With OPEC in the news and many countries clamoring for more oil (including President Biden), we figured an update was due…please reach out to the author at [email protected] if you’d like to discuss further.

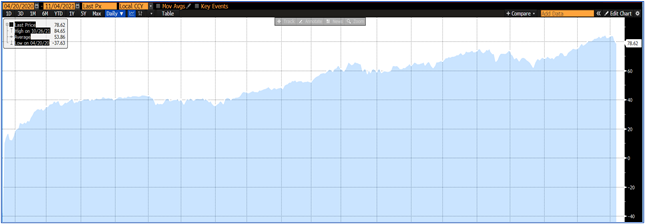

If you’ve filled up your car lately, you likely noticed a higher price at the pump. Gasoline prices, as everyone knows, are directly correlated with crude oil prices, and we’ve come a long way since the depths of the COVID crisis.

Source: Bloomberg, LP, as of 11.04.2021

You’re seeing that right…if you recall, oil briefly went to -$37.63/bbl (barrel) in April of last year, driven by a confluence of various factors (COVID-stifled demand, a brief Russia/Saudi price war, and most notably, a contract expiration at a time when physical storage was almost impossible to come by). The International Energy Agency (IEA) estimated that global oil demand fell from a high of 100.5 MMBls/d (million barrels per day) near the end of 2019, to just 83.0 MMbls/d in the summer of 2020. That type of move begs for a supply reaction, and it got one:

- OPEC+ (those “+” countries include Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, Russia, Sudan, and South Sudan, though you almost only hear of Russia because they produce nearly double the amount of the other nine combined) cut 9.7 MMbls/d in May 2020. They have since began bringing some of that production back online, currently adding 400,000 bls/d per month until they reach full capacity, which is expected in September 2022.

- The largest oil producer in the world going into COVID, the United States, saw its output decrease from 13.0 MMbls/d at year-end 2019 to 11.0 MMbls/d just a year later. In similar fashion, the North American rig count, which stood at 1,350 at year-end 2018, fell to a low of 276 in July of 2020.

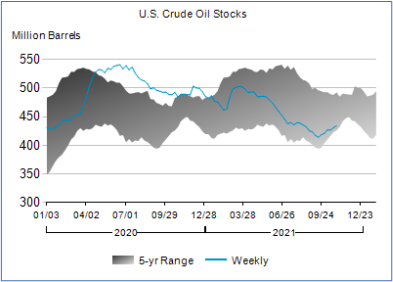

Even with such a response, crude inventories piled up. Just here in the US, total crude inventories peaked at 539.2 MMbls in July 2020 – compare that to 429.9 MMbls at year-end 2019.

Source: EIA (US Energy Information Administration), as of 11.08.2021

At the time, the narrative of “peak oil demand” was getting a lot of traction. Would the world ever return to where it was prior to the pandemic? Fast forward to today, and we’re already nearing where we left off in 2019. In fact, the average forecast for 2022 from OPEC, IEA and EIA sees demand at 100.4 MMBls/d. Perhaps not without its hiccups, but the confidence brought on by the COVID vaccine announcement in November 2020 ushered in a global reopening that has seen GDP surpass its prior highs and pulled oil demand along with it.

That is a look back, let’s consider where we’re going from here. As I mentioned to start this piece, gas prices are high (the national average just hit $3.48/gal, highest since Sept. 2014)! So has the return in demand been fully priced in? Perhaps it has overshot?

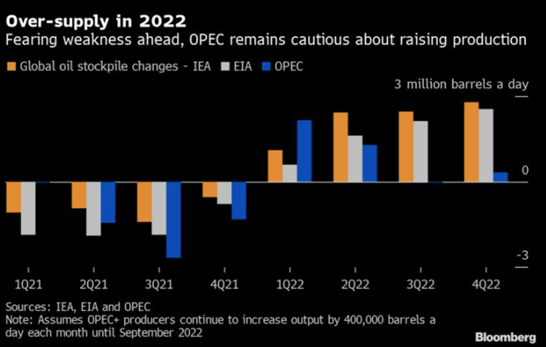

Many analysts believe that while the current market is still undersupplied (by somewhere in the area of 1-2 MMBls/d), that will alleviate itself as OPEC brings back spare capacity through its reverse taper and reinvestment elsewhere brings new product into the market. Indeed, the same three agencies which forecast a return to 2019 demand levels in 2022 see the market as being oversupplied for the year.

