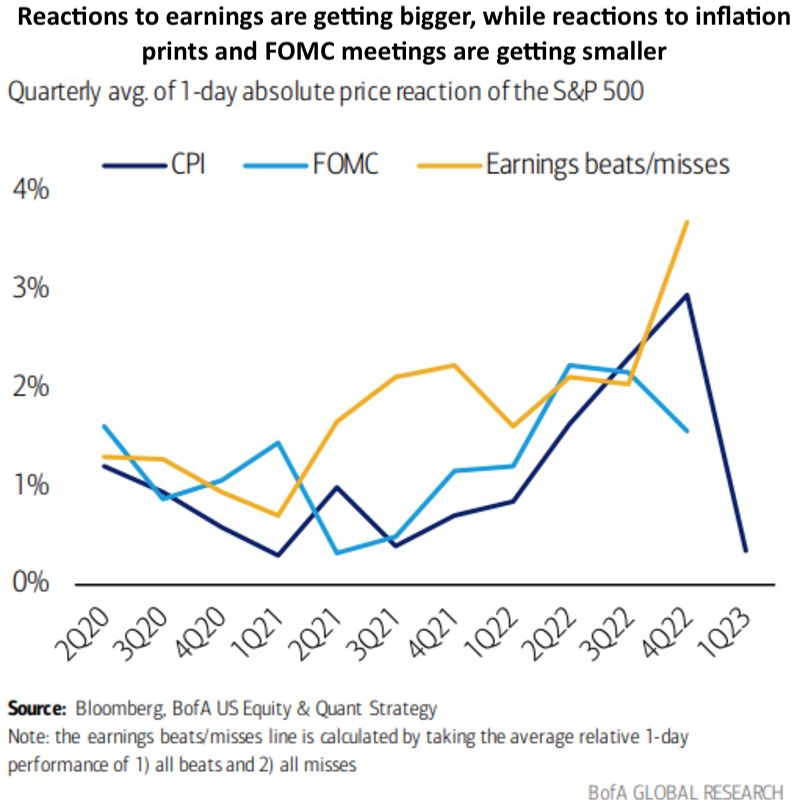

It’s showtime baby! As many of y’all are aware, Q4 earnings season tends to be a bit longer than the others, as it takes a little while longer for companies to close the books on their year-end. We expect earnings to take the center stage going forward, where reactions to earnings have been getting bigger, while reactions to inflation/FOMC have been waning (Chart below). As many of y’all know, this is one of our core themes moving forward: “Inflation to Growth Frustration”.

