If we gave you a million dollars to invest today, with the objective of delivering the highest compounded annual growth rate (CAGR) over a typical 30 year period, where would you invest that money?

Here’s the catch, you only have 2 choices:

- Stocks

- Bonds

Let’s consider a few things about each option.

Stocks

Stocks represent claims on the future earnings of a business. They offer the possibility of compounding returns through the growth in the underlying business, valuation adjustments, and dividends that can grow as the business grows.

From a practical perspective, you can own stocks through low-cost vehicles that are extremely tax efficient. Qualified dividends are taxed at long-term capital gains rates (depending on income: 0% to 20%), and the growth and valuation components of the compounded return is even more favorable as you can defer paying taxes until you sell.

In a perfect world, your pre-tax return is close to your after-tax return. The power of deferring can help close that gap.

Read this short post from Brian to drive this point home: Snowballing Returns – The Hidden Magic of ETFs. One favorite of mine from his piece:

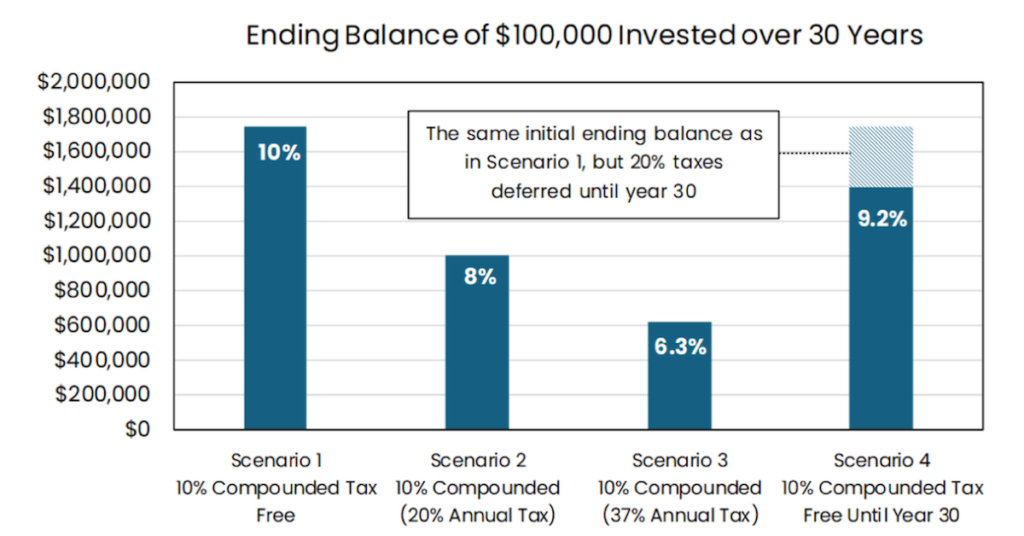

Deferred taxes allow an investor to compound at the higher pre-tax rate over time, pushing after-tax return towards the 10% pre-tax return. For instance, comparing the after-tax return of a 10% pre-tax 30-year investment under various tax scenarios:

-

- Scenario 1 – No Taxes: 10% compounded for 30 years turns $100 to $1800 = 10% annualized return

-

- Scenario 2 – Annual Long-term Tax Rate (20%): After-tax return is 8%

-

- Scenario 3 – Annual Short-term Tax Rate (37%): After-tax return drops to 6.3%

-

- Scenario 4 – Deferred Tax Payment: Compounding occurs at the pre-tax rate until the sale in year 30 = 9.2% annualized

*Aptus Conceptual Illustration

In sum, we see stocks as a blend of potential for a) compounded growth and b) tax efficiency in that growth. We want less friction along our path of compounding.

Bonds

Remember, the objective here is highest CAGR over 30 years…period. While there’s a place for bonds, this note is focused purely on an asset’s ability to compound capital over 30 years – compound being a key word.

Bonds are debt instruments. A government or a business needs capital. They raise debt to get it. Let’s follow that capital over 30 years and think critically on whether the things we find valuable at the surface level provide any value at all. Words like safety and stability, do they mean what we think they mean?

You loan $1 million to a business or the government for 30 years. The irony here is, where does the value created from a bond end up? Hint – it doesn’t accrue to the bond holders. As a business owner, especially in a growing business, equity is far more expensive to give up than the annual interest costs of debt.

As the bondholder, you send $1 million to the company where they use that capital to do whatever they need to do for the business. In return, they agree to pay you 4% annually. (Let’s just use 4% for simple numbers, the current 30-year rate is ~4.50%)

Each year, you get $40k and at the end of the term you get your $1 million back.

Safety and stability seem like appropriate descriptions for this setup if the company is solid. Their appropriateness begins to leak when you think about the friction of taxation and the value of your dollar over this period.

