We’ve seen a notable switch in tone of Chairman Powell and many of the other Fed officials over the last couple meetings as they’ve tilted their tone to sound more hawkish as they asses their dual mandate – controlling (heightened) inflation and a (strong) job market. Yesterday’s release of notes from the December FOMC meeting provided some helpful insight to what is going on inside the minds of the most powerful policy makers in the world.

The minutes pointed to the taper completing in March (well ahead of the original mid-summer timeline), rate hikes on the near horizon and in a twist to markets, the potential for the Fed balance sheet to start to shrink sometime (relatively soon) after liftoff.

Reading through the Fed notes, we get some clarity on how aligned the officials are by way of the specific wording. One key difference we noted was that “many” participants were in the camp that the labor market is quickly getting back to full employment, while “several” participants thought that we are already there. Full employment is one of the key points on when the market can expect lift off. For now, “many” > “several” and we’d expect to see the camp for faster rate hikes to increase if the next couple employment reports knock it out of the park – this is something that we will be watching closely tomorrow. So, while a March rate hike isn’t consensus at this point, if the stars align with job data, continuation of heightened inflation data, and the markets tolerating the end of the taper, it COULD happen.

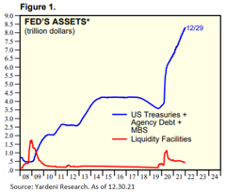

The biggest change in our opinion from the notes was the speak on a balance sheet reduction. We all know the Fed’s balance sheet has ballooned following the pandemic response (>100% increase). Following QE3 (’15), the Fed waited about 7 quarters to onset Quantitative Tightening (QT). That was comprised of simply letting maturities and cash flow from the portfolio roll off (i.e. not reinvesting). The key take from the notes was that this time the officials felt necessary to start QT significantly sooner than what happened during the QE3 period. The caveat here, as always, the officials provide themselves ultimate flexibility on the matter. So, while there was debate among the officials, there were signs of caution and no inclination to start QT immediately after the taper (we suspect 1-2 quarters). This is big news, as there could be major implications for risk assets given a change in narrative behind the market’s liquidity. We will be keeping a CLOSE eye on any revelations of how the Fed tackles the reduction of their massive balance sheet.

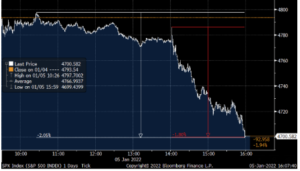

Market Response to the Fed Notes

Source: Bloomberg LP. As of 1.5.22

The S&P 500 sold off sharply following the release of the notes while interest rates continued pushing higher. The 2s are sitting at 0.85% and 10s at 1.73% (10s are approaching their highs from last March at 1.77%). To start off 2022, we are seeing a shift in the market with yields up (especially on the long end) with higher REAL yields driving nominal yields higher, not inflation expectations. While inflation isn’t continuing the monumental rise of ’21, we continue to see the yield curve dictate performance in equity land, with interest rate sensitive assets acting as you’d expect (cyclicals moving higher as expensive growth moves lower).

Bottom Line

With a strengthening economy and higher inflation, it looks as if there might be justification for earlier and faster rate hikes. This was a significant shift in consensus where, at the September FOMC meeting, only half of the Fed officials thought we’d need a rate hike in ’22 – whereas now ALL are on board for at least a hike in ’22. In addition, the FOMC mentioned the potential for a balance sheet reduction. The big question to all of this is whether the market has enough fundamental strength to stand on it’s on… and this is a big unknown.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2201-7.