On the radio last week, I heard a classic John Prine song that had the following (slightly tweaked) lyric: “a clown puts his makeup on upside down, so even when he smiles, he wears a frown”. It’s actually a pretty funny song if you listen to the lyrics.

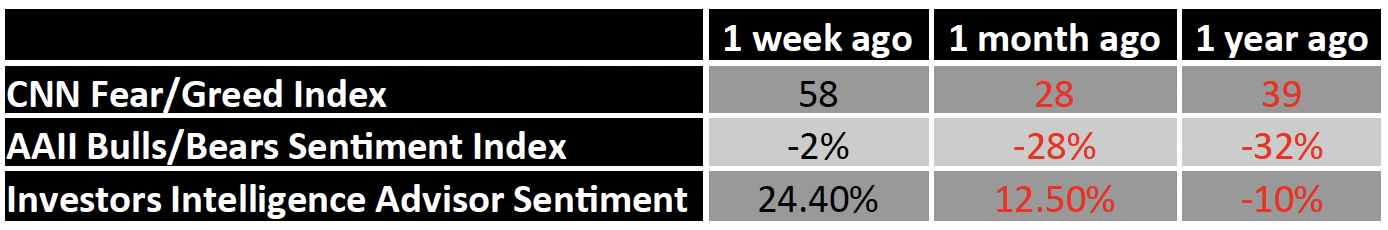

I think it resonates with the current market sentiment. It feels like there is so much consensus out there – a lot of pessimism – making investors feel like the market just has to go down. Yet, the market is up 16.5% since October, so even when investors should be smiling, they continue to wear a frown. Now, I understand that we need to look through the window and not the rear-view mirror, and that the list is most likely longer for a bearish thesis than a bullish thesis. But, that tends to be the case, as many people climb the wall of worry. Thus, by definition, the market’s direction has been the “Pain Trade”

Source: Sevens Report, Data as of 04/18/2023

Source: Sevens Report, Data as of 04/18/2023

Now, if you’ve heard me speak lately, you’d know that I’m more likely to be in the camp that the market may be over-balanced on a risk/reward basis – think back to our Yield + Growth +/- Valuation Framework. Secondly, we continue to focus on one of our themes for the future – The Market Will Transition its Focus from Inflation to Growth Frustration. These themes can take longer to play out than many would prefer, but remember, we’re only receiving the first data set of earnings for 2023, i.e., Q1 2023 Earnings.

Q1 2023 Earnings Preview

Quick Thoughts:

