Catching up

This past weekend, Aptus held our 4th annual Uncle Rico 2v2 Basketball tournament. As many of y’all know, we have a slew of former college and professional basketball players on our investment roster — it gets pretty competitive. We have tons of videos and photos if anyone wants to see them. JD came out victorious this year with a new Aptus CFA addition, Brett Bennett (lives in Denver), as his partner. Luckily for me, there was no repeat of last year’s best photo (JD dunking on me). We won’t be re-circulating that photo.

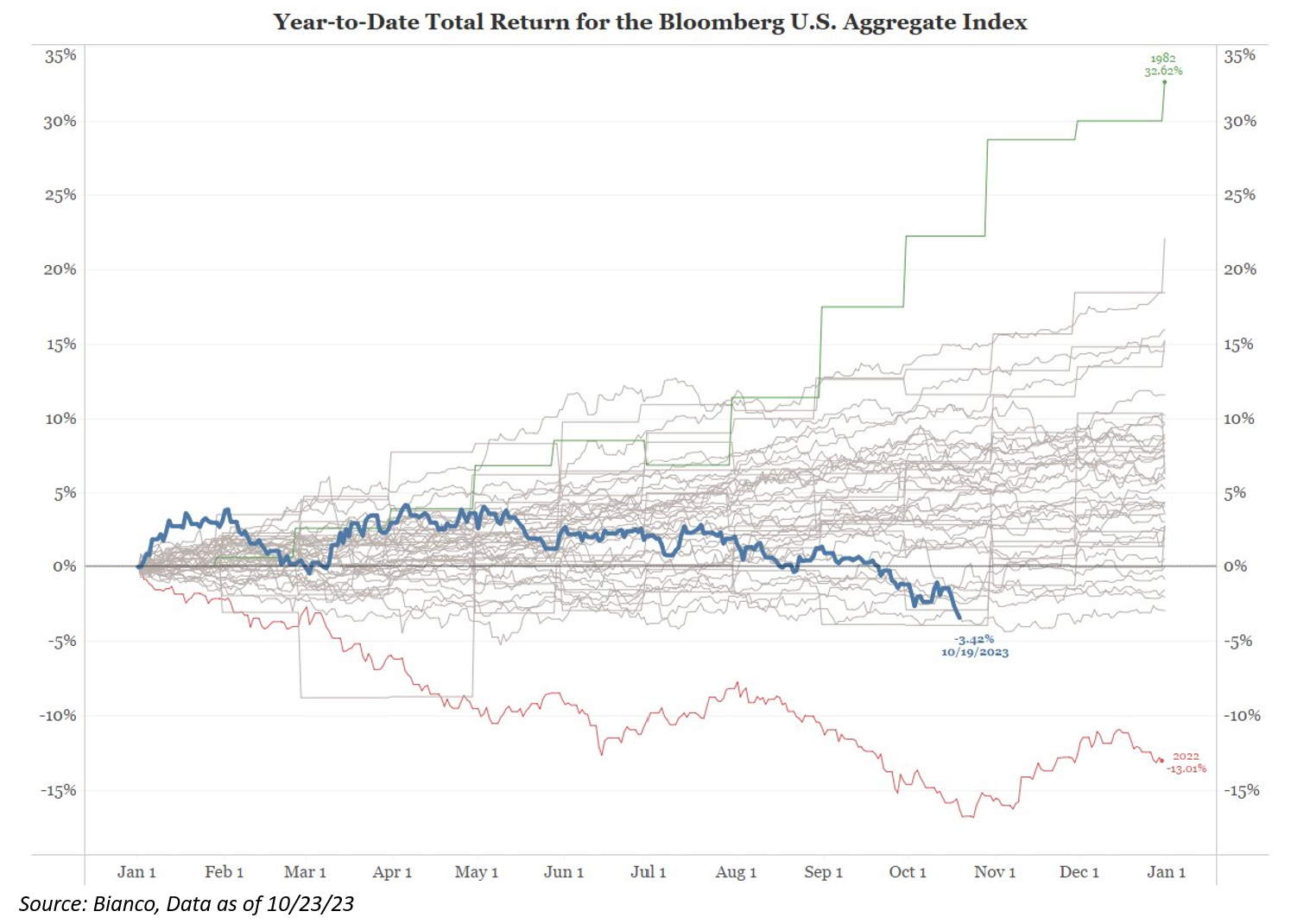

Before getting started, this is my favorite investment image from over the weekend. Many of y’all have heard us spend much of our commentary over the last year pointing out the record losses in the bond market (red) in ‘22. However, the reversion to the mean that many expected in 2023 never materialized (blue) – just think of the amount of flows into TLT this year. The Bloomberg U.S. Aggregate Index is now down 3.42% YTD on a total return basis and is within striking distance of becoming the second-worst total return year on record (data goes back to 1976).

Q3 2023 Earnings Preview

If you’ve read our content from the past year, you’d know that one of our themes for ’23 was that inflation was going to transition to growth frustration. In a nutshell, inflation and growth frustration have been the two hurdles to clear for more people to start believing in the market. First, inflation needs to be perceived to be coming back down to 2%. It feels as if we are getting there fast, barring a supply shock across the economy. EPS expectations will become increasingly important to be able to keep the rally going. If you’re keeping score at home, we’ve been partially correct; the market has stopped worrying about inflation and has started focusing on earnings – the direction of earnings hasn’t happened yet.

