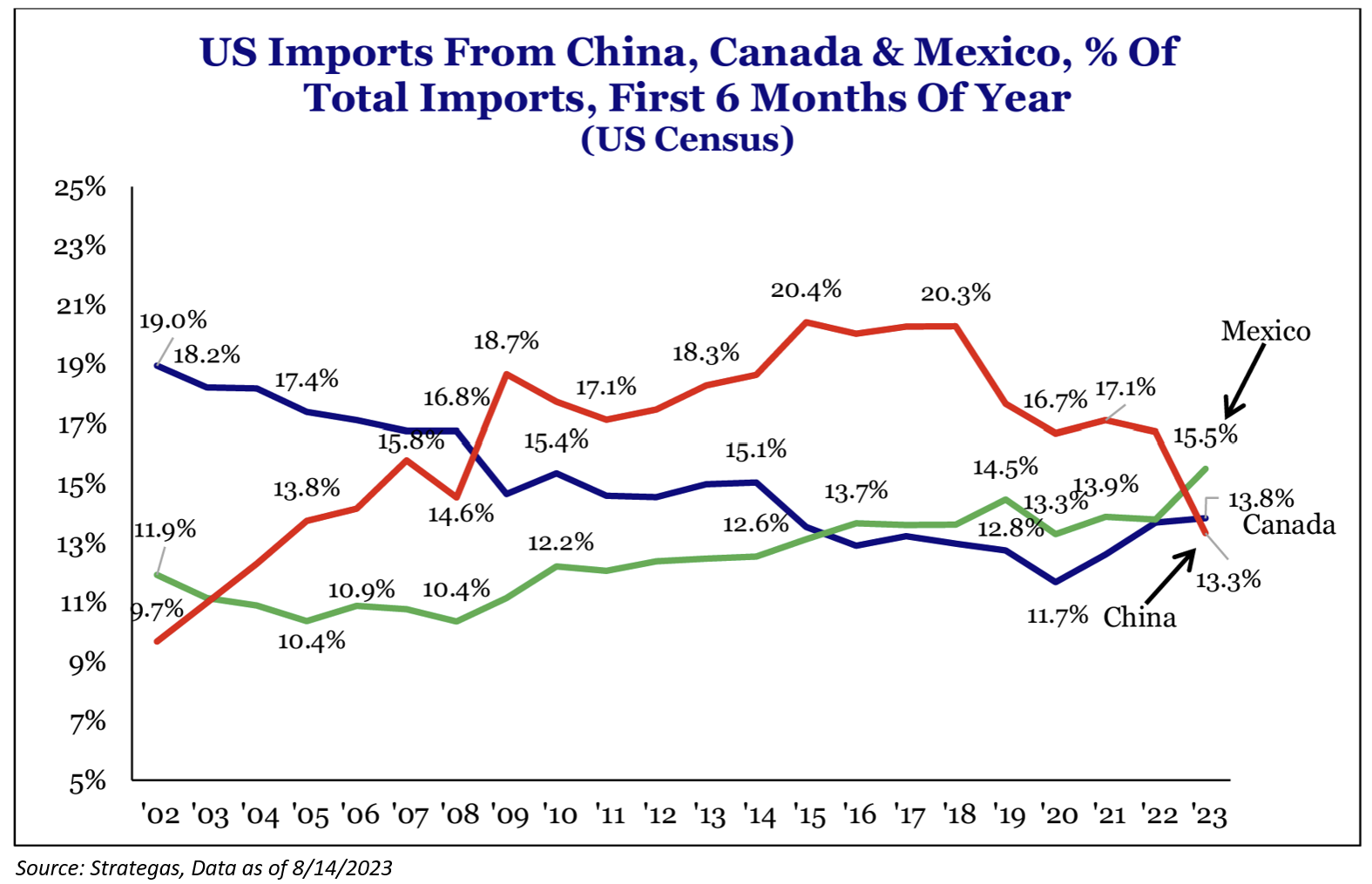

Last week, President Biden signed an executive order limiting US investments in China for advanced semiconductors, quantum computing, and Artificial Intelligence (AI) systems. While the executive order was narrow in scope, trade data released this week shows that a long-term shift away from China is underway, with US imports from China hitting their lowest level since 2004. In fact, trade with our neighbors (Canada and Mexico) is at its highest level since 2002.

