Multiple clients have asked for thoughts regarding President Joe Biden’s exit from the upcoming election, and its effect on the markets (I hear that “investor” listed at the top is pretty cool). As many of you know, these musings are like a piano bar – requests are welcomed.

As always, when it comes to politics, I don’t think anyone should or would care what I think about anything – except perhaps issues that will affect the economy and the financial markets. This piece is not meant to offend or alienate anyone. But, I did watch the movie Dave over the weekend – all I can say is that I kept the popcorn close to me.

President Biden Bows Out of the Race

As of Sunday, Americans were only 106 days away from the election, and the nation was jolted with its 4th black swan event for the ’24 election, and to be honest, there will likely be another one before November 5th.

- Black Swan Event #1: The Republican presidential nominee was convicted of felonious crimes.

- Black Swan Event #2: The Democratic candidate showed severe signs of aging that raised questions of his ability to campaign and even govern.

- Black Swan Event #3: An assassination attempt.

Fourth Black Swan Event #4: Americans learned this past weekend that power is never relinquished, it must be taken – and without full support from President Obama, it somewhat felt like current President Joe Biden was pushed out of the race. For many, it felt like it was only a matter of time for President Biden to exit the race, as he had lost support from key Senators in swing states – likely making a Democratic victory very difficult.

To be frank, this felt quite unprecedented given the fact that President Biden did not address the nation and basically only left a note (apparently there is a press conference on Wednesday). But, he did endorse Vice President Kamala Harris, which he likely had to, given that if he didn’t, it would have come off as if she wasn’t fit to be Vice President in the first place. Because, in a nutshell, the Vice President should basically be groomed as the next person to take office if something were to happen.

And with this, Vice President Kamala Harris has quickly emerged as the clear frontrunner for the Democratic nomination, with a number of potential rivals quickly endorsing her – cue Bill and Hillary Clinton, the majority of the House and Senate Democrats, and, importantly, CA. Gov. Newsom. She raised $81 million within 24 hours, putting to rest concerns about whether Democrats will have the resources to compete. While it’s true Harris is unpopular and we think she is an underdog to Trump, she has the opportunity to reintroduce herself to the American people and she could look a lot more politically formidable in a month than she has in the past four years.

There are likely two thoughts when it comes to a Harris candidacy: 1) She will run a more active and engaged campaign than Biden was running and will likely have better poll numbers against Trump, but 2) She has not proven to be an effective campaigner or manager. We will need to see a complete restructuring of her image before getting to a place where she can win the Electoral College.

History tells an unfortunate tale of VPs running for the presidency when their boss is ending his term. George H W Bush was the first sitting VP to win since Van Buren in 1836 — both following a popular president. Therein lies the tale. Sitting VPs lose because they are not viewed as strong enough candidates to win the nomination or, if they do win, they become a vote on the prior president in the general election, a president whom the public has tired of (Nixon ’60, Humphrey ’68). VPs who did win, Nixon and Biden, were four to eight years removed from office. Other VPs became president because the sitting president died and then won – Roosevelt, Coolidge, Truman, and LBJ.

That point brings me to the biggest weakness to VP Harris (in my opinion) is that she will have to defend Biden’s record – something that she cannot do a lot about. Not only that, she’ll have to answer questions about what she knew regarding Biden’s condition – and if I was a campaign manager, that’s exactly what I would target.

What Happens Next?

Per Raymond James, “…as for mechanics of what happens next, the delegates to the convention decide who the nominee will be. Biden’s delegates (he won 99% of the pledged delegates) become free agents at the convention. They can vote for whoever they want. As Biden delegates, though, they could be expected to give weight to who Biden endorses and have affection for Harris, too. About 14% of the delegates to the Democratic convention are superdelegates (party leaders) and they can support whoever they want, though whether they have a vote on the first ballot will depend on a ruling by DNC officials.”

Yesterday, it does appear that VP Harris obtained the needed delegates to win the Democratic nomination and it will likely get moved forward via a virtual nomination before the important August 7th deadline (to be included on states like OH’s election ballot).

Some of the biggest questions moving forward:

- Will Democrats unite behind a candidate or will an anti-Harris faction cause further uncertainty for the nomination?

- Does the ability to inherit the campaign funds and infrastructure force Democrats to accept a Harris nomination?

- If it is Harris, does she select a swing state governor such as Shapiro (D-PA), Cooper (D-NC), or Whitmer (D-MI) to shore-up a key state?

- Would a combination of two swing-state governors Whitmer and Shapiro give a bigger boost?

- Will President Biden step down before his term ends to give a boost to VP Harris?

The good thing for VP Harris is that her approval ratings aren’t as locked in as Biden or Trump’s. How she handles herself on the stump, in interviews, and in a potential debate will be the key to whether she can convince voters she is up to the job and will govern as a mainstream Democrat.

