Aptus Capital Market Outlook: Stocks for the Long Haul?

Surely You Can’t Be Serious. I Am, and Don’t Call Me Shirley

The movie Airplane! is sophomoric, obvious, predictable, corny, and quite often very funny. And the reason it’s funny is simply because it’s sophomoric, predictable, corny, etc. Its satirical anthology of classic movie clichés, like Saturday Night Fever and Jaws, never really adds up to great comic artistry, but the movie compensates for its lack of original comic invention by its utter unwillingness to beg, steal, borrow, and rewrite from anywhere, much like many investors’ favorite market adage. What is it? Well, it’s a proverb or short statement expressing a general truth, but that’s not important right now.

The adage states that history doesn’t repeat itself, but rhymes. Investors tend to steal, borrow, and rewrite data of the past to help predicate a narrative for the future. We believe that this is an antiquated way of thinking – what if those table stakes change? We believe that investor complacency is a huge risk, by adhering to this adage, especially as the market continues to evolve, specifically in regard to: Understanding how the market has changed over the past few decades.

These changes to the market tend to happen over longer periods, making it difficult for many to see the forest through the trees, as investors tend to be near-sighted on where they are focusing. And right now, in the world of financial markets, the journey for investors may feel a lot like the ill-fated Los Angeles to Chicago flight – turbulent – especially as the market has been awaiting the answer to the most important short-term question at hand; can the Federal Reserve safely land the economy on the proverbial runway (i.e., a soft landing) or will it crash, sending the market into a recession (i.e., hard landing).?

It may seem like the market, who is the final arbitrator, has already answered this question, with the S&P 500 coming off of two straight years of 25%+ returns. Yet, the strength of the market has left many investors feeling nervous for the first time in a while, given current valuations, but it’s okay, as we’ve been nervous lots of times.

It may seem like the market, who is the final arbitrator, has already answered this question, with the S&P 500 coming off of two straight years of 25%+ returns. Yet, the strength of the market has left many investors feeling nervous for the first time in a while, given current valuations, but it’s okay, as we’ve been nervous lots of times.

Luckily, we’re not handcuffed to the traditional playbook of only having the levers of 1) Cash, 2) Fixed Income, and 3) Equities, to make risk-based decisions. In the current environment, we think it’s necessary to be unshackled from traditional portfolio management styles that could ultimately leave investors feeling like they chose the fish over the steak.

We believe that the aforementioned environment will be categorized by higher nominal growth and above-average inflation. This should be welcomed by investors given the current debt situation in the United States, as there are three ways to attack this debt problem: 1) default on your currency, 2) grow out of it, and/or 3) inflate out of it. Between the confluence of stimulus, whether it’s from monetary or fiscal policy, we think the latter two will be driving factors.

If nominal growth can outpace the increase in the deficit, the markets can see through the debt problem, and stocks can appreciate. But, if the deficit grows too fast, interest rates may not be a reliable source of safety. Either way, we believe the necessary hurdle rate is much higher than most believe, which creates the need to be able to own as many risk assets (stocks) as possible, but also to own insurance (hedges) to protect capital if rates remain higher for longer, and don’t provide support.

Given the tailwind of liquidity being pumped into the market to engineer this growth, we think that investors are focusing too much time searching for alpha and that beta is underappreciated, as a rising tide lifts all boats. Even though the market, specifically in Washington D.C., has a lot to navigate in 2025, e.g., corporate and individual taxes, debt ceilings, etc., we firmly believe that the risk of underweighting risk assets is substantially larger than the alternative. Because if you do underweight risk assets, you may end up having more of an awkward conversation with your clients about sub-par returns than little Joey did with Clarence Oveur about Turkish prisons.

For the time being, it looks like the prospects for continued monetary accommodation, relatively easy fiscal policy, and regulatory easing should continue to keep animal spirits alive for both investors and dealmakers. This is why we believe that investors need to own stocks for the long haul… Surely You Can’t Be Serious. I Am, and Don’t Call Me Shirley.

