The U.S. CPI surged +0.8% m/m and 7.9% y/y in February. Core CPI, which is a measure that takes out food and energy, rose +0.5% m/m and 6.4% y/y in Feb. Given the recent geopolitical event since this February figure, specifically regarding the upward commodity pressures, investors should continue to expect higher future prints. Inflation is broadening and getting into the “stickier” components as areas such as U.S. rents moving higher, plus services.

It was only a few weeks ago that many economists were deeming February as the peak in consumer inflation, but now it’s starting to look more like a fresh baseline. Consensus is calling for inflation to accelerate to 7.8%, and many now think the peak could be somewhere around 9%. Last night, investor Jeff Gundlach hosted his “Total Return” webcast, where he thought that headline inflation could get to 10%. Either way, it’s a long way off the Fed’s 2% target and likely puts them in inflation fighting mode, perhaps at the risk of growth. A sticky situation for the Fed.

Prepare for Liftoff

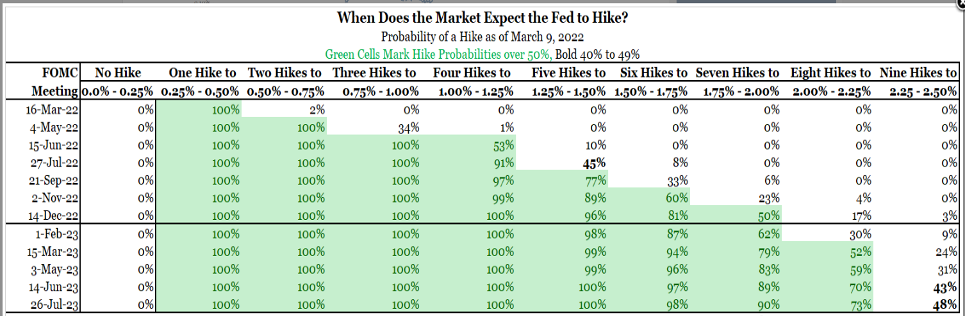

The Fed is set to have their rate liftoff at their March meeting next week. Although recent geopolitical events have probably taken a +50 bps hike off the table for the Fed this month, if the situation in Russia/Ukraine moderates, there could be renewed calls for the Fed to consider a +50 bps hike later in 2022. This of course to fight the intensifying inflation. We’re not there yet but reports like yesterday’s (and likely March’s CPI) will keep investors on their toes as they ponder how the Fed might (re)-act.

With that being said, the market is now back to pricing in seven rate hikes this year (a hike every meeting).

Source: Bianco Research, Data as of 3/10/2022

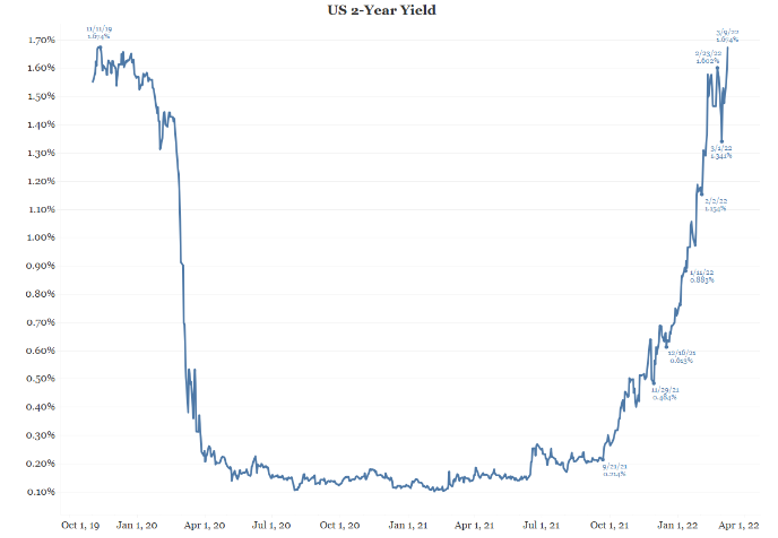

The 2yr Treasury Rate is following in lockstep as the likelihood for more rates increases, making new cycle highs.

