Update on Russia/Ukraine

Asset Allocation Implications:

How might the current geopolitical tension between Russia and Ukraine impact a client’s asset allocation? Yes; the simple answer would be that we’ve seen substantial volatility in the equity markets – that’s no surprise. More importantly, how does our asset allocations combat this type of risk? When you are long volatility and have some sort of insurance on a portfolio, nailing the exact geopolitical events isn’t important.

Having this insurance on the portfolio means that our asset allocations are prepared for anything, especially if it is an event that creates volatility in the market – much like we are currently witnessing. Meaning, none of us need to be geopolitical experts. I don’t think many analysts and experts expected Putin to go past the Donbas region and attack all of Ukraine – they did. I don’t think any experts expected that the Ukrainians would put up such a fight – they have.

More than ever, we believe we’re positioned for the unexpected. It allows us to not have to be perfect with all of our calls, because, at this point – no one knows what may happen – maybe only Putin, himself.

Market Implications:

Here is a reminder of what is at stake in Europe – specifically Germany – as to why the market is recognizing that higher energy prices could be a headwind to growth assumptions moving forward.

1. Roughly 1/3rd of European natural gas consumption and more than 1/4th of its crude imports are derived from Russia.

2. Russia is the source of 30% of crude oil supplies and more than 50% of Germany’s natural gas.

I’m going to steal from Jefferies Managing Director David Zervos’ March 1 commentary:

The war in Ukraine has added a set of complex geopolitical risks into the global macroeconomic outlook. And predicting what comes next with any degree of certainty, even for the most seasoned of foreign policy aficionados, is a near impossible task. Of course, that will not deter the “experts” from pontificating confidently about what comes next. To that end I am sure your inbox, like mine, is full of messages on the origins of, and the outlook for, this war in Ukraine. I have tried to go through many of them; and I have to say, after hours and hours of reading, I feel even more confused.

There could be escalation or de-escalation. There could be a complete destruction of Ukraine or an internal revolt against Putin by his own army and people. There could be serious financial market chaos from the sanctions, or the losses could be contained. There could be sharp rises in energy prices as the Russian supplies are withdrawn from global markets. Or prices may retreat as the US reopens shale and the Europeans temporarily pull back against their ESG goals. There could be an invasion of Taiwan as the Chinese see this as an opportune moment to act. Or the Chinese could see it in their interest to align with the West, as the sanction effects scare them. There could be silver linings, or there could be a bad moon rising.

Well, let me assure you, I am not going to make any claims about how this war will play out. I have no clue. I know when to stay in my lane, and war between Russia and Ukraine ain’t where I drive!!! Further, I am not going to send you links to the writings from a bunch of experts. To be perfectly honest, I think nobody knows what comes next, except maybe Putin.

With all that said, though, I am going to make two observations on the situation, which I think are relevant for financial markets. And in these specific instances I do believe I have at least some small edge in providing a view. The first is on the Fed reaction function. And the second is on the Ukrainian people more generally.

The Fed reaction function is not in an ideal place for those seeking protection from risk-off moves in 2022…. With inflation running this high, it’s going to take a fairly sizable risk-off move to get the Fed to repivot dovish, especially after a year where spoos (S&P 500) have just returned 25%!!! It’s not like normal times where a 10–15% correction brings a decent repricing in Fed action. It is difficult to seek reprieve in the Bond Market.

Let me now end with an observation on the Ukrainian people. I have been in Kiev close to 20 times in my life. I have spent 10 years of my life married to a Ukrainian woman. And I have many dear friends living in Ukraine. The Ukrainians are some of the smartest and toughest people I have ever met. They are fiercely proud of their culture and history. And most importantly, they see themselves as much more aligned with European values as opposed to those of Russia.

From what I have experienced personally, these folks will fight this battle for their future much more aggressively than many might have initially thought. To that point, I was not surprised one bit by Zelensky’s response when he was asked by US officials if he wanted to be evacuated from Kiev with his family a few days ago. For those who did not see his response it went something like — “I need ammunition, not a ride.” Legendary!!!

What Could Go Right for the Market

Let’s start with why stocks are down from a market functionality standpoint.

Stocks are down due to lower P/Es, not earnings – in fact, earnings growth was better-than-anticipated coming out of the Q4 2021 earnings season. P/E-led bear markets, i.e., fear and uncertainty, tend to see V-shaped rebounds. While stocks are down 11% already this year, the earnings backdrop has remained robust. Of course there are reasons to be concerned today given all of the current macro risks, and that’s why P/Es can decline. That said, they often rebound as quickly when the risks improve or investors just become numb to them (complacency). We believe that there are 5 macro themes, creating fear and uncertainty, that are weighing on stocks: rates, oil, The Fed, weaker PMI data, and CPI. An easing in any one of these could help stocks stabilize, i.e., a reason to be bullish.

