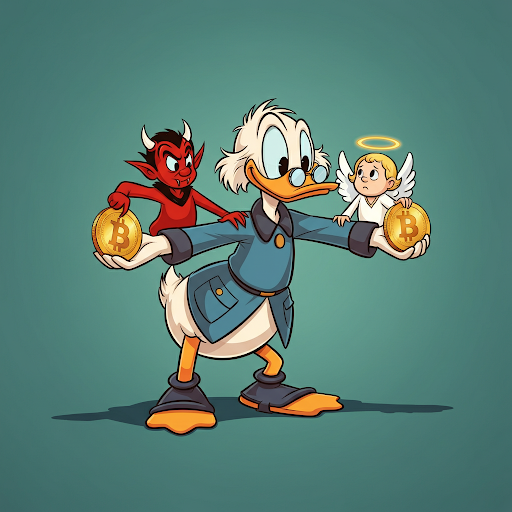

Bitcoin remains one of the most polarizing topics in finance. On one side, crypto enthusiasts celebrate its revolutionary potential; on the other, fundamental analysts caution against its speculative nature. Let’s step into a hypothetical debate between a Crypto Bull and a Fundamental Analyst to explore its role in wealth creation, transfer, and portfolio construction.

Strategic Diversifier vs. Risk Enhancer

Crypto Bull: “Bitcoin is the future of money. Its decentralized nature, limited supply, and independence from traditional financial systems make it an unparalleled asset in today’s world. It’s digital gold, a hedge against inflation, and an incredible diversifier for any portfolio.”

Mr. Fundamentals: “Digital gold? Let’s not confuse scarcity with utility. Gold has thousands of years of history as a store of value, but Bitcoin’s value depends entirely on sentiment and speculation. It doesn’t generate cash flows, improve productivity, or create economic output. It’s not an asset—it’s a bet on demand staying strong.”

Crypto Bull: “Sure, Bitcoin isn’t tied to fundamentals, but that’s what makes it unique. It’s uncorrelated with stocks and bonds, which are increasingly synchronized and impacted by underlying economic conditions. Adding Bitcoin to a portfolio reduces systemic risk by providing exposure to a completely different set of drivers—momentum and sentiment, not economic fundamentals.”

Mr. Fundamentals: “Uncorrelated doesn’t mean unproblematic. Bitcoin’s price movements are wildly unpredictable. What happens when momentum fades? Investors who think they’re diversifying may find they’ve just introduced massive volatility. You call it a hedge; I call it a risk enhancer.”

Crypto Bull: “But isn’t volatility the point from an asset class perspective? High volatility isn’t inherently bad. Small allocations of Bitcoin can generate outsized returns, creating meaningful portfolio impact without excessive risk to the overall strategy. It’s all about understanding how to manage its volatility.”

Mr. Fundamentals: “And when the bubble bursts? Bitcoin’s volatility cuts both ways. Early adopters profit, while latecomers hold the bag. It’s not wealth creation—it’s wealth transfer. Economic growth comes from producing goods and services, not from bidding up digital tokens. Bitcoin adds no real value to the economy.”

Crypto Bull: “You’re focusing too much on societal wealth. For individual investors, Bitcoin’s momentum and sentiment-driven price movements are opportunities. Yes, it’s speculative, but that doesn’t mean it’s not strategic. It can enhance returns and complement traditional assets in small, thoughtful allocations.”

Mr. Fundamentals: “Speculation is not a strategy. Bitcoin’s value is entirely dependent on more buyers entering the market. That’s the hallmark of a zero-sum game. Real wealth comes from investments that drive innovation or efficiency—not from hoping others will pay more for the same asset tomorrow.”

Crypto Bull: “Even if it’s not driving economic growth, it doesn’t mean Bitcoin has no place in a portfolio. Its lack of correlation with traditional assets, combined with its high upside potential, makes it a powerful tool for managing risk and return. You just need to understand its role.”

Mr. Fundamentals: “I’ll give you that—it has a role. But it’s a speculative one, not a foundational one. For every investor who manages the risks well, there are many more who overextend themselves, thinking Bitcoin is a sure thing. That kind of volatility demands respect, not blind enthusiasm.”

The Bottom Line

Bitcoin may not create wealth in the traditional sense—its value is driven by demand, not productivity. However, for individual investors, it can serve as a strategic diversifier when approached with caution. The Crypto Bull sees Bitcoin as a tool for opportunity and diversification, while Mr. Fundamentals views it as a high-risk bet on speculative sentiment. The truth lies somewhere in between: Bitcoin can complement a portfolio, but only when its risks and limitations are fully understood.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2412-9.