Taxes

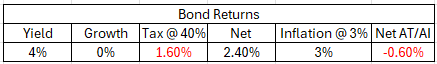

The table below illustrates how ordinary income tax rates will destroy the interest from bonds. A 4% pre-tax yield turns into 2.4%.

*Aptus Conceptual Illustration

*Aptus Conceptual Illustration

Interest from bonds is paid on the face value (or par value) of the bond and it is simple interest, not compounded.

Purchasing Power

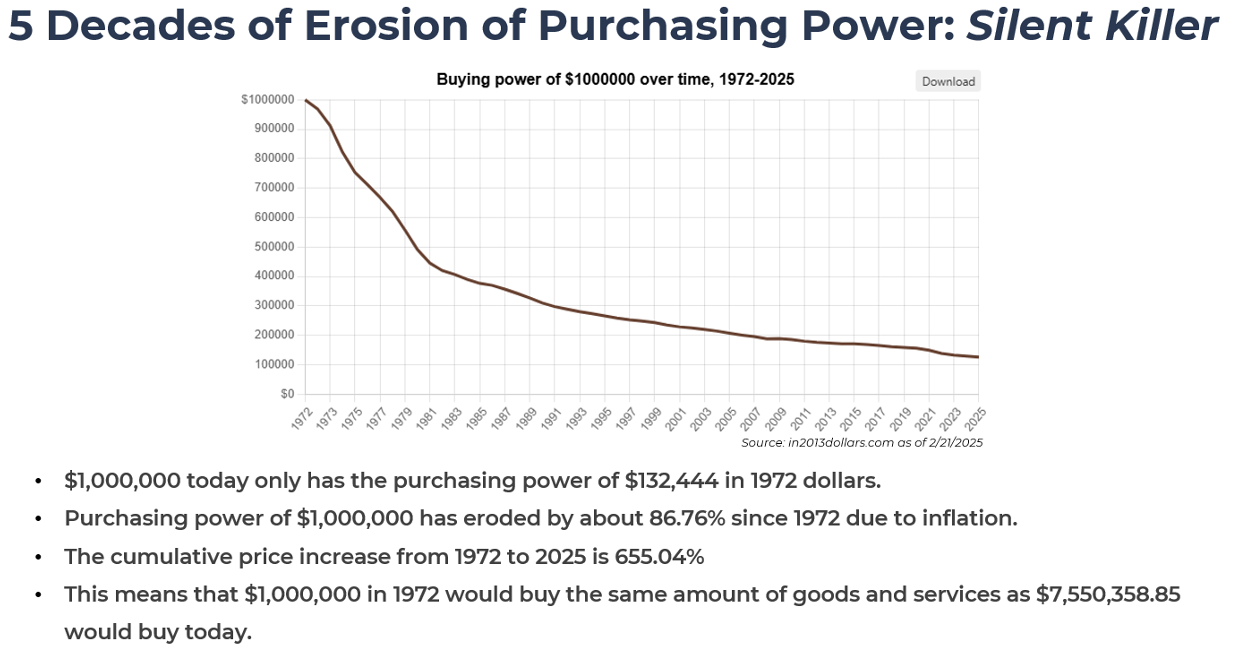

Most people just assume your money value will be the same in 30 years. That’s just not the case. Not only are you taxed inefficiently, but you are also receiving dollars back in fixed amounts annually that are worth less, and less, and less.

The end result is often a negative rate when you factor in taxes AND inflation. Meaning, you are safely losing over time. Here’s a sobering pic to illustrate this point:

