Fed Update

Chairman Powell was before Congress this week and admitted several things: 1) rate hikes will not likely bring down cost of gas; 2) rate hikes will not likely bring down the cost of food (wheat, etc); and 3) a soft landing is unlikely, and growth is coming down.

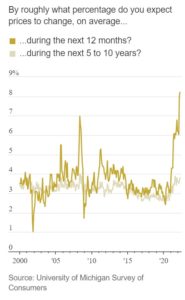

Treasuries immediately started pricing in lower growth/recession with 10yr yields coming in significantly (down 12bps) and the S&P closed essentially flat. It’s an interesting reaction for equities, since Powell basically said the Fed had to keep going despite rate hikes not really impacting a number of the key components of the inflation calculations, and odds were high that they would not be able to stick the soft landing. This can be seen in consumers take on inflation expectation survey.

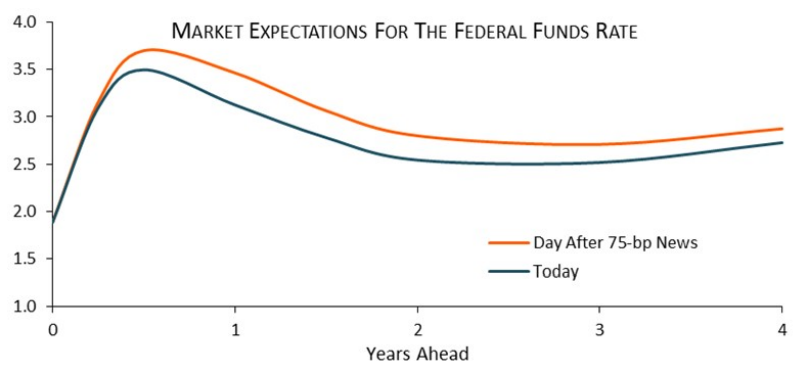

The Market is Pricing At Least a Risk of a Material Slowdown if Not An Outright Recession

Market expectations for the federal funds rate have dropped significantly over the past several days. As the chart below illustrates, expectations were very high on Tuesday, June 14—the day after the Fed telegraphed that it would hike by 75 bps at the June meeting instead of the anticipated 50 bps. Since then, expectations dropped a full quarter point or more at all horizons beyond year-end.

Source: PSC. As of 6/23/22

Recency Bias is Huge in Markets

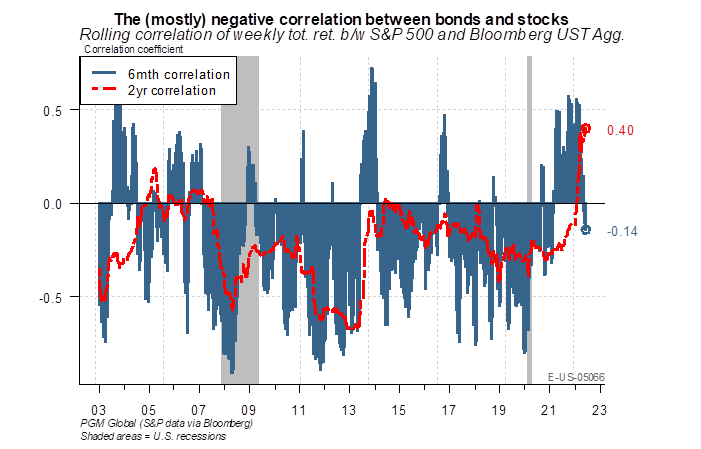

We have at least 14 years since the GFC where good and bad economic news has been good for the traditional 60/40 stock-bond portfolio. Good news meant that growth and earnings could re-rate higher and bad news meant that the Fed would loosen financial conditions via ultra-low rates and QE. The negative correlation between stocks and bonds also helped lower total portfolio risk. However, the goldilocks regime ended this year as inflation and the Fed reaction function changed the game.