One more thing….the 10-Year U.S. Treasury hit 4.2% today.

Q2 2023 Earnings Recap

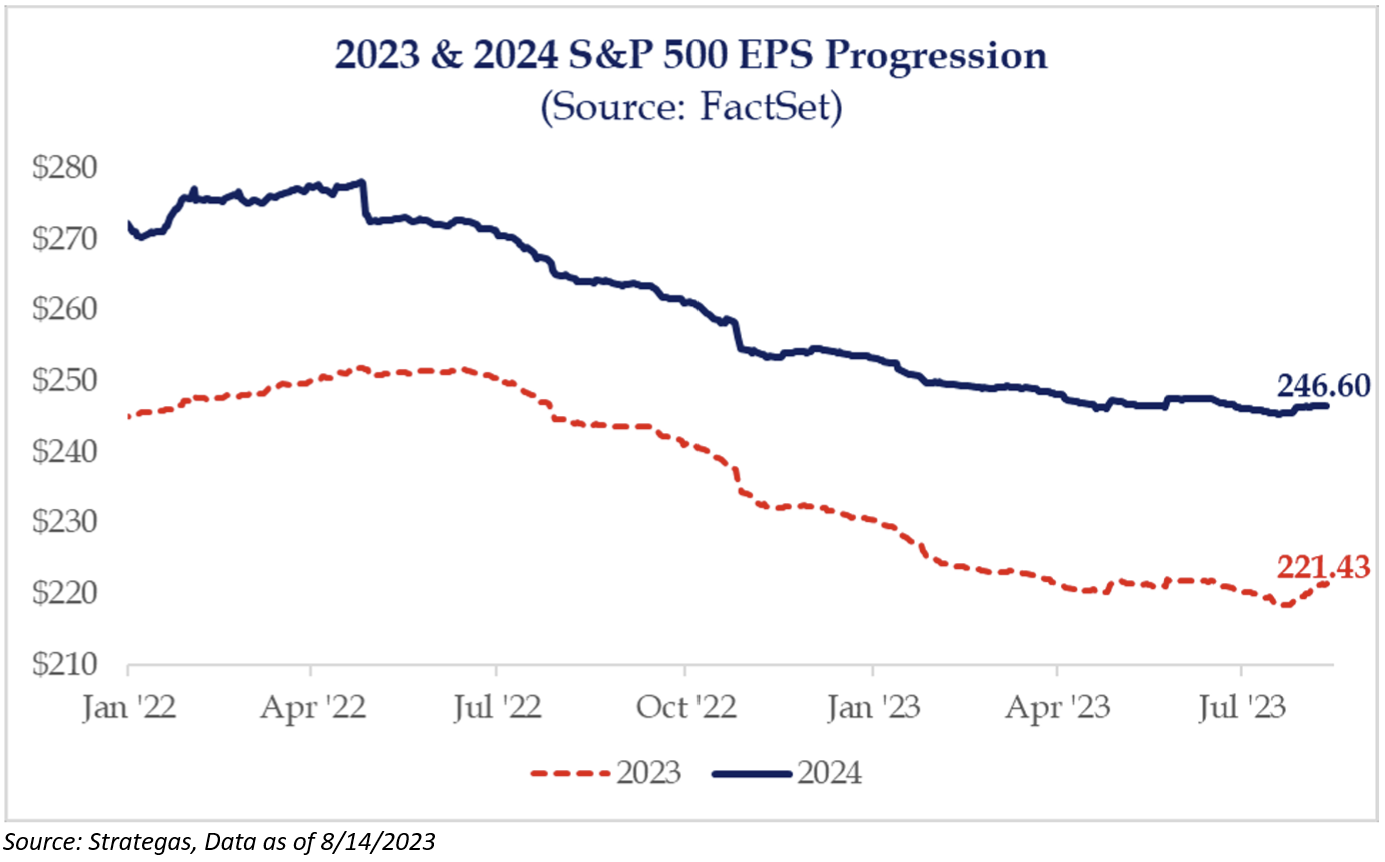

As it has been for the past five earnings seasons –and now that most of earnings season behind us– it is clear that EPS expectations have maintained better than most (including us) would have thought. Looking at sales growth, analysts expected -5.7% decline, while actual numbers only showed a decrease of -3.8%. The continued strength allowed 2023 EPS expectations to increase, approaching $221.50. However, 2024 remains unchanged over the past several weeks which is lowering the 2024 growth rate to 11.4%. This is still elevated relative to history and remains a challenge to achieve from our perspective but it’s still a long way away from recessionary type earnings numbers.

