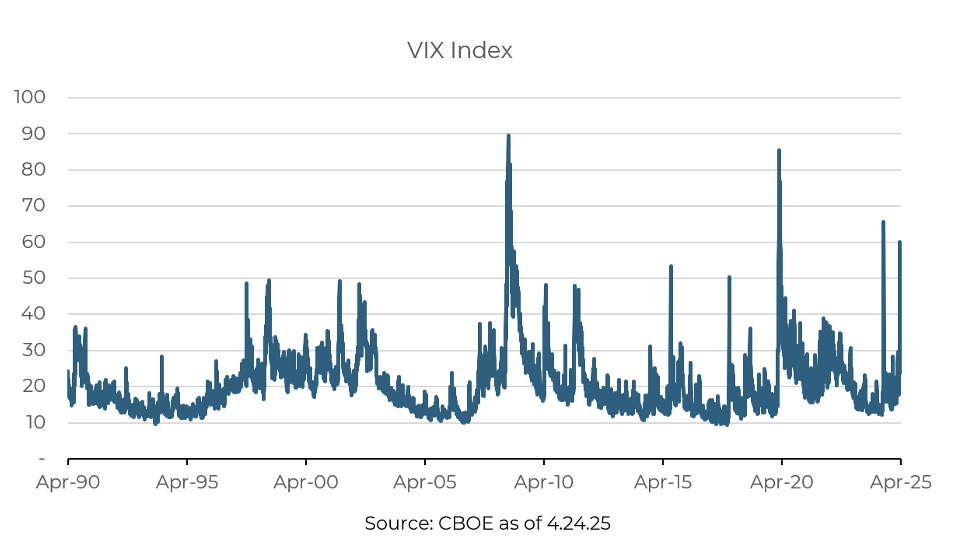

Over the past month, the VIX Index has been making headlines, first spiking, then crashing in dramatic fashion at times just a day apart.

While many investors recognize the VIX as “the fear gauge,” far fewer understand what it actually measures and how to interpret it. The VIX reflects the market’s expectations for near-term volatility, but its value goes far beyond periods of panic. It offers insight into how investors are pricing risk, and what that implies for future market behavior.

What Is the VIX?

Launched by the CBOE in 1993 and updated in 2003, the VIX tracks the implied volatility of the S&P 500 over the next 30 days. Unlike historical volatility, which looks backward, the VIX is derived from real-time S&P 500 option prices. These prices reflect the premiums investors are paying for protection (i.e., essentially, the cost of insurance against market swings). That’s why the VIX is such a powerful signal: it’s driven by forward-looking sentiment, not backward-looking data.

How to Interpret VIX Levels

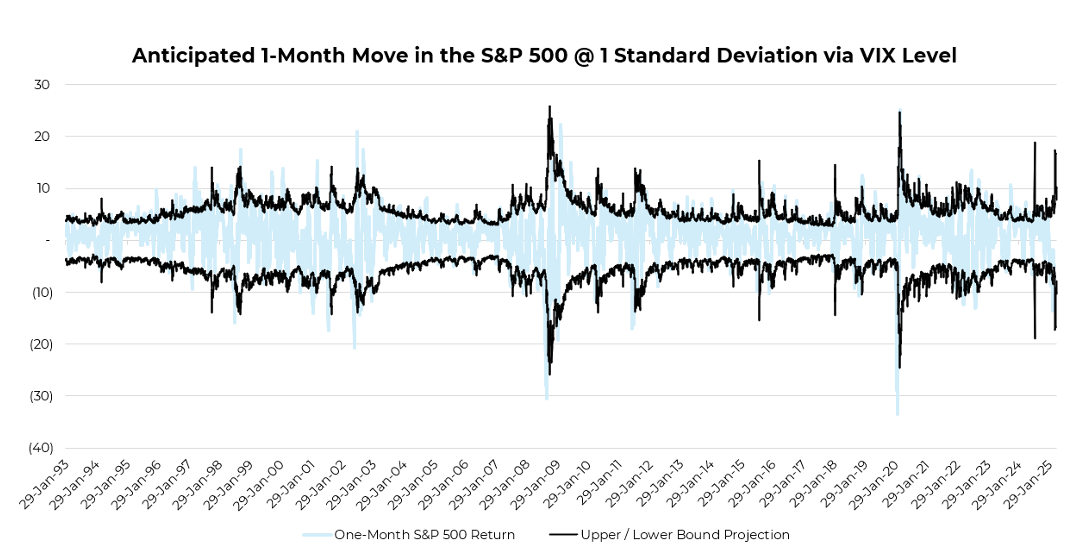

Because the VIX is an annualized figure, you can translate it into a one-month expected range using simple math. Divide the VIX by the square root of 12 (√12 = ~3.46) to get the one standard deviation range for the next 30 days. For example, if the VIX is 18… 18 ÷ 3.46 ≈ 5.2%.

That suggests the market is pricing in a 68% (one standard deviation) chance that the S&P 500 will move +/- 5.2% over the next month. Want to expand that to a 95% confidence range? Multiply the VIX by 0.57 (1.96 ÷ √12) = 18 × 0.57 = 10.3%, meaning 95% of expected one-month returns fall within +/-10.3%.

And when the VIX recently hit 60? A one standard deviation move implies 60 ÷ 3.46 = +/- 17.3%!

Is the VIX Accurate?

Generally, yes, though with a tendency to overestimate risk in the wake of spikes. That’s because volatility often mean-reverts after extreme moves, leading investors to overpay for protection just after it was most needed.

For Illustrative Purposes Only

For Illustrative Purposes Only

This behavioral pattern creates opportunity. At Aptus, we’ve long advocated for thoughtful volatility strategies, such as owning more optionality during calm markets, and harvesting it when expectations become inflated. If done right, managing volatility exposure based on opportunity, rather not just blindly owning or selling options, can lead to better risk-adjusted outcomes and even more tax-efficient protection than traditional fixed income.

Bottom Line

The VIX is not a forecast, but it is a signal. It tells us how nervous investors are and how much they’re willing to pay for insurance. While it often overshoots during stressful periods, that overreaction can be a source of return for active investors.

For investors, the lesson is this: Use the VIX to understand potential short-term ranges and stress scenarios. But if you consistently buy volatility at any price, you’re probably paying too much for something the market may have already overpriced.

Disclosures

Past performance is not indicative of future results. This material is not financial or tax advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed and all calculations may change due to changes in facts and circumstances.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2504-30.