Options offer a flexible approach to managing risk and gaining market exposure. For example, buying put options can serve as a hedge against sudden market declines, allowing investors to protect their portfolios without selling core positions. By using options as a form of insurance, investors may be able to maintain higher allocations to riskier higher returning assets, reducing the need for lower-return diversifiers and increasing the potential for portfolio growth.

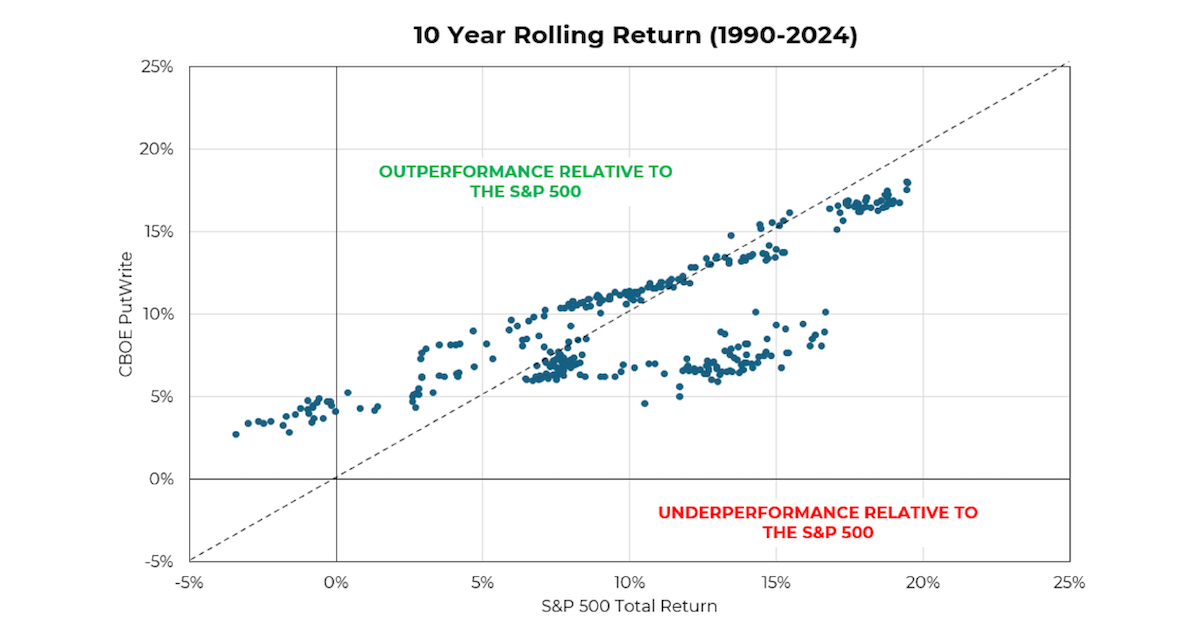

While buying protection can reduce market risk in a downturn, selling protection (such as puts) might initially seem risky at first glance. However, selling puts can also reduce risk compared to owning stocks outright. Notably, some common put writing indices have historically delivered returns comparable to equities, with a tendency to outperform during bear markets, while underperforming during bull markets.

In this post, we will explore:

1) How selling puts may help reduce market risk

2) The role of market volatility in put writing strategies

3) How this approach can be integrated into an investment portfolio

By strategically incorporating options, investors can diversify their risk management approaches and expand their toolkit, enhancing their portfolio’s risk-return profile with greater flexibility.

What is Put Writing?

Put writing is an options strategy in which an investor sells put options, often on the S&P 500 Index, while holding enough cash reserves to cover the potential cost of purchasing the underlying asset (i.e. the S&P 500) if the market falls below the strike price. In exchange for this obligation should the market fall, the seller collects a premium.

This approach offers downside similar to owning stocks, but with a slight edge during market downturns: the premium collected offsets some potential losses, while the upside is limited to the premium received. Notably, indices like the CBOE S&P 500 PutWrite Index, a common benchmark for this strategy, have delivered returns comparable to equities, with lower volatility, making it an appealing strategy for risk-conscious investors.