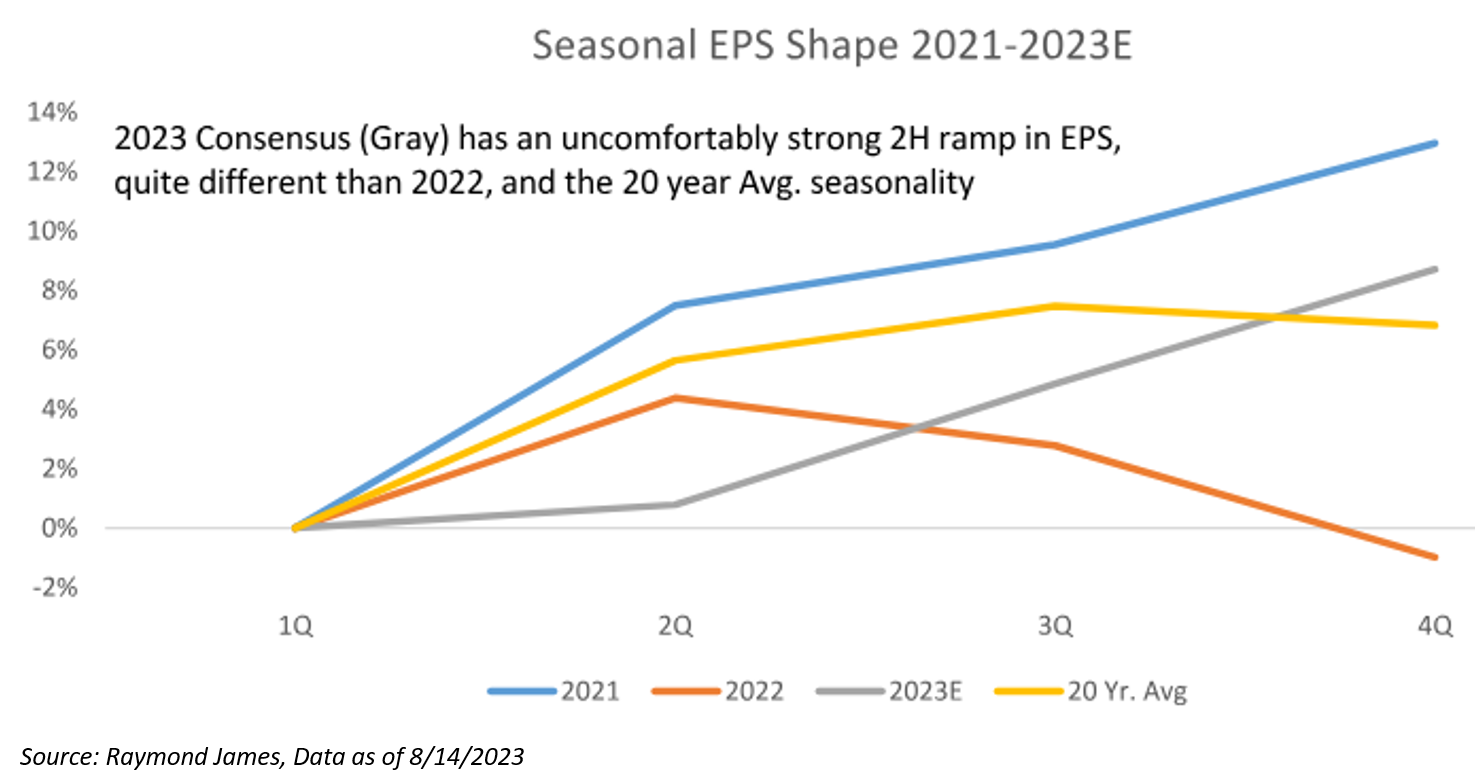

The chart below shows the shape of seasonal EPS in the S&P 500 in 2021 (big recovery year), 2022 (slowing economy year) and 2023 (better-than-anticipated), which so far has seen worse EPS seasonality in Q2, but consensus shows a rebound in Q3/Q4, unlike 2022, and more like 2021. The 2H ramp