As one of the most searing dissections of 1980s yuppie culture, American Psycho has become a movie with a cult following, as it depicts Patrick Bateman’s journey as a part-time Wall Street Vice President while being a full-time serial killer. American Psycho is a complex film. By the end of its run, focusing on the movie’s third act revelations, we as the audience are left wondering whether or not any of Bateman’s actions were real or if they were an “illusion” of his insanity.

As one of the most searing dissections of 1980s yuppie culture, American Psycho has become a movie with a cult following, as it depicts Patrick Bateman’s journey as a part-time Wall Street Vice President while being a full-time serial killer. American Psycho is a complex film. By the end of its run, focusing on the movie’s third act revelations, we as the audience are left wondering whether or not any of Bateman’s actions were real or if they were an “illusion” of his insanity.

The film isn’t about a psychotic murderer roaming New York’s streets; it’s about capitalist culture and the idea of wanting to stand out when everyone’s identity is the same. At its core, the movie is about Bateman doing a much better job at just playing a part than truly fitting in with others.

This is exactly what investors continue to witness in the current market backdrop – the level of consensus feels to be at all-time levels. It is difficult to stand out when everyone’s investment identity is the exact same. The unexpected twists of 2025 – the tariff tantrum and low-quality & International performing well – have provided investors with ample food for thought, as consensus was upset by a large magnitude, multiple times.

At Aptus, we’re psycho about asset allocation structure, which we believe should be an investor’s identity to stand out. Yet, this tends not to be the focal point of investors. Instead, that belongs to stock picking, manager selection, etc. History shows that allocation effects tend to drive the majority of long-term returns, not selection, which currently has a high degree of groupthink. In a world where everyone is trying to fit in with others, don’t just play the part. Be different and focus on what has mattered – the structure.

Moving forward, it’s tough not to like the backdrop of U.S. stocks, even after the remarkable rally in a post-COVID world. In our opinion, the biggest risk to investors is that they try to attempt to be clever by timing the market, instead of being patient. If an investor is the latter, T. Boone Pickens may start walking into your office. Remember the key tenets of the market moving forward: (1) Fed rate cuts are unfinished business, (2) The One Big Beautiful Bill Act (“OBBBA”) has front-loaded consumer stimulus, and (3) Private spending through AI is a train that is not slowing down in the near-term.

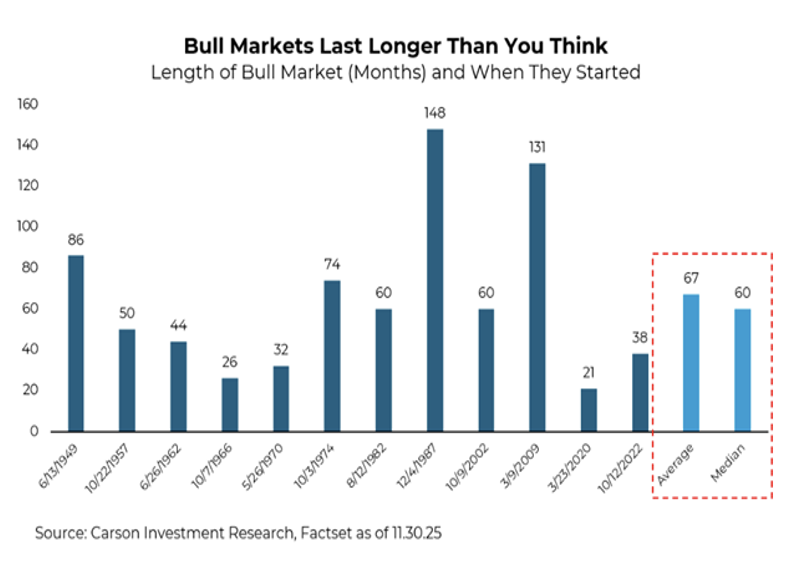

It’s likely too early to cleverly call a market top, stating that the bull market is over. In fact, looking at the 11 bull markets since World War II, the average one lasts more than five years. Not only that, the current bull market is up a very impressive 90% in just three years – which sounds like a lot – but in the context of historical rallies (the avg. bull market is +191%), perspective may state that the bull market is younger than many would think.