Source: Bianco Research, Data as of 3/10/2022

Commodity Spike and Continued Inflation

The recent commodity spike is likely to put upward pressure on headline inflation via higher commodity prices. This won’t show materially until next month’s release. Remember this is February data, which was calculated before we had the huge spike in oil. Initially, the Fed will downplay the impacts of surging commodity prices on inflation as the result of a temporary “supply shock.” But if two or three months pass and commodity pricing remains elevated, it will sustainably impact CPI and the Fed will have to react—inflation is simply too high to not act.

Bottom line, it doesn’t seem like it now, but from a medium and long-term standpoint inflation remains one of, if not the, most important variables in the market because if inflation statistics and inflation expectations do not show signs of peaking, the Fed will be forced to become even more aggressive than markets expect. This means that the Fed could be more aggressive in implementing some form of Quantitative Easing. This increases the chances of a “Fed misstep” later this year, if not sooner.

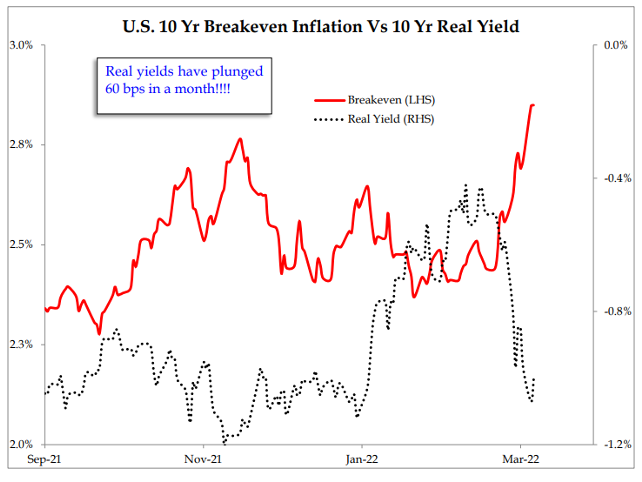

Real Rates Rise with Higher Inflation

Real rates are dropping, because corners of the bond market expect the Fed to at least delay balance sheet reduction (i.e. pause its current policy path to observe the data). We can put aside the argument of whether this pause would be politically motivated, because at this point, intention is irrelevant, and perception is all that matters in 2022. If the Fed pauses, allowing bond yields to gradually correct higher, rather than the “shock and awe” that 10% CPI would otherwise necessitate, then even rational minds will begin to question the political motivations of leaders at the Fed, particularly the newly appointed Vice Chairs!

Source: Bianco Research, Data as of 3/10/2022

What Does All This Mean?!

The 5- year TIPS/Treasuries breakeven are the bond market’s estimation of annual inflation over the next five years. The current 5-year TIPS/Treasuries breakeven has historically been very sensitive to changes in oil prices, so it should come as no surprise that they spiked higher over the past month. They are currently pricing at 3.3%, the highest level I have ever seen them (and it might be the highest level ever). At this point, it’s all about duration. If inflation expectations stay this high for the next two or three months, it will make the Fed even more hawkish – perhaps significantly more hawkish.

Bottom line

One lesson that investors re-learned this past year is that surging demand combined with disrupted supply results in something that anyone under the age of 30 won’t remember – inflation.

Clearly, inflation pressures remain elevated and seeing concrete signs of a peak in inflation is likely key to a sustained rally in stocks. At the same time, consumers are not implying they are becoming overly concerned with longer-term higher inflation. For example, the One Year Over University of Michigan Sentiment Inflation Expectations Survey has plateaued at 4.9% and the Five-Year Report sits at 3%. We’d be more concerned where the longer-term expectations to rise in line or higher than the one year number which would elude to consumers concerns of more structural inflation. Any softer inflation data will be welcomed by the Fed and likely lead to less rate hikes and slower QT. We’ll continue to watch this closely in the next month to see if the commodity spike is sending inflation expectations higher, or if consumers are still viewing it as temporary.

Time will tell.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The 2 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 2 year.

The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the “risk free” rate when valuing the markets or an individual security.

Treasury Inflation-Protected Securities, or TIPS, provide protection against inflation. The principal of a TIPS increases with inflation and decreases with deflation, as measured by the Consumer Price Index.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2203-12.