Simply put, most market pundits were probably too pessimistic on the future earnings picture in the U.S. – at least for this quarter. I believe that corporate earnings surprised a lot of people – there was broad-based strength in the Mega-Caps, the most cyclical areas of the market, and even in the beaten down areas of the market (PYPL, UBER, etc.).

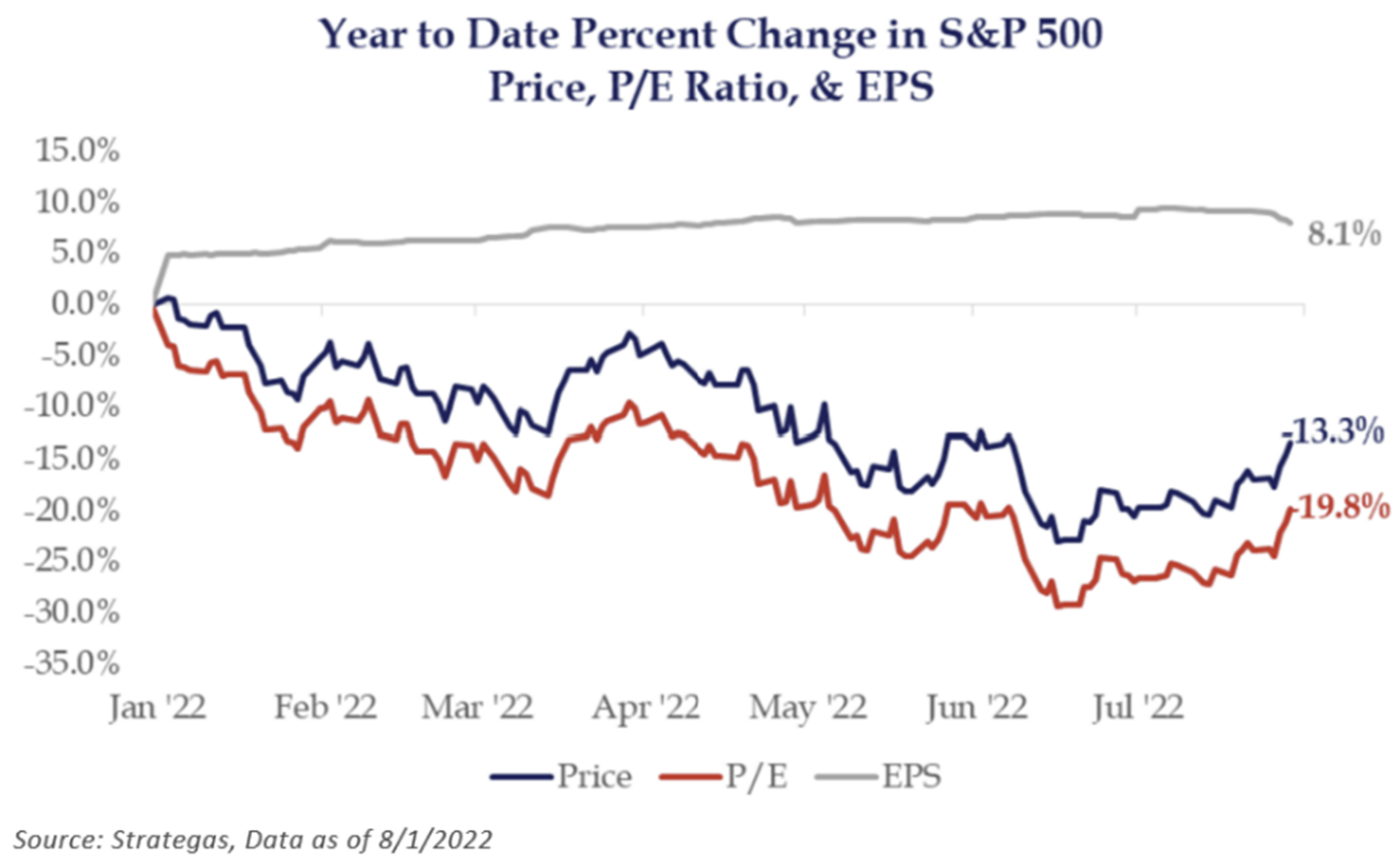

Overall, results were better than feared, especially with more above-consensus guidance than below, which was the biggest positive surprise. We believe that we are still in the very early innings of estimate cuts. As of week’s end, around 71% of the S&P 500 have reported. Q2 2022 EPS is tracking a solid 3% beat at $56.87 vs. consensus estimates at $55.35, while 2H EPS estimates have been revised down 2% since July 1. For the second quarter, S&P 500 earnings grew 7.7% year-over-year, while sales increased 12.1% à showing that inflation continues to drive revenue and earnings growth, but at a lower profitability threshold.

