Unfortunately, we are about to talk politics – let’s rip the band aid off and dive in. The U.S. just hit its debt limit.

Taking a Trip Down Memory Lane

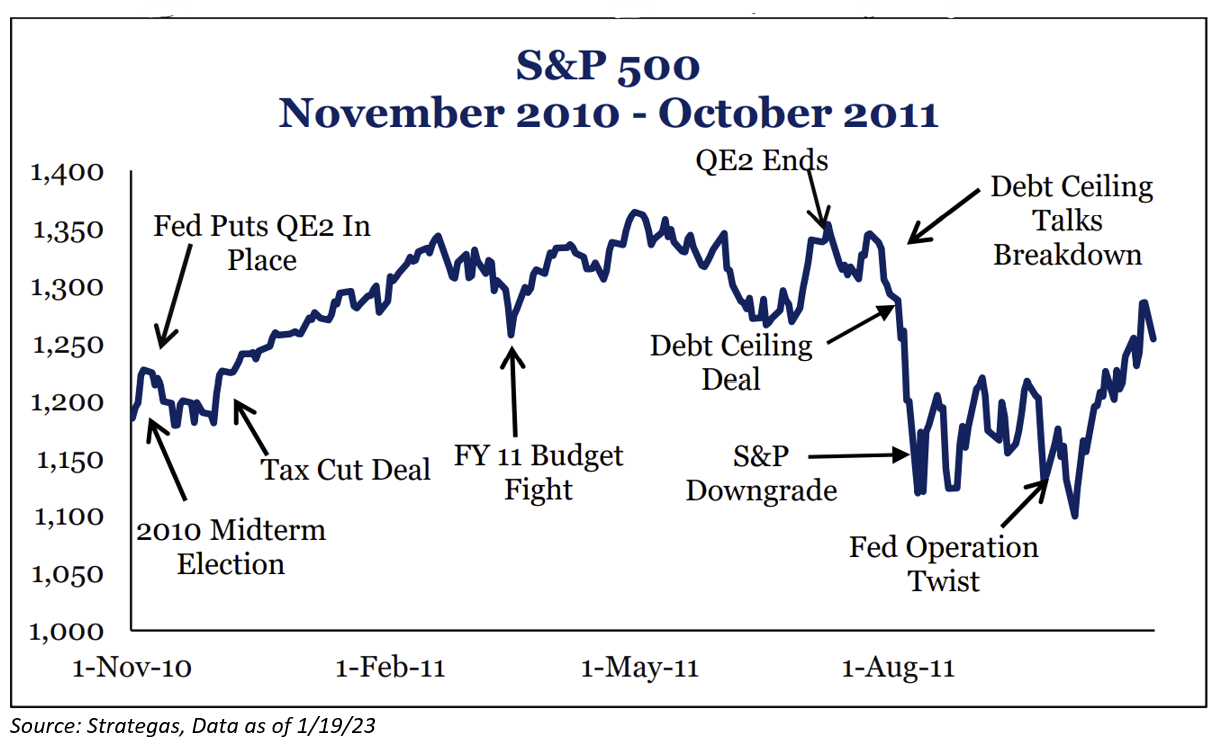

Essentially, the political environment in D.C. in ’11 is much like today – Dem. President / Dem. Senate / Rep. House and the Republicans could not get their own members on the same page regarding policy. Thus, the two parties had to immediately engage in budget trench warfare leading to a government shutdown at the end of Q1 and a debt crisis a few months later. Not only that, but the events were compounded by a series of other occurrences – a slowdown in corporate earnings and an economic crisis in Europe. Sound familiar?

The S&P 500 fell 20% during that summer. Though, unlike today, the Fed was able to provide a cushion to these fiscal policy shocks.

What the Republicans learned during this period is that the party will have more leverage to cut spending in ’23 if they do nothing during the lame duck session – which is exactly what happened.

What investors learned is that the process is just as important as the outcome in the short run.

Moving forward

U.S. Debt Ceiling: $31.4T

Current U.S. Debt: $31.4T

Originally, I thought that the extent to which fiscal brinksmanship poses a risk to investors in ‘23 would be largely determined by the progress made during the Congressional lame duck session – obviously that did not happen. With a divided government, budgets and debt ceiling deadlines are the limited tools available for Republicans to cut spending. No surprise, but Democrats are unlikely to go along with this process.

Enter stage left a series of fiscal cliffs and debt ceiling concerns = Deficit politics.

