Markets at Highs: A Pathway, Not Obstacle, to Strong Market Returns

The recent resurgence of global stocks, with many (especially those within the United States) edging closer to new all-time highs, has sparked apprehension among some investors. However, contrary to common concerns, approaching or hitting new all-time highs in the equity markets may not be the harbinger of impending downturns that some perceive. In fact, historical data reveals an intriguing trend: stock markets around the globe have generally exhibited stronger performance and lower risk when scaling new heights.

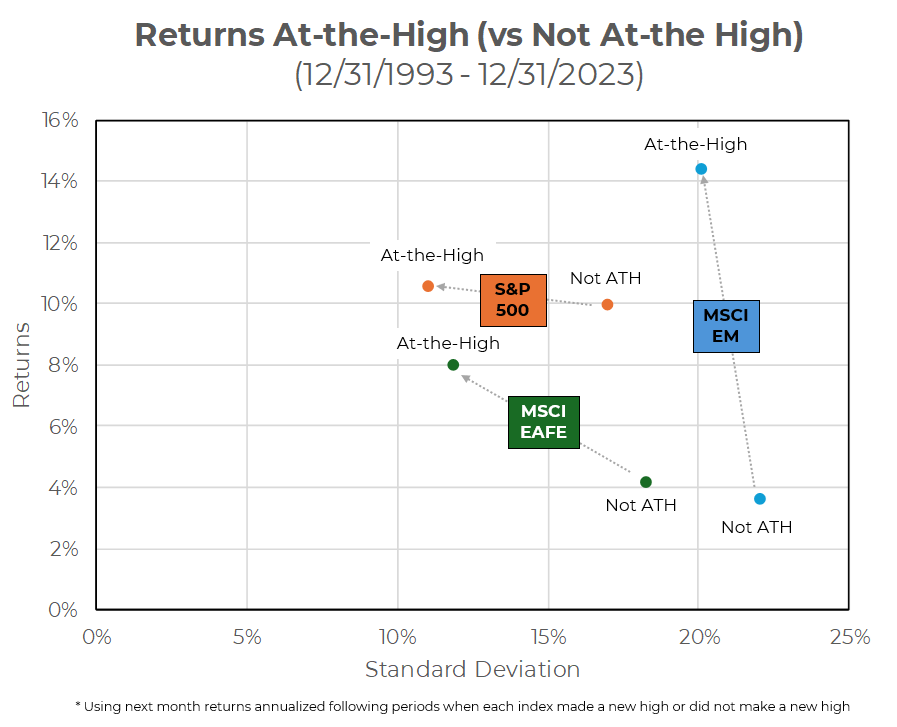

An analysis of the S&P 500, MSCI EAFE, and MSCI ACWI indices over the last 30-year period from December 31, 1993, to December 31, 2023, underpins this compelling narrative. The data underscores a consistent pattern where these indices not only delivered higher returns but also showcased reduced volatility when they attained new all-time highs.

Source: Aptus via YCharts

Source: Aptus via YCharts

This empirical evidence challenges the notion that market peaks should evoke caution or move out of return-seeking investment strategies. It signals an opportunity for investors to reassess their perspectives on all-time highs and view them not as warning signs, but rather as potential indicators of continued growth and stability in the markets.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-26.