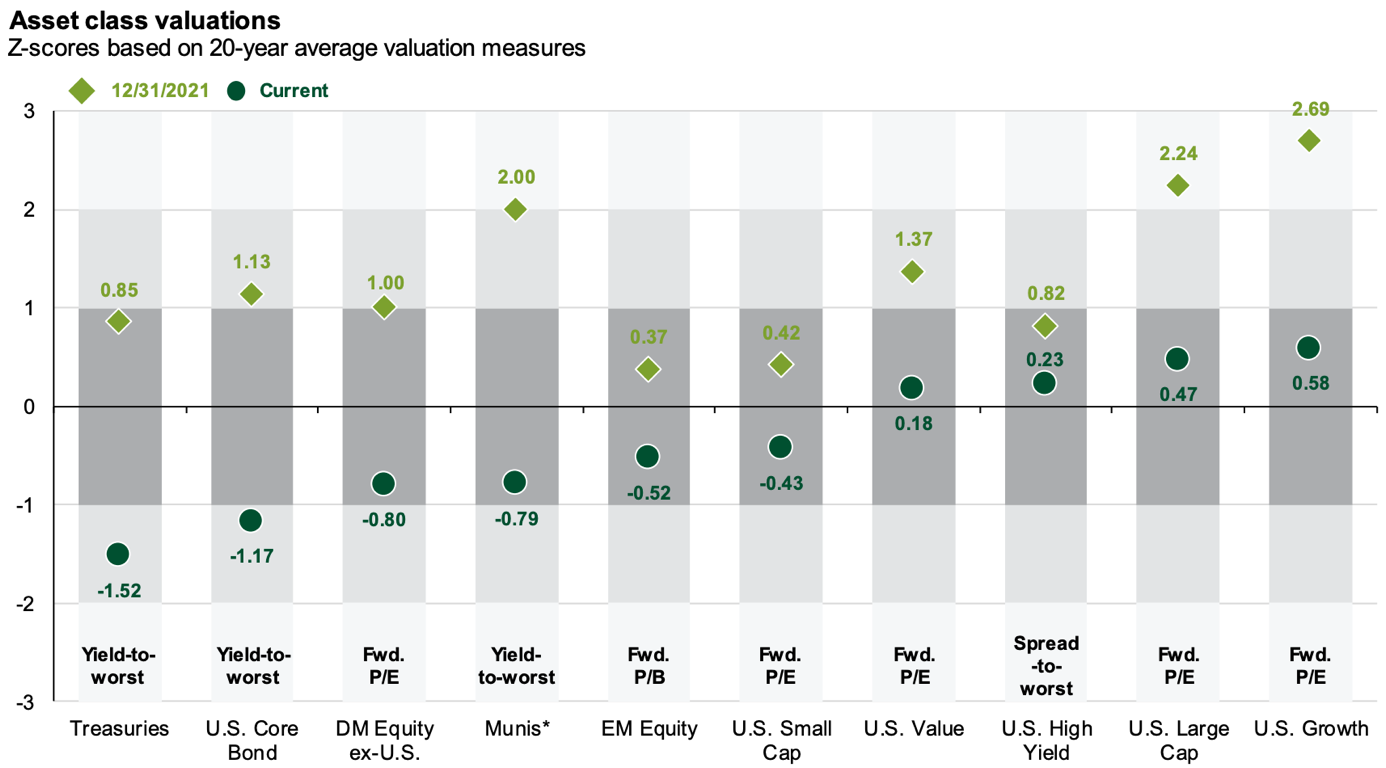

Over long periods of time, valuations do matter. In fact, valuations explain ~80% of subsequent 10YR returns for the S&P 500. In our view, this year’s bear market provides an attractive opportunity for asset growth of long-term investors. As illustrated below in just a year’s time, we have seen a significant reversion in valuations, which we believe will play an important role in the long-term return outlook.

Source JP Morgan as of Dec 31, 2022

Source JP Morgan as of Dec 31, 2022

Our investment team does a great job simplifying where portfolio returns come from: Yield + Growth +/- Valuation Change. To this point, historically, yield has contributed roughly 36% of total return of the S&P 500. Yet, in the 2010s, it only contributed 14%. We believe yield will be a much stronger contributor to performance in the near term for both your stock and bond allocation.

Looking Forward: Asset Allocation

You now see the silver lining of a painful year as you look through the windshield in how you manage your future sequence risk. At this point, we are not making a huge bet that we are through the pain in markets. We don’t think as an investor you need to either. Attempting to time the market to manage sequence risk could very easily do more harm than good.