Source: Bloomberg, as of 11.08.2021

Source: Bloomberg, as of 11.08.2021

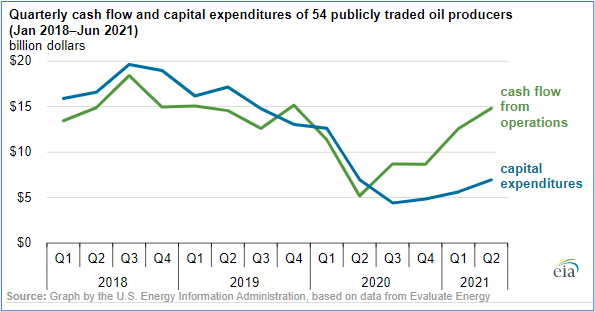

And we all know that the entrepreneurial spirit of the US oil patch can’t contain itself, right (drill baby drill!)? Well, that may not be the case this time. In fact, publicly traded domestic operators have gotten the not so subtle hint over the last few years that investors want returns, not more oil. As such, we’re seeing a phenomenon in US E&P (exploration & production) – spending only what it necessary to hold production flat, while using abundant excess cash to pay dividends, buy back stock and pay down debt.

Source: EIA (US Energy Information Administration), as of 06.01.2021

Source: EIA (US Energy Information Administration), as of 06.01.2021

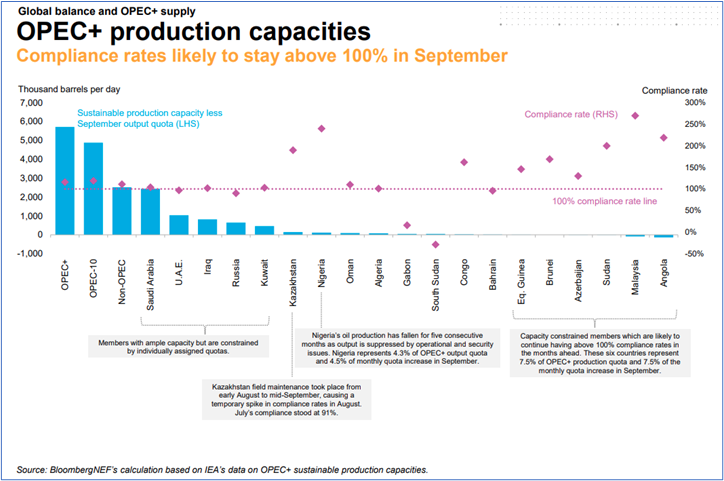

Domestic producers aren’t the only ones underinvesting in future production. Take OPEC+ for example: though they are on a current path of increasing production at a rate of 400,000 bls/d per month, some countries (namely Nigeria and Angola), haven’t even been able to meet their quotas due to fiscal neglect of their assets.

September 2021 production output vs quota by OPEC+ member country

This lack of investment comes at a time when investment in fossil fuels is becoming increasing unpopular to begin with. This week, leaders of the United Nations are meeting in Glasgow for the COP26 summit, a pow wow on how to “accelerate action towards the goals of the Paris Agreement and the UN Framework Convention on Climate Change (source: ukcop26.org).” And it’s not just coming from policy makers…Larry Fink, CEO of the world’s largest investment manager by AUM, BlackRock, has made climate change one of his marque issues in capital allocation going forward (https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter). In other words, even if operators wanted to produce more, there is a lot in the way of structural disincentives to do so.

We’re keeping an eye on all of this. But as it relates to investments, two things are certain:

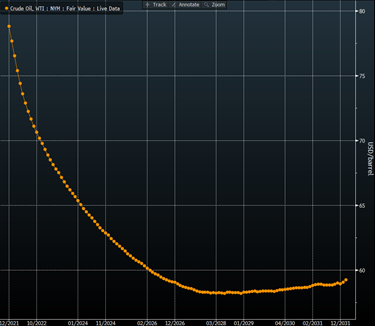

- Domestic operators have become extremely efficient at producing oil, generating free cash flow at levels below $55/bbl. With oil priced near $80/bbl as of the time of this writing, it is hard to imagine a long-term environment where that type of economic rent is allowed to exist. Oil prices can do any number of things in the short term, but we would expect for them to come down over time. This sentiment is confirmed in the futures curve, which currently forecasts oil to settle in around $60/bbl four years out.

Source: Bloomberg, LP, as of 11.08.2021

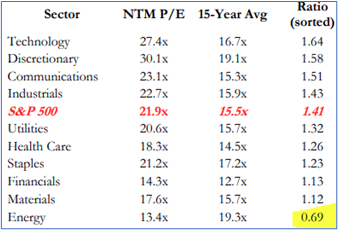

- A regime shift in the way people look at climate change and ESG will put a structural ceiling on the valuation multiples offered to those working in “old world” energy. Even with that being the case, most all high quality, well capitalized, domestic E&P companies are trading below 5x EV/NTM EBITDA. Even a climate activist has to agree – that’s cheap!

Source: Strategas, data as of 2Q’21 end

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2111-5.