I hope that y’all have not had PTSD 2.0 of the GFC over the last few days. The KBW Regional Banking Index (KRE) is having its worst week since … October 2008. We had to break out the textbooks on my last musing (ERP), so I’ll do my best to keep this as simple as possible because accounting was never one of the original six love languages. Let’s hit on the recent news in two different parts:

1. What Going On, and

2. What Does it Mean for Clients

What’s Going On?

Simply Speaking, What Happened?– Bank deposit rates have been egregiously low relative to other higher-yielding options. That was not a problem until depositors began to move money out of the banking system for these higher-yielding instruments. Banks did not raise deposit rates because it would hinder profitability (this is called “Deposit Beta”). Sitting in your shoes, think of the yield on money markets that you can now get your clients – there are officially alternatives to letting cash just sit in your checking account.

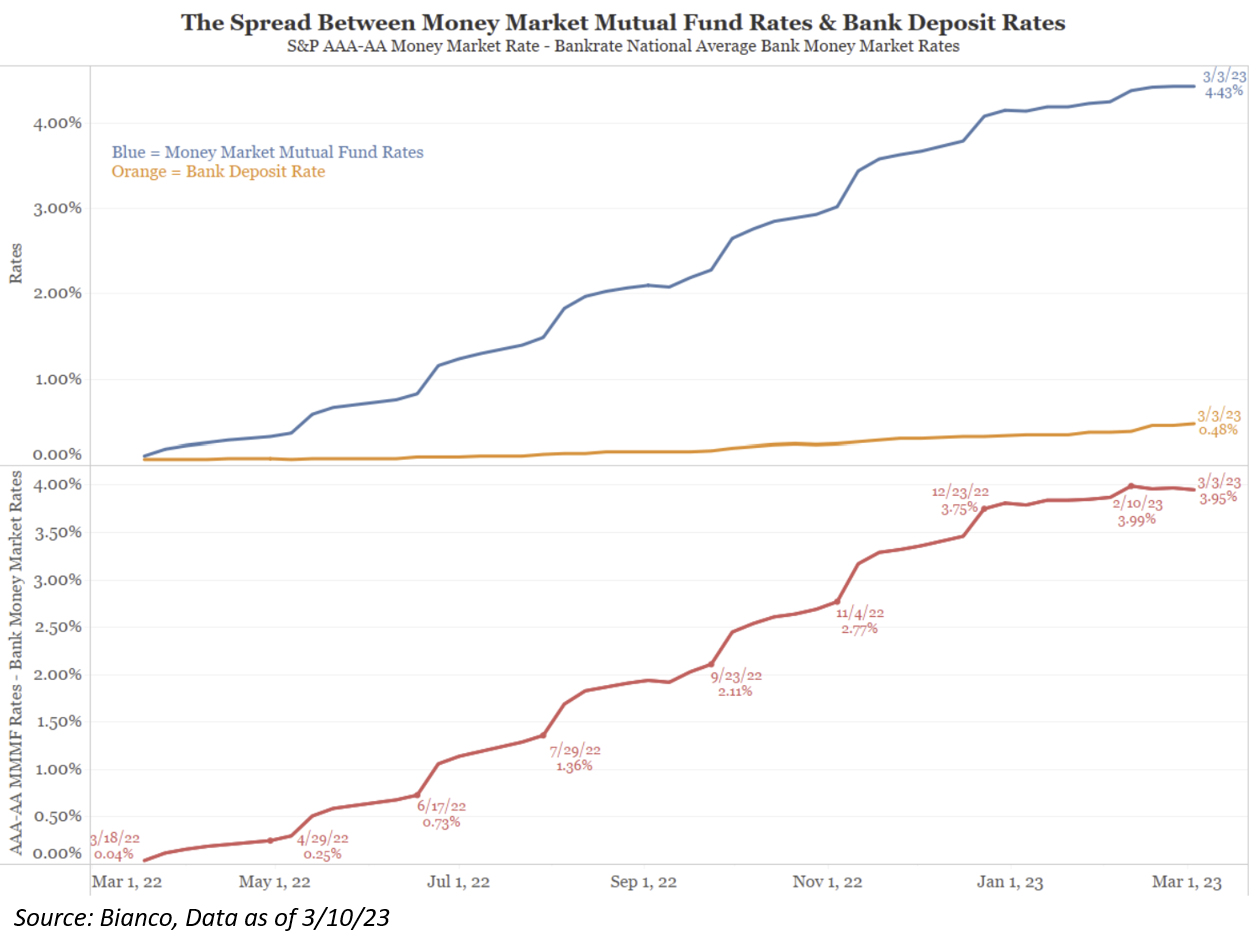

