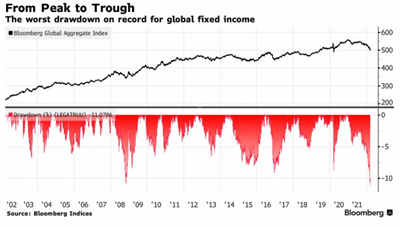

* Bonds… A Rough Stretch: The Bloomberg Global Aggregate Index, a benchmark for government and corporate debt, has fallen 11% from a high in early 2021. That’s the biggest decline from a peak in data stretching back to 1990, surpassing a 10.8% drawdown during the financial crisis in 2008. Another fun fact: Bonds are actually underperforming stocks for the year by about 75bps (AGG – 6.00% & SPY -5.25% as of 3/24/22).

Source: Bloomberg LP as of 3/24/2022

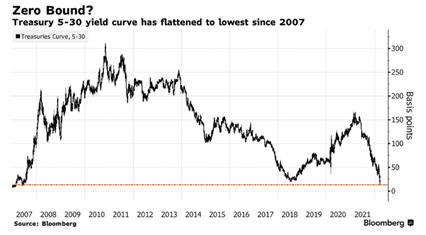

* Current Rates & the Curve: The FOMC Minutes and Chairman Powell’s Press Conference last Wednesday did not set off the fireworks, but this week’s Fed Speaking Circuit has lit a fuse. President Bullard set the tone early Monday morning by calling for 275 bps in rate hikes this year. Chairman Powell’s comments later in the day echoed the hawkish tone, and away we went. The 10-year US Treasury is just above 2.35%, and the curve is flat to slightly inverted between the 3-year and 10-year tenors. The 2-year UST continues its march towards inversion, it currently stands at 2.14%. The yield curve is flat as a pancake. 5 – 30-year spreads are also approaching 0bps. While a yield curve inversion doesn’t ALWAYS signify a recession, it’s reasonable to believe Powell and team will try to avoid it considering its past track record of predicting a recession as well as the visual it sends to Wall Street.

Source: Bloomberg LP as of 3/24/2022

* Well Yields Have Risen, Is It Time to Buy Bonds?! What this boils down to is it is very unclear if the risk-reward is in one’s favor to own bonds here. We’ve not had a situation like this since the 1970s so using history, and recent history that inflation is transitory, as a guide leads me to conclude we would NOT be putting new money to work in any long duration, fixed assets. The bottom line is where is the better risk-reward? We don’t know how the inflation path plays out and to be long duration in a rising inflationary environment with negative real yields is just a bet on capital gains. On top of that, if yields move higher but inflation also continues its ramp, you won’t get the risk parity hedge you are hoping for – the magic seltzer that bonds have provided to portfolios the last 40 year where bonds hedge against stock mkt volatility while providing reasonable returns. We don’t believe this will work in inflationary periods.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The 2 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 2 year.

The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the “risk free” rate when valuing the markets or an individual security.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-eight local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2203-21.