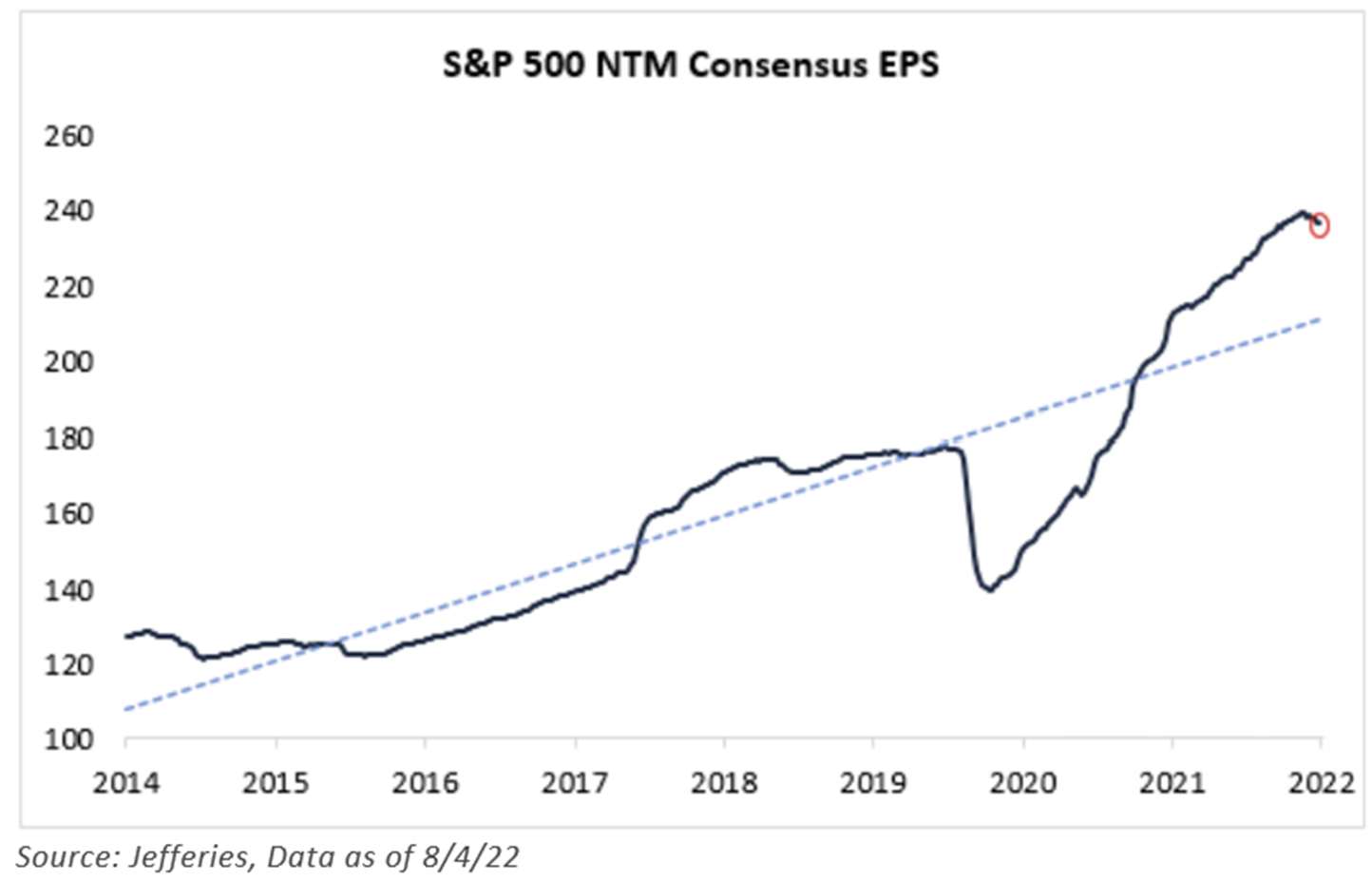

Consensus EPS for ‘23 is $245 (-2% from a peak estimate in June of $251). However, that $245 estimate still implies +8% YoY growth relative to ‘22 (while the 2022 estimate assumes robust growth relative to 2021 – the latter ’21 was aided by unprecedented fiscal stimulus and unusual WFH-related pull forward demand) – quite a remarkable annual CAGR. The picture below does a great job just showing how “above trend” we are relative to historical growth norms.

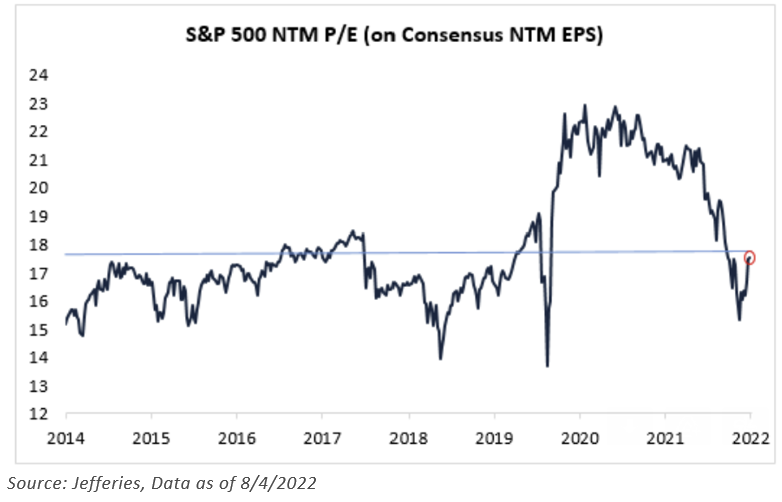

The market has rallied almost 14% since June 15th – we believe all this performance has been due to valuation expansion. The S&P 500’s valuation increased from 15.3x to 17.5x, while ’23 earnings have declined by 2%. Remember, the market’s valuation is a metric of investor sentiment.

As we stated to many of you, we have been focusing on management commentary. Our takeaway was that we saw corporate commentary that points to a softening in business conditions. Several companies discussed weakening demand, signs of consumers trading down to lower end products/services, and a problematic level of inventory build. The inventory build is one of the key reasons, outside of the stronger U.S. dollar, as to why real GDP has been negative over the last two quarters. Moreover, earnings revisions breadth has come down hard, but we haven’t seen forward earnings drop yet as the magnitude of earnings cuts has been modest. We expect cuts to ramp up as concerns around growth spread.

The bizarro land for us has been the relative difference between large-cap and small-cap earnings expectations. We already mentioned that S&P 500 earnings expectations have decreased 2% since July 1st to $245, but small-cap earnings have actually increased modestly. This is EXTREMELY UNUSUAL during times of slowdown as typically the higher operating and financial leverage of small-caps make earnings come down faster than large-caps.

Why is this happening? I’m not positive, but we believe that we are seeing the fingerprints of the negative impact from global exposure in index earnings. We suspect earnings expectations are decelerating faster outside the U.S. than inside, which hasn’t really occurred in at least the last 20 years, and so far, allowing small-cap earnings to hold up better than large-cap.

Lastly, I’d note that earnings in value indexes are holding up better than earnings in growth indexes, for what we suspect is the same reason (more global exposure in growth indexes).

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2208-12.