“This guy is throwing a two-hit shutout and he’s shaking me off. You believe that? Charlie here comes the deuce. And when you speak of me, speak well.”

– Bull Durham (1987)

In the NL Wild Card round, something happened that has never happened before in the history of Major League Baseball. Pete Alonso hit a series-deciding home run that flipped the lead from the Milwaukee Brewers to the New York Mets in the 9th inning of the deciding game in the series. In 121 years, that has never happened before. What is amazing about any elite hitter is the unique combination of both urgency and patience. They must have the patience to analyze the pitcher, the situation, and not act too early when every competitive instinct they possess is screaming at them to swing out of their shoes. At the same time, when all the preparation and patience have come together to put the hitter in a situation where they are going to get that one pitch, they must have the urgency to act with controlled violence and bring bat to ball.

There is a harsh truth to investing, squandered opportunities cannot be made up for. They represent a permanent loss, just as a batter making the last out in a playoff game ends a season. There is nothing left to do but tip your hat to the other team and head off into the cold reality of winter. As we consider the market and economic backdrop, we may be entering a setup that represents an incredible opportunity for stocks. Consider for a moment what we experienced since 2021. We saw a generational inflationary pulse that spiked to nearly 10% as measured by CPI. The Federal Reserve in response raised short-term rates nearly 550% with Jay Powell explicitly stating that any collateral damage, even a recession, would be necessary evils in the fight against inflation. Despite all those headwinds, consider where we are two years later. A soft landing appears to be a reality, inflation sits at under 3%, unemployment remains well below 4.5%, and the S&P 500 has risen over 50%. The prediction business is tough. However, we would be fools not to take this opportunity to try to understand how we achieved this outcome. Just as a hitter studies film to build a gameplan for their next at bat, examining what got us here may provide some clues as to what pitch we may see next.

There appear to be some interesting dynamics underlying the economy that prevented a recession despite one of the most violent rate hike cycles that we have ever seen out of the Federal Reserve. These undercurrents are important to understand as they are overlooked by the financial media, yet their impact is undeniable given the unexpected outcomes we are experiencing. One aspect that we feel should be of particular focus, is a somewhat arcane piece of legislation that was passed all the way back in 2006. Here we may find some clues as to why a recession has not been triggered up to this point, namely the Pension Protection Act.

Before diving in on that topic, let’s set the stage. It is a commonly held assumption (which happens to be true) that the stock market leads the economy. Given where we find ourselves today, it is useful to have a discussion as to why. What must first be understood is that US economic growth is dependent on credit. If credit expansion is occurring, then economic growth will follow. On the other hand, if credit is contracting you will almost certainly have a recession. If you don’t want to take this author’s word for it (fair), Richard Vague’s The Paradox of Debt is an excellent book on the subject. How does that relate to stocks? This next part is a bit oversimplified but what needs to be understood is that when markets are going up, we see earnings expectations go right up with them. Eventually, those companies arrive at the point where they can no longer outpace those expectations, and their earnings start to disappoint analysts. In a world where discretionary managers are evaluating those businesses and can sell, they do so as they arrive at the conclusion that it is time to harvest the gains that were made and identify more attractively priced investments. If markets have gotten far enough over their skis, we see markets broadly decline as other investors catch on and begin to look for exit liquidity. If this pattern maintains itself, we then enter a bear market as there isn’t enough sustained optimism for buying activity to reverse the momentum.

Where this becomes important is that when equities go down… so does the protection for the creditors of the underlying business. The equity is the buffer between the lender and an impaired loan on their balance sheet. For higher quality companies this tends not to be much of a problem as they have the assets to weather the storm, and creditors have plenty of collateral to protect themselves. On the other hand, for businesses that have more debt and not enough cash on hand to wait, this becomes existential. If creditors begin to think that the company may not be able to pay back the debt and have no equity buffer to protect them, things can go downhill fast. That is where you begin to see layoffs, bankruptcies, acquisitions at distressed valuations…and more layoffs. From there, you have unemployment shooting up which lowers overall aggregate demand in the economy, and voila… you have yourself a recession.