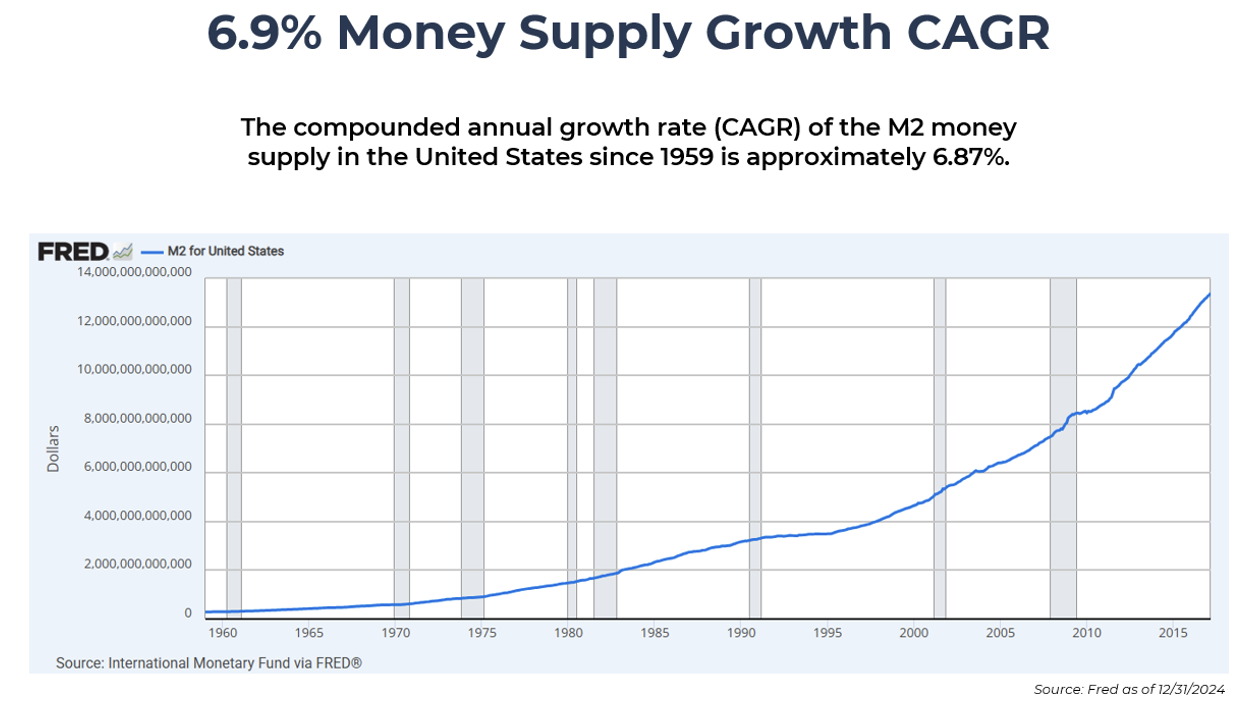

What could be causing this? This might have something to do with it:

If supply of something can be increased substantially, it’s Economics 101 to assume that it will lose value over time. Even the mighty US dollar is not immune to that.

Going off the script a little bit here – I’m not sure why more people don’t see this and aren’t upset about it. Productivity should lead to dollars buying MORE stuff, not less stuff. That’s not allowed to happen, our debt loads couldn’t handle it. We seem to have bought into the belief that a small amount of inflation is necessary. It’s not. Your wealth is being confiscated under the illusion of safety.

The environment is one where the investor is responsible for converting dollars into something that can protect purchasing power, those things are risk assets they are not bonds.

We have structural deficits that we don’t think will go away. The investment implications of that statement simply mean, as Lyn Alden says, “Nothing stops this train.”

It’s our belief that assets with supply constraints, risk assets, will far outpace the “conservative” assets in the future.

I understand there are arguments to the points I’m making, I’m just not sure they matter. Highest CAGR possible, that’s the objective. I don’t see accomplishing that objective via fixed income.

Back to the Question

If you have to generate the highest terminal wealth (the thing that drives the success of a financial plan) and can only invest in stocks or bonds…,what do you do?

I’d imagine I know the answer.

Another simple question, do you expect stocks to be higher or lower 30 years from now vs today?

I’d imagine I know that answer too.

The question I can’t answer – knowing the above, why are there so many assets with horizons far greater that 30 years stuck in blended allocation funds or ‘safe’ assets exposing the investor to purchasing power erosion?

A logical explanation could be a misinterpretation of risk. Volatility or historical stock market crashes have warped investors’ minds away from longevity risks in favor of drawdown risks.

Keep in mind, we spend half our time talking about fixing the allocation issues that come with too much fixed income, while the other half is spent talking about the devastation drawdowns have on CAGRs! We understand the importance of avoiding true nasty stock market environments.

Our Business and Your Portfolios

Coach Brownell used to tell us if we wanted things to be better (better meals, easier practices, etc) – just win games. Winning makes everything better.

In our job today, higher CAGRs are synonymous with winning games. Clients are happy, advisors’ businesses grow faster, and we don’t get fired. This is the way!

We build strategies to improve CAGRs. We are convinced that risk assets are mandatory, in larger size than historical allocations. In simple terms, can we take a 50/50 portfolio and turn it into a 65/35 to benefit the client over time.

We recognize that you can’t make this move to more stocks and less bonds with the hope of never experiencing volatility. It’s why we run option-based strategies that blend in convexity through hedges. We want to build solutions that empower more risk to be absorbed at the portfolio level with confidence. Bigger engines with better brakes.

As of 3/3/2025, according to Bloomberg, the 5-year total return for TLT (long term treasury ETF) is -32.63%…yes, that includes the income.

Investors are realizing the need for risk assets. Aptus is building solutions that can provide more stock exposure, with confidence that drawdowns will be contained.

We could not be more excited about our business today and what’s being built. We recognize that if you are reading this, you are part of that, and work daily to continue to earn your trust. We appreciate you. Please don’t hesitate to reach out with any questions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

*Conceptual Illustration: Information presented in the above charts are for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2503-2.