Basketball is a simple game. There’s complexity when it comes to different offensive or defensive schemes. There’s advanced analytics and Moneyball-type statistics everywhere. That stuff is fun to think on and discuss, but it can also be a distraction.

The team that wins is the team that scores more points. Period.

Offensively, only two things can happen:

-

-

- We get a shot, or

- We turn it over.

-

Let’s do #1 and not #2.

Evaluate the pieces we have and put together an overall approach that leads to getting more shots. Being good at this one thing makes everything better. There’s nothing you can think of in the game of basketball that trumps what I just said – it’s all just footnotes in a book about getting more shots.

It is THE thing that matters most. If we are good here, we can be mediocre elsewhere and still win the game. Our focus and energy should be spent on understanding why this matters and how we plan to execute.

Portfolio Construction and Today’s Market

Allocation is THE thing that matters for your portfolios.

We want to empower advisors through portfolio performance, better perspectives, operational efficiency, and confidence.

I believe, to my core, that we are fighting the right battle and focused on the thing that matters. We are solving allocation issues in ways that should lead to higher compounded annual growth rates (CAGRs) with digestible risk.

We are a weapon in the battle for our advisors to solve THE largest issue. Our system is broken, in so many ways. We can’t fix it, but we can sure play the hand we are dealt. Most don’t realize the battle they are in…and if you cannot tell from the last 7 or 8 months of monthly notes from us, we are trying to provide the perspective needed to illuminate the issue.

The Problem

For some reason, we’ve all grown used to the fact that a dollar under my mattress today is not worth a dollar under my mattress in the future. Meaning, that dollar is guaranteed to lose value if it is not invested in something. We all think that’s normal. I won’t get started on the issues with that. I’ll focus on the point of this note.

What we need to solve is purchasing power risk. We can call it longevity risk, purchasing power risk, or simply financial repression. The point is, investors need to protect their wealth and in order to do that, we believe the backdrop forces the need to own more risk assets.

More stocks, less bonds, risk neutral. That’s our story and we are sticking to it.

Please read last month’s note for more color into that: Winning within the System.

There is no middle ground. You either own risk assets that inflate as currency is debased…or you own the currency that’s being debased.

Our aim is to create portfolios and strategies that fix ALLOCATION issues. Getting your allocation right is akin to getting more shots in basketball.

What Do I Mean?

CPI measures inflation. It’s bogus… completely. Don’t believe me, read this: Larry Summers Inflation Measures.

Why does the cost of everything go up so much? It HAS to, and it will continue to. Otherwise, we will have a debt crisis. Which we won’t. At least not for a long time.

Growth comes from people, people being productive, and debt.

When you have declining trends of people in the workforce AND declining trends of productivity of those people…how do you get growth?

Through debt.

Anybody want to guess the trajectory of debt over the last 20 years?

Who absorbs that debt? Our government. Why? Because they can print money to finance the debt.

More debt = more money in the system = debasement of currency. It’s the only way we can service the debt when you have the debt loads that we do. Maybe that doesn’t sound too bad to you … keep reading.

Our system is DEPENDENT on more debt. To say the same thing, our system is DEPENDENT on currency debasement. If you hold the currency and not risk assets, the system you are in will steal your wealth no matter how safe you think it is.

Source: Aptus via Bloomberg

Source: Aptus via Bloomberg

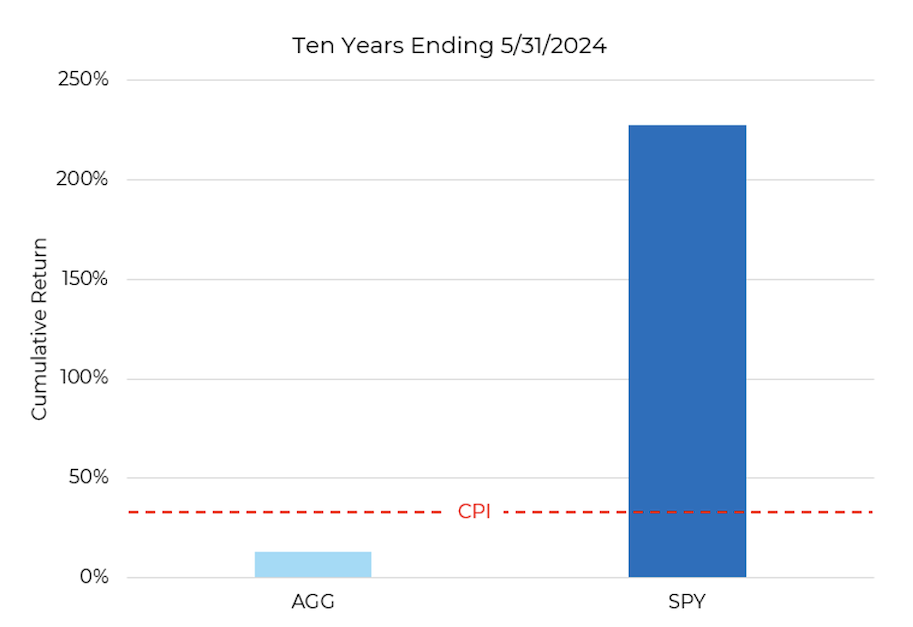

Just look at the chart above. Any wealth invested in something below the red ‘CPI’ line means you are poorer now than you were 10 years ago. Now, consider the link I shared earlier with a real look at what inflation is. Anything other than the fairy tale CPI number we are given, and the gap only increases.

