Alright, let’s hit a polarizing topic because I’ve been asked this question numerous times over the last week or so – the currency debate. It’s no secret that the dominance of the U.S. dollar has been challenged for years decades. In fact, I saw a clipping from 1975 stating that OPEC was cutting links w/ the U.S. Dollar. But it’s also no secret that the landscape continues to change and that’s why I want to focus more attention on a binary question: Will the US lose its reserve currency status? Personally, I’m in the “No” Camp.

Again, these are my opinions – who knows If I’m right or wrong. FYI: John Luke has been working on a strong piece regarding Gold so keep your eyes peeled, as Gold tends to be the next topic of conversation.

The Currency Debate

After the recent mini-banking shock in the U.S. and subsequent liquidity provisions, the dollar’s global reserve currency status has become a hot topic (again – the dominance of the U.S. Dollar has been challenged for decades). Additionally, the moves by some emerging market countries, including China, to settle trade flows in local currency and avoid the need for dollars has added fuel to the fire.

My simple opinion is that the U.S. Dollar (“USD”) will not lose its reserve currency status in the near future. Even if the Chinese government can increase the penetration of the CNY, it would be a complement to other currencies like the USD, and not a substitute. Let’s just look at the overarching details:

- The USD is still used in most transactions worldwide, accounting for ~60% of international banking claims and liabilities.

- The USD is bought or sold in ~88% of global currency transactions.

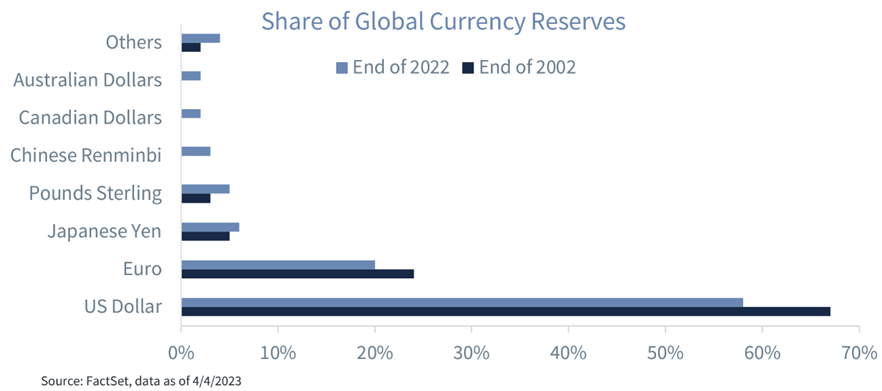

- Nearly 60% of globally disclosed foreign exchange reserves are held in USD.

While these numbers have changed over the last two decades, the dominance of the USD has remained relatively stable, and it will take a long time for this to change, if it ever does. Central banks, reserve managers, oligarchs, and the wealthy aren’t likely to sell their USD assets for the Chinese Yuan (“CNY”).

Obviously, we have no idea what the future holds for markets and investors, so instead of arguing why the U.S. won’t lose its status, I’d prefer to take the angle of why the CNY is not one of the most important reserve currencies, despite China being the second largest economy in the world. Hopefully this will help investors understand why the supremacy of the USD is not at stake today. Lastly, I would say that even if the USD loses its principal role as a premier currency, that doesn’t mean that it cannot remain as an important reserve currency as the yen, the euro, and the pound sterling.

Let’s walk through the reasons why:

Lacking Transactional Volume

I do not believe that the increased transactional use of the CNY is a negative for the USD. The fact of the matter is that the participation of the Chinese currency in international transactions and as a reserve currency should be much larger than it is today. The question should be, why is it that the Chinese currency’s representation in international transactions and as a reserve currency is so low? China is the second largest economy in the world, yet has a significant underrepresentation in the currency transaction markets.

The USD (59%) and the Euro (20%) are the two preferred currencies in the world in terms of central bank reserves – the Chinese Renminbi (RMB) only represents 3% of central bank reserves in the world.

Lack of Transaction Opportunity Across Borders

The most important reason that the CNY is not a highly traded currency across global economies is because the country’s capital account is not open. The correct terminology is that the CNY is not “liberalized” or “non-convertible”. If you hold a non-convertible currency, that means that you cannot exchange it freely at the going exchange rate. Said another way, this basically means that if you hold CNY, you are not free to use your CNY to buy Chinese assets. A holder of the currency can purchase dinner in China, but not hard assets.

A Raymond James analyst had the best real-life example of this: In the early 1990s, a Japanese billionaire bought the land rights under the Empire State Building in NYC. This was a shock to both U.S. citizens and politicians. Individuals who hold USD have the opportunity to buy US assets because the US capital account is ‘liberalized,’ that is, there are no restrictions on acquiring US assets if you have enough US dollars to do so. That is, the dollar is fully convertible. However, that is not the case in China. The Chinese capital account is not fully ‘liberalized’ so if a foreigner holds CNY, they cannot go and buy Chinese assets freely.

The caveat here is that – even if China does not fully “liberalize” their currency, they could still increase transactional penetration in the international markets through trade links through swap lines, which is what they are currently doing, but that only increases usage marginally.

Communist China Does Not Love Transparency

The idea of fully “liberalizing” the CNY is probably not something that the Communist Chinese government would be comfortable with. Once you liberalize your capital account, you are at the mercy of international capital flows and market forces.

In a nutshell, this would mean that China would lose control of their economy. As an example, the current collapse of the Chinese housing market would have made more noise and would have represented a much larger crisis if the capital account had been completely liberalized. That is, China has been able to keep better control over the collapse of the housing market than the US and other European countries were able to do during the Great Financial Crisis. Secondly, the Chinese government determines the value of their currency – nobody actually knows what the value of the CNY is in the open market. Obviously, the USD is freely traded.

Conclusion

Even if the CNY was to become a reserve currency, and that is a big “if”, the two reserve currencies would be complements, not substitutes. Holding dollars may have disadvantages for China, as this creates mutual dependence with the US. But this peculiar relationship between the world’s two largest economies is the only way for China to make the CNY a significant reserve currency without embarking on full capital account liberalization. Basically, the reason why central banks and investors do not hold CNY is because they cannot easily purchase or sell them in international markets.

The biggest surprise to me is that, even with all of the surrounding noise of countries ditching the USD, is that the value of the USD has remained quite stable even when all of these debasement stories appear. If the experts that have been pontificating this theory were to be true, well then, the USD would be performing much worse.

In fact, the USD has appreciated over the past ten years, and only recently started to weaken, perhaps because of the differences in interest rates between different countries rather than because some countries are ditching the dollar.

Basically, I do not believe that a manipulated, non-liberalized CNY can compete with the USD. This is not because the US currency is perfect, but simply because, at least for now, the US dollar is still the top dog in a weak pack.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2304-16.