Understanding How the Market Has Evolved

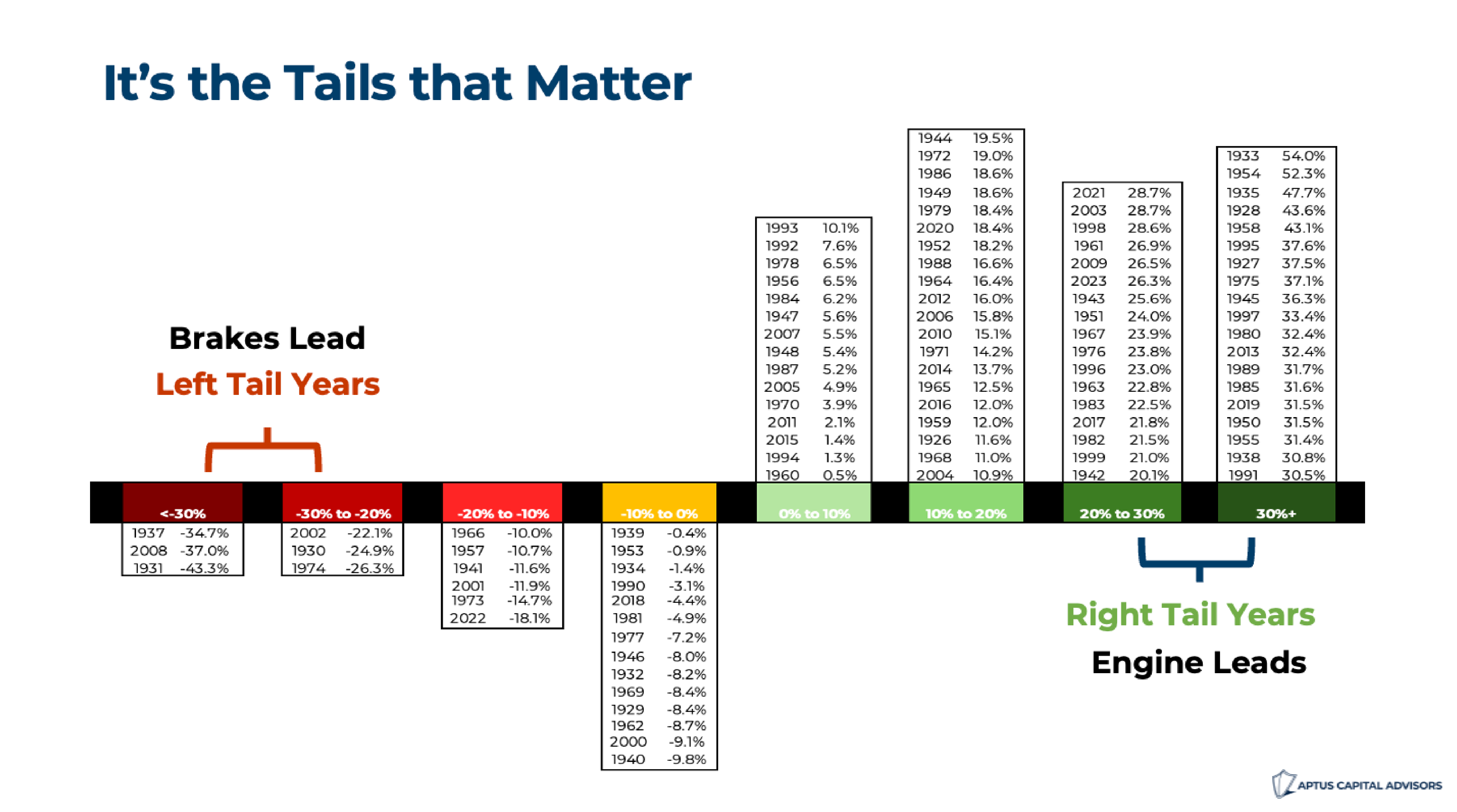

The market is not a static mechanism – it is constantly evolving, and as it evolves, investors must adapt, or their investment methodology may become obsolete. In that context, when a major fundamental inflection occurs, the markets can’t reprice fast enough. In fact, the market Gods have generally rewarded a simple playbook, applied with brute force. This may create an environment where the market may witness more “tails” – some left tails (bad), and some will be right tails (good). But the fundamental nature of the game has changed, and it starts with two misunderstood market aspects:

-

- Properly understanding the market’s multiple, and

- The evolution of operating leverage in large caps.

