Stock buybacks are a frequent corporate practice that often sparks debate and confusion. As a means for companies to return excess capital to shareholders, buybacks can seem complex and sometimes even controversial. However, when you peel back the misconceptions, the logic and economic equivalence of buybacks become much clearer.

Debunking some common myths about stock buybacks:

Myth 1: Companies Shouldn’t Buy Back Stock When it is Overvalued

A common criticism is that companies repurchase shares when the stock price is high. However, this view overlooks the reason an investor holds the stock in the first place. If the stock is truly overvalued, one could argue that the investor shouldn’t own it at all, regardless of the company’s buyback policy. Moreover, as we’ll explore, whether a company buys back stock or distributes excess capital via dividends has no impact on shareholders as a whole.

Myth 2: Buybacks Spike in Bull Markets and Disappear in Bear Markets

It’s true that buyback activity tends to increase during bull markets and slow down during bear markets. This pattern, however, reflects the broader business cycle rather than a deliberate strategy to manipulate stock prices. When earnings are strong and cash reserves are plentiful, companies have more resources to return to shareholders through buybacks.

The Economic Equivalence of Buybacks and Dividends

When you ignore taxes and any signaling effects, buybacks and dividends are economically identical, regardless of stock valuations. Both methods distribute excess capital to shareholders, but they do so in different ways.

