Obviously, yesterday’s news regarding the market was all about the Fed. Just a few weeks ago, it seemed very unrealistic that the market would get a 75bp hike in June. Yet, due to Friday’s CPI report and a “mysterious” WSJ article on Monday, it created an environment where 75bps became the “base case”. Thus, not a complete surprise for the market.

What Happened?

Yesterday was the Fed’s moment – their moment to try to regain credibility in the eyes of the market regarding inflation. Did they deliver? That remains a hotly debated topic. The FOMC voted 9-1 to raise the fed funds rate by 75bps to a range of 1.50% to 1.75%., which was the largest rate hike since 1994. In the meeting statement the committee noted that economic activity remains strong while inflation is still elevated. They also reiterated that they are “strongly committed” to getting inflation back down to the objective of 2%.

Here are the takeaways:

- The Fed’s “dot plot” revealed that the FOMC now plans to raise rates to 3.4% by the end of 2022, up meaningfully from the March median projection of just 1.9%.

- US. growth expectations in 2022 were revised down from 2.8% in March to 1.7% at this week’s meeting.

- Labor, the second and forgotten aspect of the Fed’s dual mandate, remained steady, but expectations did uptick +0.5% by EOY 2023 to 4.1%.

- Inflation expectations were also revised sharply higher with the PCE price index expected to hit 5.2% in 2022 vs. 4.3% previously, but that figure is seen falling to 2.6% in 2023 and 2.2% in 2024.

- No change to the Quantitative Tightening

My Big Takeaway? The Fed is willing to inflict a lot of damage on the market in order to bring inflation back down – for 3 main reasons:

- The fact that they did raise rates by 75bps,

- They took out the line: “labor market to remain strong” from the pre-written statement,

- They increased the unemployment rate to 4.1% next year.

We believe this is very hawkish meeting that shows the number one goal for the Fed is fighting inflation – no matter the damage.

What Does this Mean for the Markets?

In the press conference, Powell noted that either a 50bps or a 75bps hike is likely at the July meeting. Powell made encouraging comments about the current state of the economy but also hedged that by explaining how difficult both a soft landing and getting inflation back to 2% will be. Though, I would not look too into the optimistic growth outlook, as Fed Chair Powell knows that talking about a strong economy makes it easier to aggressively hike rates.

Ultimately, the Fed caught up to market’s pricing expectations on where rates would end this year. The Fed doesn’t want to be in this same exact position next meeting, so they laid out expectations for the next few years, but, as I said, it appears that the Fed is willing to inflict a lot of damage on the market in order to bring inflation down.

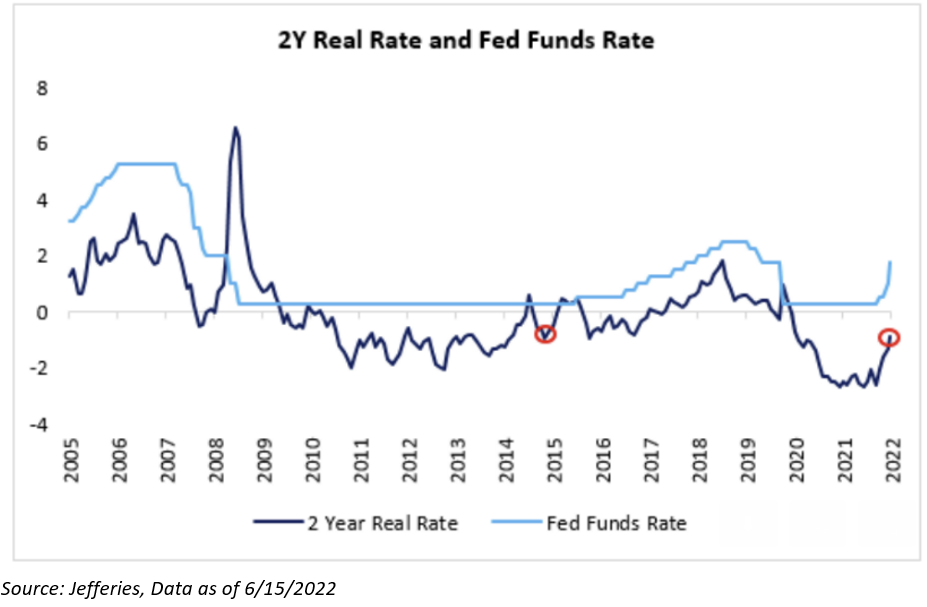

Lastly, the Fed may be finally talking the talk, but real rates need to walk the walk. The 2YR real rate is still -1%….negative 1%. Fed policy is restrictive only as far as real interest rates are positive and rising. In 2018, when the Fed Funds Rate was 2.5%, the 2YR real was +2%. CPI was 1.9% (today 8.6% YoY). 10YR breakeven was 1.7% (today 2.7%).

Real Rate = Current Nominal Rate – Breakeven Inflation.

2YR Nominal: 3.23%

2YR Inflation Breakeven: 4.30%

= (-1.1%)

A -1% 2YR real rate will not topple an 8.6% CPI. Real rates, across the curve, are too low relative to inflation – especially at the short end. This must change unless inflation rapidly deflates.

John Luke and I loved this quote from David Einhorn (Greenlight Capital): “It is monetary policy 101 that to defeat inflation, you need positive real interest rates. In 1980, Volcker raised rates to 19% to combat 14% inflation. Greenspan raised rates in 1990 to 8.5% to fight 6% inflation. Even Burns raised Fed Funds to 13% in 1974 to fight 11.5% inflation but retreated too quickly to get the job done. Today, we have real interest rates at the most negative levels of the last 70 years. The idea that tightening a percent or two from here will beat inflation is hardly credible.”

Conclusion:

The FOMC indicated that it plans to raise rates a lot—to a peak rate of about 3.8% according to the median 2023 dot. That level is well above any reasonable definition of neutral. 130bps above neutral for those keeping score at home, even taking into account that inflation expectations will be higher than normal for a while. History tells us that tightening above neutral rarely ends well. So, at some point it’s legitimate to expect a deterioration in the labor market, and at that point the Fed tone will change significantly as growth slows throughout the year.

Lastly, let’s review the market’s reaction yesterday vs. today – We believe, after Jerome hinted of even odds of a 50bps or 75bps hike in July, i.e., strongly downplaying a 100bps hike, the market rallied – a dovish take. The market was fooled last time by his 75bp comment that a “three-quarter point rate hike was not on the table” – but, today, the market says that they will not be fooled twice. We know that the Fed remains data dependent, as they were regarding this hike. Thus, if we continue to see structurally high CPI – 100bps rate hike has to be on the table – which perfectly alludes to Einhorn’s comments. Hence, the market’s poor reaction today.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the changes in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA- 2206-17.