There are two large overhanging problems heading into this debate:

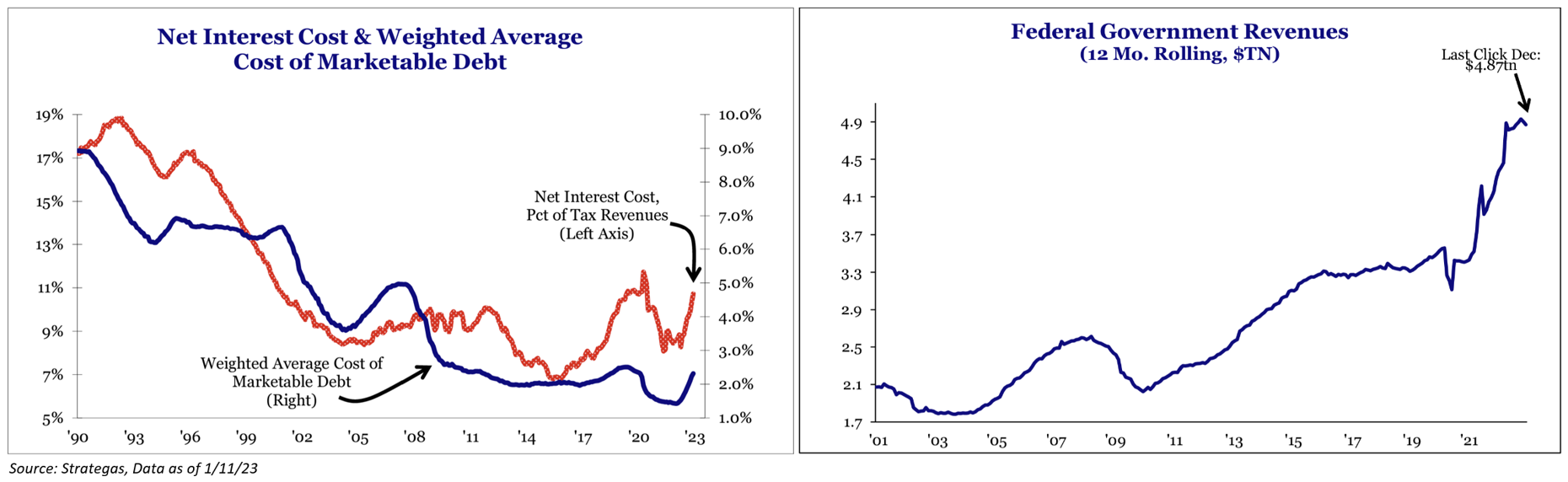

- Interest Rates: The U.S. needs to de-lever in the coming years – Interest costs are up 44% in the last three months and now represent the largest share of the US economy since 2000

- We have found that when net interest costs hit about 15% of tax revenues, financial markets have historically begun to impose discipline on policymakers. Today net interest costs are at 11% but will be close to 15% later this year.

- Tax Revenue: Tax revenues declined in December 2022 compared to the prior December by 6%, mostly driven by lower income taxes. December tax revenues are a good leading indicator that April tax revenues, the largest month of tax collections, will be down substantially.

What is the Timeline of the Debt Ceiling?

Once the debt ceiling is hit, the U.S. Treasury will have several months to move money around and give Congress time to act. This has been expected for July, but that timeline has been pulled forward because we are in a complete regime change on interest costs.

In a note to House Speaker Kevin McCarthy on Thursday Jan 19, Janet Yellen stated that the Treasury’s measures would last through June 5th, 2023. But, as many of y’all could figure – these extraordinary measures taken by the Treasury are subject to “considerable uncertainty”.

A Few Things Investors Should Know (Big Shout out to our Partners at Strategas for their help on this):

- Default v. No Default: The debt ceiling issue is important for financial markets because if the debt ceiling is not raised, Treasury will not be able to issue net new debt when the limit is reached. Rating agencies and political commentators will refer to this as leading to a default, or at least a technical default, as Treasury cannot pay its full obligations on time. We find this debate to be less useful because the US has more than enough cash flow to ensure that interest payments are made. As such, even under the most extreme circumstances, default is unlikely. However, other discretionary spending programs will likely not receive funding and rating agencies may refer to this as a technical default. There will also be times when large interest payments need to be made and the US government will not have enough cash flow to make all of its payments, leading to a squeeze.

- The Process is Just as Important as the Outcome: We believe the debt ceiling will be raised. We also think default is unlikely. But we have learned that the process is just as important as the outcome. We are headed for a fairly toxic debate over the debt ceiling. In early August a deal was reached to raise the debt ceiling. But stocks got pummeled in the process as the market had to re-rate political uncertainty and future political risks.

- Monetary Policy and the Debt Ceiling: In 2011, the Fed ended QE2 on July 1st. Then we had the debt ceiling fight in July. We went from really easy monetary and fiscal policy to tight monetary and fiscal policy in a matter of weeks while Europe was blowing up. It’s no wonder that stocks fell 20% quickly. Equities began to recover when the Fed announced it would do Operation Twist as fiscal policy struggled. Bernanke also pushed QE3 in fear that Congress would not be able to come to a decision on the expiring Bush tax cuts, leading to a large fiscal contraction. The read through from this is that if Congress screws up the debt ceiling, it may force the Fed back into the game. That’s harder to do with elevated inflation. But the Fed does not move until a crisis approaches and is usually forced back reluctantly. The Fed’s tools are more powerful than fiscal policy, all else being equal.

Ultimately, we know that the U.S. is going to come to a resolution – it’s like myself in 8th grade waiting until 11:59PM to start working on a book report, but it will ultimately get completed. The process in which the debt ceiling is raised is just as important as raising it itself.

This should create an overhang in the market over the next few months. The only thing I’m more certain about is that the political uncertainty can definitely lead to market volatility.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2301-21.