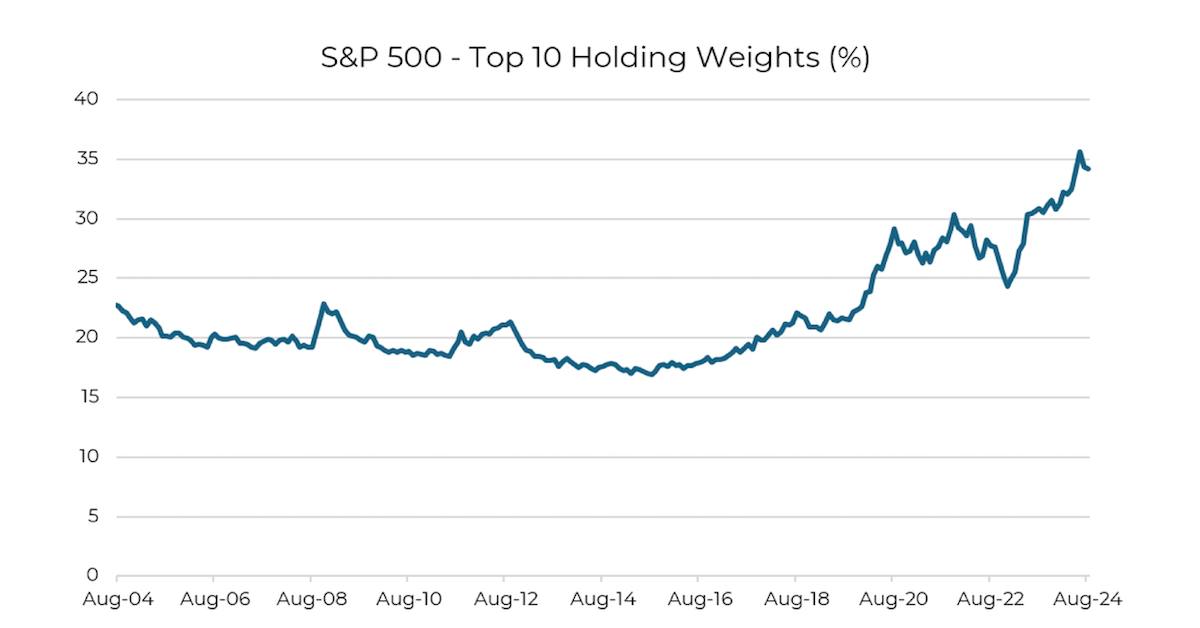

In today’s market, it’s hard to ignore how much power the largest companies hold within the S&P 500. These massive companies have grown to represent the highest concentration of weight in the index we’ve ever seen, and they’re valued at a higher multiple as compared to the rest of the market.

Source: S&P as of 08.31.2024

Source: S&P as of 08.31.2024

For many investors, this raises a natural question: is there a better way to diversify and find value elsewhere?

