Unleashing the Power of ETF Tax-Efficiency for Higher Compounded Returns

Exploring how reinvested earnings, return, and tax deferral provide the rocket fuel for compounded dollar growth

Compounding > Couponing

Compounding, the process where reinvested earnings generate additional return, hinges on two critical factors: 1) reinvestment and 2) time.

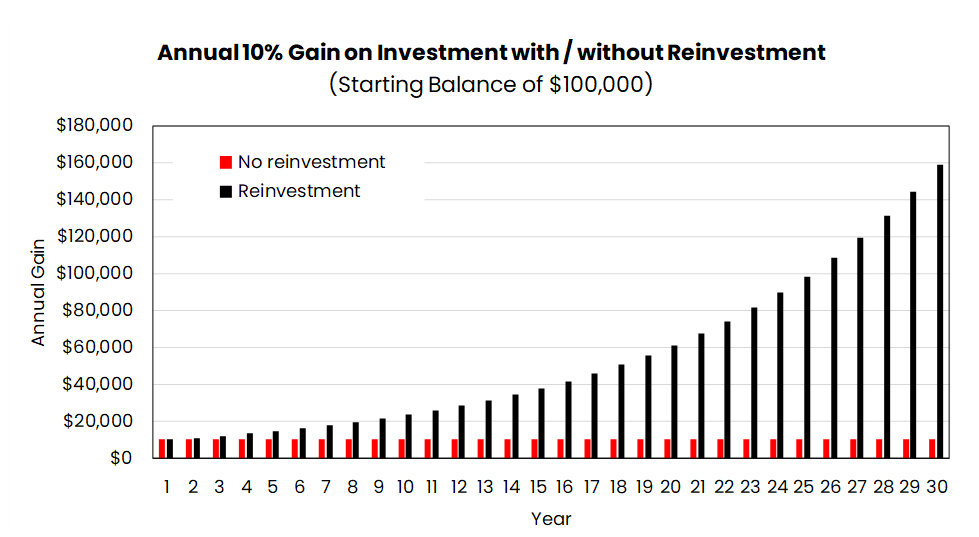

Let’s consider an example: investing $100,000 annually at a 10% return.

If just collecting the dividends or coupons without reinvesting, you’d earn $10,000 each year. By reinvesting, that $10,000 compounds, resulting in $11,000 in year two (a 10% return on the initial $100,000 plus 10% of the incremental $10,000 earned and reinvested in year 1), $61,000 by year 20, and a remarkable $159,000 by year 30, compared to the static $10,000 annual gain without reinvestment.

*Aptus Conceptual Illustration

*Aptus Conceptual Illustration

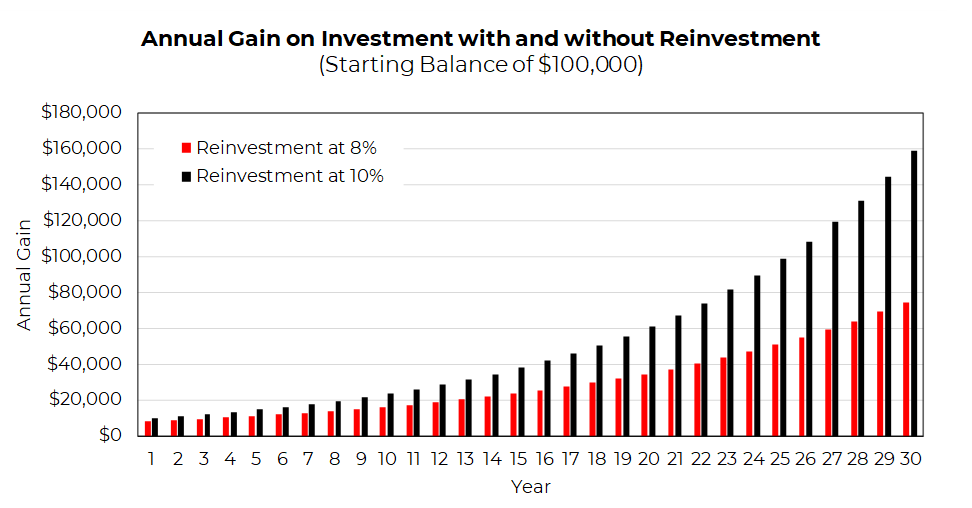

The Impact of Return

The rate of return plays a pivotal role in compounding. A $100,000 investment at a 10% annualized return initially differs by only $2000 in year one relative to an 8% return. However, by year 30, the 10% return surges ahead $159,000 relative to the $75,000 of the 8% return—showing the power of compounding at a higher rate.