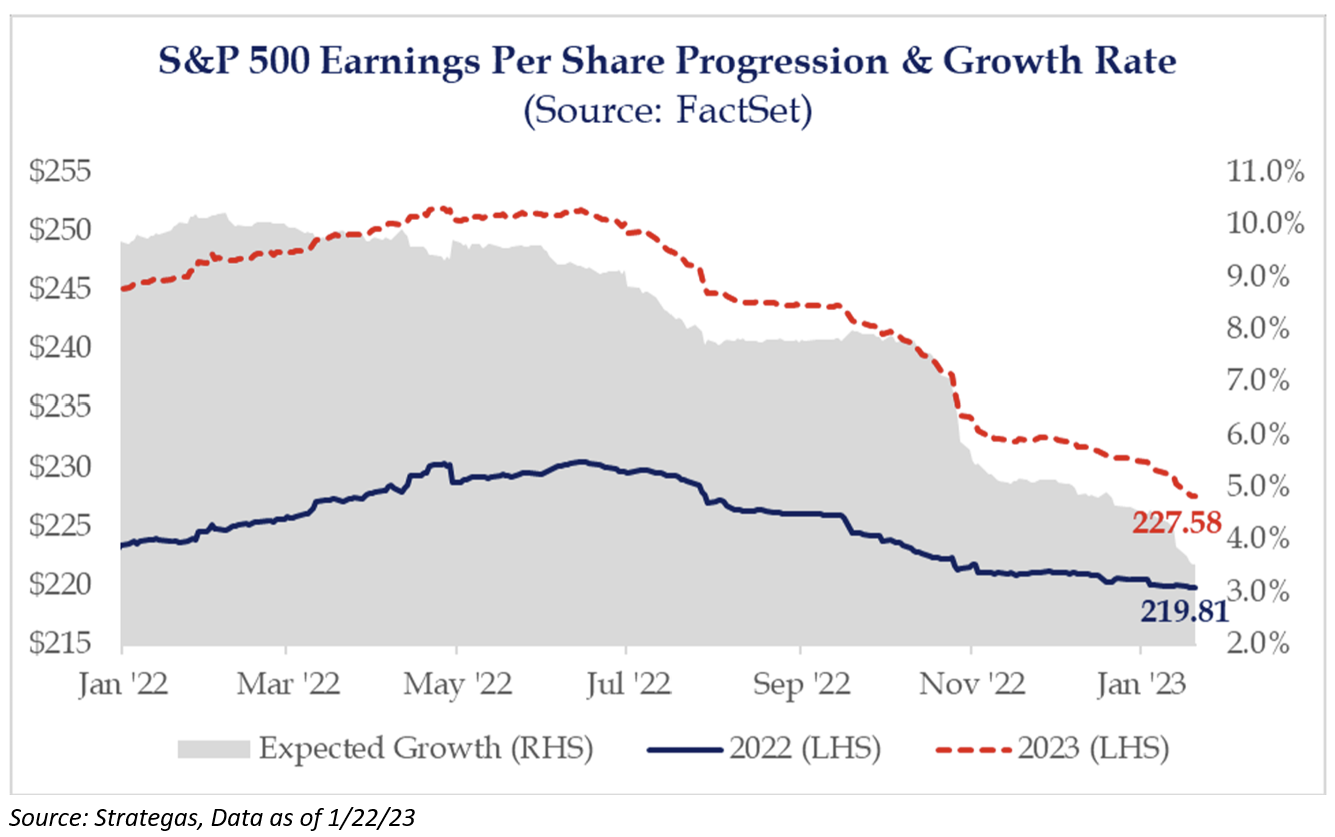

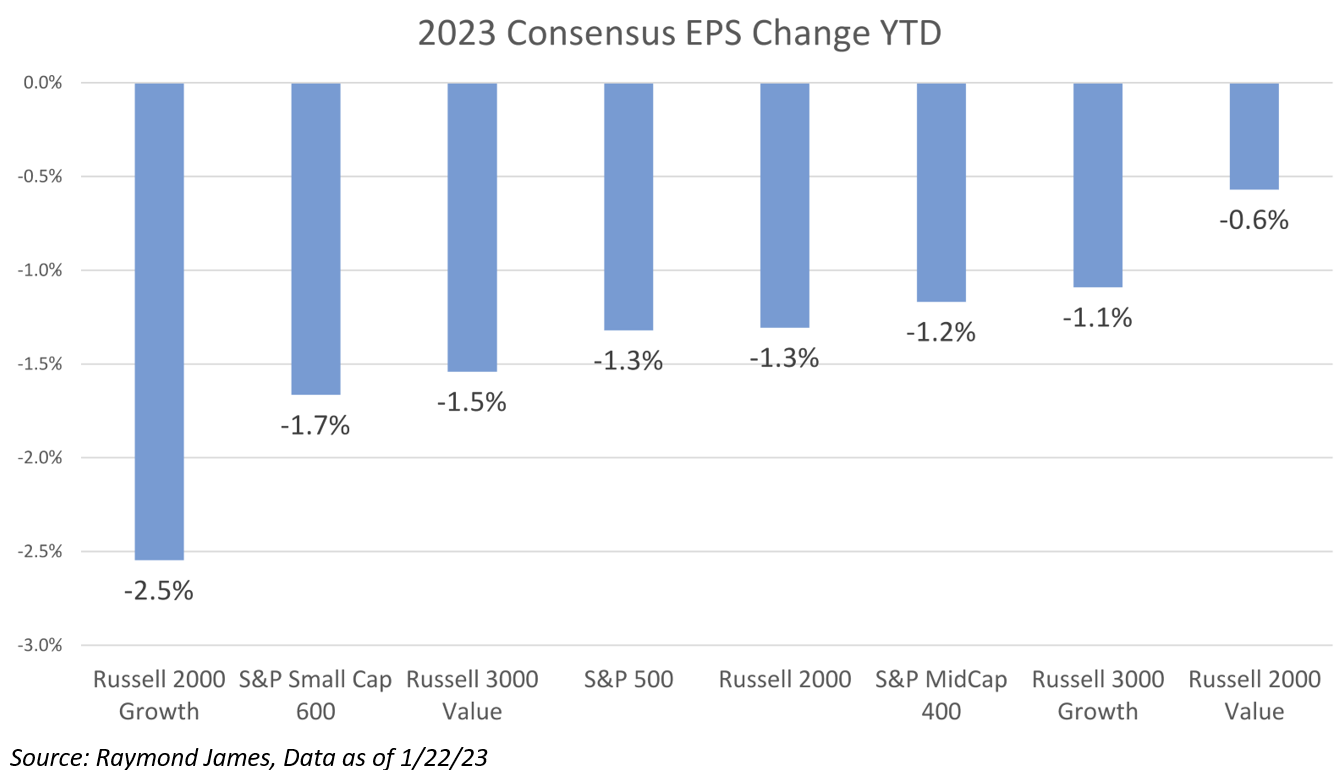

With a focus on the Fed tightening cycle, peaking inflation, and a 2023 recession, S&P 500 earnings have declined to reflect the economic pain ahead. Yet, economists and analysts are unsure how far earnings will fall. Next year’s EPS is down -9% since the June ’22 peak to $228, over 2x the typical cut over the same period. The bar could be lowered dramatically as management teams have the cover to lower guidance. With growth still estimated to be about 4% next year, the consensus remains a ways off from accounting for a recession. We’ve said it before: the median decline in earnings during a recession is 20%.

