We’ve been fielding a few questions as to why higher rates have seemingly had no collateral damage on the economy except for a few banking failures back in March. Let’s hit on a few talking points.

The data on the investment side of the economy tells a story of strong balance sheets and wages enabling consumer spending to sustain despite higher rates, while tremendous government spending and a number of “mega projects” (think EV supply chain and semiconductor fab builds) are enabling investment growth to remain relatively strong despite higher yields.

How long this resiliency can last is unclear, but the bond market started shifting its view over the last two months. Bond yields surging has been the story of the past two weeks as the 2-year Treasury yield rose to 5.03%, and 10-year Treasury yield approaching cycle highs of at 4.32%. But then again, maybe the bond market is just being whipped around by the giant financial experiment being run by Japan and China – I’ll let John Luke answer those questions.

Nonetheless, the market is witnessing the highest rate levels since 2007.

Let’s break this musing down into two segments:

- Corporate Implications

- Consumer Implications

I think that I could create a third section on “government implications”, but the message is quite clear. Given that almost 50% of Gov’t debt is coming due in the next 3 years (current coupon ~2%), the government may be in a difficult spot as interest expense on the income sheet is approaching the current defense spending budget. But all of this is a topic for another day (and we covered it quite a bit on our debt ceiling musings back in April).

Why Rates Haven’t Had a Material Impact

Corporate Implications:

It’s no secret that consumers are generating more income than ever from their cash and the same holds true for corporations. Given the rise in rates, companies are generating roughly $6.6B/month. This is the highest level on record (previous record was in ’97 at $3.0B/month) and is likely a contributing factor to the labor market holding up better than many anticipated, as companies can afford wage hikes more easily.

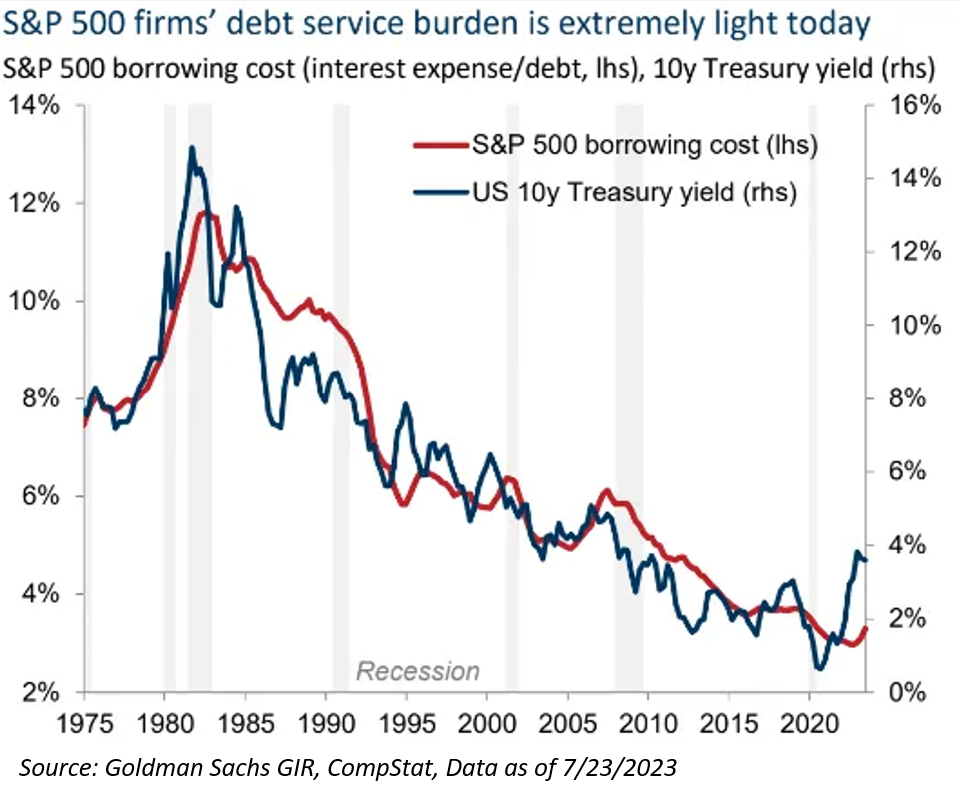

But not only does it help offset wage gains, its starting to help offset higher interest expenses. Originally, the inclination of higher rates on corporate debt was that it was going to degrade profitability. Currently, S&P firms are paying around 3% on debt while treasuries are yielding 4%. Below is a great illustration of the incredible lags that have been created via ZIRP post GFC.