Valuation

To many, mentioning valuation in detail is like speaking jive, so we’ll cut you some slack Jack. Said in its most simplistic form, comparing today’s S&P 500 valuation to its value over thirty years ago is not a fair comparison. Yet, many in the industry continue to utilize the scapegoat of expensive valuation relative to history and mean reversion as a reason to be wary about future market returns. These investors have woefully underestimated that the market has simply re-rated higher – and we believe that it is warranted.

To many, mentioning valuation in detail is like speaking jive, so we’ll cut you some slack Jack. Said in its most simplistic form, comparing today’s S&P 500 valuation to its value over thirty years ago is not a fair comparison. Yet, many in the industry continue to utilize the scapegoat of expensive valuation relative to history and mean reversion as a reason to be wary about future market returns. These investors have woefully underestimated that the market has simply re-rated higher – and we believe that it is warranted.

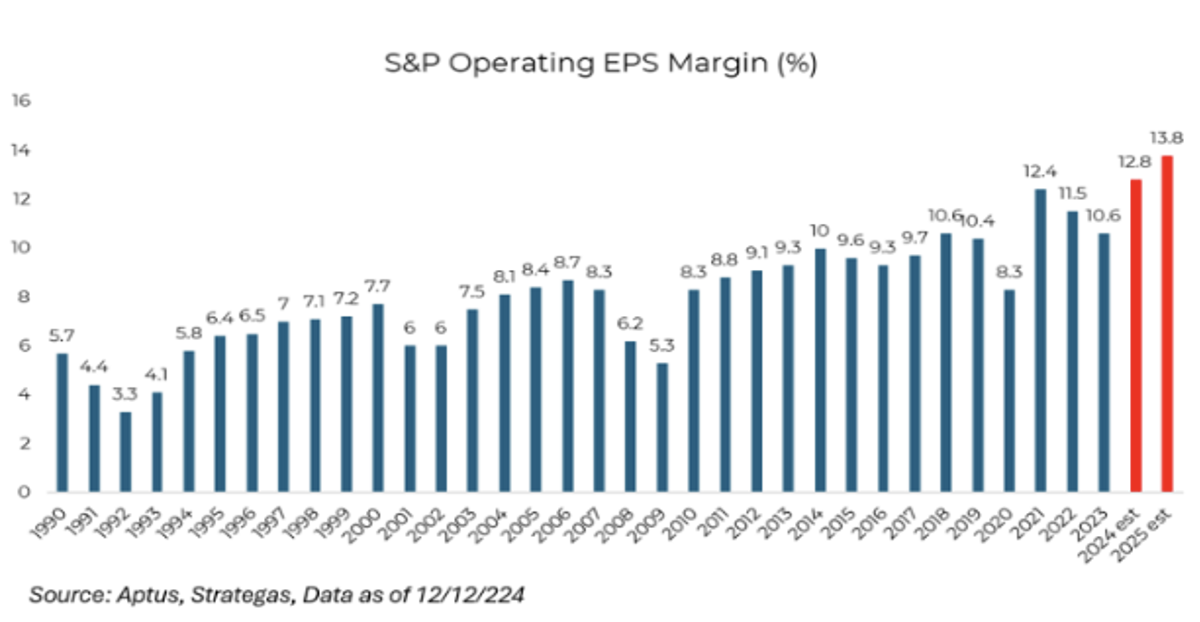

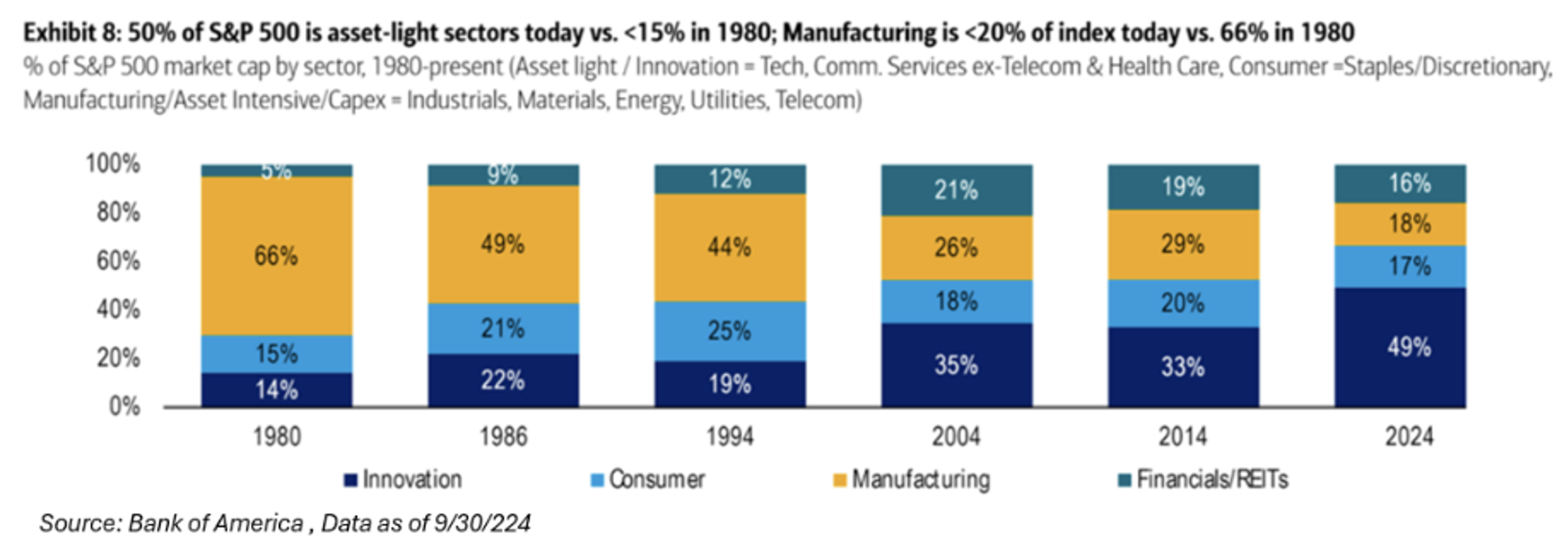

It’s warranted because the market evolved in its margin composition. The reason that the market has become more profitable is because it now a more asset-light (better profitability) and innovation-focused index (more growth). In 1990, the S&P 500 was sporting a 13x P/E valuation with a 5.7% operating margin. Fast forward to today, the market trades closer to 22x, but with an operating margin of 12.8% – a profitability figure that is 120% higher, yet valuation has only expanded by 69%.

The market is a simple creature – it is not political, and it is not emotional. The market only cares about policies and characteristics that increase or inhibit growth. And the past few decades, especially relative to other countries, have shown that it’s very tough to ever bet against America – the most resilient country in the world.

And lately, growth in the U.S. has been defiant in the face of hard-landing bears, who have gone back into hibernation. This has left many of the mean reversion believers, who have remained conservative through the first two years of the bull market rally, feeling like they picked the wrong week to quit smoking.

Operating Leverage

A byproduct of the S&P 500 becoming a more asset-light, innovative market is that it now embodies the characteristic of operating leverage. Operating leverage can be an investor’s best friend or their worst enemy.

