When someone says, “It’s football season”, Kentuckians, in their own dialect, instantaneously translate that to “Keeneland is about to open”. Even more exciting this year, the racetrack will be getting an extra weekend of fun with the ’22 Breeders Cup being raced the first weekend in November. For those that follow, look up the horse Flightline – you won’t be disappointed. So, grab your Keeneland Breeze and get touched up on your trifecta box par wheel.

This week, earnings season is being called to the post, as banks will begin reporting Friday and many other larger companies will follow suit the following week.

Q3 ’22 Earnings Season

Everyone is debating where the earnings numbers for ‘22 and ‘23 will shake out. The EPS estimates are all over the map and for good reason. When moving through a slowdown with Fed tightening in the works, it’s nearly impossible to predict which weak links will affect EPS estimates.

This earnings season in particular holds importance as it could shape the debate between the bulls and the bears. A sharp reduction in earnings estimates could signal significant earnings cuts and a potential earnings recession. On the other hand, more resilient Q3 numbers and stable guidance could suggest a more moderate earnings correction or at least push the earnings debate until January’s Q4 reporting season.

As always, the Q3 numbers will be important and drive short-term moves in the market but investors are more closely watching for ’23 guidance. The market has started to see cracks with some bell-weather stocks reporting both top-line and bottom-line misses in recent weeks; however, the majority of company guidance still suggests that margin and earnings are in a healthy state despite many of the macro headwinds.

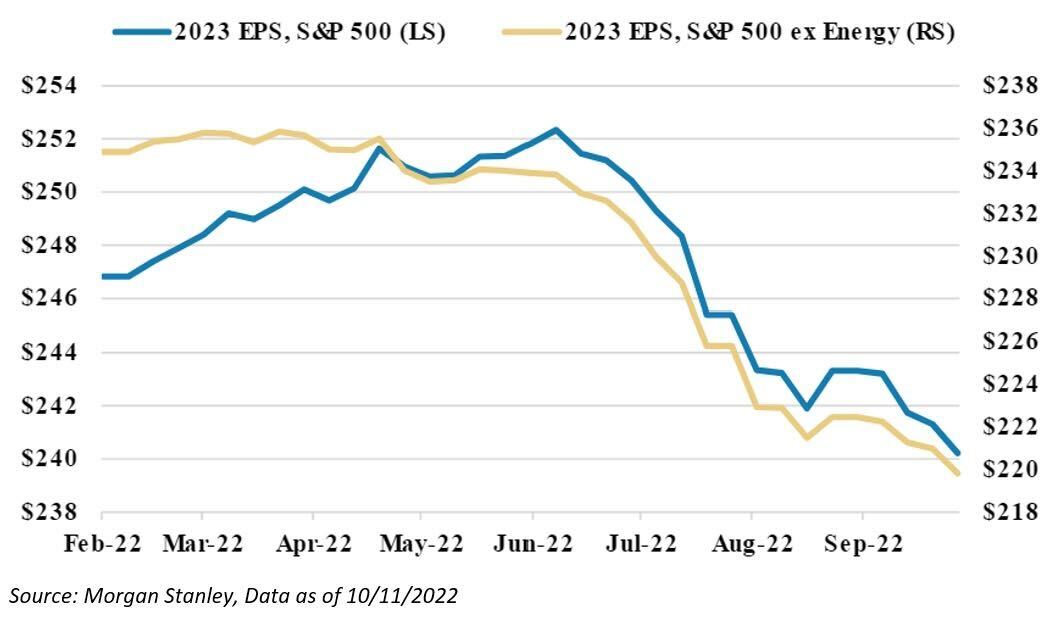

Since the peak of estimates in April, Q3 ’22 expectations are down 8%, while S&P 500 ex. Energy is down close to 11%.

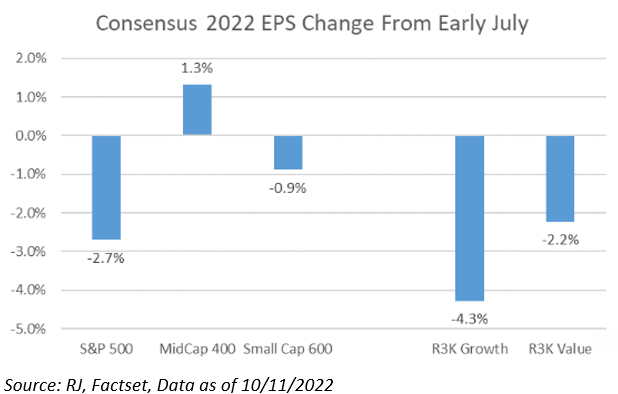

As has been the case since the summer, large cap EPS expectations are coming down faster than small/mid cap, while growth EPS expectations are coming down faster than value. This is VERY ATYPICAL in an economic slowdown in the age of globalization, but we expect it to continue as for the first time, the US economy is in far better shape (not great, just better than Europe or Asia.) – A truly unique time period.

Lastly, I do think that there is a potential to see another quarter of “relative” strong earnings. Why?

- Consumers still have excess savings (roughly $1 trillion) which alone could boost nominal spending by 7% over the next year.

- Consumers’ willingness to borrow, as the job market remains strong, bloated corporate labor costs, with compensation up 10% YoY in Q2 ’22, and probably up another 8% in Q3 ’22 along with higher input prices.

So to bring those two points together, companies are taking advantage of strong nominal growth to raise prices.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2210-20.