Quick CPI Inflation Thoughts: Simply put, the last mile of bringing inflation back down to the Fed’s long-term target will be difficult – most likely due to the continued strength in the job market, i.e., Friday’s NFP is a prime example. I think J. Powell will take the stance of: “Where is the recent progress of inflation coming down to a point where we are comfortable with a policy shift?”. Reach out if you’d like to talk more about this.

Right now, the most common questions that I’m receiving from partners are:

- If the Magnificent Seven Falters, due to their valuation, will the market crash?

- Why Don’t We Own More Bonds in this Environment – All of our Clients Want More Bonds, Why Not? What are the Risks to this Thinking?

These are very important questions, both of which can have lengthy responses, so let me focus on the first one, and if I get enough positive feedback, I’ll write a musing on the latter.

Can the S&P 500 Win if the Magnificent 7 (Mag 7) Loses?

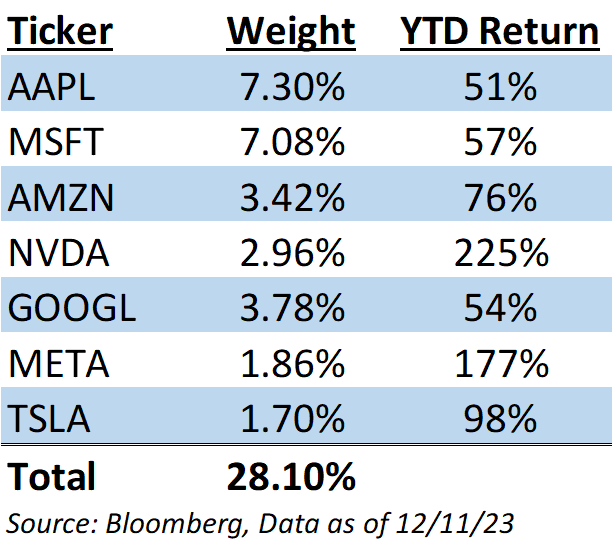

First, let’s set the stage. It feels like everyone I speak to believes that there is a tremendous risk in the market capitalization indices, given the concentration in the largest stocks. Almost 30% of the S&P 500’s weighting is comprised of the top 7 stocks. Then, investors couple this with their performance year-to-date, making them heed to the wisdom of Isaac Newton: “What goes up, must come down”.

Basically, many investors are very happy with YTD returns but are highly skeptical that they can hold.

For reference, the Mag 7 has driven 70% of the S&P 500’s year-to-date return.

Now, let’s play Devil’s Advocate with this argument of skepticism. If the Mag 7 —which accounts for almost 1/3 of the S&P 500— can drive YTD returns of 20%+, while the average stock basically endured a technical recession (a peak-to-trough drop of 20% or greater), then why can’t the remaining 493 stocks insulate the market cap weighted index if the Mag 7 performance mean reverts?

Let’s Look at this dilemma in two different parts + a conclusion: where we’ve been, and where we are going.