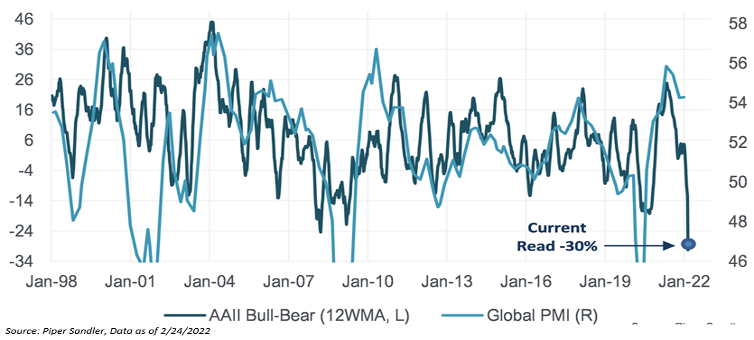

Right now, market sentiment is as bearish as ever. The market officially entered into a corrective phase last week and investor sentiment is as bearish as it was at the bottom of March 2009 and March 2020. Peak “bearishness” is actually a bullish indicator.

We get it – we are in an unprecedented market environment – it’s hard to think of a time where there were so many macro headwinds, but let’s highlight some things that could offer sentiment reprieve for investors. Now we’re not saying that we agree with all of these, as the market continues to be a fluid situation, but let’s attack each of those aforementioned macro factors depressing market sentiment and if they ease:

1. Fed Rate Hike Expectations Could Ease:

a) If the Fed follows through with as much tightening as the market expects, we believe that could invert the yield curve due to likely lower term premiums. However, the Fed may not hike as much as the market thinks. Geopolitical tensions point to higher inflation because of energy prices but also to slower growth, which central banks are sensitive to. Overall, we continue to think that the market is pricing in too much Fed action. Russia won’t delay liftoff but could limit the pace and total amount of Fed tightening over the next year or two. Historically speaking, the market and the Fed have always overpromised on rate hikes.

b) If the Fed does ease rate hiking expectations, it could be a positive to multiple expansion.

2. Declining Inflation Data:

a) Yes; inflation is at the highest level since the Volker-era. We believe that there are a few reasons as to why the CPI could decline throughout 2022:

1) Weakening demand for retail goods

2) Increasing supplies of retail and manufacturing goods

3) Increasing labor supply, and

4) Slowing unit Labor Costs. And of course, an overall more efficient supply chain. An easing of inflation could help the S&P 500’s P/E rebound.

3. Economic Growth (PMIs) Could See a Bounce:

Much like after the original re-opening time period and the post-Delta environment, we believe that PMIs could see a Post-Omicron bounce – this was apparent in both the U.S. and Europe with the most recent Flash PMIs. Couple this with the U.S. entering into a capital expenditures cycle, as many companies’ update their infrastructure, can potentially keep PMIs above their “Mendoza Line” of 50. We understand that current level PMIs are not sustainable and should remain in a downward trajectory, but a bounce in PMIs, even if its short-lived, could help the S&P 500’s P/E rebound.

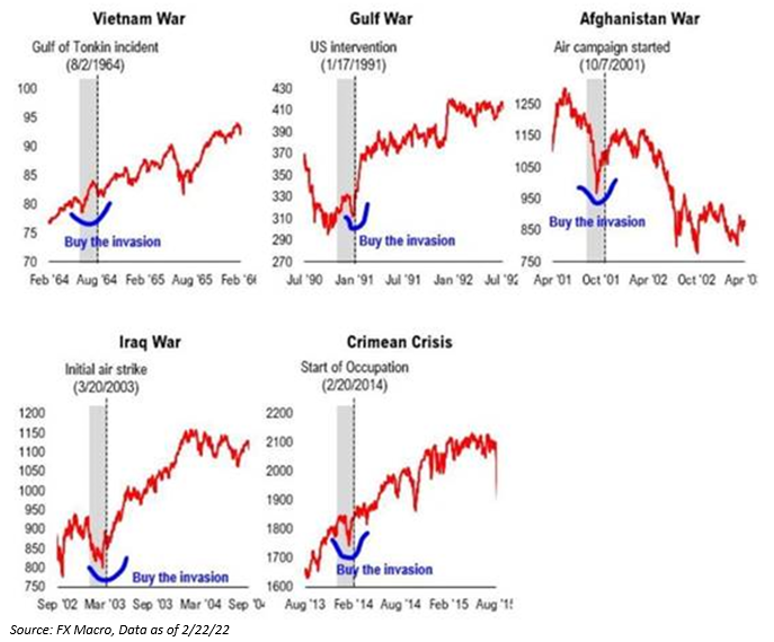

That said, major crises of the past saw short-term sell offs that were all great buying opportunities – “Buy the Invasion”.

Disclosures

The opinions expressed are those of Aptus’s Investment Team. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Forward looking statements cannot be guaranteed.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.

Material presented has been derived from sources considered to be reliable, but the accuracy and completeness cannot be guaranteed.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2203-2