Source: Aptus, Cboe, S&P as of 08.31.2024

Source: Aptus, Cboe, S&P as of 08.31.2024

The Role of Volatility in Put Writing

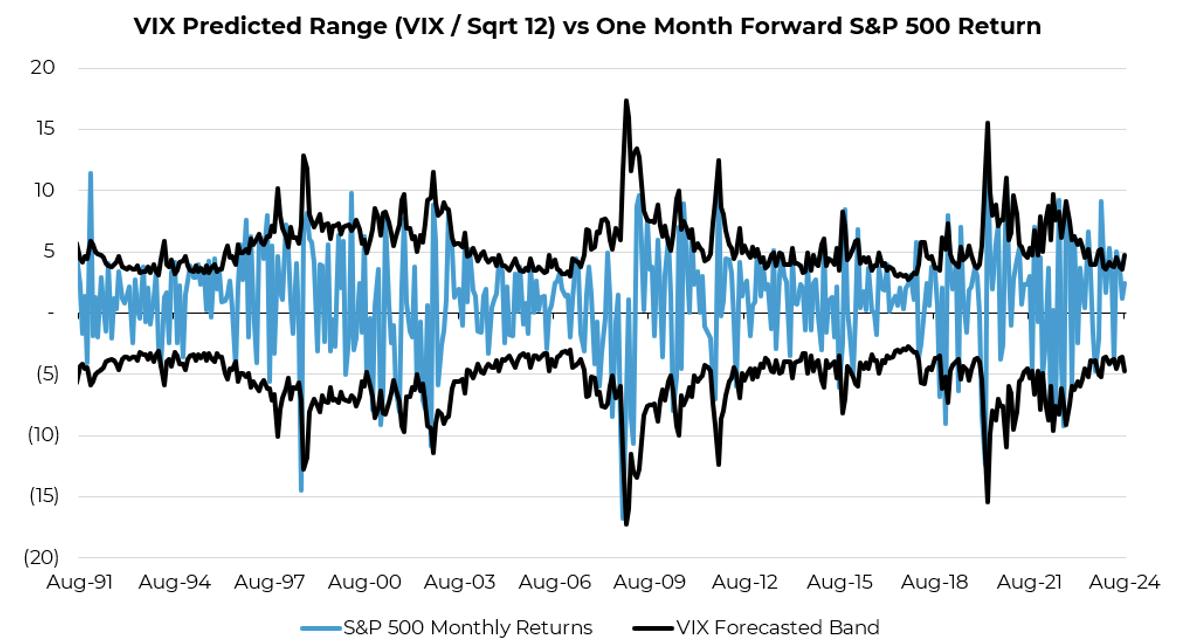

The VIX Index, often called the “fear gauge,” measures expected market volatility over the next 30 days. While it doesn’t predict market direction, it reflects the anticipated magnitude of price swings. A high VIX suggests greater uncertainty or fear, while a low VIX signals more market stability.

To illustrate, the VIX is an annualized measure, so dividing it by the square root of 12 converts it to a monthly volatility estimate. For example, a VIX of 20 translates to a 5.77% expected monthly movement (20 / √12), whereas a VIX of 10 suggests a 2.89% monthly movement (10 / √12). Investors can use these volatility estimates to inform their strategic decisions, with VIX levels above 20 typically signaling heightened market volatility.