Given the renewed characteristic within the S&P 500 – operating leverage – we continue to believe that tails will occur more frequently – both left (bad) and right (good) – driven by growth expectations. In 2026, a new variable may briefly enter the market landscape – mid-term elections. Investors need to remember, over longer periods, that the market isn’t political. Any short-term political movement or agenda that is viewed by the market as getting in the way of better earnings or growth will be viewed as negative and be a headwind on risk assets, and vice versa. Mid-term election years tend to be the most volatile year for stocks in the four-year presidential cycle. The average intra-year decline for the S&P 500 is 19%, compared to just 12% in the other three years (average of all four years is 16%). We would note that the S&P 500 has been positive in the following 12 months during every instance since 1938.

The past few years of the bull market have allowed investors to think that they were wearing a Valentino Couture suit, as the S&P 500 has had a 23.7% annualized return since 2022. That time frame has come with increased investor skepticism. With this, investors need to think about protection differently, understanding the difference between diversifiers and hedges. In a way, traditional fixed income has been its very own American Psycho, as correlations to stocks continue, even when it’s masked during positive market return years. Now may be the time to pragmatically adjust, so investors don’t get duped thinking that they had dinner reservations at Dorsia, eating the sea urchin ceviche, but instead were taken on a date to Barcadia, if bonds continue to be certificates of confiscation.

Long-term investors need to take a note out of Patrick Bateman’s methodical morning routine. Preparation is key to having a plan for the future, as it is nearly impossible to predict. While most investors continue to play the game of consistently making market calls, stand out by allowing the allocation structure to do the heavy lifting – own volatility as an asset class for left tails (bad) and more stocks for better CAGRs in right tails (good). We believe that having the proper asset allocation structure gives investors the opportunity to have the best business card at the table – whether it is bone, eggshell with Ramalian type, or even a watermark.

The Three Key Tenets of the U.S. Market: Until Fundamentals Change; Own Risk Assets

We believe that investors need to continue to be psycho about American risk assets, which should act as an investor’s north star. Specifically, being underweight risk assets is one of the biggest threats to clients and the magic elixir to unknowingly inject longevity risk into a portfolio.

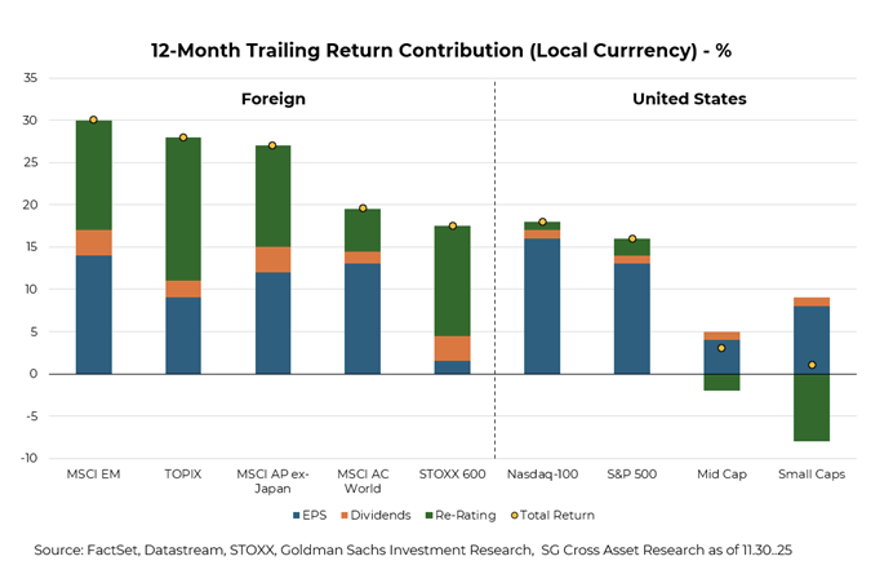

The growth trajectory on fiscal, Fed dovishness, combined with AI and broader capex, should continue to drive returns in the near future. Historically, the index does not de-rate when rate cuts occur against a non-recessionary backdrop; however, the scope for re-rating will hinge on the magnitude and pace of Fed adjustments and fiscal spend. For now, we believe the base case is that earnings growth will continue to dictate the direction of market performance; a dynamic that should remain robust.