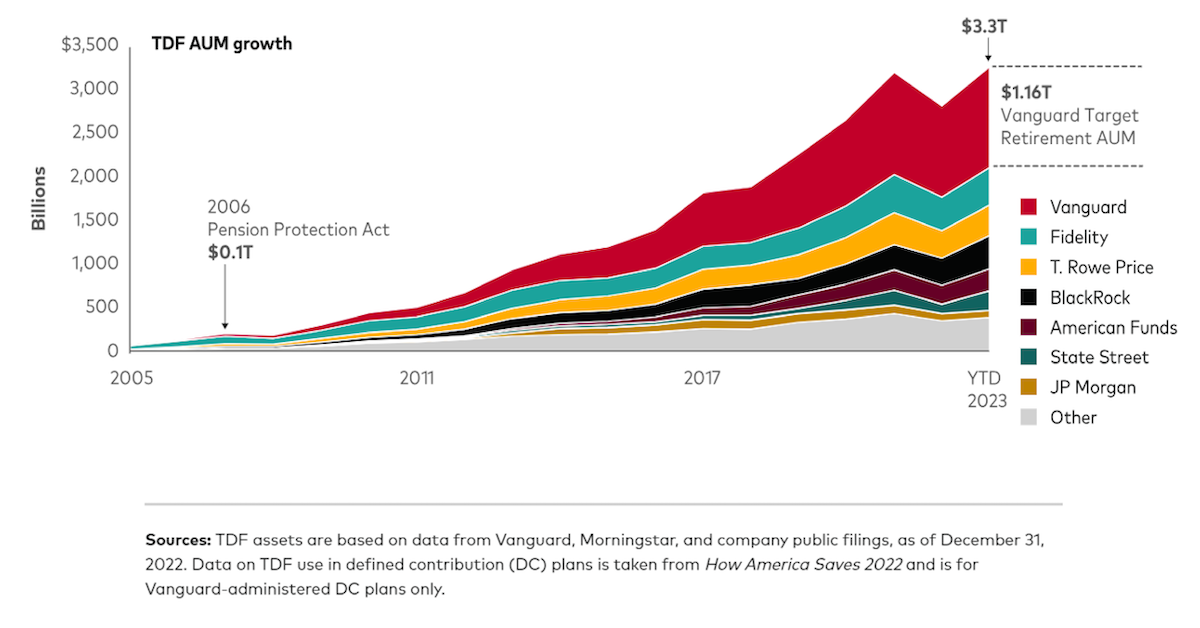

What on Earth does the Pension Protection Act of 2006 have to do with all of this? The legislation is important because it brought sweeping reforms to the defined contribution retirement system. In particular, it made Target Date Retirement funds the Qualified Default Investment Alternative (QDIA) in defined contribution plans. Prior to the act, cash was the default investment unless the participant selected another fund for ongoing contributions. Along with other reforms that incentivized plan sponsors to abandon active investment options in favor of passive, low-fee investments, unsurprisingly we have seen an absolute explosion in TDF AUM.

It cannot be overstated how dramatic that increase is, although Vanguard’s commentary below takes its best shot:

“TDFs have become the primary choice for a DC plan’s qualified default investment alternative (QDIA) since the passage of the Pension Protection Act of 2006. The percentage of plans using a TDF as their default fund grew from 71% in 2013 to 90% in 2022.1 TDFs now account for 40% of all plan assets (compared to only 19% in 2013) and 63% of all contributions were directed to TDFs (compared to 34% in 2013).1 Additionally, the space continues to grow regardless of the market environment. For example, despite the market volatility of 2022, TDFs saw more than $153 billion in new net cash flow.”

Jonathan Parker and his team at MIT have put together a brilliant paper on how this rapid and massive adoption is impacting single stock performance which you can find here.

More importantly, how did TDFs potentially prevent a recession? It is important to recognize that TDFs are perfectly price insensitive when they transact. Remember our discussion about how markets begin to go down once the underlying companies can no longer justify their valuations? That assumes a world in which the marginal dollar is going to active managers who focus on those characteristics. Passive strategists are completely indifferent to earnings forecasts, price targets, analyst reports, etc. When they get the flows, they simply buy…at whatever price the market offers them. As passive strategies are receiving over 100% of US equity flows (yes that statistic is right, your eyes are working just fine), the marginal buyer of stocks ignores all the signals that would cause a discretionary manager to sell. Don’t just accept it from this author, our friends at Pivotus Partners have been laser focused on this dynamic, see their note from September 20th:

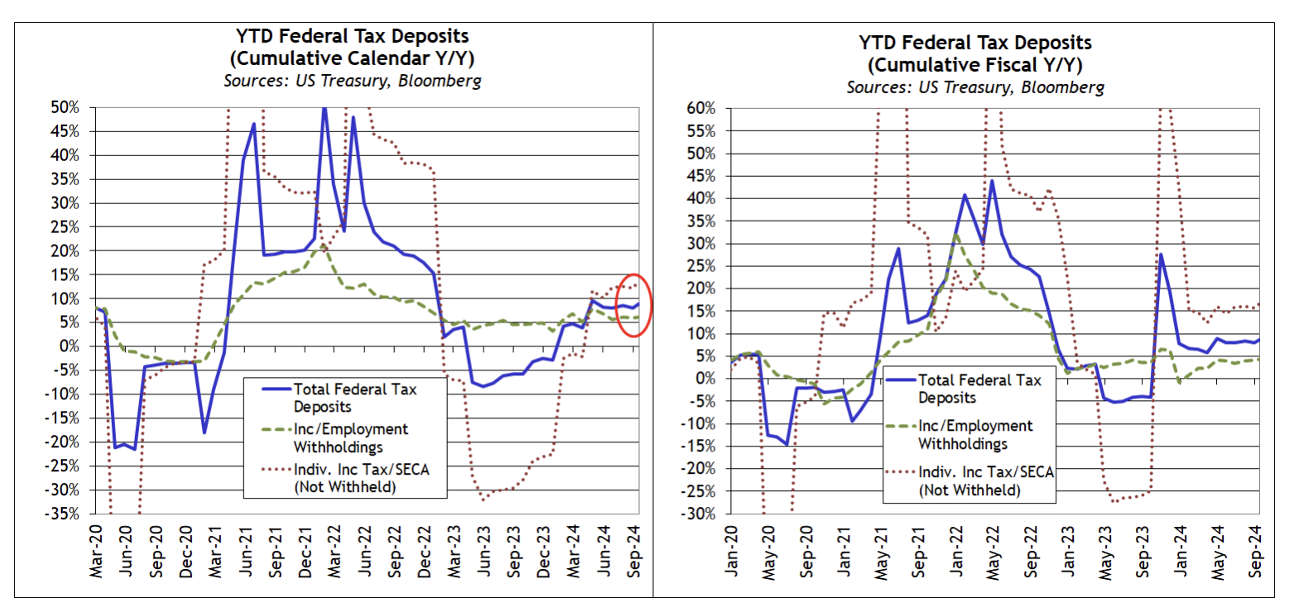

We study nightly tax receipts because they are correlated to passive flows (both taxes and 401k contributions are set percentages of income). There has been no discernible weakness in tax receipts so far. In fact, Total Federal Tax Deposits have accelerated through September 18th (+8.9% cumulative Y/Y, versus +8.1% at the end of the second quarter).

Income withholdings are also proving to be steady at +6.1% cumulative Y/Y (basically the same level throughout all of Q3).

Data as of 09.20.2024

Data as of 09.20.2024

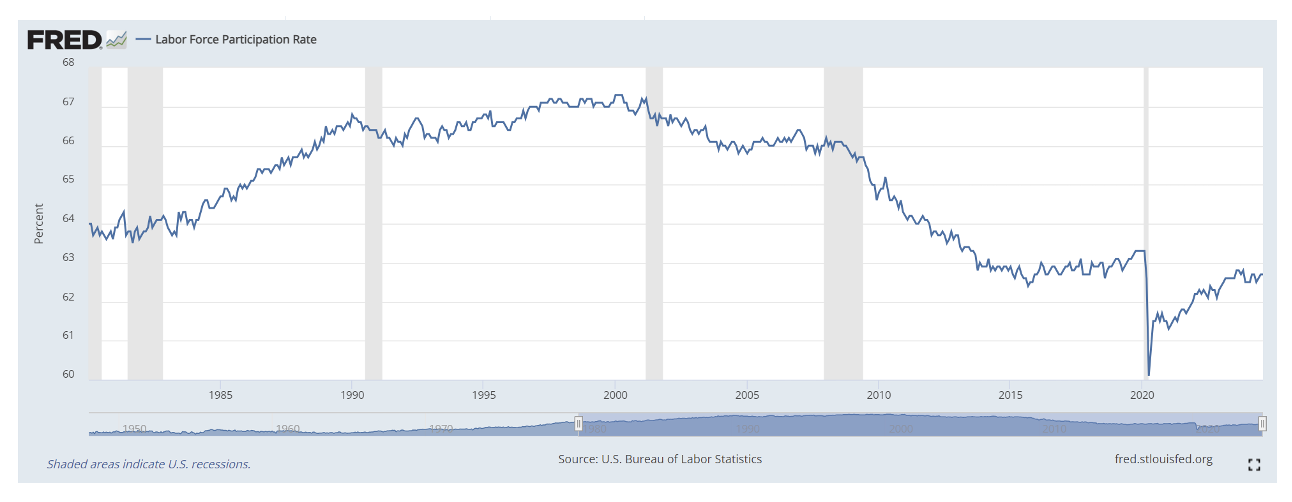

If the labor market is healthy, DC plans will continue to receive those increased flows which will be pushed into the market and be absolutely price insensitive. Now let’s combine that with a structurally tighter labor market that we have not seen in a couple of generations.

Data as of 10.04.2024

Data as of 10.04.2024

The point in all of this is that we’ve seen all the pitches, and everything is flashing that while we always need to maintain a proper hedge, the biggest risk is that investors don’t own enough stocks. Imagine being an investor in 1995 that was allocated to money market funds and bonds, waiting for a market crash that never came. If you wasted that opportunity in the late 90s, you had to wait for over a decade to get another chance at positioning yourself for a long-term run in stocks. It is no different than a hitter that keeps the bat on their shoulder when they finally get that one pitch in the zone. Once you let that moment pass, there is no getting it back.

In our view, investors should be approaching this moment with urgency. Traditional stock and bond allocations are not going to reward you enough if our trajectory is to the upside. For the portfolio to be prudently allocated, the necessary excess exposure to bonds will likely be a drag on the portfolio return. On the other hand, if we were to see a recession crop up unexpectedly, the market has not even begun to price that scenario in and we’ve already discussed the spotty performance of bonds when things really get ugly. Our guiding principle of “More stocks, less bonds, risk-neutral” could not be more relevant given the current economic picture. Like Pete Alonso, we need to make sure that we are ready for our pitch.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2410-21.