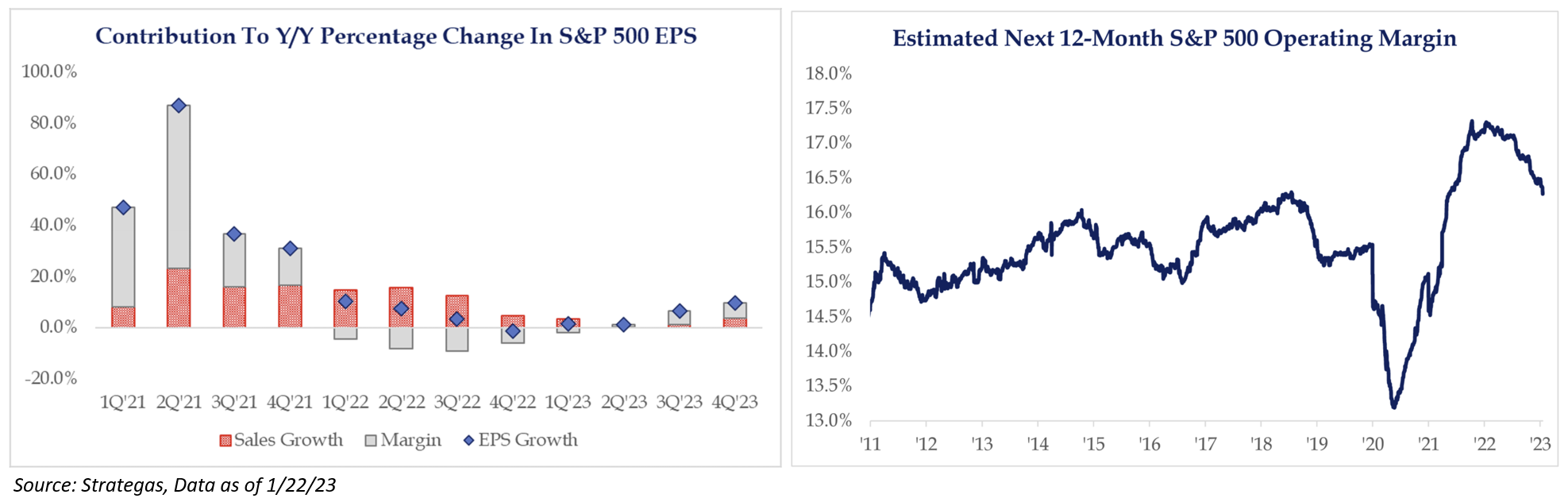

Looking at the full-year 2023 sales estimates shows that expectations are being reset lower on both the top and bottom line. Sales growth for the year is now expected to be 2.5%. What’s important is that this growth rate is expected during a period where inflation is stickier, and companies are charging more. It will be imperative over the next several quarters to also watch unit sales on top of dollar value of sales as higher prices may mask underlying weakness in businesses.

Our Biggest Worry: We expect tighter monetary conditions to exist for some time. This is likely to have a continued and negative impact on companies’ ability to expand operating margins. While the “money illusion” can result in higher levels of nominal earnings and make recession-related percentage earnings declines appear less severe than they would in low inflation regimes, contracting operating leverage in combination with tighter financial conditions has historically led to lower earnings and earnings growth.

Sell-side stock analysts are forecasting an increase in operating earnings this year of +3.5% on the heels of an increase in revenues of only 2.5% – an implicit expectation that S&P 500 corporations will be able to expand profit margins this year – seems unlikely to us. Simply said, the Street’s estimates still imply profit growth for CY’23. This is inconsistent with the near universally held view that the U.S. economy will contract in the next year.

Fun Fact: The biggest differences between sector market cap weights and their respective earnings weights are in the Energy and Technology sectors. The Energy sector represents 12.4% of the Index’s earnings but makes up only 5.2% of its market cap. The Technology sector, alternatively, represents 21.4% of the Index’s earnings but 26.3% of its market capitalization.

As always, I’ll do a recap of the earnings season in a few weeks, of which, I expect there to be a lot of fun intertwined between now and then.

Please reach out to us if you have any thoughts / questions / comments on the individual reports. We have our ear to the ground and would love to filibuster a conversation on any stock talk.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2301-23.