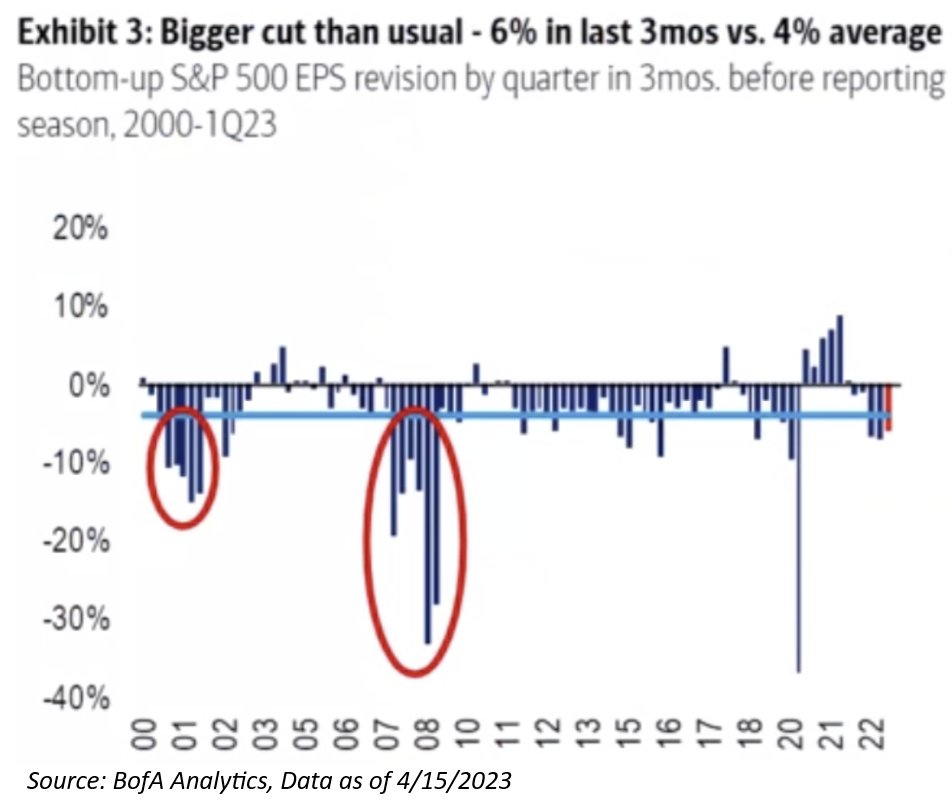

I know that we’ve continued to state that earnings will start to see some headwinds in the future, as operating leverage can cut in both directions in the face of directional inflation. What we’ve learned from history is that the rug does not always get pulled out from underneath expectations. I’m not sure if this quarter is the period that we will see the big hit to full-year (“FY”) expectations. Typically, analysts only guide 1-quarter out at a time – that’s why we’ve seen slower revisions to expectations so far in this cycle. Truth be told, this was also the case during the Great Financial Crisis (“GFC”). The below photo shows that there wasn’t one steep drop in expectations during the GFC, they were cutting one quarter at a time. This appears to be similar to what is occurring right now.

S&P 500 Q1 ’23 consensus EPS has already been cut by 6% YTD to $50.70 (-7% YoY), more than the average -4% pre-season cut. Macro indicators started the year strong but slowed after SVB news. Basically, there were two strong months of economic data (January & February), and then one month of slowing data (March). Thus, Q1 EPS may be more insulated than anticipated. But this quarter should not be about first quarter results – investors should focus more on guidance and commentary.

Let’s Talk Numbers:

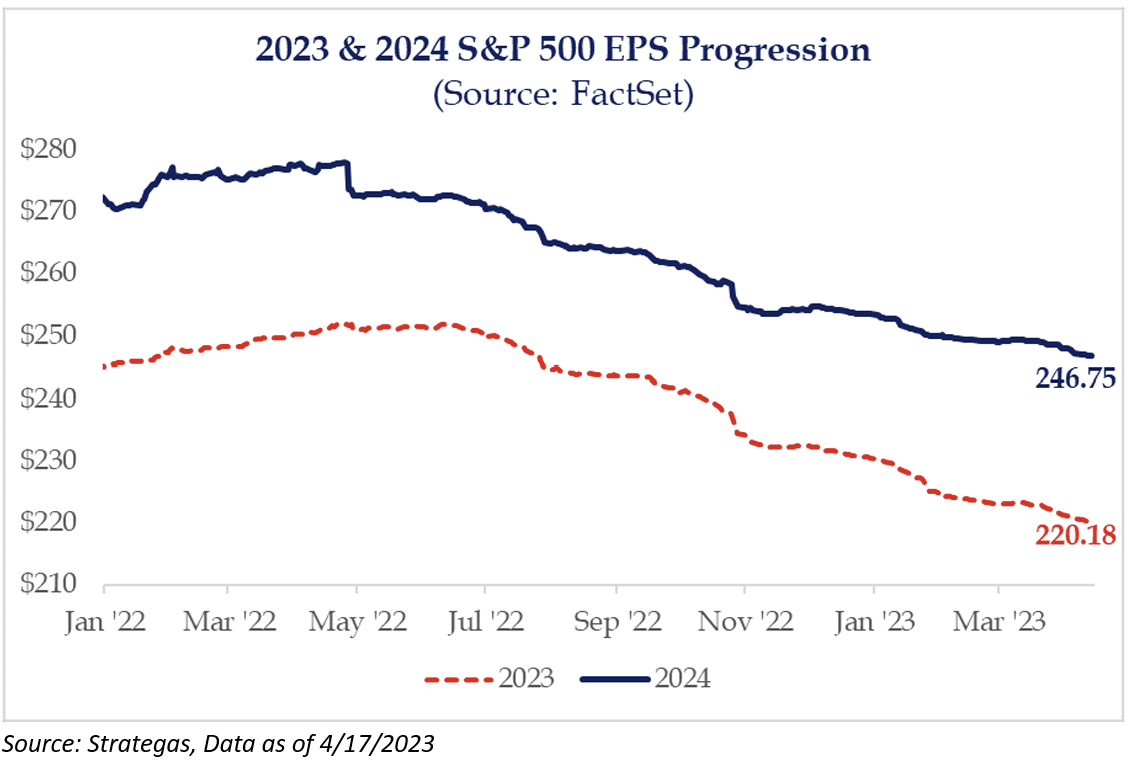

The last 3 earnings seasons have seen relief rallies in equities as EPS weakness was not as bad as feared. Earnings growth for FY ‘23 is now expected to be flat, down to $220, in line with 2022 EPS. The 2024 estimate is garnering more attention in our book as the street still has growth of greater than 10% v. ‘23. A resetting of expectations during this upcoming earnings season could result in this figure being revised lower, but, as of now we would take the 2024 consensus estimate with a grain of salt.

Current expectations for Q1 earnings suggest that a second consecutive decline in S&P operating earnings year/year is likely (Refinitiv currently expects Q1 profits to fall -4.8% YoY).