is still alive and well in consensus estimates. This sentiment has continued to drive the market higher.

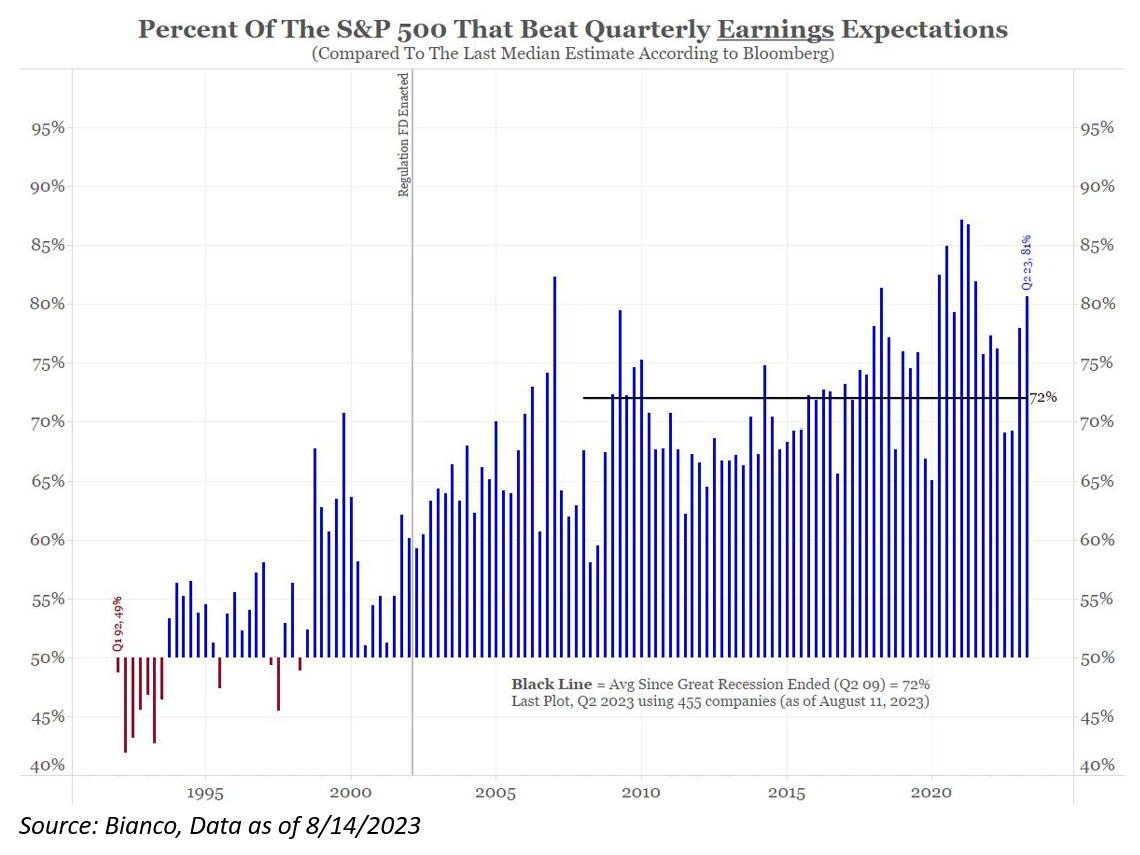

As it goes for the bottom line (earnings / net income) – close to 81% of companies beat on the bottom line. This is above the 72% average beat rate since the end of the Great Recession.

