Risk is the game of world conquest, and Vladimir Putin is currently Player 1, as Russia has been on an epic struggle for Ukraine domination ever since they voted overwhelmingly for independence in 1991 (from the Soviet Union). Yet, investors and NATO should have taken note from Cosmo Kramer, circa 30 years ago, when he stated that Ukraine was a “sitting duck”. But if President Biden is correct, that an attack is imminent, we better hope that “Ukraine is {not} weak” and “Ukraine is {not} feeble”.

Nonetheless, the market has taken note of this geopolitical volatility, as it can have ramifications regarding NATO and the current oil/gas supply issue around Europe, i.e., impact global growth.

The Russia/Ukraine Situation

A lot of investors find it hard to imagine Vladimir Putin will launch a full-scale invasion of Ukraine because it is hard to see how that is in his interest. Most national security experts were skeptical a few months ago of an invasion for the same reason and only came to the conclusion it was likely as the buildup continued, Putin rejected diplomatic off-ramps, and Western intelligence pointed in that direction.

Why is this an issue?

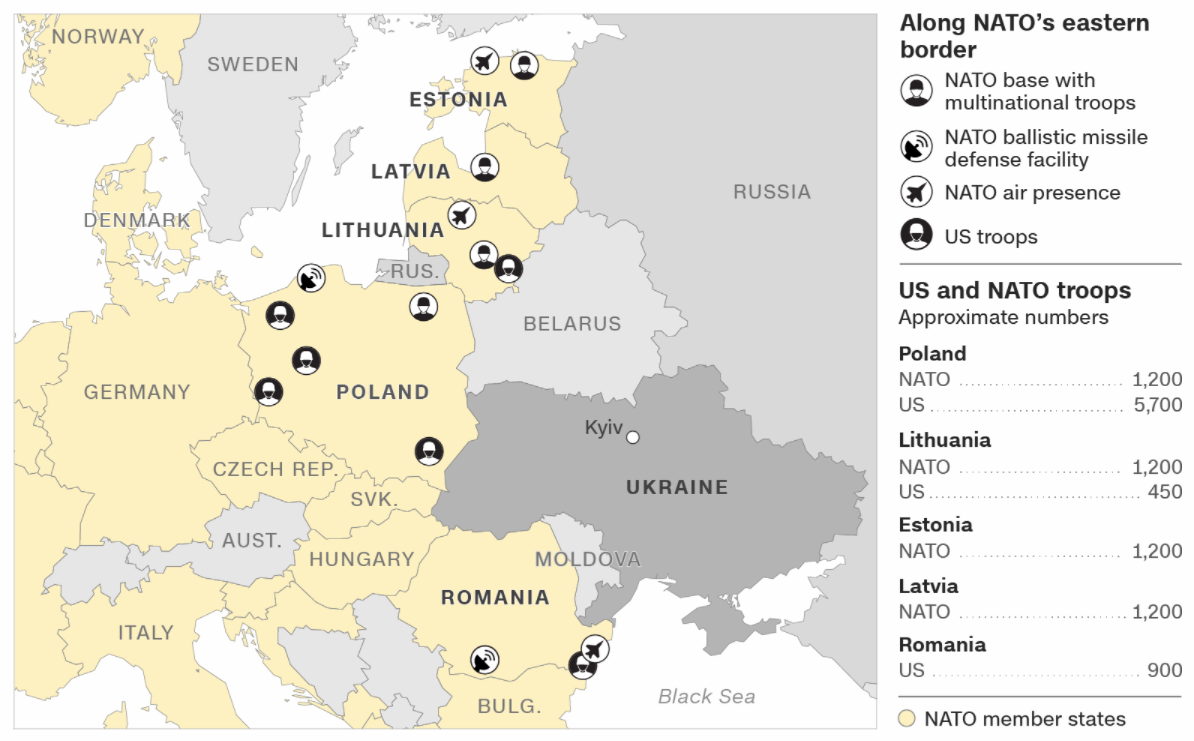

Ukraine was a cornerstone of the Soviet Union until it voted overwhelmingly for independence in 1991, a milestone that turned out to be a death knell for the failing superpower. After the collapse of the Soviet Union, NATO pushed eastward, bringing into the fold most of the Eastern European nations that had been in the Communist orbit. In 2004, NATO added the former Soviet Baltic republics Estonia, Latvia and Lithuania. Four years later, it declared its intention to offer membership to Ukraine some day in the distant future — crossing a red line for Russia. Putin has indicated he sees NATO’s expansion as an existential threat, and the prospect of Ukraine joining the Western military alliance a “hostile act.” Putin believes that Ukraine is part of Russia – culturally, linguistically and politically.

So where do we stand?

So where do we stand?

The outlook has turned more ominous during the past few days. There’s violence in the Donbas region – NATO officials say more Russian troops have moved closer to Ukraine in recent days, and Russian officials appear to be lying about reducing troop levels. In addition, Russia has erected field hospitals and brought in supplies of blood, kicked a senior US diplomat out of the country, and is likely the source of another cyber-attack against Ukraine.

What are my thoughts?

I believe that Putin is taking calculated risks and he’s getting everything that he wants right now. Russia is getting attention from the international community, as a parade of world leaders have come to Russia – strengthening his position in Russia as a powerful defender of Russia’s interests.

Furthermore, it appears that Ukraine won’t be joining NATO for the foreseeable future. Plus, oil and gas prices are higher – Russia’s top export – and Ukraine’s economy has been hampered. Perhaps, this is Russia’s version of a “maximum pressure” campaign, which helps its own economy and hurts Ukraine’s economy.

Bottom line, it’s hard to see how an invasion of Ukraine is a good risk/reward for Russia. It appears that Putin has already had maximum benefit, per given amount of risk, by just playing this game of cat and mouse. If Russia does invade Ukraine, the West could impose punishing economic sanctions on Russia that will harm ordinary citizens and the wealthy oligarchs aligned with Putin.

Starting the largest land war in Europe since WWII would make Russia a pariah state, and countries in Europe might adopt far-reaching policy changes to reduce their dependence on Russian energy – a long game that Russia doesn’t want to play (or lose).

What Does This Mean for Markets?

The market continued its decline in the latter half of last week – specifically after President Biden said that an attack was “imminent” – the S&P 500 briefly touched the lows from late January. Why? Well, the scapegoat was because Russia accused Ukraine of shelling Russian rebels in the Ukraine territory of Donetsk and Luhansk. Those regions are disputed territories, where Russian rebels want to break away from Ukraine, while Ukraine wants to keep these regions.

Like in 2014, with Crimea, a Russian invasion of Donbas would result in significant international sanctions against Russia. And those sanctions would put an incremental headwind on U.S. and global growth via potentially higher energy costs and other restrictions. Most importantly, those sanctions should not materially derail the global economic recovery, assuming no further invasion of Ukraine – which isn’t expected.

Bottom line, a limited invasion in Donbas would be a temporary headwind on some of the risker assets in the market, but I don’t believe it would be a bearish game changer in the market as a whole – much like the market’s reaction in 2014. It only becomes a major risk, in my opinion, if this spiraled into a broader conflict between Russia and NATO – which, again, is unlikely at this current juncture.

Disclosures

The opinions expressed are those of Aptus’s Investment Team. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Forward looking statements cannot be guaranteed.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2202-32.