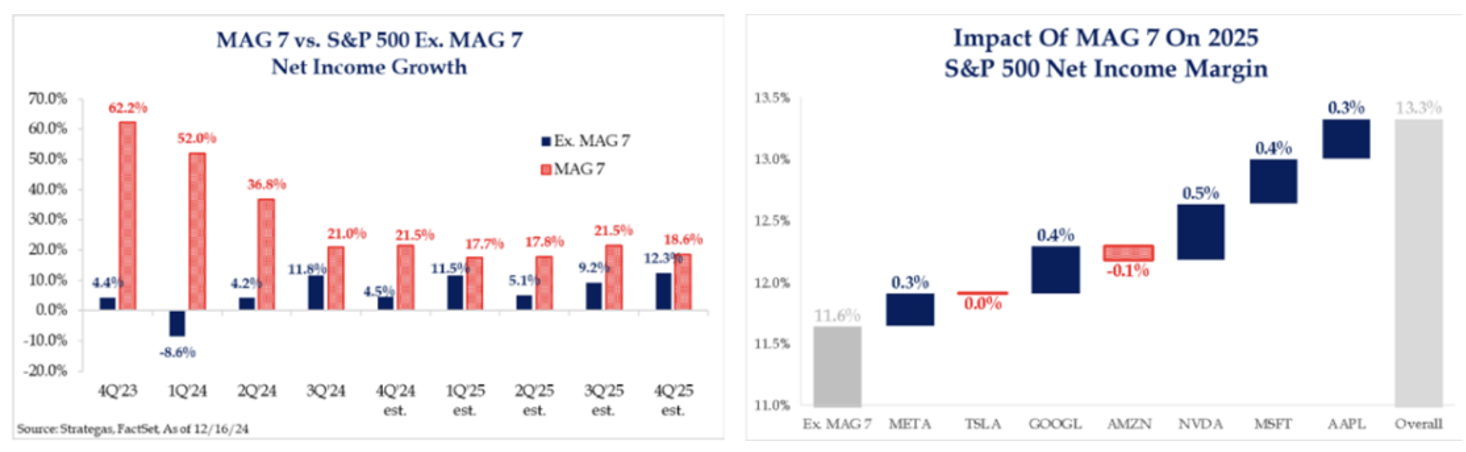

Market concentration, such as the top 10 stocks of the S&P 500 accounting for ~39% of the index, tends to be viewed as a reason to remain skeptical. But it’s these mega-cap tech stocks that are the reason for this newfound characteristic. This leads to U.S. domestic large-caps stocks being the only major asset class in the world that can gain from operating leverage. U.S. small caps and international equities, which tend to be more services-oriented, don’t have this benefit. Emerging markets are more commodity-based – whether in energy, metals/mining, or value-additive technology services.

And next year’s estimated growth is a perfect example of why operating leverage can be the S&P 500’s best friend. In 2025, the index is expected to grow its revenue by 5%, which equates to an earnings expansion of ~15%. Said another way, for every unit of revenue input, there is more earnings output. And this embodiment is one of the main reasons that the S&P 500 has had a return of ~63% over the last two years.