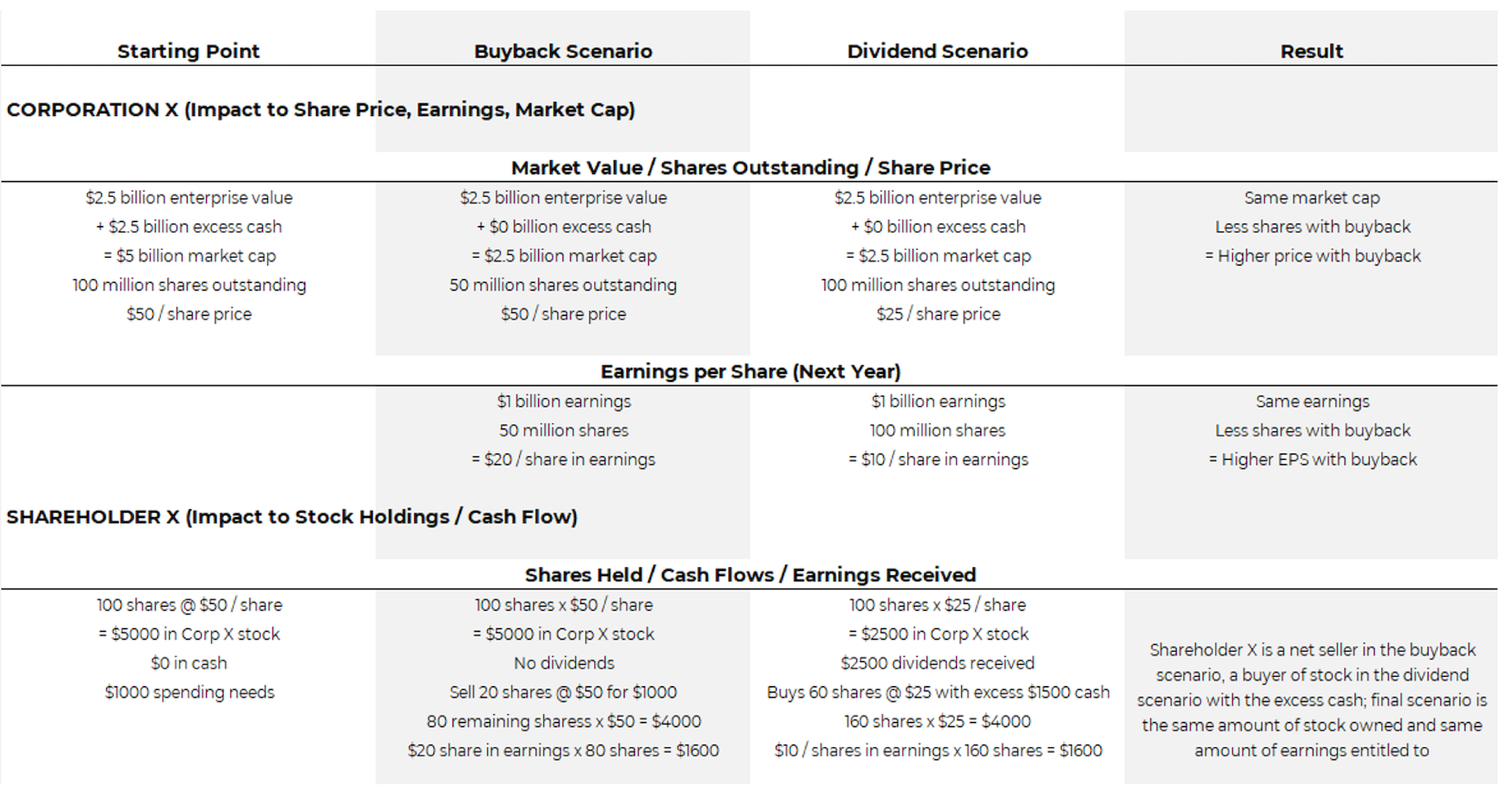

Let’s illustrate this with a hypothetical example of Corporation X, which can either return excess capital via buybacks or dividends:

- $2.5 billion in excess cash

- $5 billion market cap

- 100 million shares outstanding at $50 each

- Expected earnings of $1 billion ($10 per share) next year

Scenario 1: Buybacks

- Corporation X buys back $2.5 billion worth of shares, retiring 50 million shares

- Post-buyback: 50 million shares outstanding, still worth $50 each

- Market cap remains $2.5 billion

A shareholder needing $1,000 sells 20 shares at $50 per share and retains 80 shares. Next year, those 80 shares earn $20 per share, totaling $1,600 in earnings exposure.

Scenario 2: Dividends

- Corporation X distributes $2.5 billion via dividends ($25 per share)

- Post-dividend: Shares worth $25 each ($50 initial value minus $25 dividend)

- Market cap remains $2.5 billion

A shareholder receives $2,500 in dividends, spends $1,000, and buys 60 more shares with the remaining $1,500. They now own 160 shares, which earn $10 per share next year, totaling $1,600 in earnings exposure.

In both scenarios, the economic outcome for shareholders and the company is the same. The only difference is that post-buyback, the company has fewer shares outstanding, leading to a higher price per share and associated per share metrics.

To summarize the above:

