The world lost a great icon the other day; Jimmy Buffett. And in honor of the man, the myth, and the legend himself, this Musing is dedicated to him. For those that don’t know, his loyal followers were called the Parrot Heads – a term coined in 1985 in Cincinnati, OH, my hometown. To make the connection even more apparent, Jimmy was born in Mississippi, but spent most of his childhood in Fairhope, AL, Aptus HQ.

In today’s musing, we’re not going to talk about our normal market commentary, but one that is a bit more nuanced: When Does that Market Actually Derive its Returns? What many investors do not know is that much of the returns from the S&P 500 occur outside of market hours, i.e., over the weekend and/or in-between market close and market open on the weekdays.

In honor of Jimmy B, this Musing is entitled Come Monday, his first ever hit in 1974, because Come Monday, investors have already received their returns. So, sit back and literally make money while you’re sleeping or relaxing on a hammock while drinking a margarita / eating a cheeseburger in paradise.

Come Monday

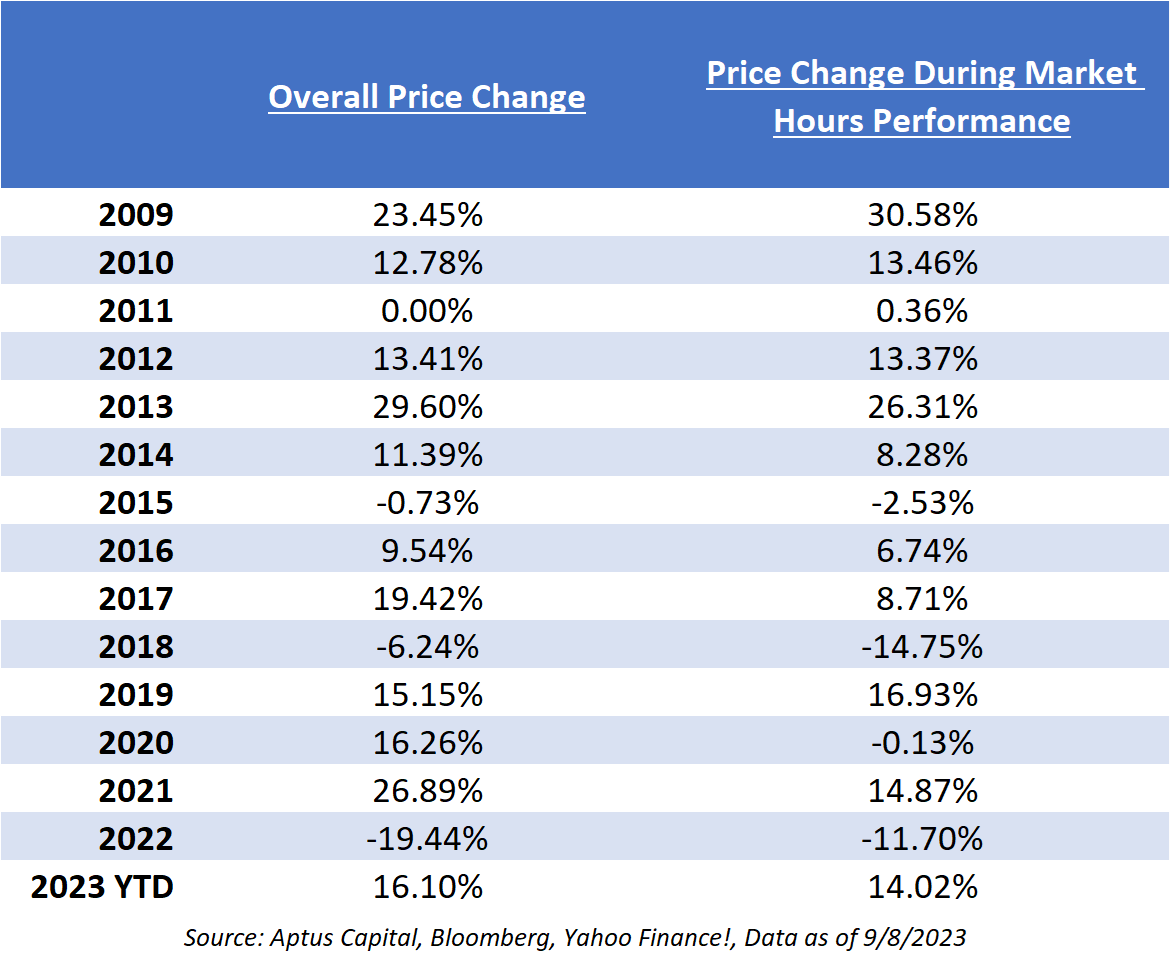

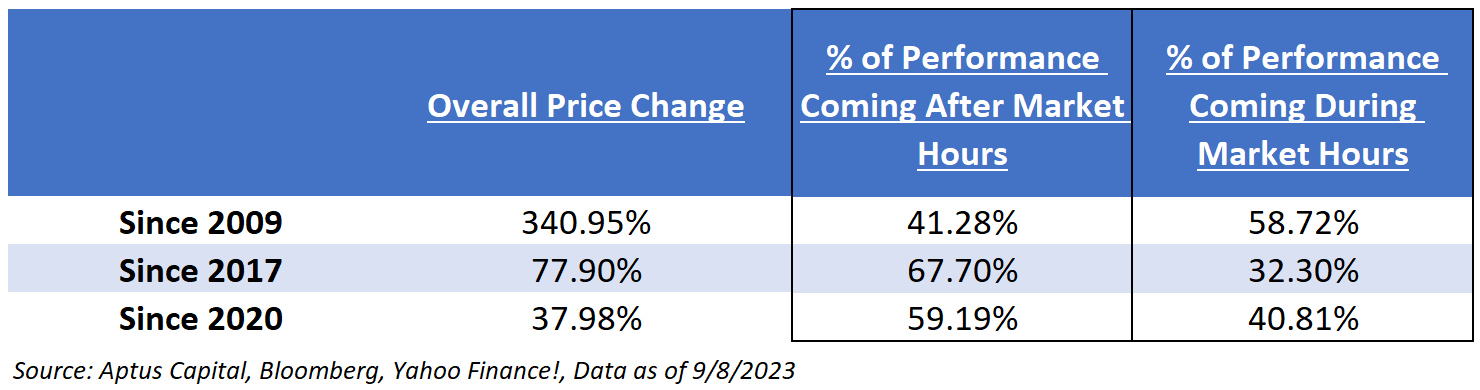

We’ve talked about a phenomenon that a good chunk of the stock market’s returns has come after the market is closed. For example, if the market closes on a Friday at $100 and opens the following Monday at $102, then there was a 2% gain that occurred outside of the normal market hours. Below are the returns, by year, of “intraday return” versus “non-conventional hour returns”:

