Investors are always looking for ways to enhance returns, such as seeking alternatives that can provide higher yields without excessive risk. Traditional high-yield bonds can offer attractive yields and potential returns but come with significant volatility and potential for losses. This post delves into factors driving high-yield performance to see the current opportunity, and how we might create a simple (yet improved) alternative driven by those same factors.

The Appeal and Pitfalls of Traditional High-Yield

High-yield bonds, often referred to as junk bonds, have been a staple for investors seeking higher returns than high-quality bonds. These bonds, issued by companies with lower credit ratings, offer higher interest rates to compensate for the increased risk. However, the quest for higher yields through junk bonds is fraught with challenges. The primary issues include:

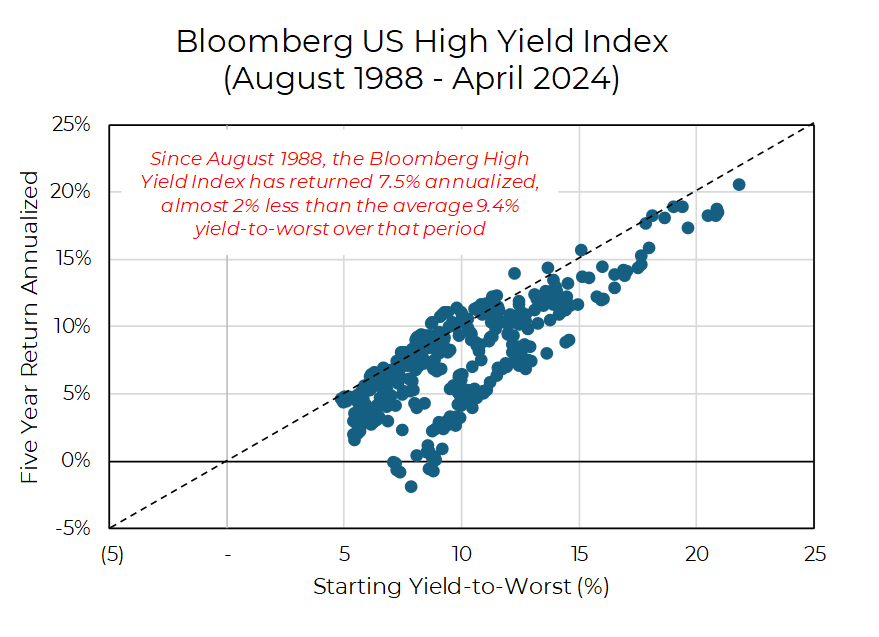

- Credit Risk: High-yield bonds are more susceptible to default, especially during economic downturns, meaning the yield of a high-yield bond should be considered its best case (not likely) long-term return.

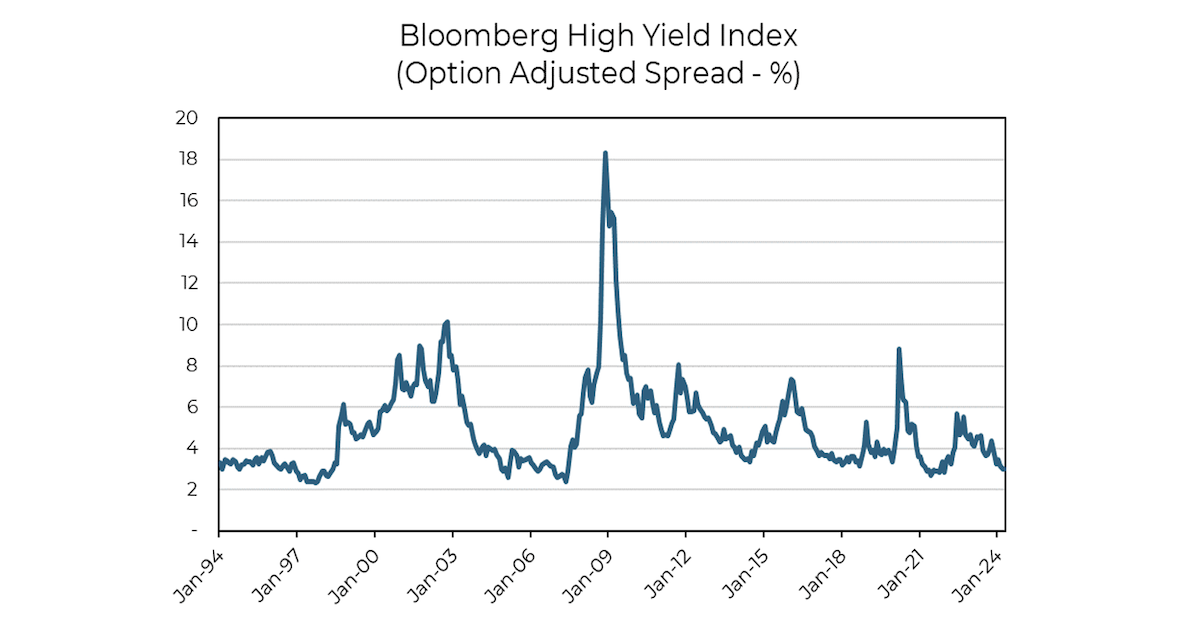

- Varied Incremental Yield (i.e. Spread): Current spreads of high-yield bonds are near record low levels, meaning investors are compensated less than typical for taking on this risk.

- High Correlation to Risk Assets: The high-yield bond market can be extremely volatile, reacting sharply to changes in interest rates, economic conditions, and market sentiment in a similar manner as equities.