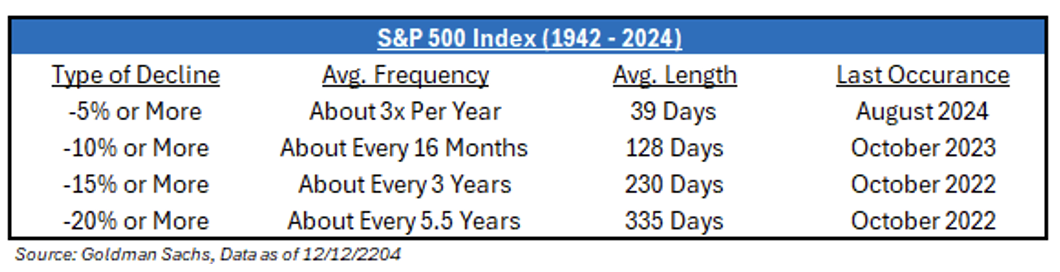

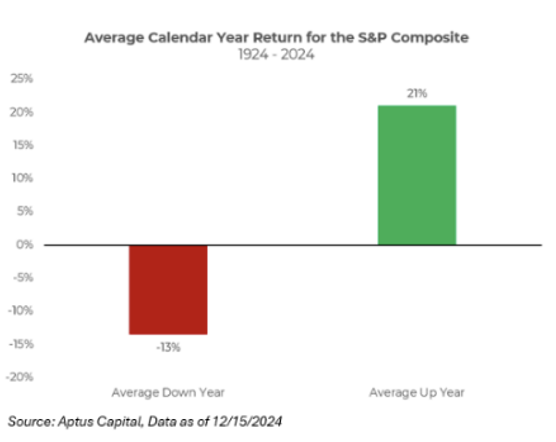

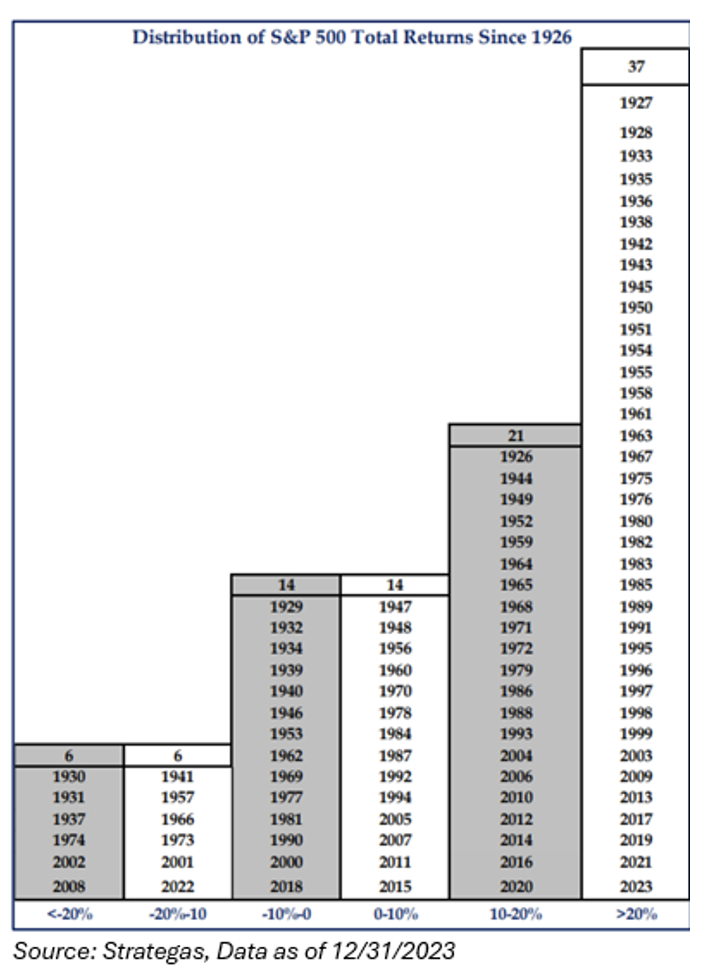

But operating leverage cuts both ways – The “Mag 7” can quickly turn into the “Lag 7”. When fundamental growth is apparent, times are great. Yet, when there’s a slowdown, the market can getwhacked on by slowing growth and on lower profitability. The two factors have the best predicting power for future market returns. As shown in the chart below, the annual performance of the S&P 500 rarely shakes out to be close to the longer-term annualized performance of the S&P 500 (average up year is +21%, while the average down year is -13%). In fact, the S&P 500 has finished with a return above 25% in 26 out of 96 years since 1928. That’s 27% of the time!

This should be the focal point – the potential ramifications to market return activity. If the index is characterized by operating leverage, then the market will incur more tails. The good years are great, and the bad years are tough. This plays right into one of Aptus’ main investment methodology: Doing Better in the Tails.

While most investors’ focus tends to be on the left tail (downside), we believe the lack of focus on the right tails (upside) has unintentionally injected longevity risk into portfolios, by remaining too conservative for too long, i.e., always waiting for the pullback and not capitalizing on the benefits of operating leverage. And, if longevity risk is silently injected into allocations and expected returns are not met, advisors may have difficult conversations with their clients, leaving them feeling like they picked the wrong week to quit sniffing glue.

