Given the recent market volatility, we wanted to share some thoughts on the evolving landscape and provide some opinions on what it means for volatility and markets. There is a lot of noise between Trump policy, DOGE, inflation, and monetary policy that is creating market choppiness.

We think there are two predominant scenarios playing out, with each having different market implications. Ultimately, the timing of a potential “Trump Pivot” will determine the short-term pathway forward.

Scenario 1: Austerity

There is the potential that the Trump “reset” is serious. Short-term pain for long-term gain has not historically been the D.C. policy of choice. In addition, fiscal prudence and Donald Trump have rarely been used in the same sentence.

Tariffs & Potential Trade War: Tariffs can raise revenues, rebalance trade, and accelerate the U.S. manufacturing renaissance. Short-term, the implications could be higher prices leading to lower demand. Long-term, the goal would be to reset competitiveness and bring home middle-class jobs.

DOGE: The Department of Government Efficiency (DOGE) is taking a hacksaw in trying to cut government waste and shrink the deficit. The short-term ain’t pretty but the long-term could help free up talent (labor) and capital for the private sector to take the growth baton.

Global Chaos: Trump likes to be a deal maker. He’s pushing for peace in Ukraine and increased supply from OPEC. Flooding the market with oil will decrease inflation. Peace leads to prosperity and reduces risk premiums.

Mar-a-Lago Accord/ Weaker USD: Trump wants a weaker USD to increase export competitiveness for U.S. goods and services. Trump wants other countries to pay their share for U.S. defense. Trump is eyeballing pressuring other countries into purchasing longer-dated, lower-yielding U.S. debt to help foot the bill. This could help reduce interest expenses.

Lower Rates: Decreased demand, lower commodity prices (especially oil), a weaker dollar, a better fiscal picture, and an increase in market uncertainty could push rates lower and accelerate the Fed’s cutting cycle. At heart, Trump is a low rates guy.

The short-term result of the above policy is a decline in economic activity. This pushes rates lower which could set the stage for the next cycle to occur (better housing affordability, lower consumer debt burden, etc.). Long-term, the economy resets and capital shifts back to the private sector. Earnings and the consumers emerge stronger. The short-term could be painful, but the long-term picture looks more promising. Trump and Bessent have been open to the fact that “it’s going to hurt”. The market has taken them at their word and the earnings multiple of the S&P 500 has declined to accommodate (from roughly 22x to 20x).

The real question is whether those in charge have the real appetite for pain. The above policy (tightening fiscal & monetary policy while also bringing tariffs into the mix) could lead to mild recession. Keep in mind we’ve been running war-time deficits at full employment. Any blip in GDP will put further pressure on debt/GDP and deficit levels. We still believe the way out of the current predicament is a combination of inflation and hopefully growth.

Scenario 2: Trump Being Trump

The aggressive approach to cost-cutting and austerity is less about fixing the long-term fiscal picture and more about aesthetics of a cleaner “fiscal pathway” via DOGE, tariffs, etc. Just three months ago, Trump was pushing Congress to eliminate the debt ceiling completely. Has he really done a 180? Can you teach an old dog a new trick?

Trump has a reputation in his private business dealings of taking an axe to costs, to present rosy financial projections to a bank to get the financing. The playbook from there is to grow out of the debt. Extrapolate lower costs into the future that compares to higher revenues (2024 had record tax receipts), and you create fresh money to spend. The trick to this is timing. The debt ceiling can probably go on until late summer or early fall until Trump can get Congress to approve more debt and extend his tax cuts. Once the funding is secured, Trump can ease off the austerity and get back to business (stimulate) with infrastructure spend, rebates, and lower rates.

We think Scenario 2 is more likely.

So Where Are We?