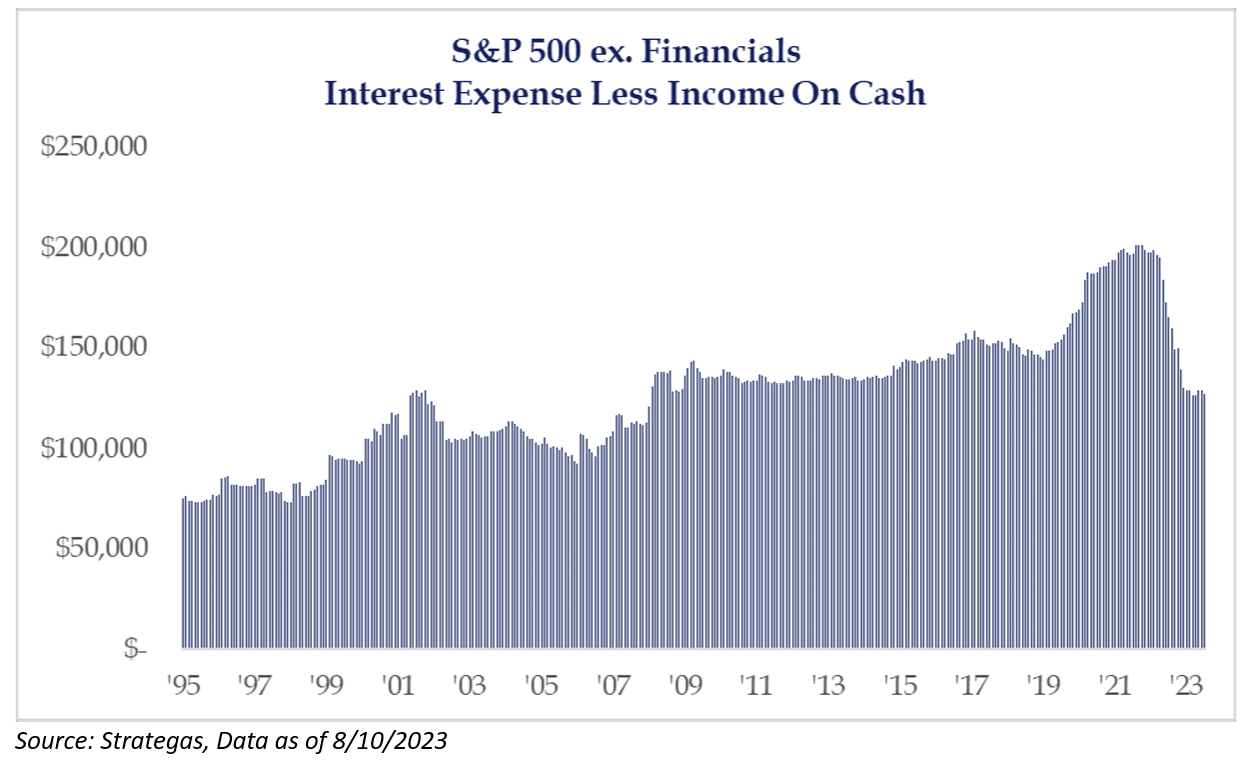

Said another way, looking at interest expense less the income generated on cash for the S&P 500 ex. Financials shows that the income generated on their cash has more than offset the higher interest costs.