That gap is investors ‘safely’ becoming poorer with assets in traditional bonds. We believe the gap between ‘conservative’ assets (like the AGG) and risk assets (like the SPY) will only increase over time given the deficit spending and fiscal backdrop of today. Keep that in mind as clients are fooled by the comfort of CDs or T-Bills in today’s inverted yield curve environment.

Jack Mallers of Bitcoin payment provider Strike says it best. I’m paraphrasing, but he views money as an abstraction of your time and your energy. That’s all we have…our time and energy. You are paid for your time and your energy. When currency is debased, which our system HAS to do, the value of your time and energy is being stolen. Your time and energy are worth less and less. To get the same things you have today in the future will require more and more of your time and energy.

There is a solution: Own risk assets.

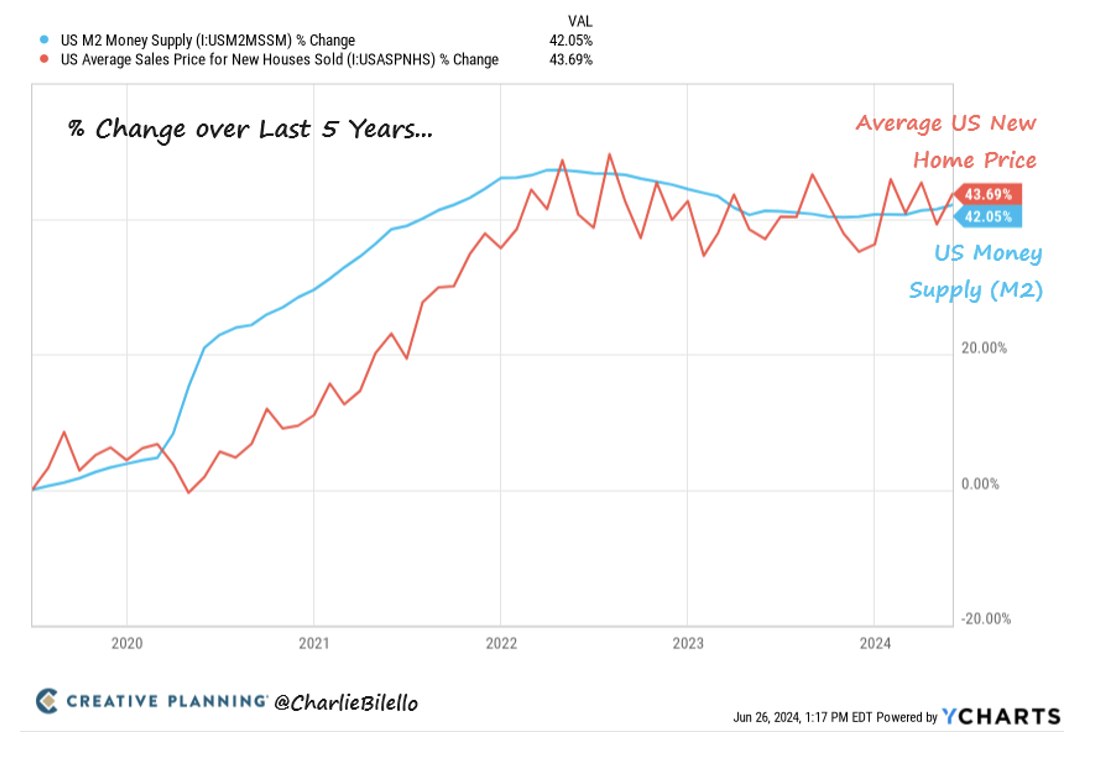

Look at the chart above: ‘The value of my house is up 44% since I bought it in 2019!’

NO, IT IS NOT! It is up 1.5% when you consider it through the appropriate lens of currency debasement. It’s an asset that will inflate as currency is debased.

Summarizing all the above, own more stocks (risk assets).

We want to provide the default allocations within financial services (think stock/bond blends), with avenues out of traditional handcuffs that keep them more susceptible to longevity risks. We want to provide a path towards confidently owning more risk.

But what if stocks go down a lot? THAT’S WHY WE OWN THE SPECIFIC INSTRUMENTS TO PROTECT IN THAT EXACT ENVIRONMENT!

Own the thing that frees us up to take the risk.

Hedges can offer convexity to portfolios. The presence of potential payoffs allows us to absorb more risk at the allocation level.

Closing

The complexity of financial markets is infinite. There are so many data points that seem to matter. Don’t get sucked into the complexity and devote your energy and focus on things that don’t move the needle for your clients.

Yes, we have a team that can answer questions on the headlines or the topics of the day…but our attention remains on making sure we are impacting portfolios at the allocation level and providing the support needed for the most effective messaging possible.

For your clients and their financial plans, the investment returns on their portfolios are crucial to making their future the one they want. An 8% CAGR sure makes the scenario analysis look better than a 6% CAGR. That’s always going to be the case. Higher CAGRs solve all types of problems. You earn them by allocating appropriately.

At Aptus, we are trying to position for higher CAGRs while keeping drawdown risk at bay. You are starting to see the portfolio performance reflect the allocation shifts we’ve been able to facilitate through the inclusion of differentiated strategies. We will continue to look for ways to impact the things that matter.

As always, thank you for your trust and please don’t hesitate to reach out with any questions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2407-10.