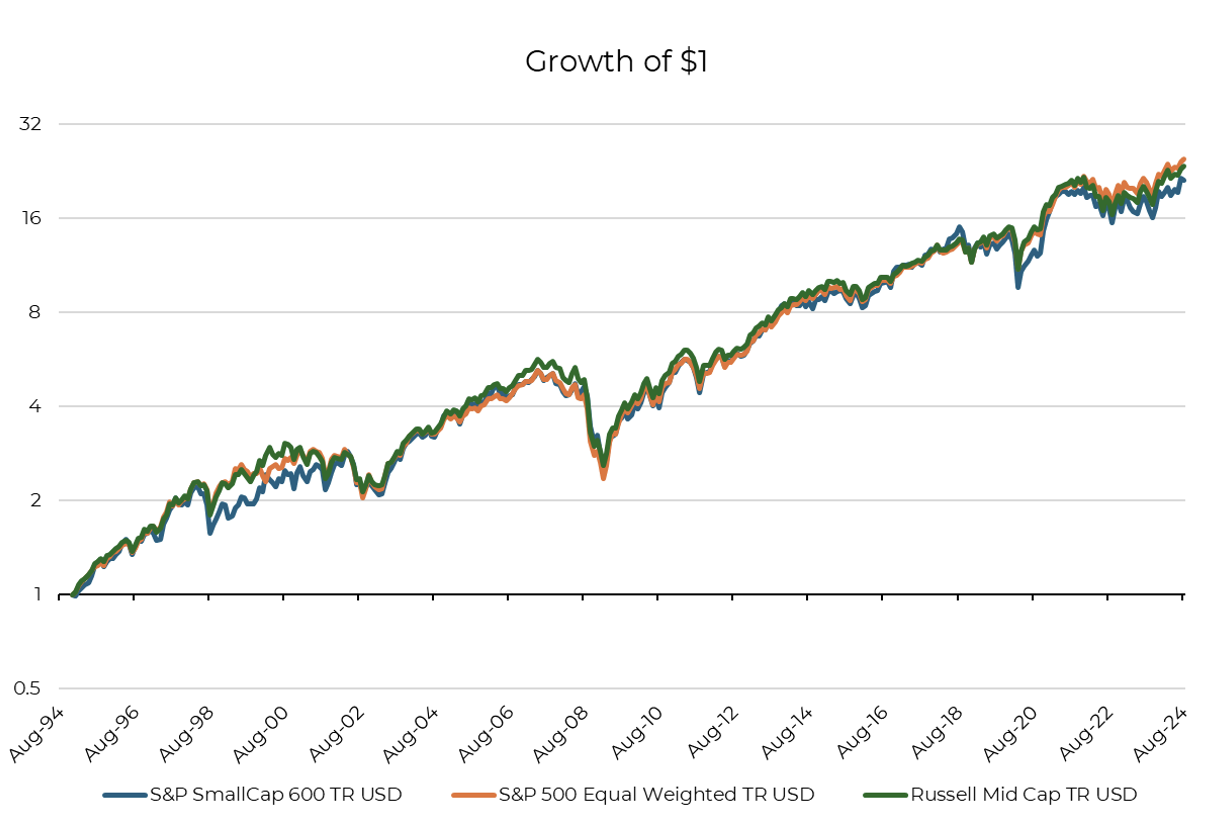

One popular response has been to move away from traditional market-cap weighted indices that hold these companies at record weights, turning to alternatives such as the S&P 500 Equal Weighted Index. Others have opted to diversify further into mid-cap stocks with an allocation to an index such as the Russell Mid-Cap Index. Yet another popular choice has been for investors to venture into small caps through an allocation to an index like the S&P 600 Index. The logic here makes sense—these indices range from large to small, so are likely to ebb and flow differently creating a diversified alternative. Right?

The Problem: Similar Factors, Similar Results

The reality is that, while these indices might appear to offer diverse returns, they aren’t as different as you might think. Since the inception of the S&P 600 Index 30 years ago, these three indices have moved in nearly perfect alignment with one another. A chart showing their performance over time reveals just how closely they track each other, raising an important question: Are you truly diversified by these allocations, or is there a better way?

Source: S&P Russell August 1994 – August 2024

Source: S&P Russell August 1994 – August 2024

What’s the Solution?

If the goal is to reduce the downside risk of exposure to the largest companies in the world, while maintaining an equity allocation, any of the three should work well. However, if the goal is to build diversified equity exposure the answer may lie in taking a more thoughtful approach.

The issue with the S&P 600 is its main benefit. It screens out companies that do not yet have earnings, which has led to strong excess performance compared to the Russell 2000 Index, which does not screen this way. But by doing so, it tends to also screen out the smallest companies, the ones that differ in their return and fundamental profiles from more established mid-cap (and smaller large-cap exposure within the equal weight index) companies.

Instead of focusing purely on size, investors could seek factor-based screens that emphasize attributes like quality, value, or momentum that would shift exposure away from overvalued companies, irrespective of size. These factors have historically offered differentiated performance and can provide more targeted exposure.

For those explicitly concerned about the downside risk of overexposure to the largest companies, hedged equity products can also offer a solution. These strategies are designed to outperform during market downturns by protecting against losses. By incorporating hedged equity into a portfolio, investors can improve their resilience during times of market stress while still maintaining a level of equity exposure.

The Takeaway

The common thinking around diversification has long been to allocate across different size indices, but that may not be enough to achieve true portfolio diversification. Instead, investors should consider more innovative approaches, such as factor screens and hedged equity products, to truly separate from market-cap driven large cap peers. These alternative methods can help create a portfolio that is better positioned to navigate volatility, capture upside, and protect against downside risks. In the end, it’s about finding smarter ways to allocate—not just more ways to replicate.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2410-13.