Where We’ve Been

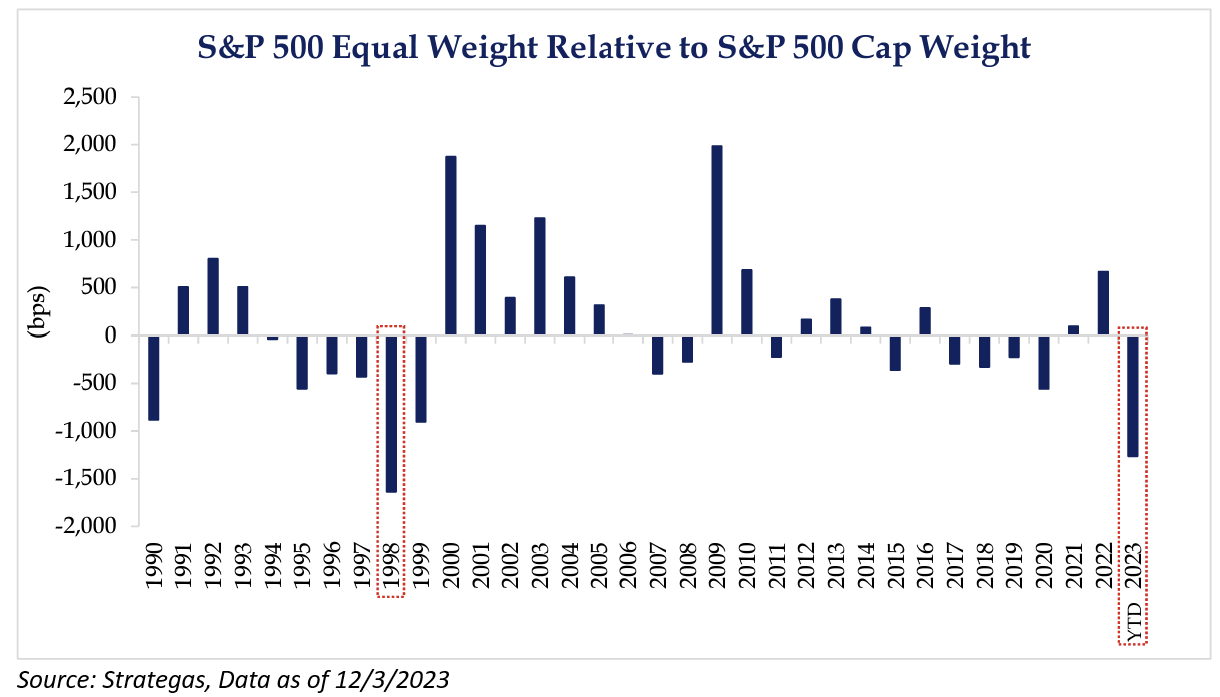

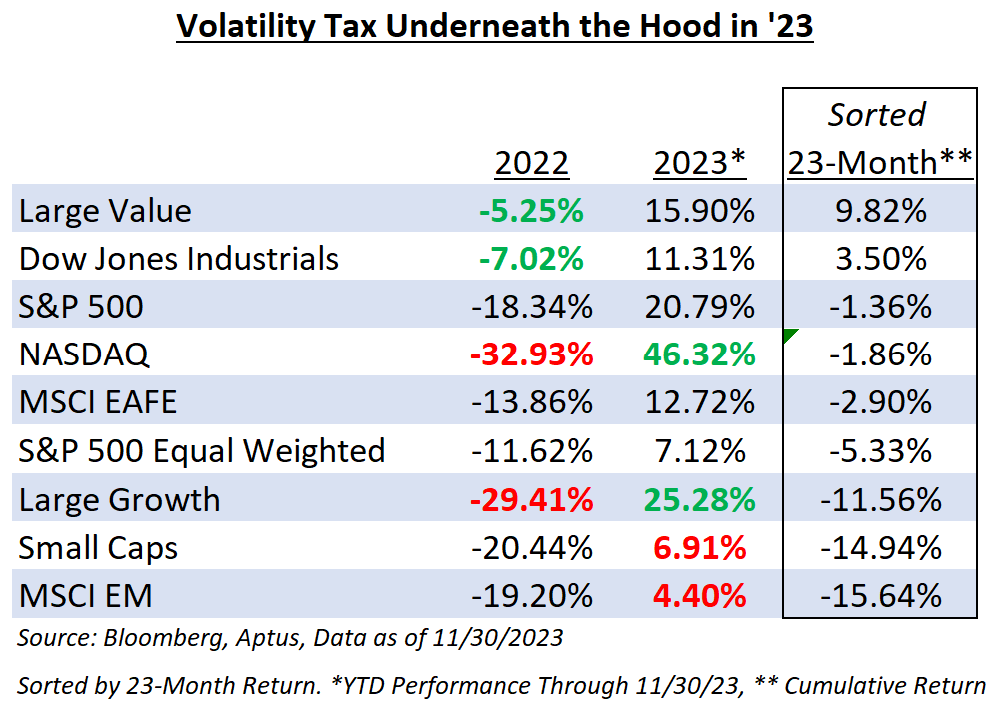

Let’s take a step back and look at what has happened this year. We’ve covered the narrow market leadership that’s been observed in our work extensively throughout the year but thought it may be important to provide context for just how tough it has been for the average stock. Using the S&P 500 equal weight index (ticker: RSP) as a proxy for the average stock, this has been the worst relative performance year to the cap weighted index since 1998. It should be noted that the equal weight index underperformed handily again after this in 1999 but then went on to outperform the cap weighted index for almost the entirety of the 2000s.