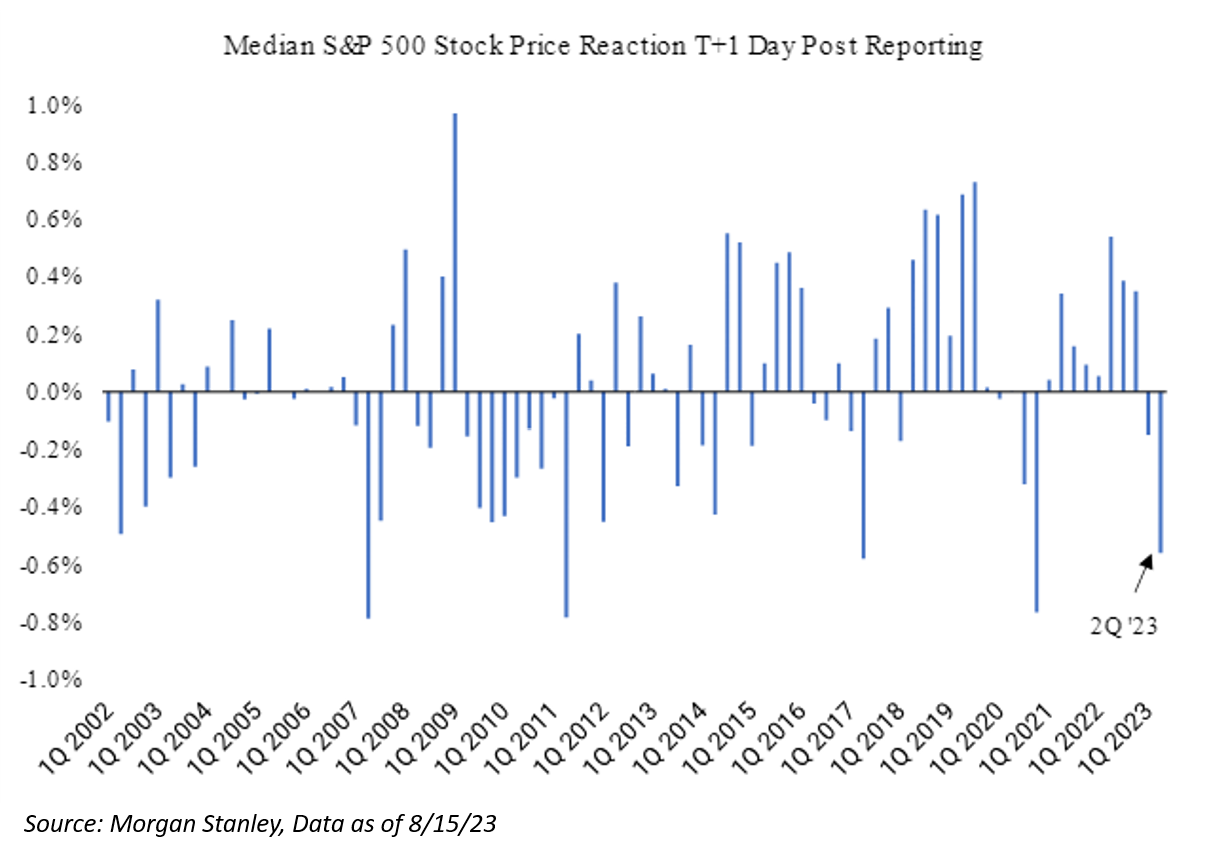

The biggest surprise to me has been the median T+1-day price change post reporting is -60bps, which is the lowest price reaction since 2020, and one of the lowest since the early 2000s. This is driven by a combination of negative price responses post both EPS beats and misses. However, the bigger outlier of the two outcomes from a performance standpoint appears to be the median price change post earnings beats, which is one of the lowest we’ve seen historically. This tells me that a lot of the positive sentiment is already priced into the market.