Source: Aptus, Cboe, S&P as of 08.31.2024

Source: Aptus, Cboe, S&P as of 08.31.2024

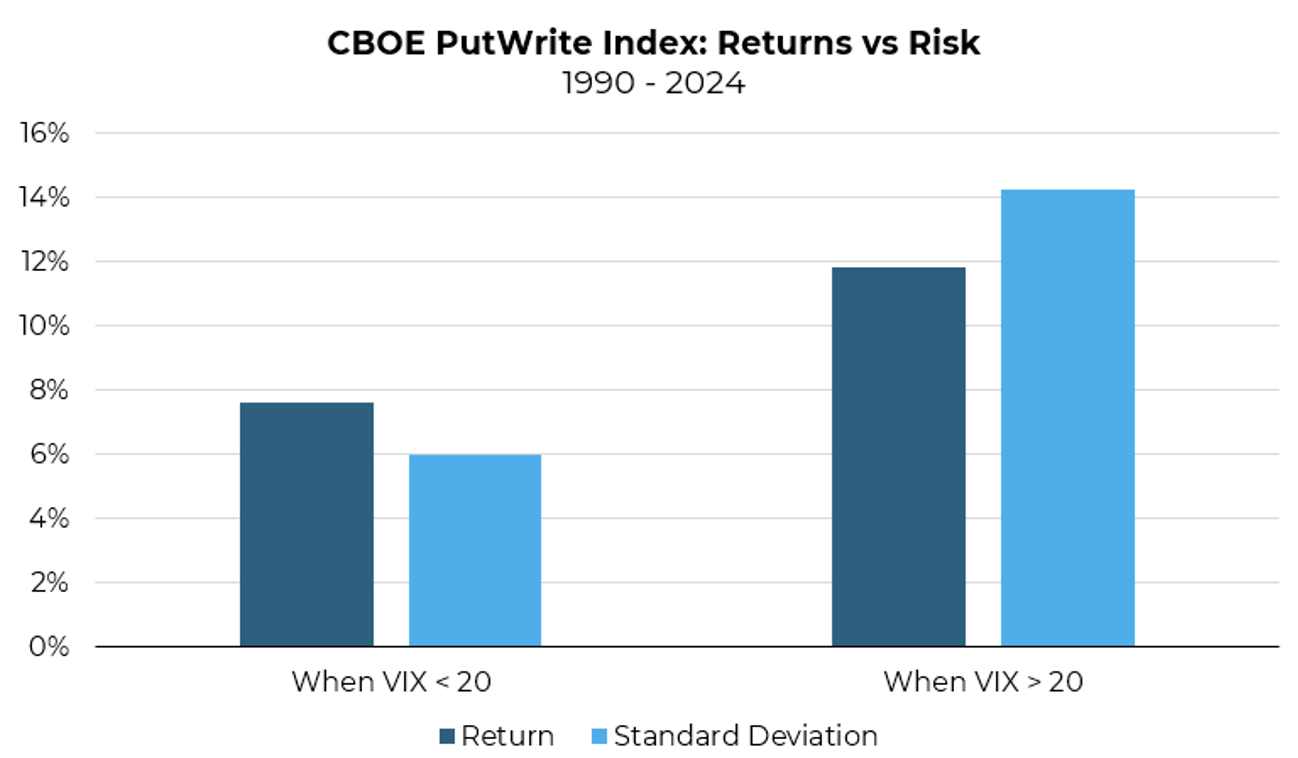

Why Low Volatility May Be Ideal for Put Writing

Selling puts in low-volatility environments is similar to insuring a low-risk driver: the chance of a payout is small, so the premium collected is more likely to be retained as profit. Research shows that put writing strategies tend to perform better on a risk-adjusted basis when volatility is low, even though the absolute returns may be lower compared to high-volatility periods.

For example, when the VIX was below 20, the PutWrite strategy has historically generated forward next month annualized returns of 7.6% with a standard deviation of 6.0%. In contrast, when the VIX was above 20, the strategy produced higher returns of 11.8% but with significantly more risk (standard deviation of 14.2%). Fewer market corrections when the VIX was low, allowed for a more consistent collection of the (smaller) premiums.

Source: Aptus, Cboe, S&P as of 08.31.2024

Source: Aptus, Cboe, S&P as of 08.31.2024

This suggests that dynamically adjusting exposure to put writing based on volatility conditions may enhance returns and improve risk-adjusted performance. Increasing exposure during stable, low-volatility periods and reducing it when volatility spikes may lead to better long-term outcomes.

Final Thoughts

Utilizing options for both defensive purposes and alternative market exposure gives investors greater control over risk, enabling them to construct portfolios that can perform well across various market conditions. Put writing is a versatile strategy that may offer consistent returns with a lower risk profile, particularly during periods of low volatility. By dynamically adjusting exposure based on volatility conditions like the VIX, investors may be able to further enhance the strategy’s effectiveness making it a valuable investment approach for investors.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2409-12.