When it comes to betting on risk assets, you need economic growth, and there’s no better place to find growth than the U.S. due to the following reasons:

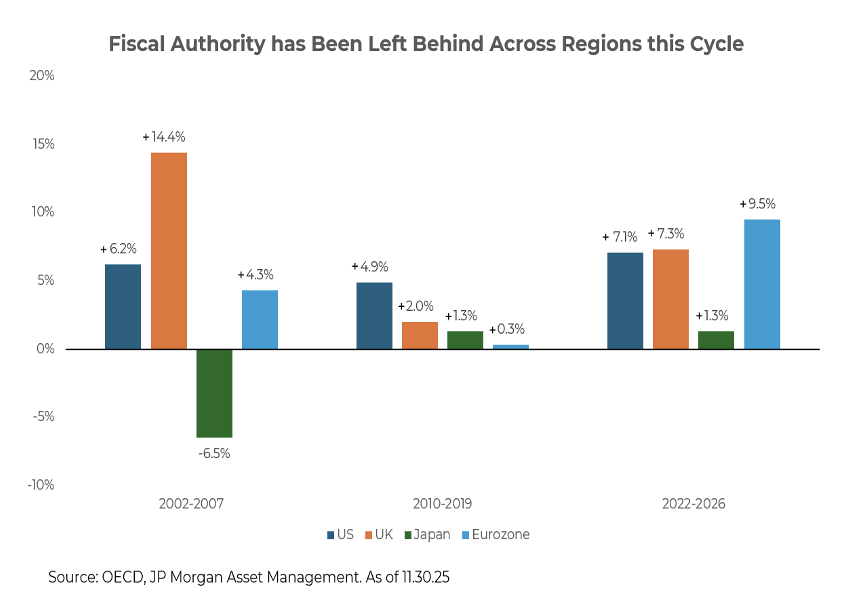

1) Fiscal Policy

Whether or not it was purposefully created this way, the bulk of the benefits from the OBBBA will be distributed during the first half of a mid-term election year. This economic liquidity bazooka, which was the exact legislation that was created as an opportunity to sterilize the negative economic impact of tariffs, is expected to see a combination of business and consumer tax cuts totaling around $285B in 2026. Federal tax refunds are also expected to increase by 44% to $517.3B. The U.S. consumer, more specifically in the upper end, continues to be strong, but these tax benefits should act more as a rising tide that lifts all consumer boats.

negative economic impact of tariffs, is expected to see a combination of business and consumer tax cuts totaling around $285B in 2026. Federal tax refunds are also expected to increase by 44% to $517.3B. The U.S. consumer, more specifically in the upper end, continues to be strong, but these tax benefits should act more as a rising tide that lifts all consumer boats.

While tariff policy was a shock to the markets, it once again showed that corporate America did what it does best – adapt. Companies were not apathetic. They realized they must act to defend margins, reworking supply chains, while continuing to drive productivity with AI implementation. As the Supreme Court rules on the legality of Trump’s tariffs, we think investors should remain optimistic. The status quo is likely already priced in, whereas if they are struck down, companies will instantly see margin expansion, benefitting risk assets. While participants shouldn’t expect the Trump administration to shy away from the campaign promise to use tariffs, they could see a world where tariffs are in place, albeit at a lower rate, providing another margin catalyst for US stocks.

Moving forward, as the Fed cuts rates, the sensitivity impact on the government deficit will likely be as, if not more, powerful on the way down than it was on the way up; the U.S. is basically a floating rate borrower. This could be another bullish point for Fiscal policy in 2026 and beyond, as lower rates give Washington, D.C. more room in the budget to spend capital, given that it would not be used on interest expenses. With the government rarely running a surplus, there’s a high likelihood that if D.C. has dry powder, it will be spent.