Sticking the Landing

John Luke Tyner, CFA: David, how soon will there be a market correction?

David Wagner, CFA: I can’t tell.

John Luke Tyner, CFA: You can tell me. I’m a Portfolio Manager.

David Wagner, CFA: No. I mean I’m just not sure.

John Luke Tyner, CFA: Well, can’t you take a guess?

David Wagner, CFA: Well, not for a while.

John Luke Tyner, CFA: You can’t take a guess for a while?

Investors will make more money by being agnostic than by being dogmatic. People who are prescriptive about how the world should work often become disillusioned and struggle as investors. The world is messy, people are flawed, and pretty much every human system works imperfectly. Investors make money by being optimistic about the potential for future innovation, efficiency, and excellence. Yet, many investors roll their eyes at optimists.

While it’s easy to fall into the trap of long-term pessimism, history shows that markets have navigated through challenges. Progress, despite setbacks, has been constant. Betting against this trend means betting against the resilience of human nature and innovation.

The market is not political and it’s not emotional. It doesn’t care about draining swamps, political retribution woke or anti-woke campaigns, or DEI initiatives. The market only cares about policies that:

-

- Increase (or decrease) earnings, and

- Support growth (or hinder it).

Any political movement or agenda that is viewed by the market as getting in the way of better earnings and growth will be viewed as negative and be a headwind on risk assets, regardless of whether those policies are from Republicans or Democrats. This is the way we must view political coverage over the next year (and likely four years) and this will help us cut through the noise and stay focused on the policies that will impact markets.

Yet, most of the outlooks that investors will read will be filled with pessimistic worries about what can go wrong – pontificating “let the market crash” – whether it’s economical or policy-driven, e.g.,taxes, tariffs, geopolitics, etc.

It’s very hard to time the market, and more importantly, it’s even more difficult to determine what will actually cause the root of the turbulence – we believe that it pays more to be patient than clever at timing a market top. Be optimistic – the S&P 500 is entering the third year of its bull market, following two years of above-average returns – this is normal. Historically, if the bull market reaches two years in duration, the minimum length of the bull market is five years – the market officially entered year three in October 2024. So why would an investor, who purchased a plane ticket from New York City to San Diego, get off in Chicago? It’s not like a rogue pilot with a drinking problem, like Ted Striker, is flying the plane.

While many investors may believe that the market will be in a holding pattern, they need to recognize that while often forecasted, single-digit returns are surprisingly uncommon. So be prepared to do better in the tails because if an asset allocation structure is properly implemented, your investments and their respective returns will feel like they are on autopilot.

Work smarter; not harder.