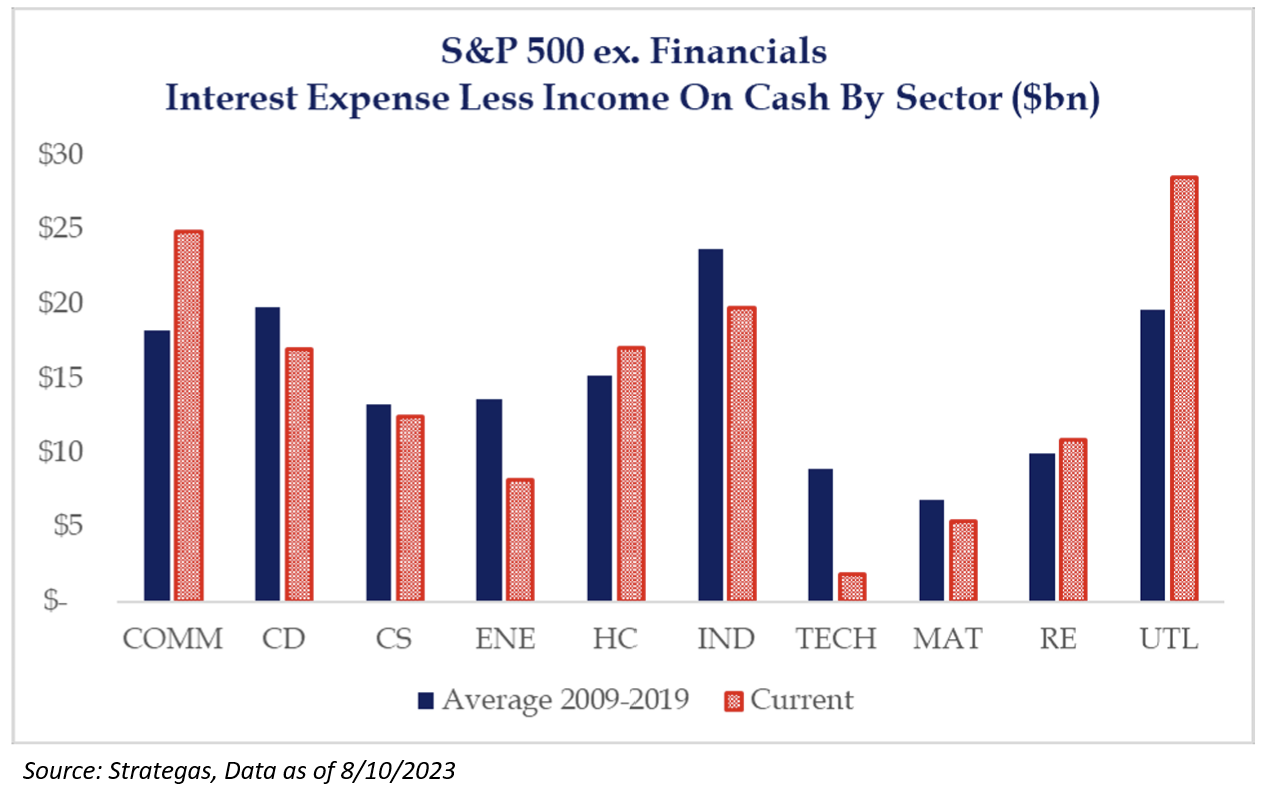

This story gets even more interesting if you look at it by sector. Perhaps not all that surprising is that the technology sector has benefitted most from the higher returns on cash. What may be less known is that energy and industrials have also benefited. On the other hand, utilities and real estate have been hurt the most. It is not much of a secret that companies like Apple Inc. (AAPL) and Microsoft Corp. (MSFT) are heavy contributors to the Tech space.