The Market’s Reaction

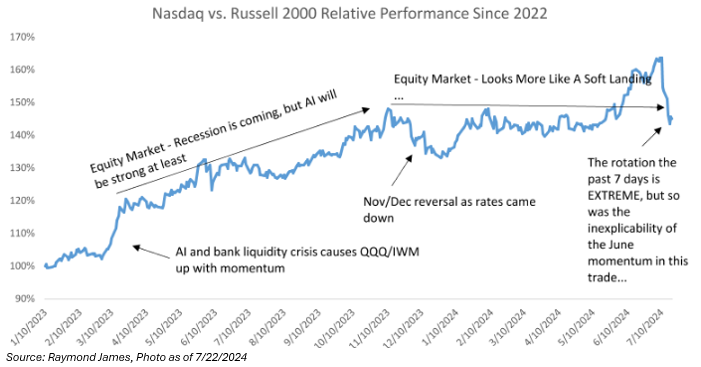

What Has Happened: Since the recent June CPI report and the June Presidential debate, small caps and the average stock have had an extreme run. More importantly, technology stocks (or tech-proxies) have been the funding mechanism. The rationale is three-fold:

- Investors have been expecting the Trump 1.0 investment playbook to mimic the Trump 2.0 playbook – given that he is currently projected to win. The expectation of corporate tax cuts and de-regulation of banks drove the small cap performance in late 2016 – we’ll see if that continues.

- The flint to the fire that also started the small cap rally was the expectation of more rate cuts. Small Caps have a large amount of their debt in floating debentures and a maturity wall much closer in expiration that large caps.

- There has been a pretty substantial unwind in hedge fund positioning. One of the most basic macro trades is: 1) If you believe the market is accelerating, investors should go “long small” / “short large”, 2) If the economy is slowing, investors should go “long large” / “short small”. And given the recent performance of large caps > small caps, the trade saw a large swap in positioning.

Hit me personally for a CNBC link of me talking about Small Caps the other night (we don’t own the rights to the video so I can only send it 1:1).

The Markets Moving Forward: The recent rally in the “Trump trade” and overwhelming view that Trump will win could see some reversal in this scenario or at least a stalling out of momentum. Should a Democratic ticket emerge that appears to tilt the race towards a Democratic win and/or sweep, we would likely see a market reaction – especially given the potential policy implications in 2025, with the December 2025 expiration of the Trump-era tax cuts for individuals more likely to expire. However, we would note that the policies of a potential Harris administration would largely align with those of President Biden.

What’s the Playbook?

If anyone has heard me speak over the past few months, I’ve mention the following fact:

The S&P 500 has increased in the past 13 presidential re-election years. In fact, the last time the S&P 500 fell in a presidential re-election year was 1940. And since 1940, there have been three years where the market fell during the election year – 1960, 2000, and 2008. The commonality of these three years is that there was an open election – JFK, Bush, and Obama. Furthermore, when the incumbent has been on the ticket, the average return of the S&P 500 during re-election years is 16%!

We no longer have an incumbent running for re-election. But that doesn’t necessarily mean that one should throw the playbook out the window. Yes; the incumbent is no longer on the ticket. BUT, the forces that drive the market in re-election years are still very much present. Presidents like to “prime” the economy into an election year to minimize an election fallout. Presidents know that if there is a recession in the third or fourth year of an election cycle, the incumbent is not re-elected. Given the fiscal stimulus and liquidity injected into the economy, stocks have historically responded favorably during re-election years, and 2024 has been no different.

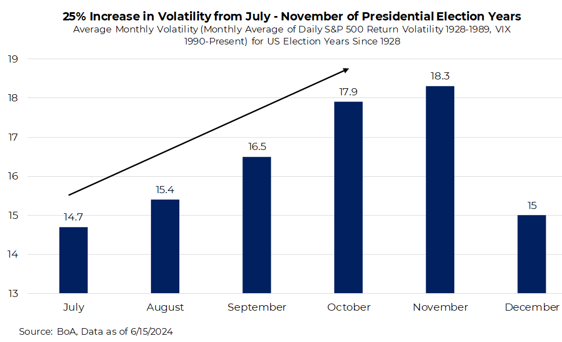

Plus, it’s well known that market volatility tends to show its face ~August in election years. Remember, volatility and market pull backs are natural and healthy…

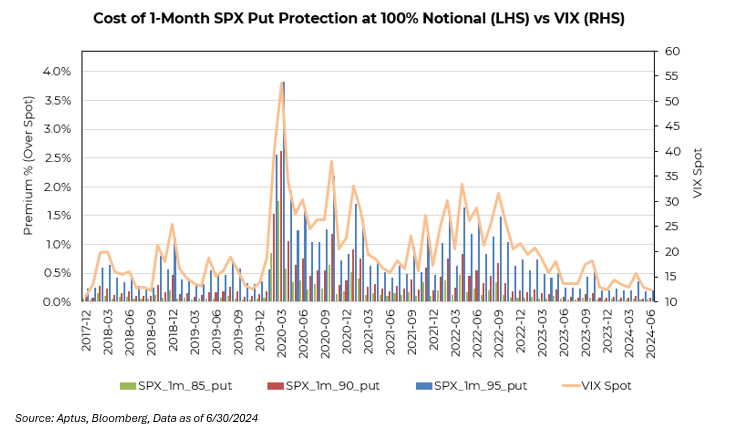

Luckily, volatility is VERY cheap right now to protect portfolios.

Simply said, it’s OK to toss the playbook out, but that doesn’t mean that the market is going to the proverbial “hell in a handbasket”. This is why we utilize volatility as an asset class to provide guard rails, at the allocation level, to protect the allocation in case there is another “Black Swan” event.

Please reach out if you have any questions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2407-30.