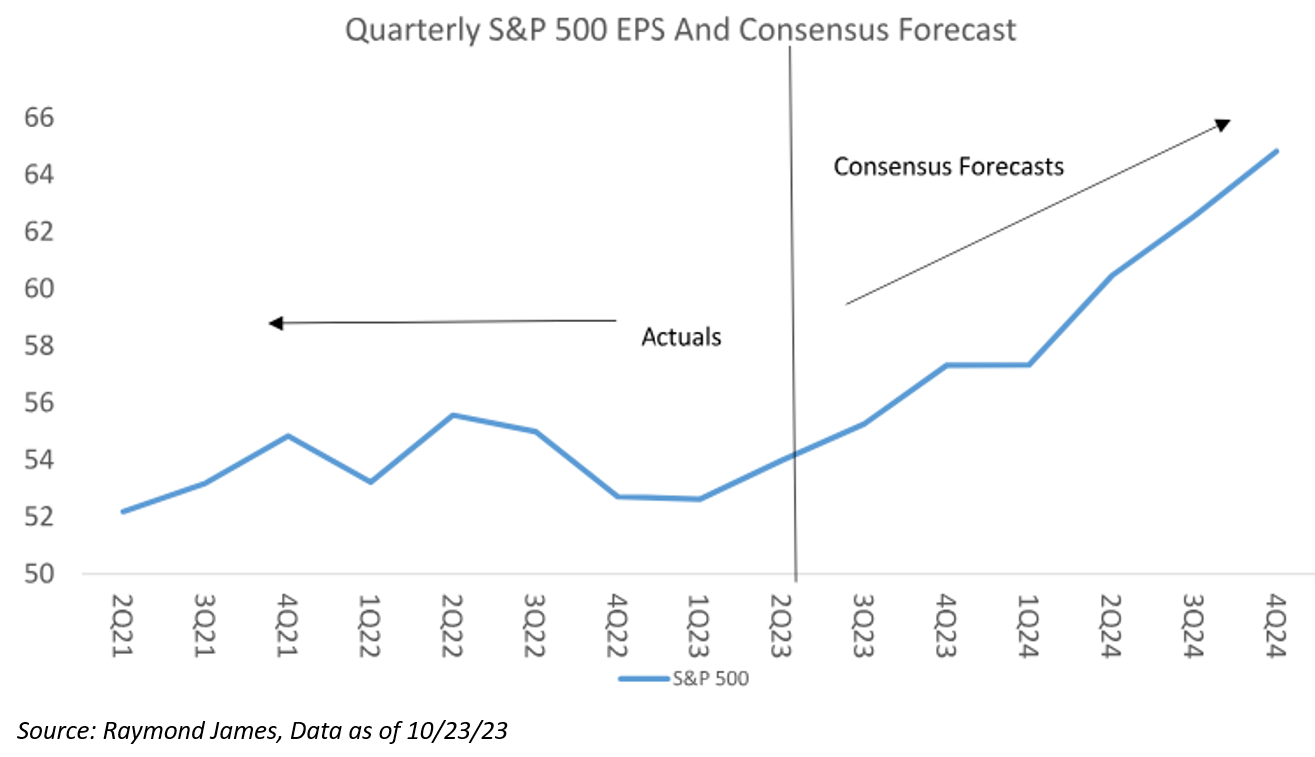

Earnings season is already underway and with so much uncertainty in markets today, Q3 earnings releases are a hot topic of investors. Personally, it feels like headwinds are brewing for earnings as expectations appear elevated, especially if you look into the future. I think that there are legitimate concerns of economic slowing (higher rates, student loan payments, geopolitical fear, global weakening) with the reality that GDP accelerated meaningfully in Q3 ‘23 and consensus EPS expectations that look like a “breakout” over the next few quarters after being range bound since early 2021.