Fiscal exuberance is something that has always been present in the economy, and it’s likely something that will not slow down and will come at larger scales in the future, as it’s difficult to put toothpaste back in its container once released. Not only that, but this type of economic engineering is also something that has become more commonplace across the global landscape – the winners will likely be the ones that can utilize it to spur growth.

Bringing it all together, the money printer is unlikely to slow down in the near future, as the government runs 5% – 6% deficits. And when deficits are running at these levels, there is a corresponding debasement of one’s currency, which we think necessitates the ownership of risk assets.

2) Monetary Policy

The Federal Reserve has confirmed that it is officially in a rate-cutting cycle after nearly one year of holding the federal funds rate steady. While the rate cuts are expected to continue in 2026, we believe that’s just the first lever to help create an economic environment that is more stimulative for risk assets. We believe that the real substance of Monetary policy will come from the expansion of the Fed’s balance sheet after years of the balance sheet declining via Quantitative Tightening (“QT”) to deal with liquidity issues building in the financial system.

-

-

- Fed Rate Cuts: During 2025, the Federal Open Market Committee (“FOMC”) cut the target interest rate policy by 0.75% – via three separate 0.25% cuts – to a level of 3.50% – 3.75%. To that point, the official FOMC statement, which reflects the consensus of the FOMC, kept forward guidance, clearly exhibiting an easing bias. That tells investors the consensus of the FOMC still sees rate cuts as appropriate heading into 2026. That’s important because it’s not so much which month the Fed cuts rates as is the fact that they are still cutting rates. Bottom line, if Powell implies that we’ll be on another extended pause, that would be more negative for markets. But right now, the Fed is cutting rates, and that’s what matters the most.

- Expanding Balance Sheet: The Fed started expanding its balance sheet once again. Issues were developing in overnight lending markets due to a shortfall in reserve supply, as hedge funds lever up to fund the growing federal deficit, and banks have minimal firepower to quell repo market volatility. With the Standing Repo Facility not functioning as intended, bill purchases were needed to begin to prevent major disruptions in the repo market. Nonetheless, injecting liquidity (a bullish positive) into the market.

-

Whether one agrees or disagrees with the Fed’s policy actions moving forward, they continue to become more economically stimulative. The market knows that the Fed will likely always be behind the curve – the Fed intentionally waits longer to act than markets would like, as they tend to avoid acting prematurely. As a result, the Fed is always late moving, but usually not too late to avert a disaster. This is why the market has its own automatic stabilizers on both sides: (1) Re-inflation will cause higher market rates, which will cause slowing, and (2) Deceleration will cause lower rates, which will cause a re-acceleration in economic data. But the psychological impact on the market of moving in either direction could be meaningful in the short term.

Remember the old adage: Don’t Fight the Fed.

3) Private Company Capital Spend

One of the biggest, most polarizing topics in the investment landscape is the narrowness of the domestic market, in regard to performance and earnings growth, driven by the revolutionary, not evolutionary, technology of advanced computing. While new technology and its long-term benefits may be difficult to quantify, we believe that investors need to return their videotapes and recognize that there are material long-term benefits that could come from artificial intelligence (“AI”).

The transformative power of AI has taken center stage, igniting both excitement and apprehension about its expansive reach. This Technology’s ability to enhance productivity and profitability across various industries has kept the market optimistic about its future prospects. However, this technological revolution promises to be gradual and non-linear, possibly triggering significant rotations, maybe even an “air pocket”.