- Liquidity Concerns: Junk bonds are generally less liquid than investment-grade bonds. In times of market stress, finding buyers can become difficult, leading to wider bid-ask spreads and increased transaction costs.

Source: Bloomberg as of 04.30.2024

The Case Against High-Yield Investments

When analyzing historical returns, it becomes evident that traditional high-yield bonds are unlikely to provide a return that consistently matches the yield offered. At a current spread to Treasuries of just above 3%, history suggests they may not outperform higher-grade bonds.

Source: Bloomberg as of 04.30.2024

Source: Bloomberg as of 04.30.2024

An Improved High-Yield Alternative: Decomposing and Recomposing Risks

Given the current opportunity and risks embedded within traditional high-yield investments, investors may prefer an alternative that can provide similar (but better?) exposure. One innovative approach is to decompose and recompose the major risks inherent in high-yield bonds using a combination of stocks (as an alternative to the spread) and higher-quality bonds, such as Treasuries (as an alternative to the interest rate exposure).

We believe this approach offers several advantages:

- Decomposition of High-Yield Exposures: By breaking down the major risks in high-yield bonds—credit risk and interest rate risk—investors can address each component separately. Stocks can be used to capture the risk premium associated with economic growth, while higher-quality bonds like Treasuries can provide stability and interest rate risk management.

- Recomposition of High Yield Using These Better Ingredients: Combining stocks and higher-quality bonds allows investors to recompose their portfolios in a way that maintains the potential for high returns, with the potential to improve the risk profile and increase liquidity. Stocks historically have offered growth potential and higher returns, while Treasuries provide a safe haven and liquidity during market volatility.

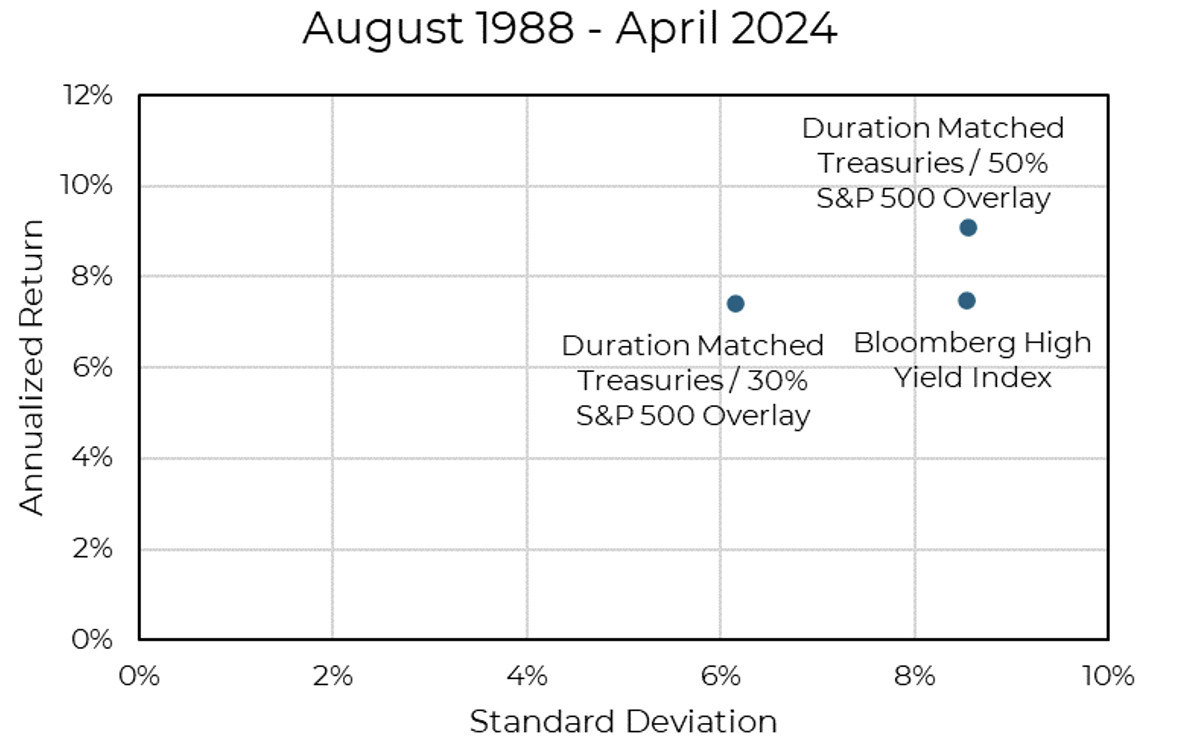

The chart below shows the historical return and risk of an allocation to the Bloomberg High Yield Index, alongside two return series that combine Treasuries (with a similar duration as the Bloomberg High Yield Index) with an overlay of S&P 500 returns at various notional values.

A 30% notional allocation to an S&P 500 overlay would have achieved a similar return to the Bloomberg High Yield Index but with lower risk. Meanwhile, a 50% notional allocation to an S&P 500 overlay would have produced a similar risk profile to the Bloomberg High Yield Index, but with higher returns.

Source: Bloomberg, Aptus as of 04.30.2024

Source: Bloomberg, Aptus as of 04.30.2024

Conclusion

In our opinion, investors seeking higher yields should consider alternatives prioritizing quality and strategic risk management over traditional high-yield bonds. By decomposing the major risks associated with high-yield bonds and recomposing their portfolios with a combination of stocks and higher-quality bonds, such as Treasuries, investors can achieve attractive returns with more controlled risk. This improved high-yield alternative offers a balanced approach to generating income while managing the inherent risks of the bond market, highlighting the lack of need to allocate directly to high yield in an unattractive market environment.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2405-22.