*Aptus Conceptual Illustration

*Aptus Conceptual Illustration

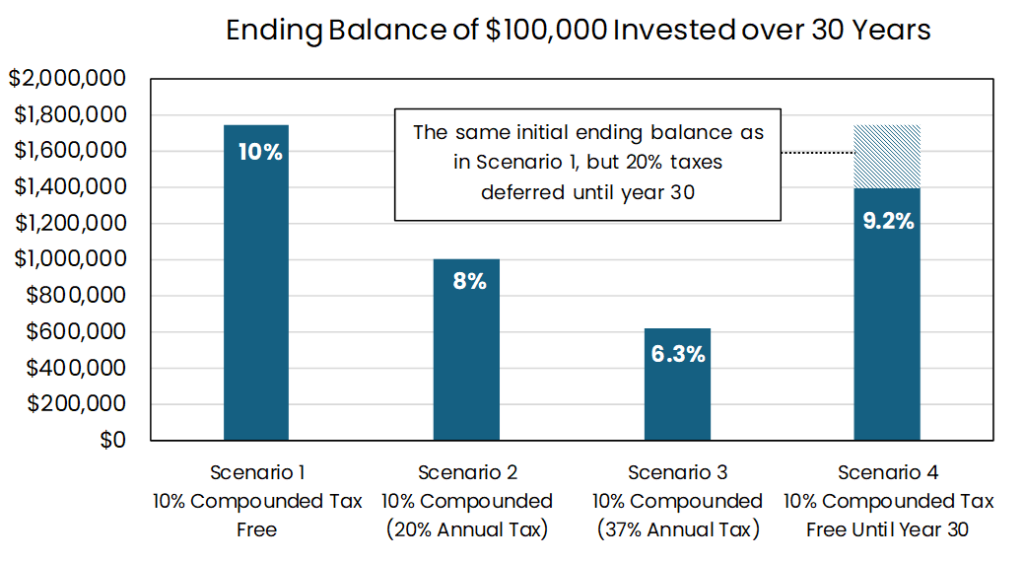

Tax Deferral’s Influence on Compounding

Deferred taxes allow an investor to compound at the higher pre-tax rate over time, pushing after-tax return towards the 10% pre-tax return. For instance, comparing the after-tax return of a 10% pre-tax 30-year investment under various tax scenarios:

- Scenario 1 – No Taxes: 10% compounded for 30 years turns $100 to $1800 = 10% annualized return

- Scenario 2 – Annual Long-term Tax Rate (20%): After-tax return is 8%

- Scenario 3 – Annual Short-term Tax Rate (37%): After-tax return drops to 6.3%

- Scenario 4 – Deferred Tax Payment: Compounding occurs at the pre-tax rate until the sale in year 30 = 9.2% annualized

*Aptus Conceptual Illustration

*Aptus Conceptual Illustration

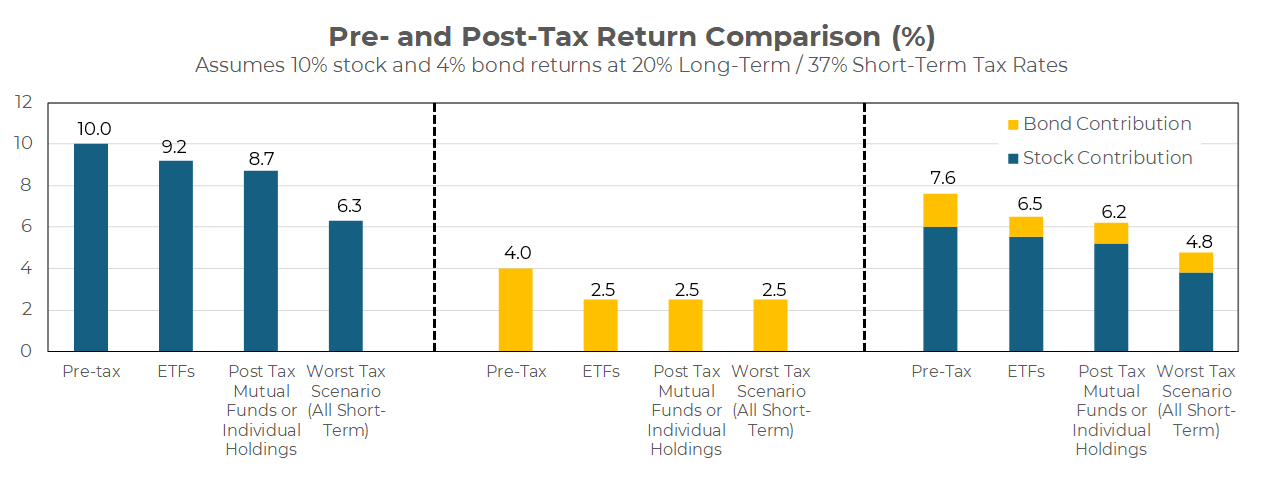

ETF Tax Efficiency + Asset Class Optimization: Maximizing Compounded Returns

ETFs, unlike mutual funds or individual stocks/bonds, offer a significant advantage in tax efficiency. In most cases, ETFs can sidestep and defer capital gains, even when internal rebalancing or transacting individual positions within the ETF. This allows investors to potentially defer capital gains taxes from the time the ETF is purchased until its eventual sale. This deferral enables returns to compound at a higher pre-tax rate over time.

Similarly, while taxes on equities can be deferred when structured within an ETF, fixed income investments do not offer the same benefit in an ETF or outside of an ETF. This is because more than 100% of the return over time is driven by coupons which are taxed as income and cannot be deferred, irrespective of the structure. As a result, a portfolio primarily composed of tax-efficient equities could yield substantial return advantages, even if the pre-tax returns were similar. The unicorn is for an investor to structure a portfolio more heavily tilted in equities within an ETF, but with a comparable level of risk and return as a diversified portfolio of stocks and bonds.

Estimating the after-tax benefits paints an intriguing picture and points to the outsized benefit of ETFs. An ETF that successfully delays all capital gains could yield a net after-tax benefit of up to 1.20% annualized compared to a fund that was taxed annually even at a similar 20% tax rate. We estimate a more realistic savings of between 0.25% to 0.50% for an equity allocation structured within an ETF for long-term investors. However, this tax savings becomes much larger if an investor is able to move a portion of their fixed income to a more tax-efficient equity allocation with similar return characteristics.

*Aptus Conceptual Illustration

*Aptus Conceptual Illustration

These estimations underscore the significant impact of ETF tax efficiency on compounded returns. In today’s evolving tax landscape, prioritizing long-term tax efficiency through a larger allocation to ETFs more likely to defer taxes paves the way for amplified compounded growth within investment portfolios.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

*Conceptual Illustration: Information presented above is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flow.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-22.