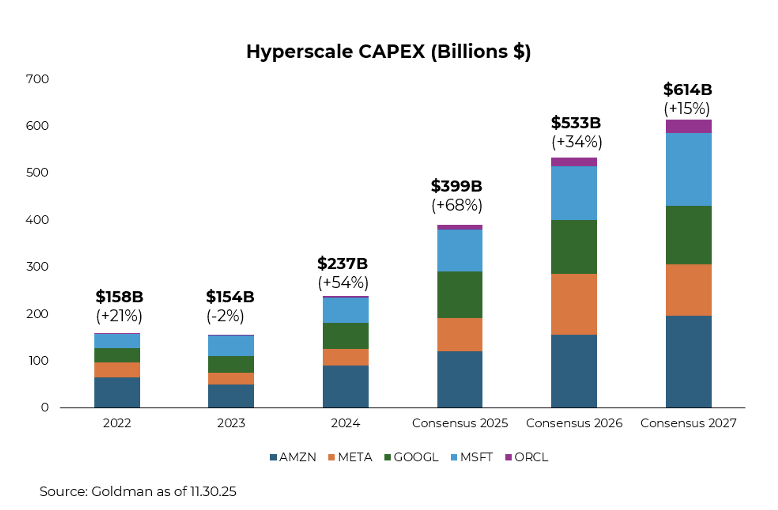

Nonetheless, AI investment is surging as major technology companies compete to secure the chips, data centers, and power infrastructure needed to support their expansive training initiatives and growing inference workloads. Capital expenditures have already reached historically high levels, with data center spending representing roughly 1.2–1.3% of GDP, and this isn’t slowing down in 2026 as analysts expect spending to increase by 34% – an estimate that has historically undershot actual spending.

Meanwhile, business adoption is also accelerating, although it remains early to measure productivity gains in official data, there are already signs that consumers are benefiting from AI-enabled products and services.

It may surprise investors that the Technology sector of the market, where much of the AI concentration lives, has witnessed no multiple expansion this year, which stands in sharp contrast to the tech bubble in 2000, making it far more difficult to characterize today’s market as a bubble. The profitability across the tech sector is substantial, and it’s hard to imagine AI-related capex suddenly coming to a halt. Growth will inevitably slow, but the absolute dollar spend is likely to remain elevated.

While the market tends to dislike this spending as of late, given the questions surrounding a return on invested capital, the absolute numbers continue and should not be bet against, unless there is a fundamental change in the narrative. It should be noted that the dollar spent in this space during 2025 and moving forward is larger than most fiscal bailout packages in Washington, D.C., pre-2020 – a force to not reckon with.

Artificial Intelligence Investment Cults Are Hip to Be Square

American Psycho was adapted from a 1991 novel by Bret Easton Ellis, and the author believes that the movie reached “cult status” due to its metaphorical message about greed in America. Coincidentally, the cult classic has caught up to the current society of finance – investors are asking themselves an existential question – is Artificial Intelligence a way of the future, or is it a cult following that will likely lead its victims to a Patrick Bateman-style of “murders & execution”?

In our opinion, one of the biggest risks to the market is some type of slowdown in the AI narrative. While this seems to be a consensus opinion, we believe that market pundits have difficulty seeing the forest through the trees on this topic because fear sells, and the benefits of this technology need to be viewed through a longer-term perspective.

Fear of asset bubbles has been ingrained in investor behavior since the Dutch Tulip-Mania of the 1630s. Then, more recently, as the market had to digest the commentary from Michael Burry, who correctly called the mortgage-backed security crisis in 2007, about AI-exuberance. Yet not all booms lead to busts.

