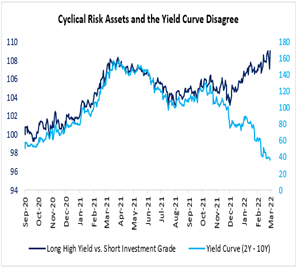

Current Rates & the Curve: The Ukraine-Russia War captured investors’ attention as the 10-year US Treasury traded in a ~30 bps range since last week. The yield of 2.00% quickly became a sub-1.70% as the market digested the ever-changing geopolitical risks. Currently, the 10-year UST is 1.86% but is still in a price discovery mode. This past week, the 5-year UST has traded a 40bps range, 1.91% to 1.52%, and currently sits at 1.75%. Despite the robust volatility in interest rates, the curve appears committed to remaining flat, as the spread between the 2 and 10-year US Treasury remained below 40 bps (currently 32 bps). Even with the market volatility, high yield remains well bid.

Source: Jefferies, as of 03.01.2022

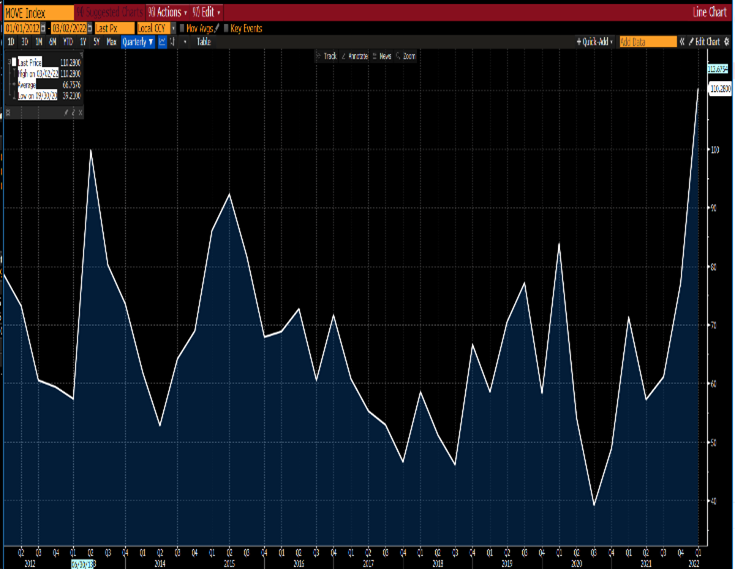

Bond Market Volatility Remains High: The calls for two rate hikes in March faded to a more dovish one rate hike expectation. Opinions diverge of the Fed’s overnight rate direction following the March meeting, with some primaries sticking with a 2% year-end projection – the futures curve forecasts a 125 to 150 bps range. Bond Volatility is at the highest level in over a decade, aside from the immediate reaction to the COVID-19 Pandemic. The MOVE index (interest rate volatility index) is at 110, which it has only reached three times since 2012-Taper Tantrum and COVID Pandemic.

Source: Bloomberg, as of 03.01.2022

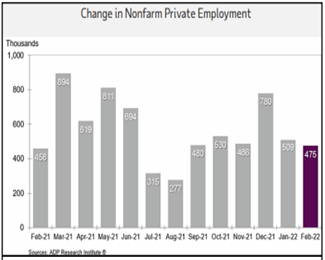

All Eyes on the Fed… Is a Rate Hike Cycle Beginning? In the end, what the Fed will do in March and beyond? We believe that it solely depends on inflation and labor market data. In that regard, we will pay particular attention to the employment report on March 4, and the CPI release on March 10. The FOMC meeting is on March 16. The market is pricing in a 25bps hike. A hot job number (>500k) along with lofty wage data (>5.4% YoY) on top of a big inflation print next week could force the Fed’s hand in hiking faster over the next couple months, even with the issues going on in Eastern Europe.

Source: ADP, as of 03.01.2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2203-7.