If you look at it by year, the data isn’t that clear, but if you break it down over a longer period, the results are much more impactful.

Most of the gains over the past few years look to have come when the market was closed but going back to 2009, the data shows the majority of gains have come during market hours.

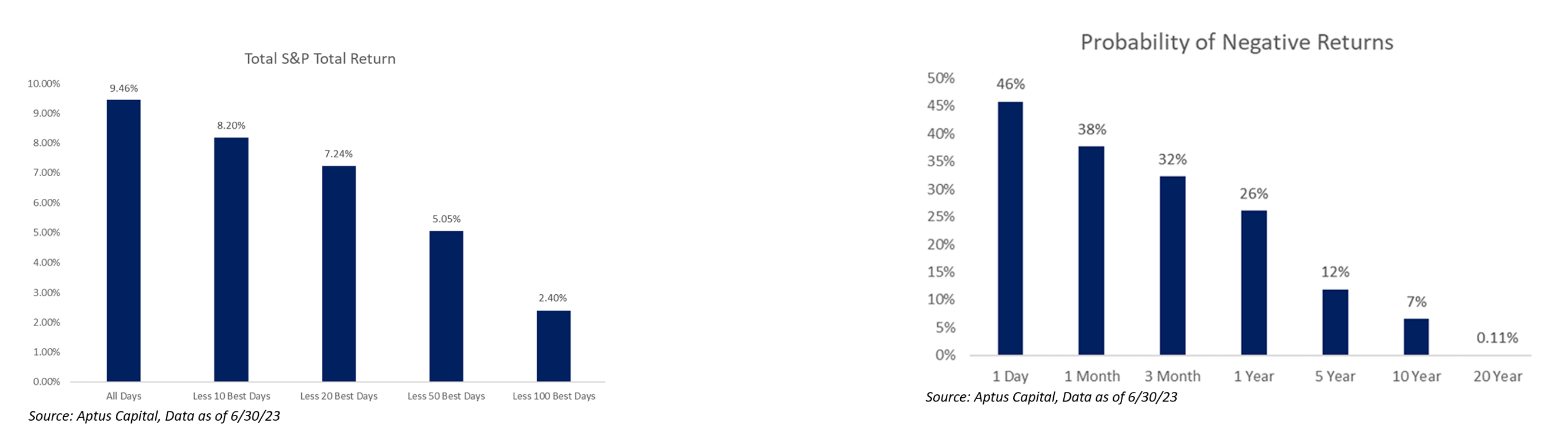

The biggest question one should be asking themselves is – does this even matter? Not if you’re a LT investor. If you are a short-term “trader”, it may matter. If you’re trying to buy every single dip and sell every single rip and time the intraday tops and bottoms, sure, this could have an impact on your bottom line. This basically tells me that the market has a hard time making up its mind in the very short-term. It had no memory from day-to-day and can reprice itself literally while you’re sleeping. But for normal, long-term investors it doesn’t really matter all that much. The day-to-day, week-to-week or even month-to-month movements in the stock market shouldn’t have that much of an impact on your results if you have a time horizon measured in years or decades.

Moral of the Story: Stay invested over long periods of time and you may make money while you’re sleeping → WORK SMARTER, NOT HARDER

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2309-17.