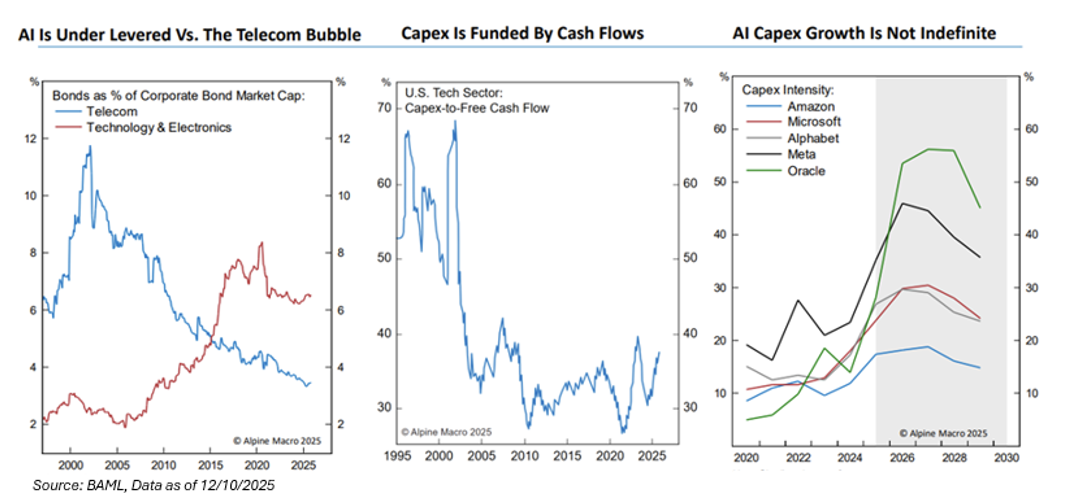

In fact, we don’t think that all booms are created equally. The worst kind of bubble is one that is unproductive and financed by banking institutions, e.g., tulips, gold, and housing. The best kind of bubble, relatively speaking, is one that doesn’t hurt growth too badly, but adds an element of future productivity. The best example of the latter is the dot.com bubble of the late 1990s.

While lots of money was both made and lost during the tech bubble, investors at the time could have had no idea of the long-term benefits that the internet would bring to the global economy. For example, the bubble occurred four years before Facebook was created, seven years before the first iPhone, and nine years before Uber. While there was some short-term capital pain for those who didn’t remain patient, the entire world population continues to benefit from the addition of the internet to their day-to-day lives.

We believe that advanced computing will be no different, though it is nearly impossible to fully understand the long-term benefits and how the market evolves to this technology through the lens of today. Much like the internet, no investor or economist had the ability to understand how the labor market would evolve during the period of time after the internet frenzy. For example, the gig-economy was born and facilitated by digital platforms (like Uber, Doordash, YouTube Influencers, etc.) – though we may not like it, these “new” occupations have added to the wealth of the consumer.

Unlike past episodes of speculative excess, today’s AI cycle is being largely financed by profitable, cash-rich firms and underpinned by robust demand. The Tech sector’s free-cash-flow margin, near 20%, is more than double its late 1990s levels, underscoring both robust profitability and capacity to self-fund AI investment. Price appreciation to this point has been primarily driven by sustained, superior earnings growth, and the dominant companies of today have particularly strong balance sheets in which the AI investments are financed by free-cash-flow. Not to mention their valuations are much lower than what we’ve witnessed in the past.

Still, markets are struggling to price a technology that is advancing at an exponential rate. While markets appear undeterred, even with solid fundamentals, they can have a correction. We believe there is a difference between a bubble and an air pocket. While we don’t believe that we are currently in the former, the latter is a possibility. The boom in tech stocks and AI spending could lose its luster, even if temporarily. While few doubt the potential transformative impact of AI, a shift in momentum could be triggered by a range of factors (i.e., a miss on mega cap earnings, a supply crunch on power or critical materials, or an external liquidity shock). Given the significance of AI investment, such a slowdown could cause a swift pullback in the overall market, or at a minimum, pressure the AI-linked wealth gains that have lifted consumption.

Understanding the overall AI risk doesn’t mean that an investor should be underweight in the market or afraid to invest. Simply said, the best way to approach AI is not to try to pick the winners and avoid the losers, but to address it at the asset allocation level by owning more stocks.

We believe that it is a very rational and conventional framework to not fade this new technology, but embrace it with the safety of utilizing hedges on the exact thing that investors want to protect against – a pullback in the S&P 500 – which has a concentrated exposure to advanced computing. If one can do this, without chasing the more speculative areas within this AI theme, we think they will continue to see returns that are too hip to be square.

Aptus’ Biggest Conviction: Bonds Don’t Work Best as a Solo Artist, Nor Within the Confines of a Group

Music plays a big part in American Psycho, and in particular, Patrick Bateman’s life. There are several great 80s songs throughout, but three specific artists featured in pivotal scenes throughout the film: Huey Lewis and The News, Phil Collins, and Whitney Houston, all of which Bateman gives long-winded critiques. For those who have followed Aptus for quite some time, you are aware of our long-winded critique of traditional fixed income.