Pavilion Global. As of 6/24/22

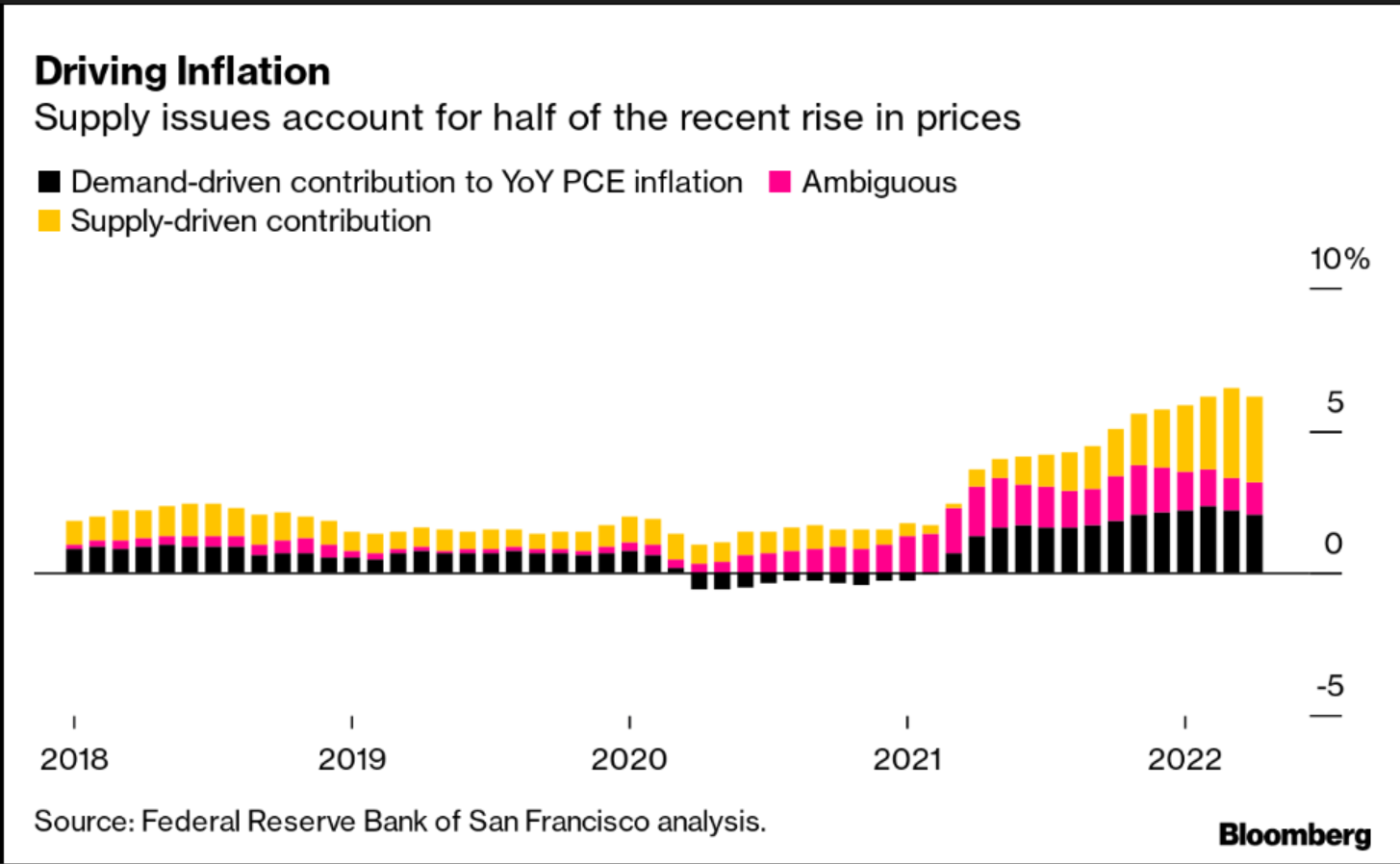

“These results showing that factors other than demand account for about two-thirds of recent elevated inflation highlight some risks for the economy,” Adam Hale Shapiro, an economist at the San Francisco Fed, wrote in a letter published Tuesday. “Because supply shocks raise prices and suppress economic activity, the prevalence of supply-related factors raises the risk of entering a period of low growth and elevated inflation levels.”

*All Data and Charts Sourced from Bloomberg LP, as of 6/23/2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

The Bloomberg Barclays U.S. Corporate High-Yield Index covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2206-20.