Looking at the data, the average yield on a money market funds (blue) reached as high as 4.43% recently, while bank deposit rates (orange) remained at just 0.48%. The gap between deposit rates and money rates was almost 4% (red).

We believe there are two reasons banks have been slow to raise deposit rates: 1) Fourteen years of QE (2008 to 2022) left them massively over-reserved. They did not need to compete for deposits – clients leaving it in their checking account was the path of least resistance. This is truer for large banks than small and regional banks. 2) The outflows from low-yielding deposits to higher-yielding alternatives were slow. But in recent months, if not recent weeks, these flows have accelerated.

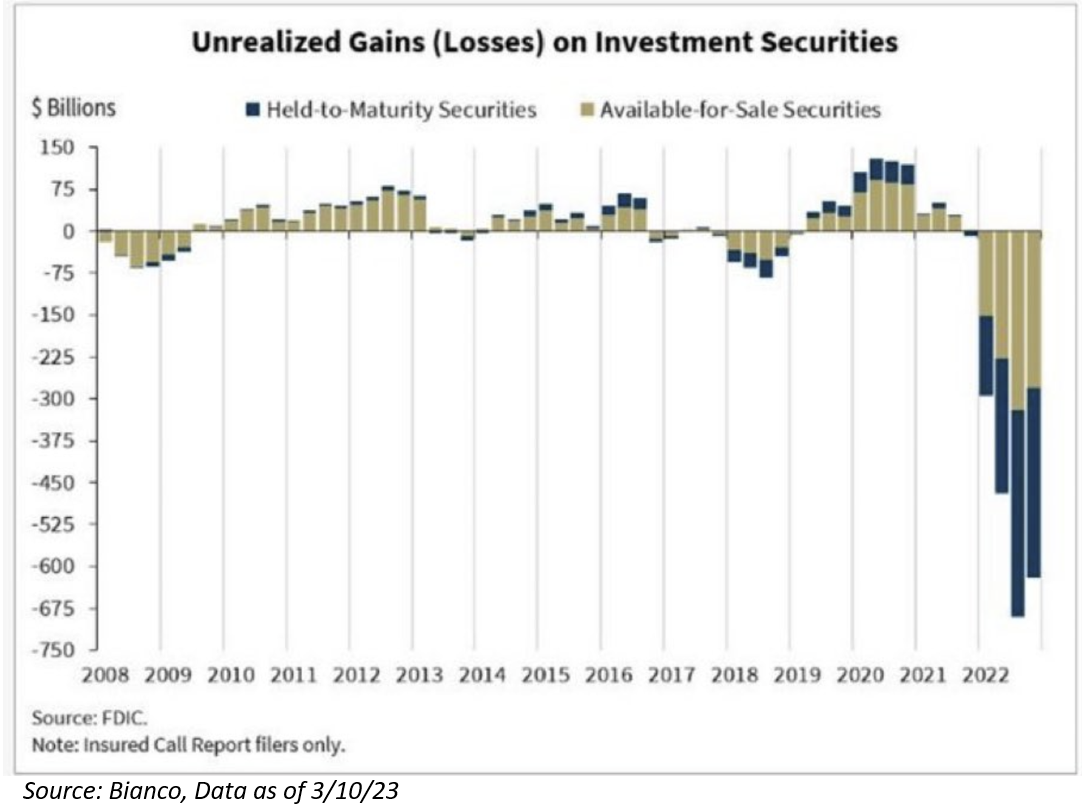

What does a bank do to meet these outflows? They can sell securities. Unfortunately, given the rise in rates last year and that banks tend to asset/liability match with fixed income, their investments have recently witnessed large losses (just think of the 60/40 portfolio performance last year). The below chart was highlighted by FDIC chairman last week:

