Over the past few months, many of you have heard us focus much of our market commentary around the perception of equity valuations – that U.S. stocks may not be as expensive as what many perceive, specifically relative to its history. The example that we’ve used is below:

Question: Which stock do you believe should warrant a higher valuation – all things considered equal (What the company does, its growth, etc.)?

- Stock A: 8% Profitability, or

- Stock B: 17% Profitability

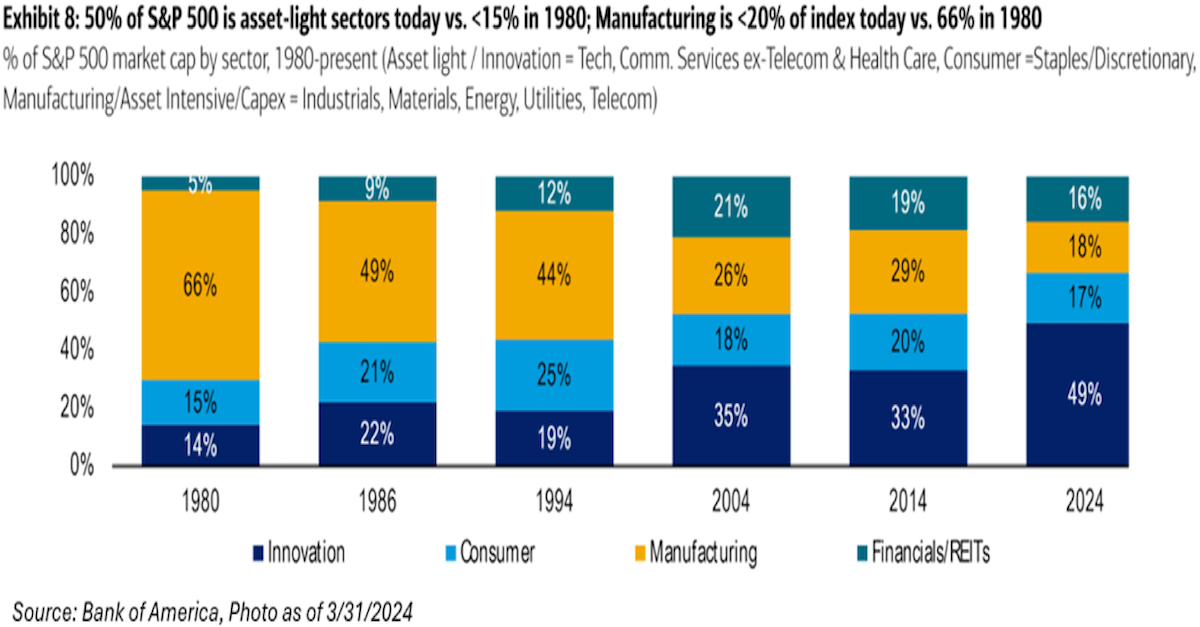

Answer: Most people would state that Stock B should warrant a higher valuation, all things considered. I would agree. This is a perfect example of the U.S. Market (i.e., S&P 500); why compare the valuation of the S&P 500 in 1980 (which had ~8% operating margin) to the S&P 500 of today (17% operating margin)? The only thing that someone should state is: of course, the S&P 500 should warrant a higher valuation today relative to the past, especially because its constituents are more asset-light (better profitability) and more innovative (higher LT Growth).

Let’s take this a step forward: now that we understand that the current market valuation may be more warranted, how do we need to think about this in relation to investing internationally vs. domestically?

I’ve continually said that historically speaking, international stocks have traded at an 8% discount relative to domestic stocks. More recently they’ve traded closer to a 30%-40% discount. What if lower re-rating occurred in international stocks, given the growth and margin differentials vs. U.S. stocks? Let’s try to answer that question; have international stocks been re-rated lower?

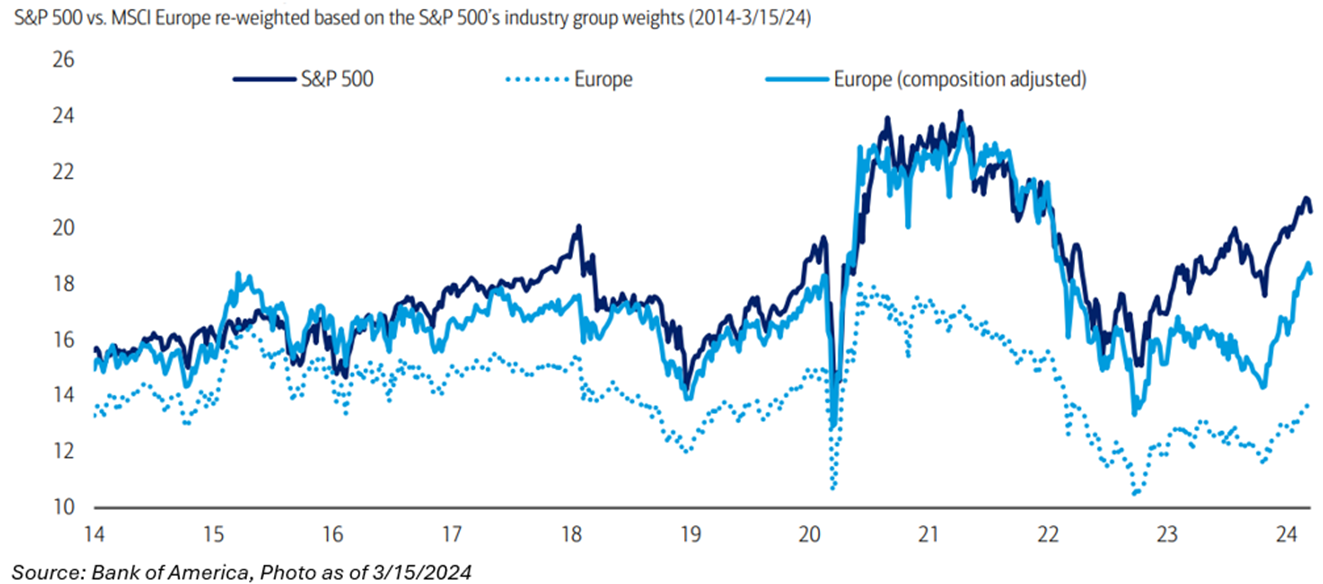

I believe at first glance; many could argue that U.S. stocks are very expensive vs. international stocks. It’s true that the S&P 500 trades at a valuation closer to 21x, while international trades at just 14x – a 50% premium. But, if we look at the underlying indices, it appears that the valuation discrepancy comes solely from compositional differences. As I mentioned above, the U.S. has more asset-light exposure, more tech exposure, higher profitability, and higher growth. This should warrant a higher valuation.

If you adjust the indices for these composition differences, the premium shrinks to just 12%.

Over the past 10 years, the S&P 500 has generated EPS growth of +7.3%, almost double the EPS growth of Europe (+3.8%). Not only that, but the U.S. has been able to generate this earnings growth with lower earnings volatility. The standard deviation of earnings growth in the U.S. was 8%, while it was 18% internationally. Said another way, the U.S. has had higher earnings growth with lower volatility.

Obviously, this is data looking through the rearview – it may change through the forward-looking windshield. Stay nimble.

So, Why Own International Stocks?

Just over a year ago, our Brad Rapking wrote a great piece, Why Own International? It highlights some of the differences, while sharing the merits of an international allocation and what it means to asset allocations. The bottom line, we feel the same way now that we did then:

Simply put, we think owning international equities helps to meet our mandate: to maximize risk-adjusted returns.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2404-20.