Music plays a big part in American Psycho, and in particular, Patrick Bateman’s life. There are several great 80s songs throughout, but three specific artists featured in pivotal scenes throughout the film: Huey Lewis and The News, Phil Collins, and Whitney Houston, all of which Bateman gives long-winded critiques. For those who have followed Aptus for quite some time, you are aware of our long-winded critique of traditional fixed income.

Fixed income had been the undisputed masterpiece of asset allocations, as the interest rate environment allowed bonds to be on a four decade-long bull market. Historically, bonds work best within the confines of the group rather than a solo asset class, and we stress the word, asset class.

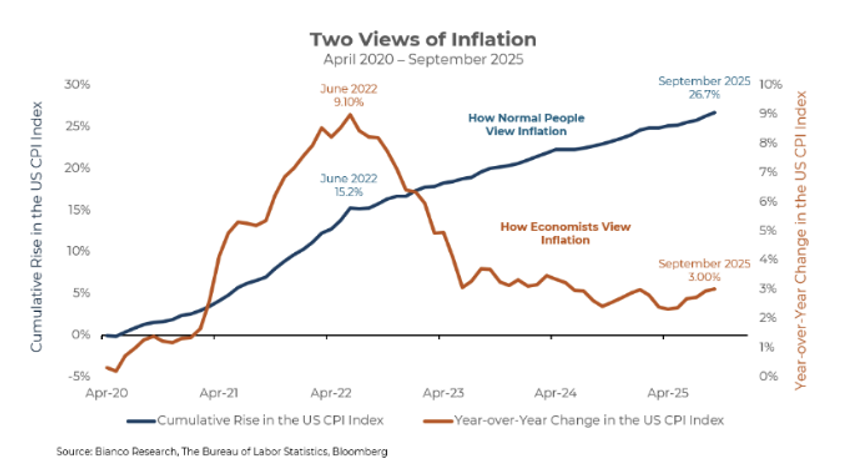

But, with the genesis of an environment where investors have started to recognize that inflation needs to be viewed from a cumulative standpoint over a client’s investment horizon, instead of from the lens of an annualized economic figure, bonds neither work best as a solo artist, nor within the confines of a group.

Given that American Psycho is a biting satire set in the Era of Excess, it shouldn’t be a coincidence that this type of environment still rings true today. The American market continues to be psycho about injecting record amounts of liquidity to support the economy, both fiscal, monetary, and private. The ramification of these policies is that the currency continues to get slowly debased, and cumulative inflation is one of the more conservative measures of one’s purchasing power loss.

Said differently, in this Era of Excess, an investor’s hurdle rate may be much higher than previously thought, and that an over-reliance on bonds is the magic elixir of unknowingly and accidentally injecting longevity risk into a portfolio. Despite their nominal stability, investors in Treasury bonds have experienced essentially zero real after-tax returns over the past century. This highlights the critical importance of considering inflation and taxes in long-term investment strategies, as well as exploring alternatives that are more likely to increase the purchasing power investors will need in the future, given a higher hurdle rate needed to maintain purchasing power.

One of the biggest lessons investors should know is that stability does not define safety. True risk is far more sinister, as it uses the comfort of stability today to rob one’s future purchasing power.

This is why owning risk assets is our largest conviction heading into 2026 and beyond, specifically, be an American {stock market} Psycho. The exogenous forces at work —injection of liquidity into the market— are not going to slow down. Especially as the U.S. economy digests a growing deficit. But the key to owning more risk assets is knowing the difference between hedges and diversifiers because drawdown risk remains.

Many investors overlooked one of the most important comments to come out of Washington, D.C. in years, and it came from the U.S. Treasury Secretary, Scott Bessent. He said that the U.S. debt problem is not worrisome as long as risk assets increase in value. Specifically, the Government can grow both the economy and control the debt. What is more important is that the economy grows faster than the debt.

The investment playbook can be easily legible if one understands that the debt problem can be attacked from three angles: (1) Austerity (unlikely), (2) Grow your way out of it (good for risk assets), and/or (3) Inflate one’s way out of it (bad for bonds). Essentially, own more stocks, less bonds, while keeping risk in check, is a palatable playbook.