Consumer Implications:

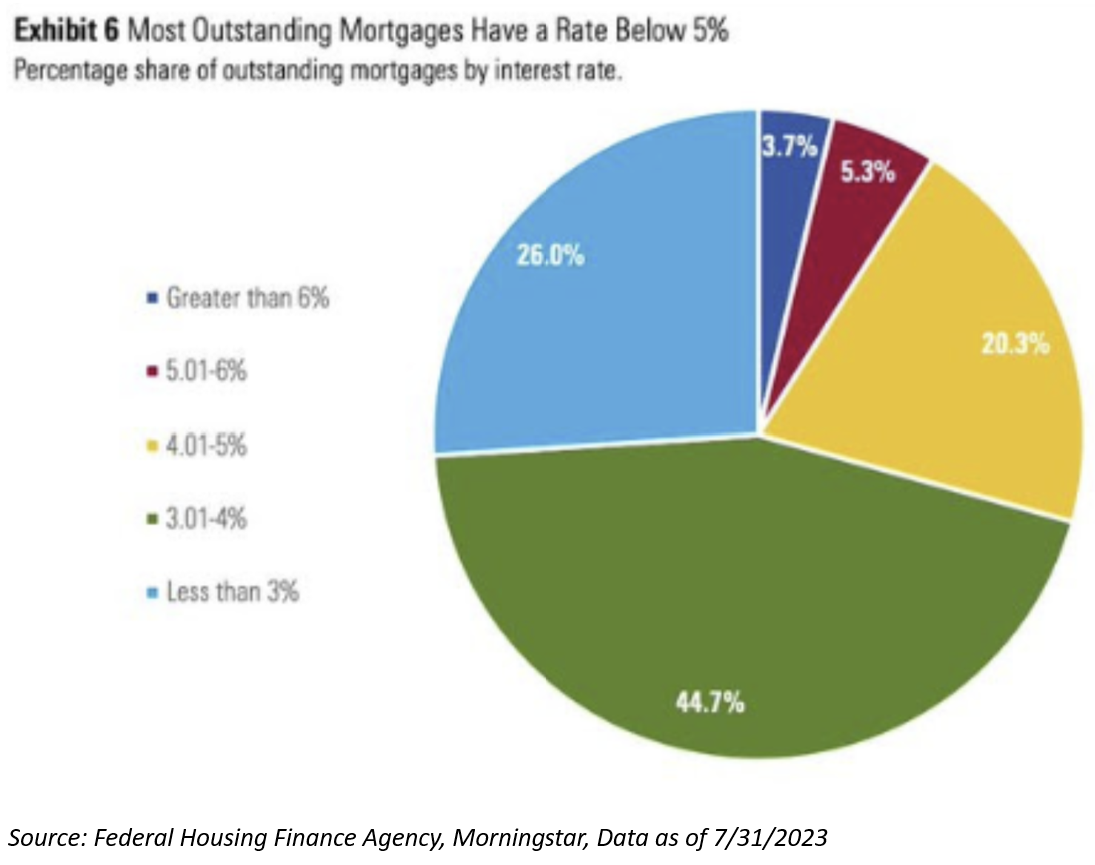

Simplistically speaking, where do rates affect consumers the most? Mortgage rates. Yet, if a person isn’t looking to buy a home, then they aren’t affected by rates. In fact, only 9% of all existing mortgages in the U.S. were taken out with a rate of above 6%, according to data from the Federal Housing Finance Agency. Moreso, 80% of the U.S. mortgages have a sub-5% rate. Basically, homeowners are locked in place by their mortgage’s “golden handcuffs”.

Even more so, millions of homeowners took advantage of ultra-low rates during the pandemic to lower their monthly payments. A recent study by the New York Fed found that 14 million outstanding mortgages were refinanced during the pandemic years. The typical homeowner who did so during this period saw their monthly payment fall by $220, the study showed. But today’s homebuyer is facing a much more expensive path to homeownership: Mortgage rates have surged since, and the 30-year is almost 8%….unless an individual must move, many folks have been staying in the same house, leaving them unaffected by current rates.

