In case you missed it – JL put something out on CPI on Tuesday. If you want any commentary on the Fed/FOMC, just reach out and we can discuss today’s hawkish “skip”, which is basically just insurance on continued inflation.

AI Investment Talk

I’ve been getting a lot of questions on Artificial Intelligence lately – simply said, the best way to approach AI is not to try to pick the winners and avoid the losers, but to address it at the asset allocation level. Please reach out if you want to understand this more. Here is my summary if you need to “Copy & Paste” it for client responses:

Ultimately, there will be winners and there will be losers, but it’s a potentially large market so there will be wild swings in prices, crazy valuations, etc. Investors just need to remain market neutral on the individual exposures so they don’t get absolutely crushed if valuations come back to earth.

That’s why we believe investors need to attack this at the asset allocation level of owning more stocks and less bonds along with owning some volatility. Because if AI takes off, so will the sentiment in the market, yet, if it comes back to earth, you have guardrails in place to insulate the damage. In our opinion, making fewer bets over longer periods of time is the best way to compound capital efficiently.

I would be remiss if I didn’t mention that we have plenty of exposure to some of the bigger AI players in the space like GOOGL / MSFT / ADBE / AVGO in the funds but also in the Compounders portfolio. NVDA may be out of Compounders, but we caught a lot of its upside this year and its replacement also has its own AI story.

Overall, we prefer to own some of the larger players that have scale — the so-called “Magnificent Seven”, a.k.a., the largest names in the economy. These have a story that is impossible with which to argue; a new technology that promises to transform business controlled by companies that, by and large, hold tons of cash and are in no way capital constrained.

It is likely to take years to fully determine whether artificial intelligence is revolutionary or evolutionary, but in the absence of significantly higher long-term interest rates, it may not make much of a difference to the likes of Microsoft, Apple, Google, Amazon, and Facebook. They have the time and the capital to get the benefit of the doubt.

But again, our opinion is that the most important thing to do here is to own more stocks and less bonds at the allocation level because we can’t perfectly decipher who will be the winners and who will not.

Market Cycles

Usually when I write a Musing, it’s on a specific niche topic that you’re likely getting inquiries on from clients. But this time, let’s just talk overall markets and history to get a greater understanding of a market that has been confusing everyone (including myself). It’s likely that very few of us would have guessed that the market would enter a new “bull” market this year – well, it did.

Despite being a big baseball fan, I very much dislike when investors categorize the business cycle by what inning it currently is, i.e. “I think that we are in the 7th inning of the cycle”. Last cycle, which I believe was one of the most hated bull markets of all time, had many investors thinking that we were in the 8th / 9th inning or “extra innings” beginning in around 2014 (the bull market officially ended in Q1 ’20 in my opinion).

Source: Raymond James as of 06.06.2023

Source: Raymond James as of 06.06.2023

First, let’s take a step back. Most people categorize a business cycle through three (3) distinct phases –—these are also not perfect definitions— I tend to use simple return as my mechanism, but that just discerns changes in bull and bear markets and does not include “mid cycles”:

- Early Cycle -The time period from an equity market bottom to the peak steepness in the 10 Year/2 Year Treasury Yield Spread

- Mid Cycle – The period between the early and late cycles

- Late Cycle – The period beginning when the yield curve inverts (or gets to its flattest point in the economic cycle) until a meaningful equity market bottom

Main Points to Know Regarding Market Cycles:

- The majority of equity returns have occurred in the early cycle phase of economic recovery, with modest gains in mid-cycles, and materially negative returns in late cycles. But remember, cycle dates are created after the fact, and very difficult to know which one you are in at the present time

- Only about 23% of the time since 1999 has the U.S. been in the “early cycle” phase vs. 43% in the “mid-cycle” and 34% in the “late cycle” since 1999

- Standard deviation of sector returns is most severe in early and late cycles, with sector selection much less important in mid-cycles

I understand that there are a slew of different opinions as to which cycle the market may currently be in today. And then, how to position for it accordingly. But let’s go back to my comments above regarding “innings”.