The first crack in the market’s financial system was SVB Financial (SIVB) over the last two days. The bank had to reclassify some of its securities, given deposit outflows, which realized losses and had negatively affected its capital levels. In the case of SIVB, it was so bad that they had to raise equity (we’ll see if they are able to – it appears that GS may be backing out of the IB – this info will be very dated by the time you read this). I would state that the problems at Silvergate (SI) and SIVB appear to be more the result of their target client base than any broader issue impacting larger, more diversified banks. Silvergate provided banking services to crypto exchanges and most of SVB’s clients were venture capital focused tech companies, the kind that burn through cash in hopes of finding treasure.

Silicon Valley Bank had to fire sale bond holdings, and in doing so it realized a substantial amount of losses because it had to sell its bond holdings at market value, which was far below where the bonds were purchased. Normally for banks, it doesn’t really matter what the mark-to-market value of most bond holdings are because they don’t have to sell them, and the bonds will likely redeem at par. However, in a stressed scenario, those bond holdings would sell at a steep discount to par value, and that means that some banks may not be as capitalized as they think they are.

First Conclusion:

Silvergate and SIVB are somewhat unique cases, but that doesn’t mean the entire sector isn’t facing other headwinds. I would surmise that banks are not facing a solvency problem. They could be facing a liquidity and profitability problem. The widespread worry here is that, given low deposit levels, there could be an effective run on the “low yielding” banking system. The simple fix is – raise deposits rates to attract capital at the expense of profitability. If banks don’t do this, in our opinion, the only other option is to sell securities and realize massive losses, which also effects profitability.

What Does it Mean for Clients?

What did the aftermath of the GFC teach us? The system will not fail. We now know what the Fed broke and it should be contained. While we view many of this week’s issues as company specific, it would be excessively optimistic to not recognize that these concerns could quite possibly weigh on investors’ minds more broadly for some time. Banks with multi-trillion-dollar assets would not have been down 5%+ yesterday on the fallout news at institutions that are a fraction of their size if these were not highly worthwhile concerns. It cannot be known for certain exactly how widespread such concerns will become practically. But we have added some newer questions to the mix, and it seems safe to say that it will remain a volatile time for bank stocks. Maybe even overall investor sentiment…

The big question is, how widespread is this situation? It goes without saying that we cannot know for certain how this plays out and the magnitude of the errors. This is why having a plan and a diversified portfolio is the first level of defense in our asset allocations.

JD’s monthly note, titled: It’s the Tails We Worry About, touches on this topic perfectly. Please click on the title to read it, or read a few of my favorite snips:

I think that JD wants to make the title of this note Aptus’ new slogan. And I can’t blame him – look at how we construct our portfolios. This phrase, “It’s the Tails That Matter”, that perfectly embodies what our allocations are trying to accomplish…. minimize the volatility tax. And the environment that we have witnessed over the last few days is a perfect example of this – how can you protect capital in an environment in which you don’t know what will happen? Very, very few prognosticated the downfall of SIVB and the potential effects that it would have on the financial market. No one knows exactly what the next event will be, but what (we believe) we do know is how to proactively and cost efficiently minimize the effect of that event, i.e., minimize the volatility tax – this allows us to build portfolios that are better in the tails.

As y’all know, please reach out if you have any questions on our funds, allocations, or just want to chat.

We are here for you.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2303-16.