Keeping Things in Perspective

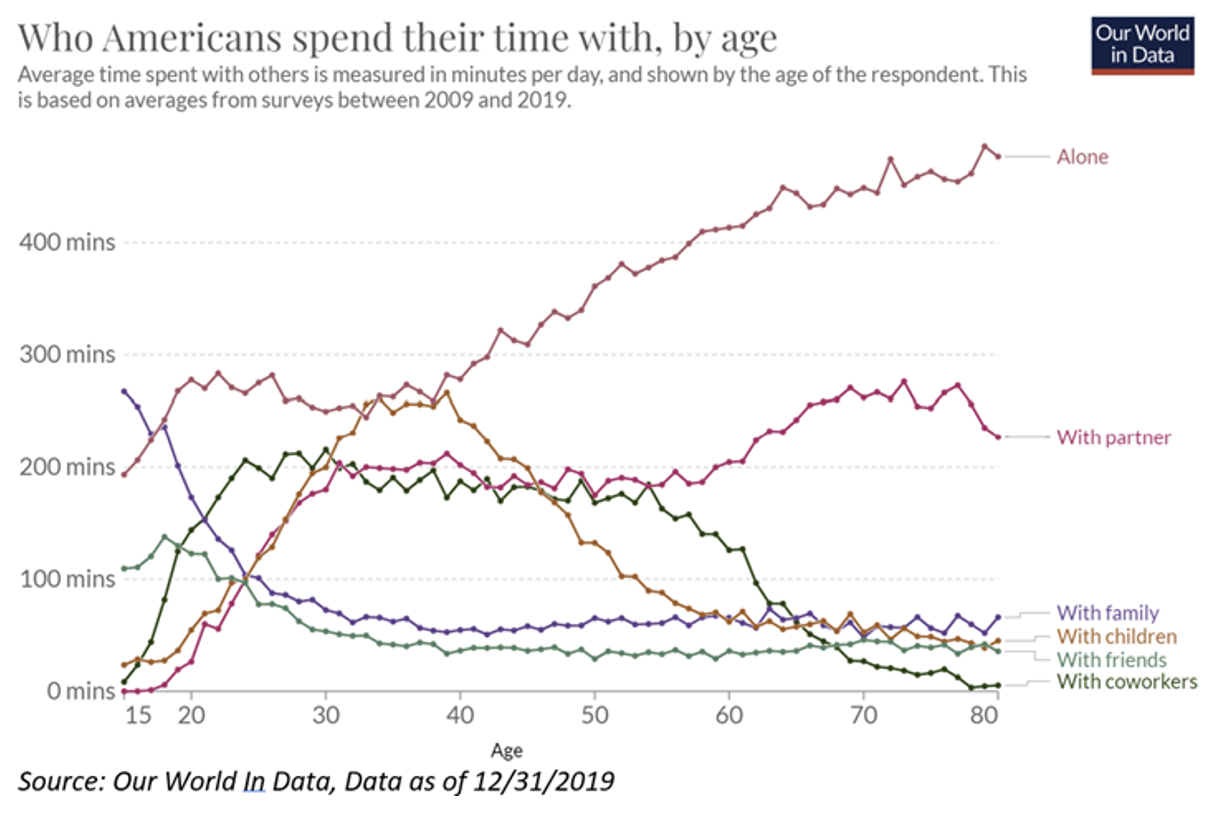

Coinciding with last year’s message of “Time Billionaire”, we want to focus on how people spend their time. Don’t worry, we won’t tell you where to spend it. As we go through life, we build personal relationships with different people – family, friends, coworkers, partners. These relationships, which are deeply important to all of us, evolve with time. As we grow older, we build new relationships while others transform or fade, and towards the end of life, many of us spend a lot of time alone.

Viewing the evidence together, the message is not that we should be sad about the prospect of aging, but rather that we should recognize the fact that social connections are complex. We often tend to look at the quantity of time spent with others as a marker of social well-being, but it’s the quality of time spent with others that contributes to our feelings of connection or loneliness.

At Aptus, we are privileged to partner with every one of you. We are blessed to have all of our new relationships, and for those relationships that we’ve had for a long time – we would not be who we are without each and every one of you. Each of you reading this outlook is the lifeblood of our company, and we couldn’t be prouder of everyone being a part of our lives. We wish everyone a safe and healthy new year.

Happy Livin’,

The Aptus Investment Committee

Aptus Outlook Themes Through the Years:

2025 Theme: Stocks for the Long Haul? Surely You Can’t Be Serious. I Am, and Don’t Call Me Shirley (Airplane!)

2024 Theme: Will Consumers Shrug (Atlas Shrugged)

2023 Theme: A Market in Constant Sorrow (O Brother, Where Art Thou?)

2022 Theme: Investors May Need to Curb Their Enthusiasm (Curb Your Enthusiasm)

2021 Theme: Ted Lasso – Investors Need a Pep Talk

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Aptus Capital Advisors, LLC is a Registered Investment Advisor (RIA) registered with the Securities and Exchange Commission and is headquartered in Fairhope, Alabama. Registration does not imply a certain level of skill or training. For more information about our firm, or to receive a copy of our disclosure Form ADV and Privacy Policy call (251) 517-7198. ACA-2412-15.