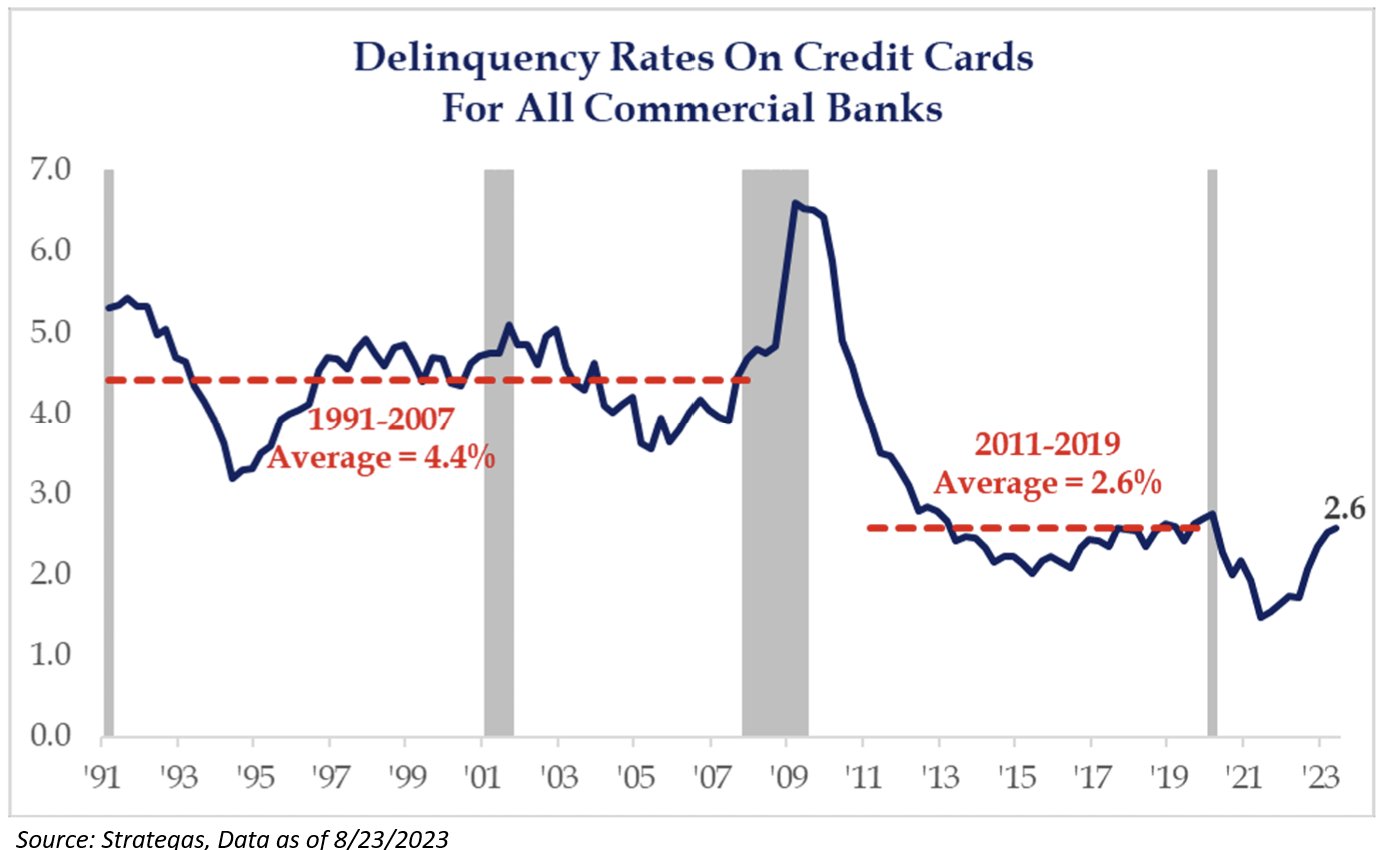

Given Macy’s earnings announcement the other day, which saw an increase in credit card delinquencies, consumers could be affected by their credit card rate increasing. Yet, consumer credit remains strong, but delinquencies are rising. However, looking at a broader set of data which was published by the Federal Reserve this past week shows that credit card delinquencies may simply be normalizing to pre-pandemic levels. At 2.6%, the latest reading is in line with the average for 2011-2019 but remains well below the 4.4% data average from 1991 to 2007.

Conclusion

In a nutshell, the rise in rates has done more to help investors from a nominal return perspective than hurt them, as the liability aspect of rates have been irrelevant to most people as they remain put in their current dwelling.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward- looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2308-19.