Stocks have rallied to start 2023 and the biggest reason for the early gains is that investors are interpreting further declines in inflation, slowing economic growth, and less-hawkish Fed rhetoric as increasing the chances for an economic “soft landing.”

For clarification purposes, a “soft landing” means inflation falls faster than growth, allowing the Fed to pivot, stop hiking rates and then start to cut them. In doing so, this keeps any economic slowdown brief while getting inflation under control. Do the facts really support this sudden burst of optimism? No, not really. Seriously, what has changed?

Yes, inflation is declining, as shown by last week’s CPI and the drop in price indices in other metrics (ISM Manufacturing and Services PMI). Yes, growth is slowing, as clearly evidenced by ISM PMIs and anecdotal commentary from companies. And yes, Fed rhetoric has somewhat softened as the Fed is clearly guiding towards a 25-bps rate hike on Feb. 1.

But none of that is materially different from what we expected for the start of 2023. On inflation, we already knew that inflation was falling, yet the services inflation (the key part of inflation) is not falling any faster than we expected. On growth, we knew it was slowing, but that slowing is suddenly accelerating, and it’s very early to guess how badly growth will ultimately slow (we’re just starting to feel the impact of last year’s rate hikes). Finally, on the Fed, a 25-bps hike in February isn’t a dovish surprise — investors have been expecting the Fed would most likely “step down” to 25 bps going forward this year.

It’s not clear to me how the data so far in 2023 makes a soft landing more likely, considering:

- Inflation is still massively above the Fed’s target

- The labor market and service price inflation remains too tight and too high respectively

- Growth is clearly slowing and it looks to be getting worse

- The biggest mistake the Fed has made in the last 40 years is pivoting too soon, and this Fed seems bound and determined not to make that same mistake

Just because we are finally in “restrictive territory”, i.e., FFR > Core Inflation, doesn’t mean a pivot is imminent. As always, if you’d like to see charts on this, please reach out.

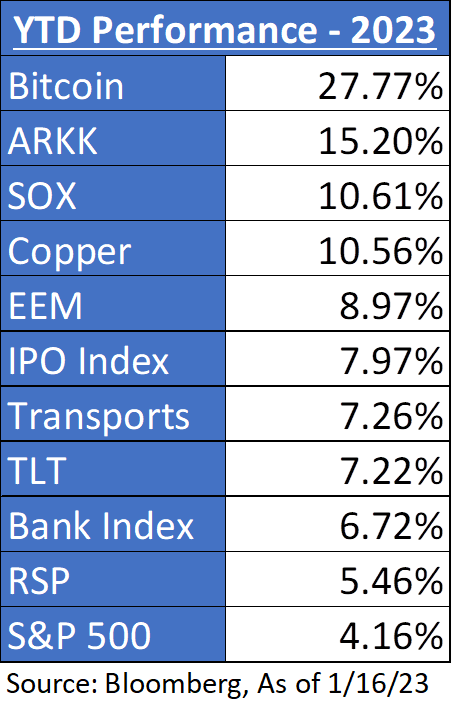

Why I am skeptical about this rally: Well, as mentioned above, it feels as if the market is pricing in more and more of a “soft landing” – what does that look like underneath the hood for equities? Let’s look at what’s outperforming:

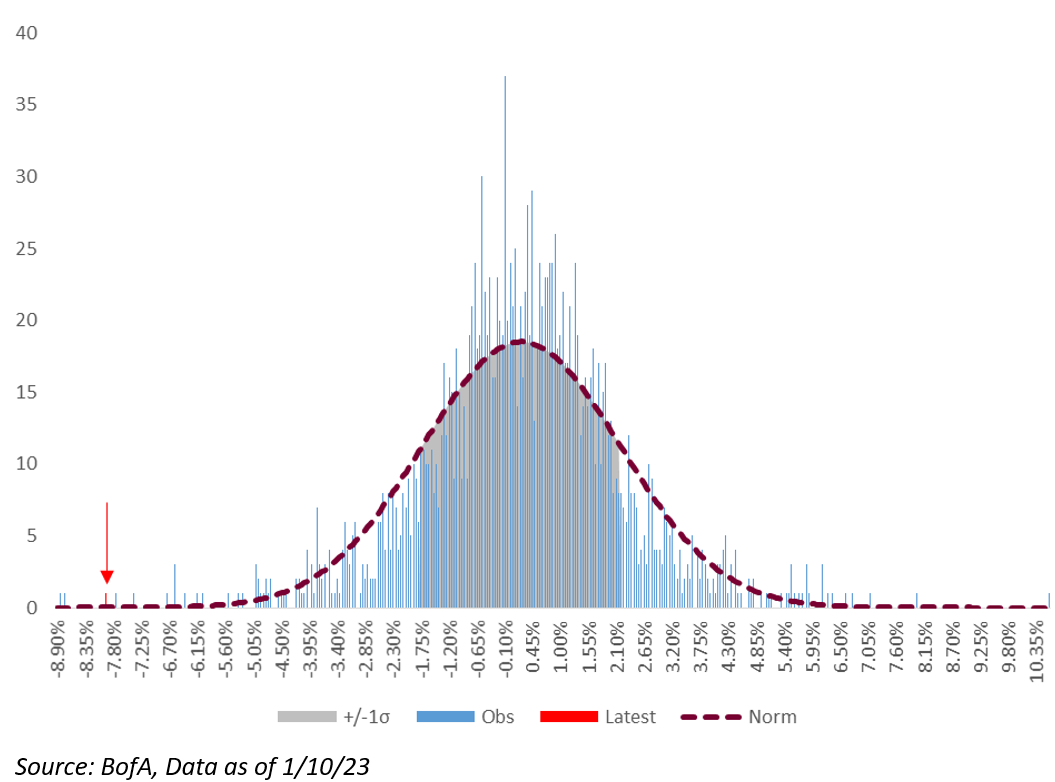

Said another way, on a YTD basis, the outperformance of the “30 Worst Performing Stocks of 2022” versus the “30 Best Performing Stocks of 2022” is at the biggest spread anyone has seen in 15 years.

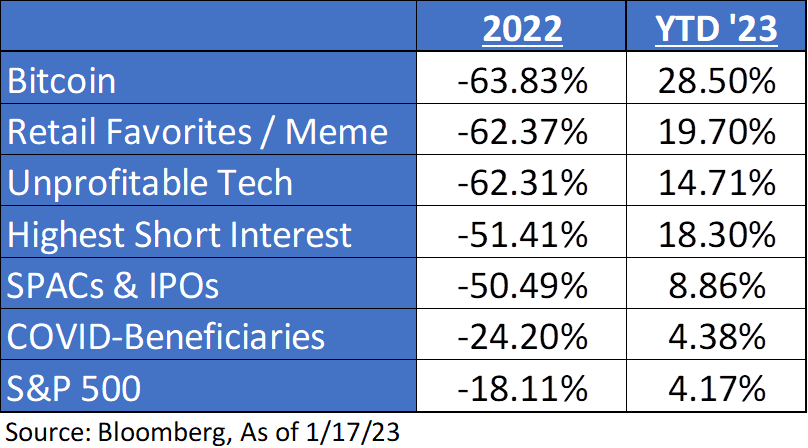

And, finally, a play off of our quarterly newsletter, in which we reference a few “investment cults”, have reversed performance YTD. High fives goes to someone who guesses the quarterly theme.

I hope y’all are noticing a theme here: low-quality / junk has been outperforming YTD. More importantly, does this feel like a great cornerstone for the onset of a new market regime? I’d reckon not. Over longer periods of time, we prefer to own quality assets that have a sustainable path for growth – these types of securities tend to outperform over longer periods of time. This “rally” does not exhibit those characteristics.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2301-19.