If there are equity pullbacks, we know that the best arbitrage opportunity for stocks is time. Lengthening one’s time horizon has been a recipe for loss avoidance. This is a benefit unique to stocks. Remember, market timing is very difficult, as an investor needs to be correct twice – once on the purchase and once on the sale. Not only that, but panic selling can also result in outsized opportunity costs, as the best market days often follow the worst days, i.e., the tariff tantrum of 2025 has been another case study for all investors.

The question facing viewers at the end of American Psycho is whether Patrick Bateman’s actions were real or an illusion of his insanity. In a sense, traditional fixed income has become the Patrick Bateman of the markets over the past few years, as there was only an illusion of a bond portfolio being an asset of stability – some kind of abstraction, only an entity. And one of the biggest questions facing investors in the future is: will fixed income’s historical attributes become a reality again, or will they simply not be there?

Keeping Things In Perspective

We always end our annual outlook with a positive message, as the investment world tends to be lived through the lens of a pessimist. The previous topics have included:

-

- The “Time Billionaire”: The average lifespan of an American is 79.0 years. The length of 1 billion seconds is 31.7 years. If you’re 47 or younger, that means you’re a time billionaire. You likely have 1 billion+ seconds left in your life. If you’re 20, there’s a decent chance you’re a multi-time billionaire. Our society places more value on being a dollar billionaire. We believe that people severely overvalue the dollar billionaire and undervalue the time billionaire.

-

- How People Spend Their Time: As we go through life, we build personal relationships with different people – family, friends, coworkers, and partners. These relationships, which are deeply important to all of us, evolve with time. As we grow older, we build new relationships while others transform or fade, and towards the end of life, many of us spend a lot of time alone. Viewing the evidence together, the message is not that we should be sad about the prospect of aging, but rather that we should recognize the fact that social connections are complex. We often tend to look at the quantity of time spent with others as a marker of social well-being, but it’s the quality of time spent with others that contributes to our feelings of connection or loneliness.

This year, we want to focus on America’s infatuation with being perfect. While everyone has a different definition of being perfect, we all likely share the trait that we’re too difficult on ourselves and our attempts to be perfect. Perfection is impossible. But one’s mentality on becoming perfect is how you control it.

The best example of this is from Roger Federer’s commencement address at Dartmouth a few years ago. For reference, Federer has been considered to be one of the greatest professional tennis players of all time. Roger won 1,526 singles matches; almost an 80%-win rate that led him to 103 titles and 20 grand slams. Yet, he only won 54% of the points that he played. Said differently, he lost almost every other point he ever played for 24 years and still became one of the greatest.

To be honest, this is a lot like investing. Pundits have stated that if you’re correct 51% in the investment world, you’re likely going into the investing hall-of-fame. And like tennis, when you’re playing your point, it must be the most important thing in the world. The moment it’s over, it’s behind you; move on. Your next trade is your best trade.

This rings true even in life. Don’t let one moment define your 79.0 years. This mindset sets you free to attack the next point, and the next, and the next with absolute intensity and clarity. As Roger says:

“The real sign of a champion is not that they win every point; it’s that they lose again and again and again… and have learned how to deal with it.

Negative energy is wasted energy.

Move on. Be relentless. Adapt. Grow.

Work harder – and work smarter.”

The next time you fail, don’t consider it falling behind. You’re just in the 46%. Every single legend has spent a lot of their career in the 46%. Forget it; play the next point.

Happy Livin’,

The Aptus Investment Committee

Aptus Outlook Themes Through the Years

2026: Be an American Psycho (American Psycho)

2025: Stocks for the Long Haul? Surely You Can’t Be Serious. I Am, and Don’t Call Me Shirley (Airplane!)

2024: Will Consumers Shrug (Atlas Shrugged)

2023: A Market in Constant Sorrow (O Brother, Where Art Thou?)

2022: Investors May Need to Curb Their Enthusiasm (Curb Your Enthusiasm)

2021: Ted Lasso – Investors Need a Pep Talk

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA 2512-18.