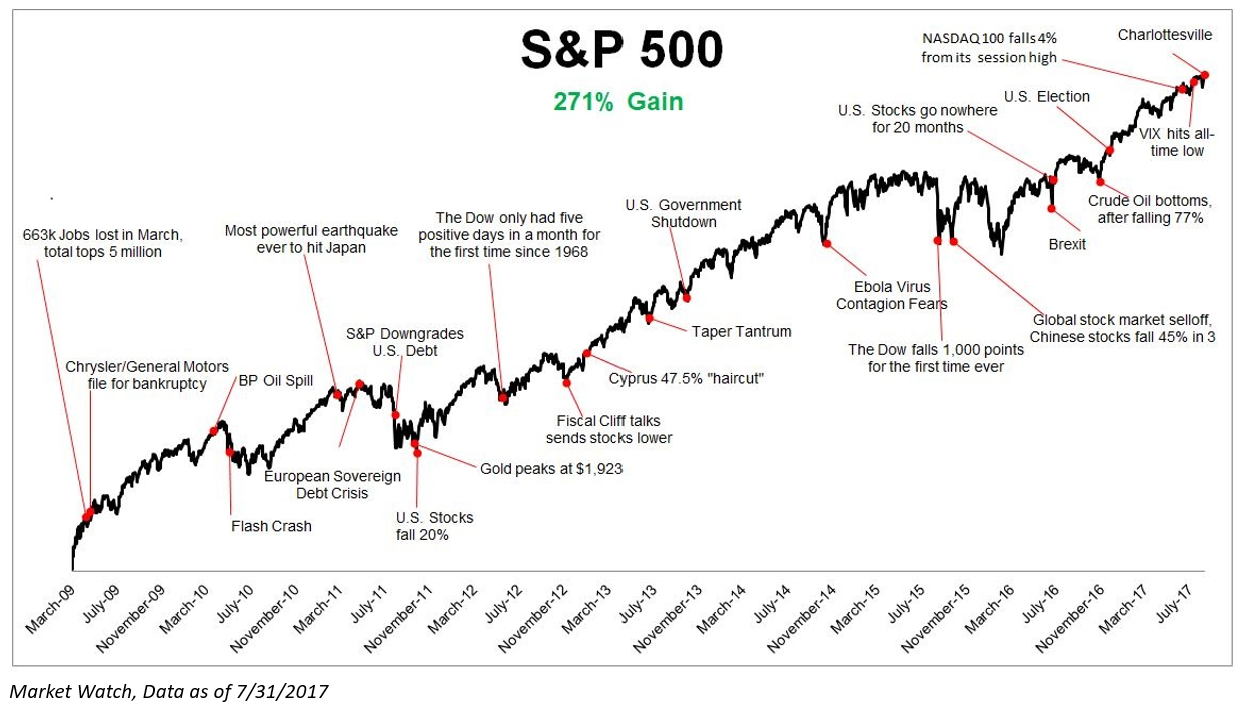

Look at the chart below: investors climbed the Wall of Worry throughout the entire last bull market. And to note, this chart only captures up until 6/20/2017. If you go until the official end of the technical bull market, ending in 2020, then the market was up 432% during that period! Think of all the investors that missed out on returns because they were trying to time the market top or play the market as if it was “late cycle”.

What is the lesson learned here? Investors need to keep things in perspective. Do not let today’s guesses alter the long-term plan for clients. Which, in a way, is synonymous to my comments above on AI – some think that it’s a bubble, while others say that it’s the coolest thing since George Strait’s first #1 single (Unwound – released in ’81).

Both scenarios come back to asset allocation, asset allocation and…asset allocation. That’s the most important part of portfolio construction; not certain exposures or tilts. How can I prepare for what I don’t know, without it hurting my ability to compound returns over longer periods of time?

Because, ultimately, trying to call what part of the business cycle that we are in, AND be correct with those distinct bets and the timing of those bets is very hard. And this may be nails on the chalkboard for some of you, so I’ll heed to Tripper from Meatballs to tell you: Picking tilts… It just Doesn’t Matter.

It starts and ends with having a seasoned process regarding portfolio construction. This should be the focus of all investors. More importantly, it should be step one for all asset allocators.

As always, reach out if you want to talk process and structure; we have a lot of thoughts right now.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2306-13.