*Aptus Conceptual Illustration

*Aptus Conceptual Illustration

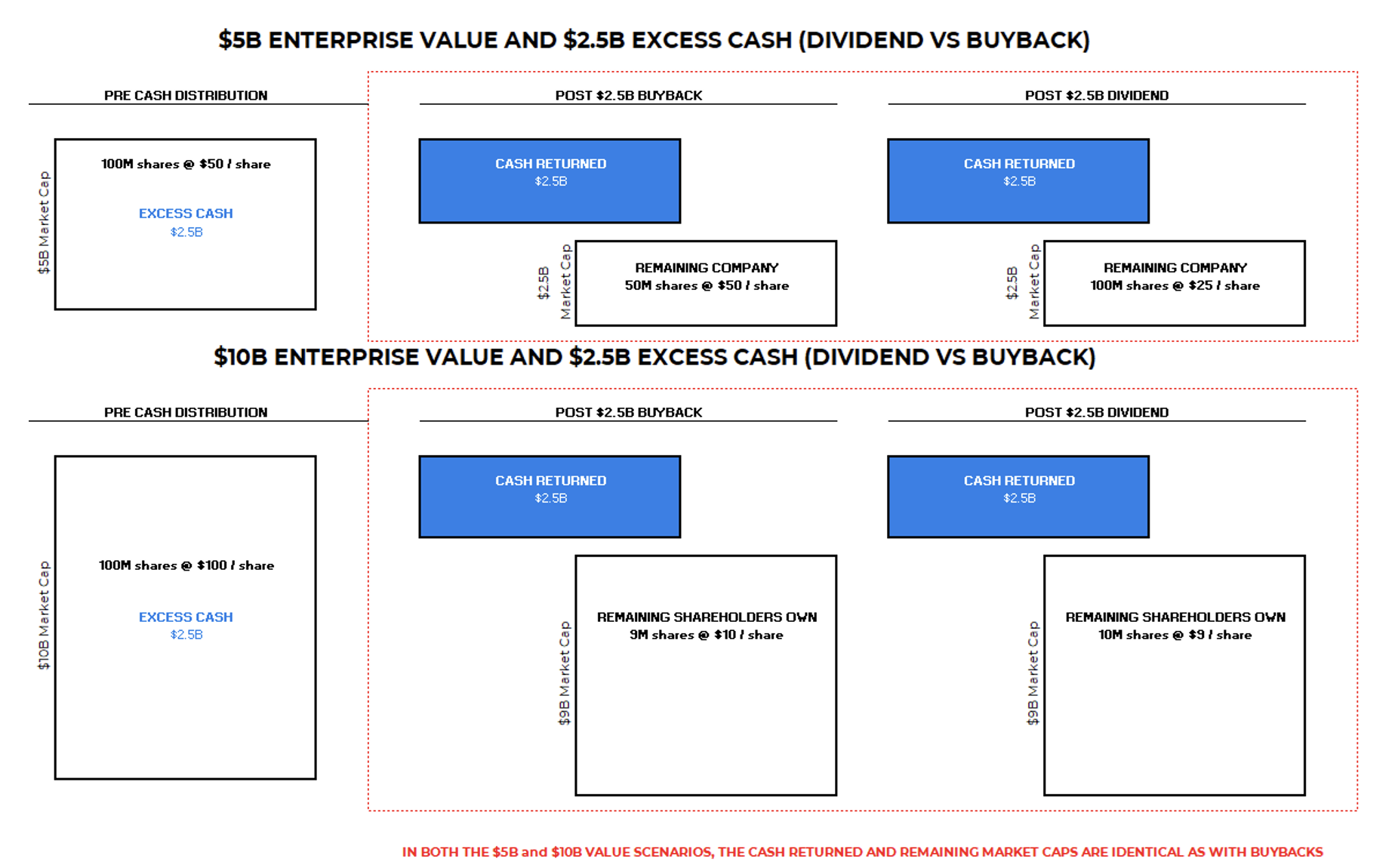

Why the Buyback Prices Don’t Matter… in Aggregate

Some argue that companies should only repurchase stock below intrinsic value. However, in aggregate, whether a company buys back shares at a high or low price, the net effect balances out compared to distributing excess capital through dividends.

Consider two scenarios with identical companies priced at different valuations:

- Scenario A: $2.5B Market Cap Company Returning $2.5B

- Scenario B: $5B Market Cap Company Returning $2.5B

*Aptus Conceptual Illustration

*Aptus Conceptual Illustration

In both cases, shareholders receive $2.5B via dividends or buybacks. The return of capital is economically equivalent, regardless of the company’s valuation. The only difference is that shareholders selling at a higher valuation give up fewer shares, benefiting more than those selling at a lower valuation. However, in aggregate, all shareholders still end up owning 100% of the remaining company and the same amount of cash.

Conclusion

Stock buybacks and dividends are two sides of the same coin, each redistributing excess capital to shareholders without altering the fundamental economic outcome. By understanding these principles, we can demystify buybacks and dispel common misconceptions. The next time you hear concerns about stock market gains driven by buybacks, try substituting “buyback” with “dividend” and notice how much less controversial it sounds. This mental exercise can help put the practice of stock buybacks into a clearer perspective.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

*Conceptual Illustration: Information presented in the above charts are for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2408-21.