The traditional way to manage risk is to increase your bond exposure. As 2022 illustrated, the correlation between stocks and bonds is not always negative. In addition to bonds, we incorporate the ownership of volatility to manage risk and allow portfolios to stay invested. By owning a small allocation of volatility which has the potential for asymmetric payoff, we can remain invested and not add timing risk as we look to mitigate drawdown risk.

Like any asset management firm, we have our thoughts on both short-term and long-term return drivers. The known in any environment is the yield. Today, after a decade of abysmal yield, your shorter-term retirement bucket can now lean on this side of the return picture. There is no need to take growth bets for your shorter-term income needs in this environment. Take what the market is giving you.

We lean on yield through the traditional mechanisms of stock dividends and bond interest, but we add a third income producer of selling volatility. As we look at portfolio positioning going forward for retirees, we think using options for income is a much better mechanism than taking on credit or rate risk to drive yield.

Looking Forward: Flexible Withdrawal Plan

After re-evaluating your short term (next 5 years) bucket and related asset allocation, consider the number of years you have remaining in your retirement plan. The longer your time horizon the more you will need to be aware of your future sequence risk. In just one year’s time, you can see how the data for future success changes. As both market returns and expectations change, your income plan should adapt as well.

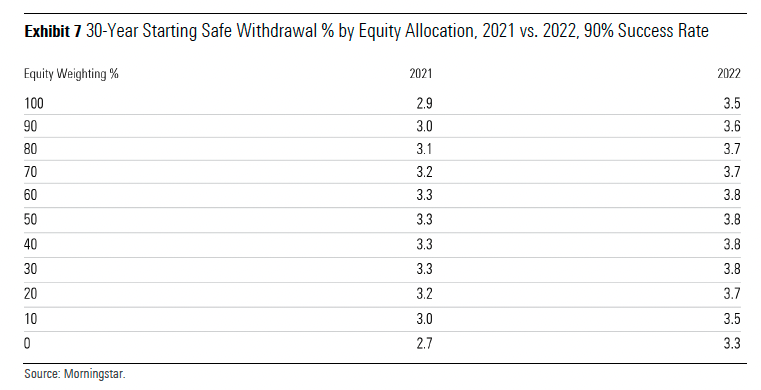

30-Year Starting Safe Withdrawal % by Equity Allocation, 2021 vs. 2022, 90% Success Rate

Morningstar’s 2022 State of Retirement Income Research suggest a 50/50 portfolio starting withdrawal rate of 3.8% over a 30-year time horizon as safe. 2021 their research identified this number as 3.3%. For additional context with that same 50/50 portfolio during periods from 1930 thru 2019 the “safe” withdrawal rate for the worst 30-year period was 3.7% and 6.0% for the best. Historically speaking, we are not in an overly optimistic timeframe as we incorporate Morningstar’s expected future returns, but we are better than at the start of 2022.

Your asset allocation, the market environment that prevails during retirement income period, and the length of retirement all are drivers in determining the “right” withdrawal rate. David Dredge of Convex Strategies recently said: “It’s not predicting what you think you know. It’s constructing resilience in what you can’t know.” Understanding the data for both your withdrawal rate and asset allocation is critical and we believe the resilience is created by carefully monitoring and adjusting as your environment changes.

Summary

Although 2022 has been anything but rosy, we do believe the long-term return picture is much more optimistic. Return drivers for portfolios include yield, growth, and valuations changing. One element of sequence risk that can cause additional harm to your plan is the need to sell assets at depressed values in order to generate your needed withdrawal. Considering the new interest rate regime we are in today, embracing yield to drive returns, especially within your shorter term bucket, will be key to avoiding this.

As your time horizon expands for life in retirement, how you manage sequence risk becomes much more important. Avoid attempting to time the market as the results could put more pressure on your plan. The advantage of owning volatility as an asset class is that it gives investors the opportunity to make choices yet minimize regret and mistakes from market timing.

There is a silver lining to an extremely painful year as you position for retirement. A quote from Howard Marks that especially applies to sequence of returns risk: “Successful investing requires thoughtful attention to many separate aspects, all at the same time. Omit any one and the result is likely to be less than satisfactory.” As you adapt to negative portfolio returns, higher than expected inflation, or whatever is in store during your retirement, remember this quote. It may not be an easy path but keep a close eye on all the moving factors and be willing to adjust. We believe this will give your retirement plan the ability to battle sequence risk with much more resilience.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed. The opinions expressed are those of Aptus Capital Advisors, LLC. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

©2022 Morningstar, Inc. All Rights Reserved. Information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Information contained herein has been sourced from Morningstar Direct. While this information is thought to be reliable, Aptus Capital Advisors, LLC does not guarantee its accuracy and assumes no responsibility or liability for its use.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2301-4.