Let the March Madness begin!

As you may know, Aptus has six (6) employees that played D-1 College Basketball at UNC Wilmington, UA-Huntsville, and Wright State. The latter of the group is the only one to make the tournament this year and will be playing Wednesday night just 15 minutes from their campus at Dayton University.

So this may be our team’s favorite part of the year.

D1 Basketball Players

UNC Wilmington: JD, John Goldsberry, Beckham Wyrick, and Joe King

Wright State: JD and Billy Graham

UA Huntsville: Will Gardner

Will the FOMC Invert the Yield Curve?

The markets are likely to turn their focus back toward the Fed this week as it begins its first tightening of this cycle following a period of the most accommodative monetary support ever provided. In our view, there is no better measure of Fed policy than the front end of the curve adjusted for QE and inflation. Based on this simple measure, the Fed has a lot of wood to chop if they are serious about removing the punch bowl.

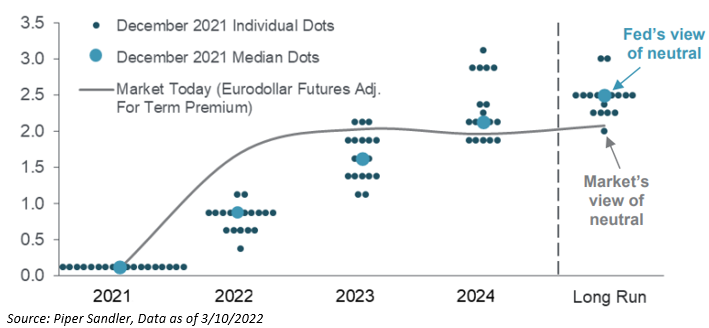

Wednesday’s meeting will provide investors with: a statement, a forecast, and a dot plot. We know that the Fed will raise rates by 25bps, but the big questions is: what will the Fed signal about the future? We know that the dots are poor predictors of what the Fed will ultimately do, but the market will pay a lot of attention to them. We believe that the new dots will indicate tightening up to, but not above, neutral, a.k.a., the Fed’s long-run target. However, there is a risk that they will turn out higher than that. If that occurs, it would be a very hawkish signal. In that case, the yield curve could invert within weeks or months, and the “R” word would be in everybody’s head.

The above chart shows that, in December, the FOMC signaled three (3) hikes in 2022 and three (3) in 2023. Thus, given that the market is currently pricing in 8 hikes over the next year and recent inflation data, there is little doubt that the median dots will move up during this meeting. The question is –“how high”.

Why Has the Yield Curve Been Inverting?

Simple –it has to do with growing concerns of future growth and Fed hiking expectations. The short-end (2YR) of the curve has been moving in tandem with higher expectations of Fed rate hikes, i.e., up. The longer-end (10YR) has been moving alongside future growth expectations, i.e., down. Thus, the “10-2” spread has declined from ~155bps in March 2021 to its current level of 29bps.

More importantly, has the yield curve been manipulated by the current geopolitical crisis in Ukraine? I would say no.

Effectively, Russia/Ukraine is only pulling forward the natural slowing in the economy that would have occurred as the Fed tightened policy. Think of it this way: without Russia/Ukraine, the Fed hikes rates and slows the economy to the point where 10s-2s would have inverted in the coming months. But Russia/Ukraine now has placed an additional headwind on growth via exploding commodity prices, so the looming rate hikes (which are still coming) will combine with the growth slowing impulse of higher commodity prices and higher inflation to bring a sooner than previously expected slowing of growth—and that’s why the 10s-2s spread is dropping.

We think the FOMC intends to raise rates again at the next meeting in May and the following one in June. At that point, they will probably reassess the situation based on information available then, and the pace of tightening could slow or accelerate depending on the data received over the next few months. Considering all the risks and uncertainties, we remain inclined to take the under with respect to current market expectations for almost eight (8) 25-bp hikes this year.

The forecast for inflation will remain front and center. The forecast is conditional on the rate hikes that the FOMC will pencil in, and if it rose too much it would beg the question of why the FOMC didn’t factor in even more tightening. But a 2021 forecast in the 3% range combined with dots that do not rise above neutral would be a sign that the FOMC intends to hedge its bets and tolerate higher-than-target inflation for a time in the name of not wrecking the economy.

Conclusion

With the forward Treasury curve now expecting eight (8) 25bp hikes over the next year and a decent reduction of the Fed’s balance sheet, will back-end rates move much higher in the near term given the rising risk of a growth deceleration amid the Russia/Ukraine conflict? This environment is creating a flattening yield curve. Theyield curve tends to be many investors’ North Star when it comes to indications of a looming recession. The message of the U.S. yield curve (flattening but not inverted) still seems to be that a soft landing is possible. But this is getting more tenuous. That’s why investors are focusing on the FOMC’s commentary regarding future policy, in light of recent developments.

We remain vigilant.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through AptusCapital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2203-15.