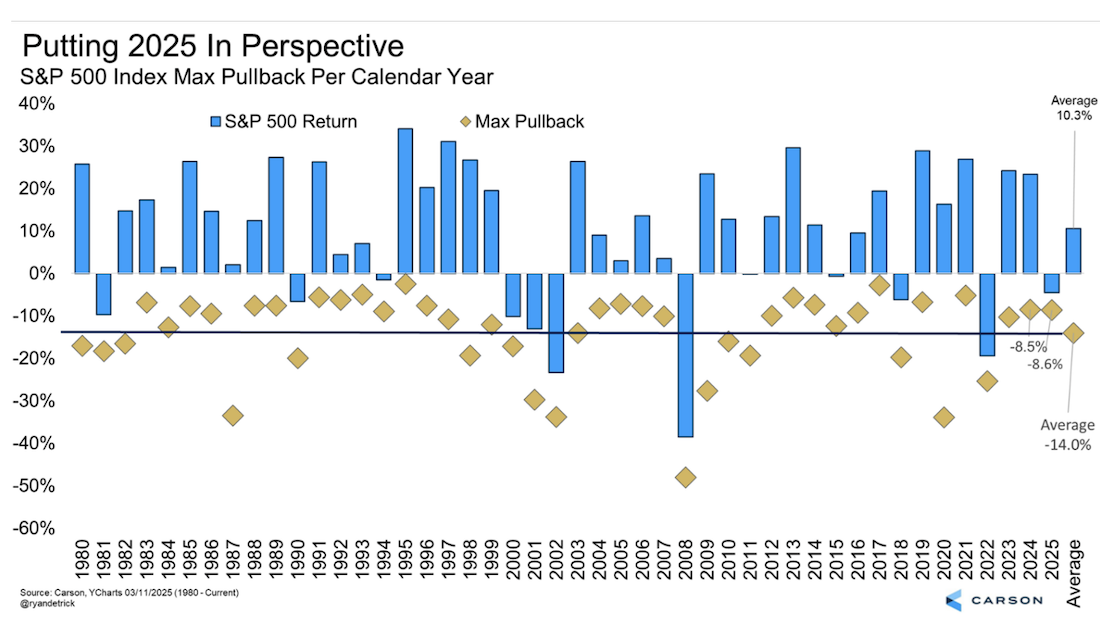

The S&P 500 has seen a larger decline in 2025 than experienced in 2024 (~8.6% through 3/10 vs -8.5% in 2024). However, the average annual decline since 1980 has been -14%.

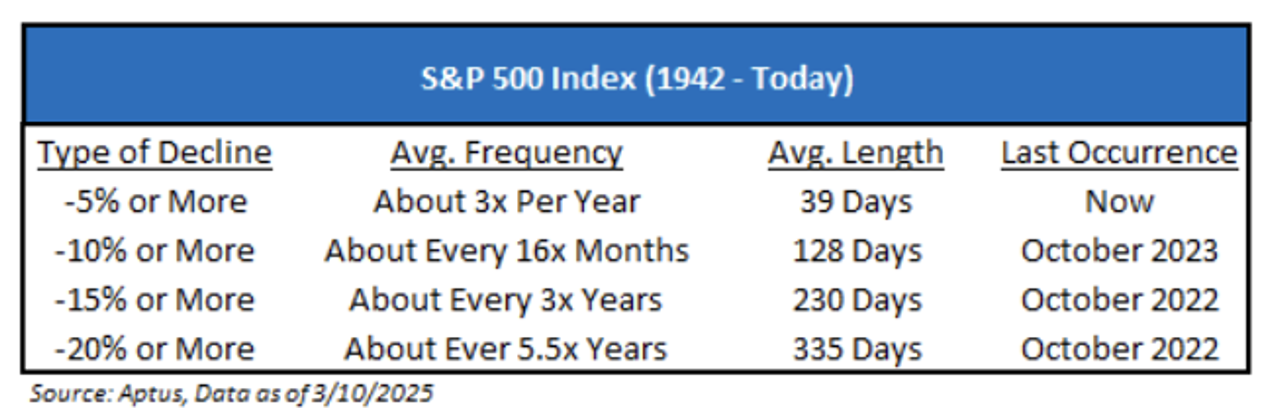

The market historically has experienced three 5% declines per year, one 10% decline every 16 months, one 15% decline every 3 years, and a 20% decline or more every 5.5 years. While market declines are uncomfortable, historically, they have proven to be good opportunities to invest capital.

Short term volatility is a toll to long term compounding. Investors that attempt to time markets must be right twice, when to sell out AND when to buy back in. The best market days often happen around the worst market days. Sticking with a consistent (non-emotional) process often leads to the best results.

Taking a step back, even with this market decline, we are at levels where the S&P 500 made an all-time high 5 months ago. While emotionally difficult, perspective is everything. This summary is our best guess as to the windshield, but we are always positioning to navigate volatility through our disciplined risk mitigation. Stay tuned for a piece highlighting specific actions we’ve been making across our strategies.

As always, we thank you for your trust and we’re here to help if you have any thoughts come to mind.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2503-15.