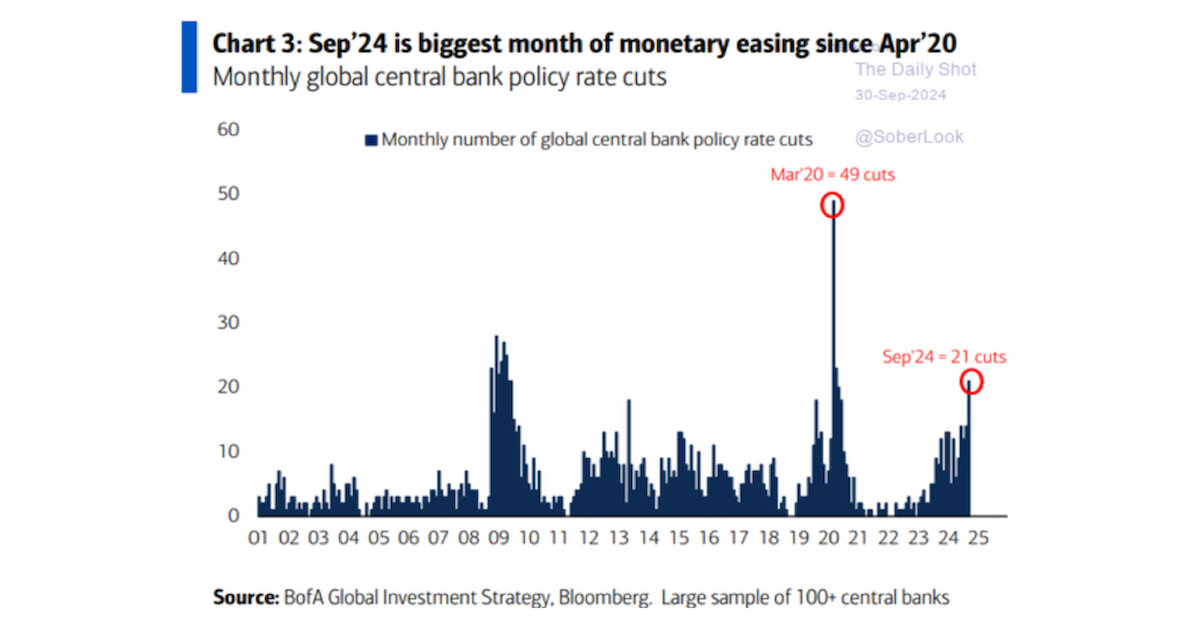

The Fed cut 50bps in September and expects more rate cuts to come. They are not alone as central banks around the world are cutting rates. September saw the most rate cuts since 2020.

JL digs further into the Fed’s positioning in a great post last week: The Fed’s Recalibration.

With two full percentage points rates expected from the Fed by the end of 2025, what could a pickup in global liquidity mean for investors?

I know there are different angles and counters to this perspective, but the reality in rising liquidity (cheaper money and expanding money supply) is the destruction in value of currency. Don’t believe me?

What a Difference 4 Years Makes

This caught my attention, from Bankrate as of January 2024:

A combination of high mortgage rates, rising home prices and low housing inventory over the last two years is pushing homeownership further out of reach for would-be homeowners, especially first-timers. To afford a median-priced home of $402,343, Americans need an annual income of $110,871, according to a new Bankrate analysis. That’s nearly a 50 percent increase in just the last four years.

Just a bit higher than government inflation estimates…seems like shelter is a key piece of many family budgets?

Beating the Same Drum

These posts will take less than 10 minutes collectively to read; please revisit these:

With our debt load and our deficit spend, I believe we are on the verge of money creation that dwarfs things of the past. As I’ve said…we either have a debt crisis in the future or a money printer that turns on.

Which do you think is more likely?

There’s no doom and gloom in this note, just the recognition that the real risk investors face isn’t drawdown but protecting the purchasing power of their wealth.

Our solution is and will continue to be… convexity. Portfolios should own hedges that provide convex payoffs that do 2 things:

- Allows for a known correlation that helps protect against drawdown

- Provides the ability to onboard more equity risk…confidently because of #1

Closing

In investing, the most important decision is asset allocation. My convictions grow by the day that for investors to preserve and improve wealth, they need to truly understand what is safe and what isn’t.

More stocks, less bonds. We will continue to build solutions and portfolios to deliver on this message. In my opinion, we are providing a path out of the traditional mindset of what is safe and how can I accomplish safety.

We believe our deficit spend is a decent gauge of a hurdle rate (6-8% annually) your clients’ money needs to eclipse to preserve and hopefully improve financial position. If stocks, bonds, or cash are my allocation decisions…I know which one gives us the best chance.

We want to be the premier options-based provider and our numbers, growing track record, and innovation in the space are helping the cause.

As always, thank you for your trust.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2410-3.