Alright, hot topic here: Tech investors are struggling. Not with investment returns, but with justifications for ever higher price targets. Shortly before Q2 earnings season, with much of tech straight up and to the right, I started having conversations with clients in which I detected a ‘struggle’ to take numbers and/or multiples higher. As such, it’s not a huge surprise that Q2 earnings season has been somewhat disappointing as even big beats/raises (e.g. META) have been met with muted stock responses (which coincides with the above paragraph).

I don’t want to highlight this notion to suggest that investors are ready to bail on the sector en masse, but rather I think that a pullback/breather in the QQQ’s is probably healthy for tech stock returns over the coming year. Another way to characterize the current situation: It may be the middle of the summer, but I think it’s becoming increasingly clear that tech investors got over their skis a bit too much headed into Q2 earnings season.

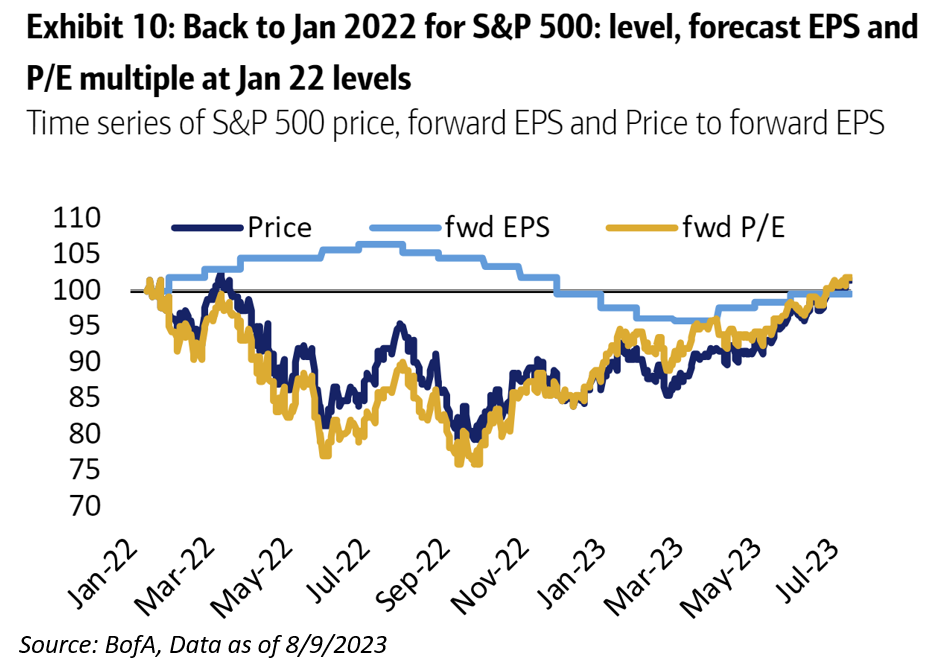

Overall, the S&P 500 has taken a roundtrip to January 2022 levels on forward earnings ($227 – next twelve months, not to be confused with ’23 expectations of $221.50) and on its multiple of 20x – a lost 18 months. But bonds and inflation have done a lot since then – the 10-yr yield jumped from 1.8% in Jan 2022 to 4.2%, real rates from -0.7% to 1.8% and Fed Funds saw the quickest ascent in history. Visibility on Fed policy, lower rates volatility, inflation cooling from 7% to 3%, and a pickup in GDP (+2.6% q/q SAAR vs. -1.6% in 1Q22) are all equity positive. And productivity gains (+3.7% YoY in Q2) could at least partially offset higher borrowing costs.

Conclusion: As earnings revisions go higher, so does the market.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2308-15.