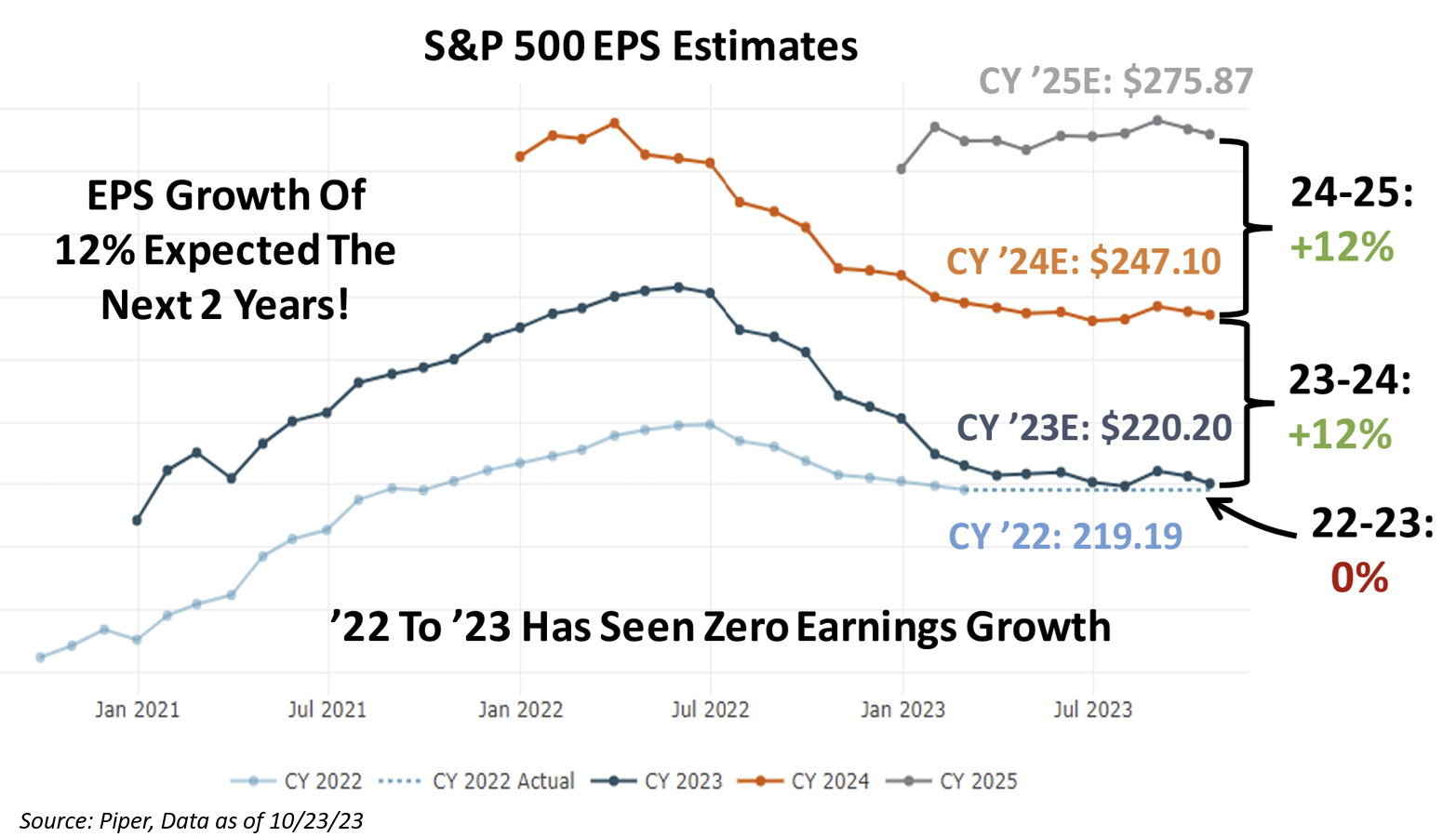

Since last earnings season, we’ve continued to see the US Dollar climb alongside interest rates. This has been a popular topic among investors and news outlets alike and is likely to continue to put pressure on EPS estimates well into the future. Bottoms-up consensus EPS estimates are still highlighting 12% growth for 2024 and 2025, without seeing ANY growth so far this year.

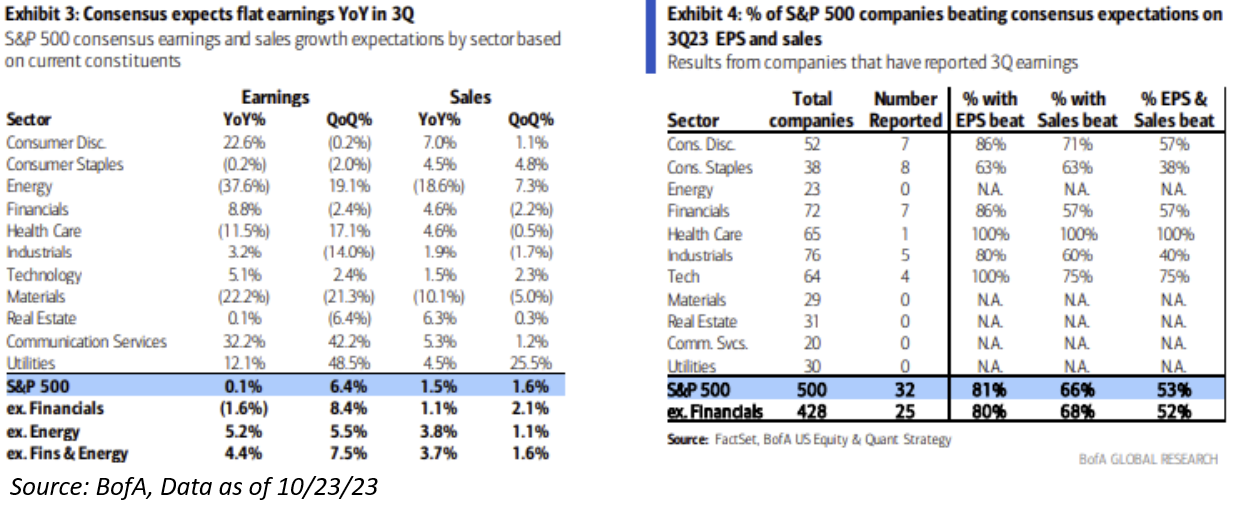

But, if expectations do come to fruition for Q3, the S&P 500 will report year-over-year (YoY) earnings growth of 0.1%, which would mark the first quarter of year-over-year earnings growth reported by the S&P 500 since Q3 2022. This figure is well below the 5-year average earnings growth rate of 10.6% and below the 10-year average earnings growth rate of 8.4%. Next quarter, the market is expecting 7.5% YoY growth.

Over the past 5 quarters, the market has rallied into or during earnings season. We’ll see if that streak continues.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2310-21.