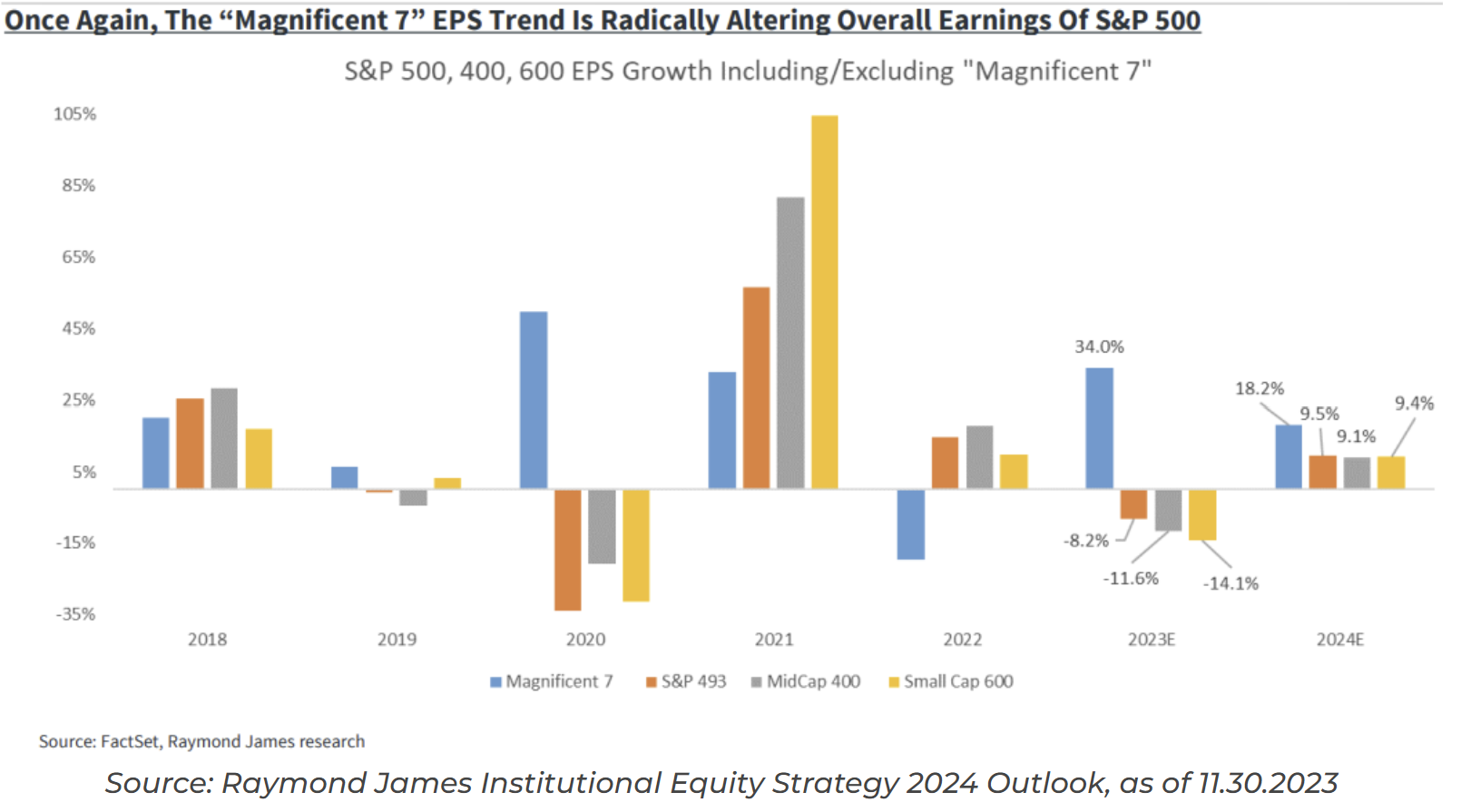

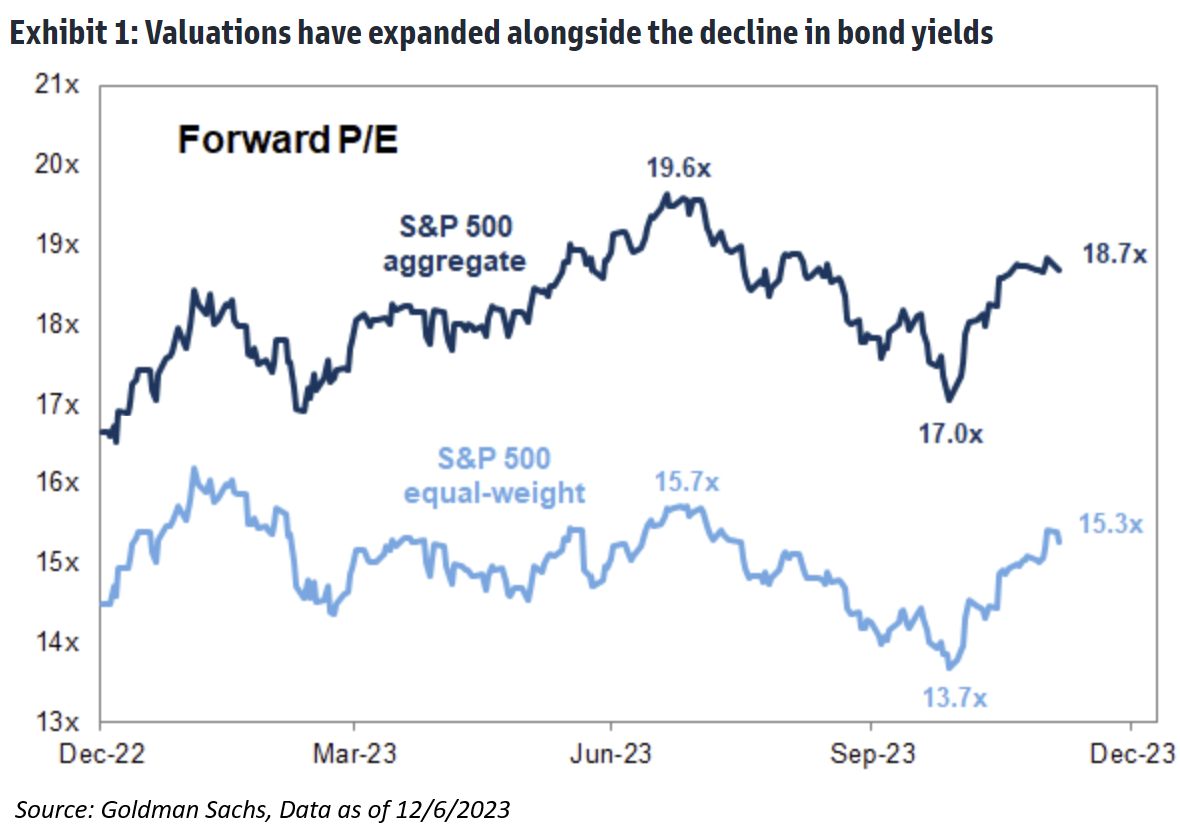

This performance discrepancy was born out of the earnings stability and growth from these mega-cap companies. The market’s return has been driven in part by soaring valuation multiples in the largest names – but is it justified? That is a matter of opinion, but the earnings story seems to say “yes.” As seen below, negative 2023 year-over-year earnings for all stocks outside of the Magnificent 7 reflect the dour economic picture that so many predicted this time last year. It was those seven names, aided by strong demand, cost-cutting measures, and no small part from the renaissance in artificial intelligence (“AI”), that carried the brunt of the earnings load.

We know that one of the market’s best factor indicators of presaging long-term performance is earnings growth, and the Mag 7 has consistently given it to investors.

But none of this is groundbreaking news.

Where We Are Going – The Devil’s Advocate Perspective

Now, let’s look forward and develop on my musing around the “remaining 493” potentially insulating the market if the Mag 7 were to witness some negative volatility. I do believe that the breadth of market leadership will expand and that the market can rally without the Mag 7 leading the way.

Now, everyone who reads these Musings knows that we think about total return in terms of Yield + Growth +/- Valuation. If the Mag 7 stocks flatline over the next 12 months, and if the multiples on forward earnings for the rest of the market flatlines, at about 15x on average, forecasted EPS growth will be the return of the market. If this were to occur, the average stock would remain below its post-COVID highs.

