As we ramped up our portfolio consulting services a few years back, we noticed the opportunity advisors had if they were able to integrate individual securities into portfolios. Limited by SMA fees and trading costs, these were generally exceptions for larger prospects who wanted something beyond a simple ETF/Mutual Fund model.

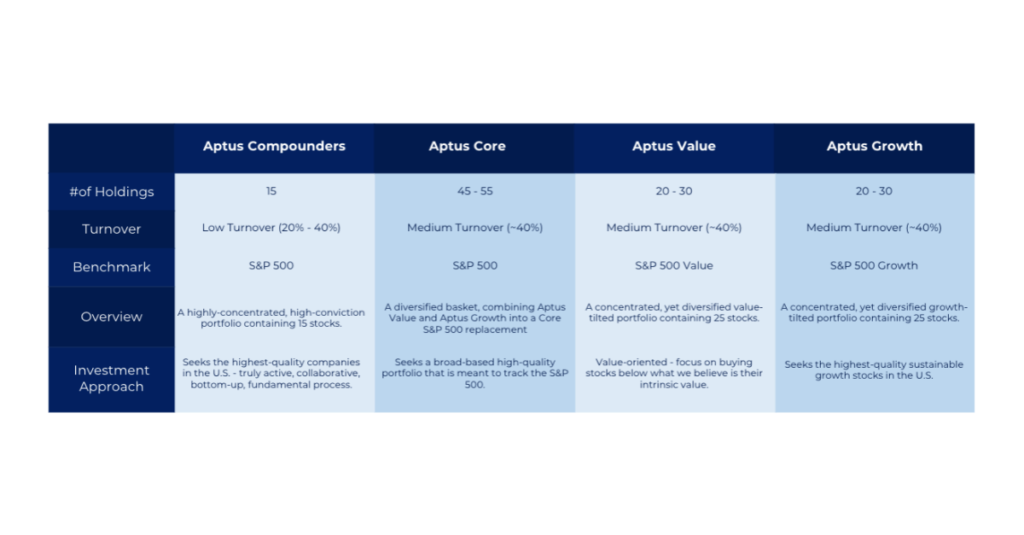

Fast forward to today, and we have a team of CFAs managing an entire suite of managed equity sleeves. “Compounders” was the first, and we’ve added “Value” and “Growth” sleeves that can all work together to deliver a “Core” equity exposure.

While we think our team does great work applying our Yield + Growth framework to these baskets, what can be even more beneficial is the client experience. Clients wanting to really know what they own can get comfortable. Prospects with wirehouse portfolios can be more easily transitioned. And chances to generate tax alpha can be expanded.

We try communicating regularly on the quality tilt behind our approach, and the sleeve updates we make along the way. Here is a more detailed presentation on the work going on behind the scenes:

Aptus Equity Sleeve Presentation

Don’t be shy about asking for more info, we’ve assisted on some great wins by helping advisors work individual securities into a set of high-net-worth model portfolios. Additionally, there are case studies behind every stock included in the portfolios. Enjoy!

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500 measures the performance of the 500 leading companies in leading industries of the U.S. economy, capturing 75% of U.S. equities.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2110-2.