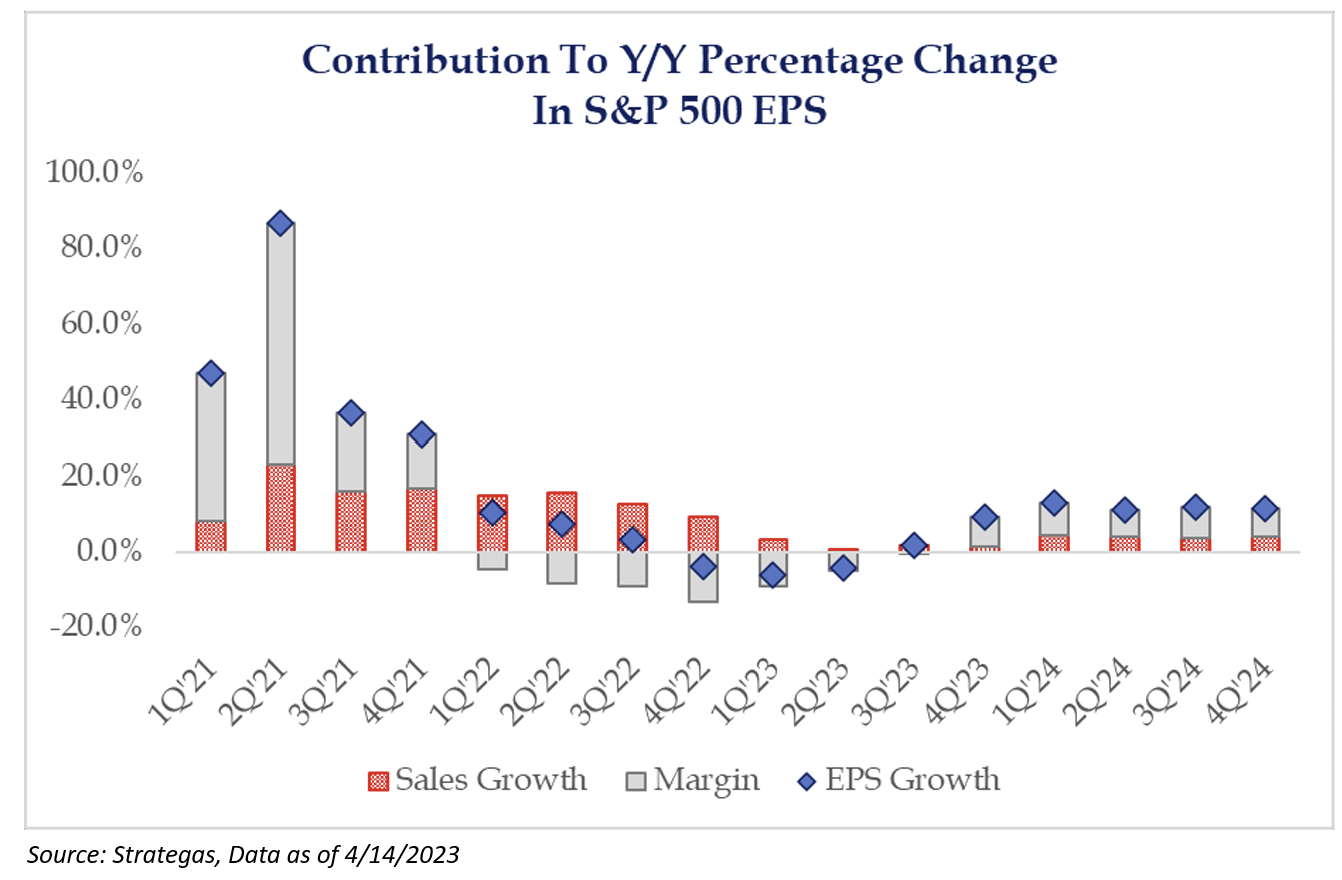

As many of y’all have heard, we don’t believe in future estimates of margins, which have been insulating the EPS figure, i.e., lower profitability = lower EPS. Consensus believes margins will return to being accretive to earnings despite inflation being stickier and wages remaining higher. Margin contraction is still expected for the first half of this year but beginning in Q3 ’23 the street has margin expansion occurring again. This is inconsistent with an expectation that we see an economic slowdown later this year.

Let’s Talk Themes:

I stole these from BofA but thought that these themes were very pertinent to setting the future stage. BofA stated that they are looking at 3 different themes for Q1 ’23 earnings:

- Impact of a Tighter Credit Cycle: This is the question on everyone’s mind. Historically, credit cycles have been very correlated with S&P 500 revenues. Thus, the growth rate should begin to start coming down. The surprising aspect here is that companies continue to spend on capital expenditures (“CapEx”), even though earnings have been pressured. The tighter labor environment has led to more management teams to invest in technology. Not only that, but the last 10 years have been very much under-invested. Then, you could couple this with the re-shoring theme. It’s no secret that banks began credit tightening even before the mini-banking crisis. So, we’ll continue to see who comes out on top of this battle.

- Tech Spending: The market is coming out of a huge demand pull forward from COVID-spend. Given the flight to mega-cap safety, we haven’t seen any initial EPS cuts to the major software players – people believe that the recurring revenue is more defensive in nature. Furthermore, 20% of IT spend comes from the banking sector. It’s no secret that banks have been shoring up their capital, via costs. This could ultimately be another headwind.

- Services Spending: Services spending has been the “Last Man Standing” in the economy. And recently, through company commentary (airlines and restaurants) and soft data, we’ve seen some initial signs of cracking. Not only that, but 2H ’23 will have some difficult comps for this area of the economy.

GDP:

Lastly, let’s quickly hit on GDP, as many people assimilate GDP and EPS together. Thus far, the “dog that hasn’t barked” as far as expectations for a recession have been concerned has been the fact that America remains at full employment. U.S. real GDP in Q1 is still tracking positive, though recession risk remains elevated as (small) cracks are starting to develop in the labor market.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2304-21.