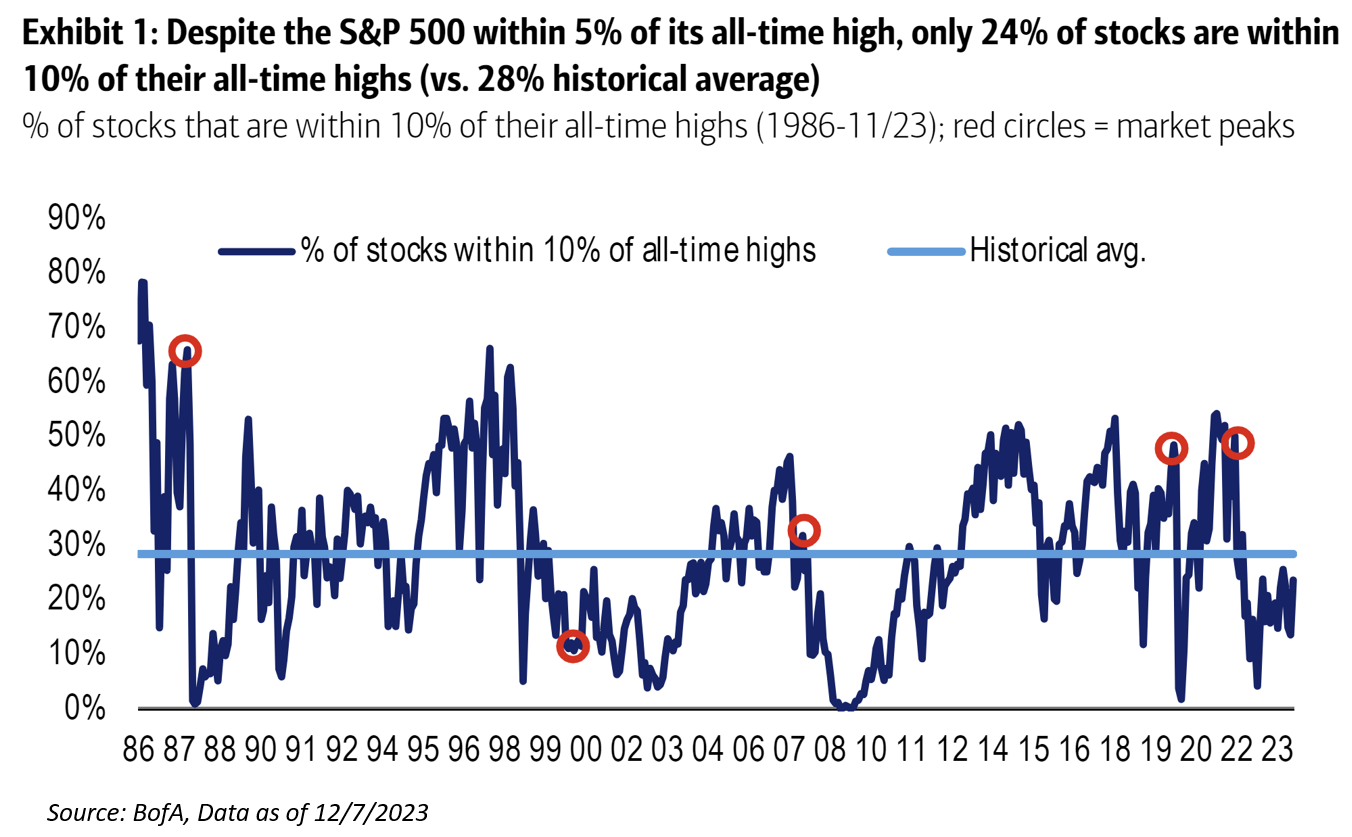

This tells me that concerns about narrow breadth this year could be misplaced, given that, except for the Tech Bubble, bull markets since the 1980s ended with far better breadth than today’s market. Only 24% of stocks in the S&P 500 trade within 10% of their all-time highs (vs. 28% historical average), much lower vs. prior bull market peaks. Stated another way, bull markets tend to end with much better participation.

Let me say that line again: Despite the S&P 500 being within 5% of its all-time high, only 24% of stocks are within 10% of their all-time high. This tells me that if we get a Goldilocks scenario, the average stock has a runway of future returns that could buoy the S&P 500, without any help from the mega-caps.

Remember that this is a market of stocks, not a stock market, and the majority of stocks remain quite cheap:

Conclusion

As I’ve told many of you before, I would not short the Mag 7 under the threat of violence. The importance of owning straight beta, i.e., not taking substantial tilts, reduces the equity volatility tax underneath the hood. This is where investors need to be focusing. Yes, I understand that many investors are worried that the top 7 stocks, which comprise 30% of the S&P 500, appear to be overvalued. But do not discount that there is still 70% of the S&P 500 Index that trades at reasonable or cheap valuations (in my opinion). And financial textbooks taught many of us that cheap stocks tend to do better on the downside, which could help support the index during a bout of volatility. This comment sparks up an old analogy that I used to state: If you are skiing down a double-black diamond trail on a mountain and were to fall down, I’d rather fall if I were 4ft tall instead of 6ft. This is true in investing — the smaller valuations should fall less.

Our brains are trained to focus on the worrisome aspects of the market and the valuation of the 30% does grab your attention, but it shouldn’t solely drive an investment thesis on Large Caps. Don’t forget about the 70%! In large-cap land, you can own an index that is comprised of 30% in stocks that have generational technology that can change the world through productivity and 70% that appear quite undervalued. When framed in this context, give me all the growth (stocks) that you can (obviously with guardrails).

While picking investment styles can be fun, the more value-additive factor at the asset allocation level is minimizing the equity volatility tax that can drive ill-timed and uninformed financial decisions. The past 23+ months have been a prime example of this behavior. Not many investors wanted to own Value in ‘22 and not many wanted to own Growth in ‘23. Investing is hard – when in doubt, just be the market.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2312-14.